Mobile Commerce Market Size

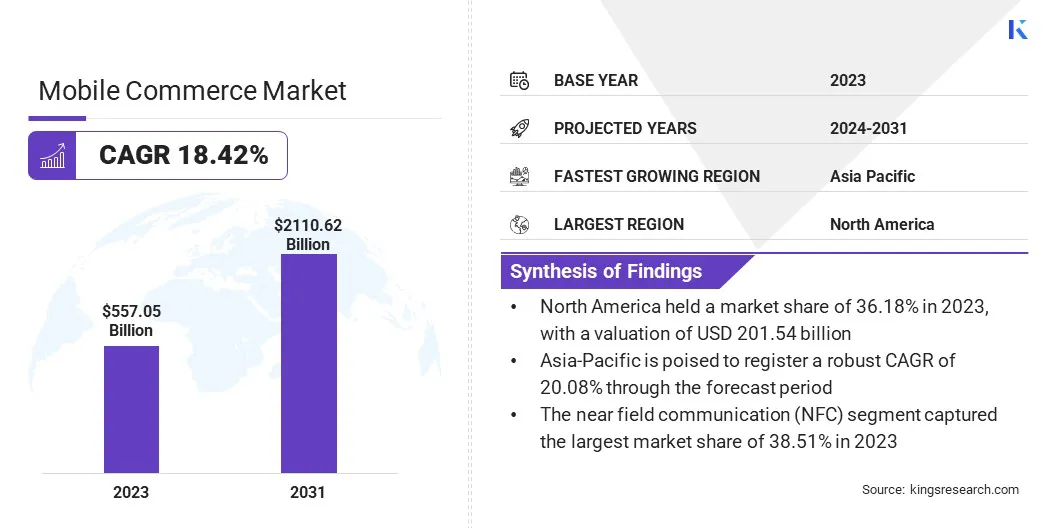

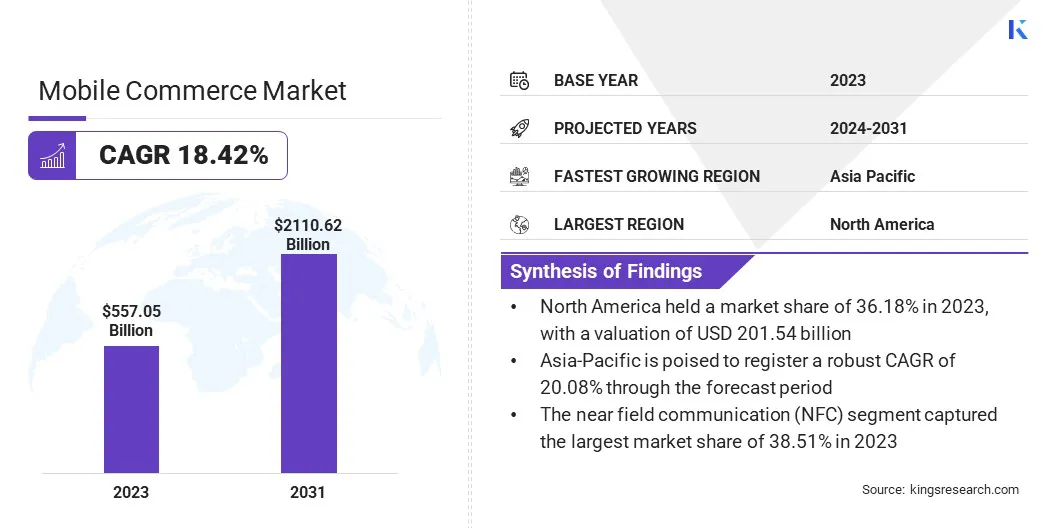

Global Mobile Commerce Market size was recorded at USD 557.05 billion in 2023, which is estimated to be at USD 646.30 billion in 2024 and projected to reach USD 2,110.62 billion by 2031, growing at a CAGR of 18.42% from 2024 to 2031.

The proliferation of 5G technology is propelling market growth. In the scope of work, the report includes services offered by companies such as Telefonaktiebolaget LM Ericsson, Google LLC, Thales (Gemalto NV), IBM Corporation, Mastercard, Paypal Holdings Inc., Visa Inc., Salesforce, Inc., SAP SE, SAMSUNG, and others.

The proliferation of dedicated mobile shopping apps represents a significant trend in the mobile commerce market, enhancing both convenience and user engagement. These apps cater to the increasing consumer preference for seamless, on-the-go shopping experiences directly from their smartphones or tablets.

Unlike mobile websites, these apps are specifically designed to streamline the shopping process, offering features such as personalized recommendations, one-click purchasing, and real-time notifications on discounts and promotions.

By leveraging user data and analytics, companies tailor their app interfaces to individual preferences, thereby enhancing user satisfaction and encouraging repeat visits. Moreover, these apps often integrate with mobile payment systems, allowing for quick and secure transactions, thereby enhancing their appeal.

