Mobile Cranes Market

Mobile Cranes Market Size, Share, Growth & Industry Analysis, By Type (Truck Mounted Crane, Trailer Mounted Crane, Crawler Crane), By Application (Construction, Industrial, Utility), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR270

Mobile Cranes Market Size

The global Mobile Cranes Market size was valued at USD 19.15 billion in 2023 and is projected to grow from USD 20.28 billion in 2024 to USD 31.69 billion by 2031, exhibiting a CAGR of 6.59% during the forecast period. Rising demand for compact and versatile cranes and increased adoption of advanced telematics systems are boosting the demand for mobile cranes.

In the scope of work, the report includes services offered by companies such as Action Construction Equipment Ltd., The Manitowoc Company, Inc., Kobelco Construction Machinery Co., Ltd., Konecranes, Liugong Machinery Co., Ltd., Tadano Ltd., Terex Corporation, Liebherr-International Deutschland GmbH, SANY Group, BAUER GROUP, and others.

The integration of automation and Internet of Things (IoT) technologies in mobile cranes is emerging as a major trend transforming the industry landscape. This development offers significant opportunities to enhance operational efficiency, safety, and precision. Automation can be used to optimize crane operations by minimizing human error, improving load management, and streamlining repetitive tasks. The integration of IoT connectivity facilitate real-time monitoring of crane performance, allowing operators and fleet managers to track critical parameters such as load weight, operational speed, and fuel consumption.

- For instance, in July 2024, Siemens incorporated Mevea’s digital twin and simulation technology into crane automation at the Port of NEOM, Saudi Arabia. This implementation is expected to enhance the automation of 10 ship-to-shore (STS) gantry cranes and 30 electric rubber-tyred gantry (RTG) cranes.

This data can be utilized to predict maintenance needs, reduce downtime, and extend the lifespan of the equipment. Additionally, IoT-enabled cranes enhance safety by providing real-time alerts regarding potential hazards, such as overload conditions or proximity to obstacles. This capability helps prevent accidents and improves overall site safety. As construction projects grow in scale and complexity, the demand for mobile cranes equipped with advanced automation and IoT features is expected to rise, presenting a significant growth opportunity for manufacturers. Companies that invest in these technologies can differentiate themselves in the market, attract more customers, and gain a competitive edge.

Mobile cranes are versatile, heavy-duty lifting machines mounted on crawlers or wheeled carriers, specifically designed to transport and lift heavy loads with precision and efficiency. Unlike fixed cranes, mobile cranes can be easily moved from one location to another; this makes them essential for construction sites, industrial projects, and other heavy-lifting applications. There are several types of mobile cranes, each tailored to specific operational needs.

Truck mounted cranes provide mobility and ease of transport over long distances. Rough terrain cranes are built on four large rubber tires and are specifically designed for operations on uneven surfaces, ideal for construction sites with difficult terrains. Crawler cranes, equipped with tracks instead of wheels, offer stability and load-bearing capacity in large-scale projects such as bridge construction or wind turbine installation. The applications of mobile cranes include construction, infrastructure development, and material handling in mining, oil & gas, and shipping industries. This makes them ideal for assembling prefabricated buildings, loading and unloading cargo, and installing large industrial components.

Analyst’s Review

The mobile cranes market is experiencing substantial growth, mainly due to rapid urbanization, expanding infrastructure projects, and ongoing technological advancements. Companies operating in this market are increasingly focusing on strategic initiatives such as mergers and acquisitions, partnerships, and product innovation to sustain competitiveness. Investments in research and development are crucial as manufacturers are compelled to innovate continuously to meet the rising demand for efficient, eco-friendly, and technologically advanced mobile cranes.

- In July 2024, Konecranes received order from The Port of Oulu of a Gottwald ESP.7 Portal Harbor Crane to enhance cargo handling at its Main Quay. This Generation 6 crane, capable of managing containers on RoRo vessels and general cargo, was ordered in Q2 2024 and is anticipated to be delivered by Q2 2025. The crane is engineered to handle heavy project cargo up to 125 tons, boosting operational flexibility.