- For instance, in April 2024, according to emerchantpay, the global smartphone user base is projected to expand by 496.7 million from 2024 to 2028, marking a 10.71% increase from 2023. With the ongoing surge in smartphone adoption, an increasing number of consumers are turning to mobile payments as a convenient and secure method for conducting transactions for goods and services.

As businesses strive to differentiate themselves in a crowded marketplace, it becomes imperative to invest in user-friendly app interfaces and robust backend systems. The proliferation of dedicated mobile apps simplifies the shopping journey for consumers and fosters deeper engagement, contributing significantly to the continued expansion of the mobile commerce market.

Mobile commerce refers to the buying and selling of goods and services through wireless handheld devices such as smartphones and tablets. It encompasses a wide range of activities, including online shopping, mobile banking, and digital wallet transactions.

The primary payment modes in mobile commerce include mobile wallets, which securely store users' payment information for quick transactions, and near field communication (NFC) technology, which enables contactless payments by simply tapping the device near a compatible terminal.

Additionally, mobile commerce often involves in-app purchases within dedicated mobile applications, where users buy goods or services directly from their mobile devices without the need to visit a physical store or use a desktop computer. As the global adoption of smartphones continues to rise, mobile commerce has become integral to modern retail and financial ecosystems, offering convenience, accessibility, and flexibility to consumers and businesses.

Analyst’s Review

Key players are strategically navigating through competitive pressures and technological advancements to sustain growth and maintain market relevance. Companies are focusing on expanding their mobile app offerings, enhancing user experiences through personalized recommendations and seamless checkout processes.

Current growth trajectories emphasize the importance of robust backend infrastructures that support secure transactions and data privacy, which are crucial for maintaining consumer trust.

Imperatives for key players include leveraging artificial intelligence (AI) and machine learning (ML) algorithms to optimize user interfaces and drive conversion rates. Additionally, partnerships with fintech companies and mobile payment providers are essential for integrating diverse payment options and ensuring transactional security.

- For instance, in August 2023, HSBC and B2B fintech Tradeshift launched a joint venture to develop embedded finance solutions and financial services apps. HSBC invested USD 35 million in Tradeshift in two stages. This agreement is part of a funding round aiming to raise at least USD 70 million.

Strategic investments in technology, user-centric innovations, and strategic partnerships define the imperatives for key players aiming to capitalize on the burgeoning opportunities within the global mobile commerce industry.

Mobile Commerce Market Growth Factors

The emergence of 5G technology is poised to revolutionize the mobile commerce market by significantly enhancing connectivity speeds, reducing latency, and enabling more seamless transactions.

With 5G networks, mobile devices achieve download speeds up to 100 times faster than 4G, allowing consumers to browse, shop, and make transactions quicker and more efficiently. This enhanced speed is crucial for applications that require real-time data processing, such as augmented reality (AR) shopping experiences and high-definition video streaming.

Moreover, the lower latency of 5G networks ensures that mobile transactions are processed almost instantaneously, thereby improving the overall user experience and reducing friction points in the purchase journey. Businesses are anticipated to capitalize on 5G's capabilities by offering enhanced multimedia content, immersive shopping experiences, and faster load times for mobile apps and websites.

Despite the rapid growth of mobile commerce, persistent concerns regarding data breaches and fraud pose significant challenges for both consumers and businesses. Mobile devices store and transmit sensitive personal and financial information, making them lucrative targets for cybercriminals.

Data breaches result in the exposure of user credentials, payment details, and personal information, leading to identity theft and financial losses. Moreover, fraudulent activities such as account takeovers and unauthorized transactions remain prevalent threats in the mobile commerce ecosystem.

Addressing these challenges requires robust cybersecurity measures, including encryption protocols, multi-factor authentication, and real-time transaction monitoring. Businesses are further investing in educating consumers about safe mobile shopping practices and providing secure payment platforms to mitigate risks. Regulatory compliance with data protection laws such as GDPR and CCPA further underscores the importance of safeguarding consumer data privacy.

Mobile Commerce Market Trends

The rise of mobile payment technologies has transformed the landscape of global commerce, offering consumers and businesses convenient and secure alternatives to traditional payment methods.

Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, enable users to store payment information digitally on their smartphones and make contactless payments at retail stores, online shops, and within mobile apps. This trend is further fueled by the increasing adoption of smartphones worldwide, coupled with ongoing advancements in near-field communication (NFC) and biometric authentication technologies.

Mobile payments enhance transactional efficiency by reducing checkout times and eliminating the need for physical cards or cash. Furthermore, these technologies support peer-to-peer (P2P) payments, allowing users to transfer funds instantly between individuals using their mobile devices. Moreover, the continued innovation in mobile payment technologies is expected to streamline the shopping experience and accelerate the shift toward a cashless society globally.