The integration of automation, IoT, and alternative power sources such as hybrid or electric systems has become imperative for maintaining market relevance. Furthermore, the expansion into emerging markets, particularly in Asia-Pacific and Africa, where infrastructure development is booming, represents a critical growth strategy. Moreover, companies are emphasizing customer-centric approaches, offering tailored solutions and after-sales services to enhance customer satisfaction and loyalty.

Furthermore, industry participants are focusing on addressing key challenges posed by stringent safety regulations and high initial costs, which require strategic planning and adaptation. For long-term success, it is imperative for companies to focus on sustainability, cost-efficiency, and continuous innovation to meet the evolving needs of the construction and industrial sectors.

Mobile Cranes Market Growth Factors

The expansion of the mining and oil & gas industries is boosting the demand for mobile cranes, as these sectors require heavy lifting and material handling capabilities in often remote and challenging environments. The growth in these industries is largely attributed to rising global energy demand, increased exploration activities, and the pressing need to access and extract deeper and more complex resources. Mobile cranes are essential in these operations for lifting and transporting heavy equipment, drilling rigs, and materials across rugged terrains.

Additionally, they are critical in the assembly and disassembly of large structures, such as oil rigs and mining facilities, which require precise and safe handling of components. The ongoing investment in new mining projects, particularly in regions with extensive natural resources such as US, South America, and Australia, is likely to further fuel the demand for mobile cranes.

- For instance, in July 2024, Konecranes established strategic partnerships with steel structure providers and subcontractors to manufacture port cranes in the U.S. This initiative aligns with the U.S. government’s long-term plans and acknowledges Konecranes' leadership in material handling solutions and its strong presence in the country.

Additionally, as the oil & gas industry explores more offshore and unconventional resources, there is a growing need for specialized cranes that operate in harsh environmental conditions. The expansion of these industries supports the growth of the mobile cranes market, prompting manufacturers to innovate and develop cranes that meet the specific challenges such as extreme weather, corrosive environments, and the need for high-capacity lifting.

High initial investment and maintenance costs are major challenges hampering the development of the market, particularly for small and medium-sized enterprises (SMEs) that may struggle to afford such capital-intensive equipment. Mobile cranes, being sophisticated and highly specialized machinery, require substantial upfront capital outlay for purchase. This substantial financial requirement can pose a barrier to entry for many potential buyers.

Additionally, the ongoing maintenance of these cranes, which includes regular inspections, repairs, and parts replacements, adds to the overall cost burden. These costs are particularly high for advanced models equipped with the latest technology, such as automation and IoT features. Although these technologies offer long-term benefits, they contribute significantly to the initial financial strain. This challenge may limit market growth, especially in regions where access to financing is limited.

However, mitigation strategies can be employed, such as offering flexible financing options, leasing, or rental services, which can make mobile cranes more accessible to a broader range of customers. Companies may further focus on developing modular and easily upgradable cranes that reduce long-term maintenance costs and extend the lifespan of the equipment. By addressing these financial challenges, manufacturers are mitigating the cost pressures on buyers, thus increasing the demand for for mobile cranes.

Mobile Cranes Market Trends

The shift toward electrification and hybrid cranes is a significant trend in the mobile cranes market. This trend is fueled by the increasing need to reduce carbon emissions and comply with stringent environmental regulations. With industries worldwide focusing on sustainability, the demand for cranes that offer lower environmental impact without compromising on performance is rising.

Electrification has facilitated the use of electric motors and batteries in mobile cranes to power operations. This has reduced reliance on diesel engines and lowered emissions and operational noise. Hybrid cranes, which combine electric and traditional fuel-powered systems, offer the flexibility of operating in environments with limited charging infrastructure while also providing substantial environmental benefits.

This trend is particularly evident in regions with strict emissions regulations, such as Europe and North America, where companies are focusing on regulatory compliance by adopting green technologies and enhancing their corporate social responsibility (CSR) profiles. Additionally, the shift toward electrification is supporting innovation in battery technology, energy efficiency, and charging infrastructure, fueling the adoption of electric and hybrid cranes.

Segmentation Analysis

The global market has been segmented based on type, application, and geography.

By Type

Based on type, the market has been segmented into truck mounted crane, trailer mounted crane, and crawler crane. The truck mounted crane segment captured the largest market mobile cranes share of 35.83% in 2023, largely attributed to its unparalleled versatility, mobility, and cost-effectiveness. Truck mounted cranes are highly favored due to their quick deployment in different sites without additional transportation equipment. This growth is further supported by the growing demand for efficient and flexible lifting solutions in urban construction, infrastructure projects, and logistics.

Truck mounted cranes are particularly popular in applications requiring frequent relocation and swift setup, such as utility maintenance, road construction, and emergency response services. The integration of advanced features such as telescopic booms, automated controls, and enhanced safety systems in these cranes further contributes to their widespread adoption.

Additionally, the ability of truck mounted cranes to handle a wide range of lifting tasks, from light to medium loads, makes them a preferred choice for contractors who seek multi-functional equipment. The cost benefits associated with truck mounted cranes, including lower operating costs and reduced setup time, further play a significant role in their notable growth. The growth of the segment is further supported by increasing infrastructure investments, particularly in emerging economies, where the demand for mobile and adaptable cranes is on the rise.

By Application

Based on application, the mobile cranes market has been classified into construction, industrial, and utility. The utility segment is poised to record a CAGR of 6.96% through the forecast period. This expansion is stimulated by the rising demand for reliable and efficient infrastructure in the energy and utility sectors. This growth is further fueled by the rising need for the construction and maintenance of power lines, water systems, telecommunications networks, and other essential infrastructure.

Moreover, with the rising global populations grow and rapid urbanization, the emphasis on upgrading and expanding utility networks to meet the surging demand for electricity, water, and communication services is increasing. Mobile cranes are indispensable in these sectors for tasks such as erecting transmission towers, installing transformers, and maintaining utility poles.

The transition to renewable energy projects, particularly in wind and solar power, further contributes to the rapid expansion of the utility segment. These projects require specialized cranes for the installation and maintenance of large equipment. Additionally, the integration of smart grid technologies and the modernization of aging infrastructure in developed economies are expected to boost the expansion of the segment.

Mobile Cranes Market Regional Analysis

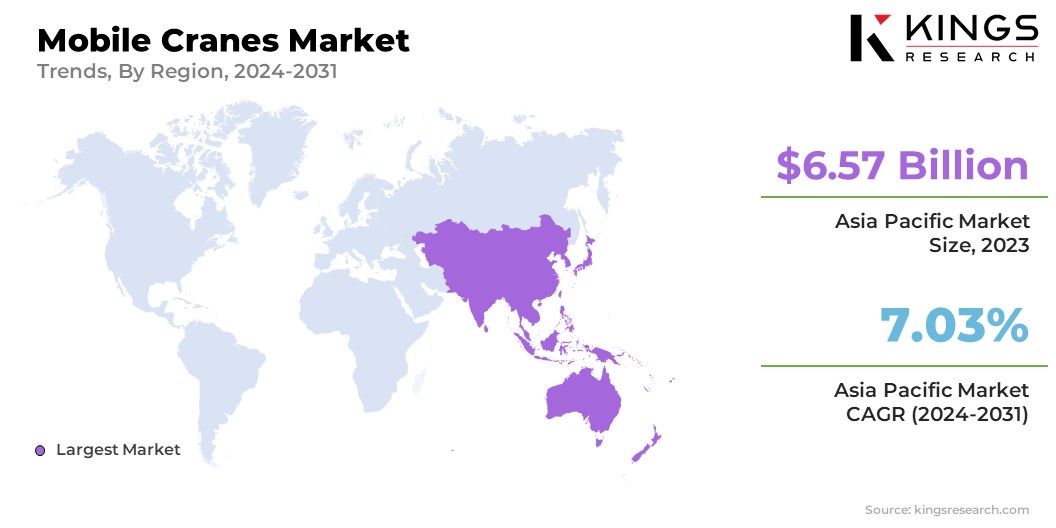

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific mobile cranes market accounted for a share of 34.32% and was valued at USD 6.57 billion in 2023, reflecting the region’s leading position in the global construction and infrastructure development landscape. This significant market is propelled by rapid urbanization, increasing industrialization, and extensive infrastructure projects across countries such as China, India, and Southeast Asian nations.