Segmentation Analysis

The global market is segmented based on payment mode, transaction type, and geography.

By Transaction Type

Based on transaction type, the mobile commerce market is classified into m-retailing, m-ticketing/booking, m-billing, and others. The m-retailing segment is poised to record a robust CAGR of 19.29% through the forecast period, mainly propelled by evolving consumer preferences and ongoing advancements in mobile technology.

M-retailing, or mobile retailing, refers to the practice of buying and selling goods and services through mobile devices, encompassing both mobile apps and mobile-optimized websites. This growth is further propelled by the increasing penetration of smartphones and tablets globally, which have become ubiquitous tools for online shopping.

- For instance, in 2022, according to GSMA, smartphone ownership reached 54% of the global population, equating to 4.3 billion individuals. Out of the 4.6 billion people accessing mobile internet, nearly 4 billion (representing 49% of the global population) utilize smartphones for this purpose, while approximately 600 million (8% of the global population) rely on feature phones.

Consumers increasingly favor the convenience and accessibility offered by mobile devices, allowing them to shop anytime and anywhere with ease. Retailers are responding to this demand by investing in mobile-friendly platforms, enhancing user interfaces, and integrating features such as personalized recommendations and seamless checkout processes. Furthermore, the expansion of mobile payment technologies, coupled with secure transaction capabilities, has bolstered consumer confidence in m-retailing.

By Payment Mode

Based on payment mode, the market is segmented into near field communication (NFC), premium sms, wireless application protocol (WAP), and direct carrier billing. The near field communication (NFC) segment captured the largest mobile commerce market share of 38.51% in 2023, largely attributed to its pivotal role in enabling secure and contactless transactions across various industries.

NFC technology facilitates seamless communication between devices within close proximity, allowing consumers to make payments simply by tapping their smartphones or other NFC-enabled devices on compatible terminals. This convenience has fueled its widespread adoption in mobile commerce, particularly in retail, transportation, and hospitality sectors where quick and secure transactions are paramount.

Moreover, NFC's integration with mobile wallets and payment apps has streamlined the checkout process, thereby enhancing the user experience and reducing friction during transactions. The robust growth of NFC underscores its reliability, security features, and versatility across diverse applications, establishing it as a fundamental technology propelling the advancement of mobile commerce globally.

Mobile Commerce Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America mobile commerce market share stood around 36.18% in 2023 in the global market, with a valuation of USD 201.54 billion. This significant share reflects the region's robust infrastructure for digital payments, widespread smartphone adoption, and a strong culture of online shopping.

The regional market expansion is further propelled by tech-savvy consumers who are early adopters of new technologies and services, including mobile wallets and digital payment solutions.

Major retailers and e-commerce platforms in North America have promptly capitalized on these trends, investing heavily in mobile-friendly websites and apps that offer seamless shopping experiences. Moreover, the region benefits from a well-established regulatory framework that supports secure and reliable mobile transactions, thereby boosting consumer confidence in mobile commerce.

Asia-Pacific is poised to grow at a robust CAGR of 20.08% in the forthcoming years. This rapid growth is largely attributed to several factors, including the expanding middle-class population, increasing internet penetration, and widespread adoption of smartphones across the region.

Countries such as China, India, Japan, and South Korea are at the forefront of mobile commerce adoption, with a vibrant ecosystem of mobile payment providers, e-commerce giants, and tech startups that innovate to cater to diverse consumer needs.

- For instance, in 2022, a report published by Discover Financial Services, mobile commerce sales in South Korea are expected to constitute 76% of total e-commerce transactions by 2025. This significant growth underscores the increasing consumer preference for mobile shopping, facilitated by high smartphone penetration, advanced mobile payment systems, and seamless user experiences offered by mobile-centric retail platforms.

The rise of super apps that integrate multiple services such as shopping, payments, food delivery, and transportation has further stimulated the growth of the Asia-Pacific mobile commerce market, offering unparalleled convenience to users. Additionally, favorable government initiatives promoting digital financial inclusion and supportive regulatory environments have created a conducive environment for mobile commerce expansion.

Competitive Landscape

The mobile commerce market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Mobile Commerce Market

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Thales (Gemalto NV)

- IBM Corporation

- Mastercard

- Paypal Holdings Inc.

- Visa Inc.

- Salesforce, Inc.

- SAP SE

- SAMSUNG

Key Industry Developments

- October 2023 (Collaboration): Global Payments collaborated with Visa to launch the Mobile Tap payment solution in Singapore. This innovation aims to transform the payment ecosystem by enabling merchants to process payments directly through their smartphones, thereby eliminating the need for additional hardware investments.

The global mobile commerce market is segmented as:

By Payment Mode

- Near Field Communication (NFC)

- Premium SMS

- Wireless Application Protocol (WAP)

- Direct Carrier Billing

By Transaction Type

- M-Retailing

- M-Ticketing/Booking

- M-Billing

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America