- For instance, in February 2024, Fassi Asia Pacific SDN. BHD. secured a prestigious certification for truck mounted crane construction from the Malaysian Department of Occupational Safety and Health (DOSH). This achievement opens new domestic market opportunities and strengthens Fassi’s position as a globally recognized brand, demonstrating compliance with stringent local production standards in Malaysia.

The region's burgeoning construction sector, facilitated by favorable government initiatives and private investments in large-scale projects such as smart cities, transportation networks, and commercial buildings, is fueling the demand for mobile cranes. Additionally, the expansion of the manufacturing and energy sectors, particularly in China and India, is highlighting the growing need for advanced lifting and material handling equipment.

Moreover, the rising investments in renewable energy projects, such as wind farms, boost the demand for mobile cranes, particularly in remote and challenging terrains. The availability of cost-effective labor and materials in the region supports the production and deployment of mobile cranes, thereby augmenting the growth of the market.

Europe is set to grow at the robust CAGR of 6.59% in the forthcoming years, propelled by several factors that underscore the region’s commitment to advanced infrastructure development and sustainability. The construction industry in Europe is experiencing a significant transformation, characterized by a strong emphasis on modernizing aging infrastructure and building new, energy-efficient structures. This shift is creating strong demand for mobile cranes, particularly those that are equipped with the latest technologies such as electrification, automation, and IoT integration.

Furthermore, the region’s focus on sustainability and reducing carbon emissions is promoting the adoption of electric and hybrid mobile cranes, which align with the stringent environmental regulations implemented across the European Union.

- In June 2024, Konecranes announced several new additions to Port Solutions portfolio, further reinforcing its position as a leader in innovation and material handling technology. These launches highlight Konecranes' commitment to eco-efficient solutions and its Ecolifting vision, which aims to reduce customers' carbon footprints through ongoing investments in digitalization, electrification, and technological advancements.

Additionally, the increasing investments in renewable energy projects, such as offshore wind farms, are boosting the demand for specialized mobile cranes capable of operating in challenging environments. The construction of new transportation networks, including railways, highways, and bridges, as well as the expansion of urban areas, are further contributing to the growth of the Europe market. The region’s strong technological base, coupled with a high level of expertise in engineering and manufacturing, supports the development and deployment of advanced crane solutions. This is supporting the development of the Europe market.

Competitive Landscape

The global mobile cranes market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Mobile Cranes Market

- Action Construction Equipment Ltd.

- The Manitowoc Company, Inc.

- Kobelco Construction Machinery Co., Ltd.

- Konecranes

- Liugong Machinery Co., Ltd.

- Tadano Ltd.

- Terex Corporation

- Liebherr-International Deutschland GmbH

- SANY Group

- BAUER GROUP

Key Industry Developments

- August 2024 (Launch): Konecranes launched its flagship X-series industrial crane, characterized by its compact design and advanced, reliable technology, including a streamlined electrical architecture and enhanced connectivity. Featuring TRUCONNECT Remote Monitoring, it offers crucial insights into crane usage and operation by emphasizing safety and efficiency.

- July 2024 (Launch): Sumitomo Heavy Industries Construction Cranes Co., Ltd. (HSC) launched the updated SCX1200-3 crawler crane. The new version emphasizes enhanced safety features and improved environmental sustainability.

The global mobile cranes market is segmented as:

By Type

- Truck Mounted Crane

- Trailer Mounted Crane

- Crawler Crane

By Application

- Construction

- Industrial

- Utility

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership