Molecular Imaging Market

Molecular Imaging Market Size, Share, Growth & Industry Analysis, By Modality (Molecular Ultrasound Imaging, Positron Emission Tomography, Single Photon Emission Computed Tomography & Others), By Application (Cardiovascular, Neurology, Oncology & Others), By End-Users, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1008

Molecular Imaging Market Size

The global Molecular Imaging Market size was valued at USD 4.67 billion in 2023 and is projected to grow from USD 4.92 billion in 2024 to USD 7.45 billion by 2031, exhibiting a CAGR of 6.10% during the forecast period. The market is witnessing substantial growth due to rising healthcare investments and a growing focus on personalized medicine.

Enhanced regulatory support and increasing healthcare infrastructure improvements are further contributing to market expansion. As the demand for non-invasive diagnostic solutions grows, innovations in imaging technologies and rising applications in research and clinical settings are supporting market growth.

In the scope of work, the report includes solutions offered by companies such as Hermes Medical Solutions, Bruker, GE HealthCare, Fujifilm Holdings Corp., Koninklijke Philips N.V., Siemens Healthcare Private Limited, Carestream Health, Esaote SpA, Positron Corporation, Medisco Ltd., and others.

The molecular imaging market is experiencing significant growth driven by technological advancements and increasing demand for precise diagnostic tools. Innovations in imaging technologies, such as enhanced PET and MRI systems, are improving diagnostic accuracy and efficiency.

The rise in chronic diseases and the surging need for early disease detection are stimulating market expansion. Additionally, strategic partnerships and collaborations among key players are fostering the development and adoption of advanced imaging solutions.

- For instance, in July 2022, Life Molecular Imaging and BIOKOSMOS formed a strategic partnership through a licensing agreement. This collaboration grants BIOKOSMOS the rights to manufacture and distribute Neuraceq, an imaging agent used for detecting beta-amyloid plaques, across Greece, Bulgaria, North Macedonia, and Albania.

These factors collectively contribute to the robust growth of the market, fostering advancements in medical diagnostics and offering new opportunities for industry stakeholders.

Molecular imaging is a specialized imaging technique that visualizes biological processes at the molecular and cellular levels in living organisms. Unlike traditional imaging methods, which primarily focus on anatomical structures, molecular imaging provides insights into the molecular mechanisms underlying diseases.

By using targeted imaging agents or tracers that bind to specific biological molecules, this technology allows for the observation of disease progression, molecular interactions, and cellular functions in real-time. It plays a crucial role in early diagnosis, treatment planning, and monitoring of various conditions, including cancer, cardiovascular diseases, and neurological disorders, thereby advancing precision medicine and personalized healthcare.

Analyst’s Review

Key market players are aiding the growth of the molecular imaging market by actively focusing on product innovation.

- For instance, in June 2023, United Imaging Healthcare Co., Ltd., a leading medical device manufacturer, launched its Next-Generation PET/CT systems and the integrated molecular technology platform, uExcel, at the Society of Nuclear Medicine and Molecular Imaging annual meeting in Chicago. The uExcel platform combines cutting-edge hardware and software advancements to enhance performance, imaging capabilities, and system functionalities. It features a high-performance ASIC chip within its ultra-digital platform (UDP) detector and utilizes AI-powered workflows to streamline processes and improve examination efficiency.

Innovations by key players, along with increasing strategic partnerships, are expected to bolster market growth in the coming years. Advanced technologies and collaborative efforts enhance product capabilities and operational efficiency, attract investment, and expand market reach.

Molecular Imaging Market Growth Factors

The growing incidence of chronic diseases, particularly cancer and cardiovascular conditions, is driving the demand for advanced diagnostic solutions. As these diseases become increasingly prevalent, there is an urgent need for precise and early detection methodologies. Molecular imaging technologies offer unparalleled insights at the molecular and cellular levels, enabling healthcare providers to visualize biological processes in real-time.

This precision facilitates early diagnosis, optimized treatment planning, and effective monitoring of disease progression. In addition, the adoption of molecular imaging is enhancing disease management and supporting personalized medicine approaches, thereby propelling market growth.

The molecular imaging market encounters challenges such as high costs associated with advanced imaging systems and the rising need for specialized training, which limits accessibility and adoption. Regulatory hurdles and the complexity of integrating new technologies into existing healthcare infrastructures also pose significant obstacles. Key players are mitigating these issues by developing cost-effective solutions and offering extensive training programs to ensure proper use of advanced technologies.

They are collaborating with regulatory agencies to streamline approval processes and expedite market entry. Furthermore, forming strategic partnerships with healthcare institutions facilitates seamless technology integration, addresses operational complexities, and enhances adoption.

Molecular Imaging Market Trends

The integration of artificial intelligence (AI) and machine learning (ML) into molecular imaging is augmenting market growth by revolutionizing diagnostic capabilities. AI-driven algorithms enhance image analysis, by providing faster and more accurate interpretations, which streamlines workflow efficiency and reduces diagnostic errors.

- In February 2023, GE HealthCare announced its agreement to acquire Caption Health, Inc., a company specializing in clinical applications for early disease detection. Caption Health's AI-driven tools simplify and expedite ultrasound examinations, allowing healthcare providers to perform basic echocardiography assessments with ease. This acquisition aims to enhance the accessibility and efficiency of diagnostic imaging.

This technological advancement enables healthcare providers to deliver improved patient care, leading to increased adoption of molecular imaging solutions. The increased accuracy and efficiency offered by AI and ML are attracting significant investments and spurring innovation in the diagnostic imaging sector, thereby propelling market expansion.

The widespread adoption of hybrid imaging technologies, such as PET/CT and PET/MRI, is bolstering the growth of the molecular imaging market. These combined modalities integrate the anatomical detail provided by CT or MRI with the molecular insights from PET scans, thereby offering a more comprehensive diagnostic perspective.

This dual capability allows for the simultaneous assessment of both structural and functional information, thereby enhancing diagnostic precision and enabling more accurate disease characterization. This allows healthcare providers to make better-informed decisions regarding patient management and treatment strategies, thereby improving patient outcomes. The increased utilization of these advanced hybrid imaging systems is supporting market growth by addressing the rising demand for more effective and reliable diagnostic tools.

Segmentation Analysis

The global market is segmented based on modality, application, end-users, and geography.

By Modality

Based on modality, the market is categorized into molecular ultrasound imaging, positron emission tomography, single photon emission computed tomography, nuclear magnetic resonance spectrometer, and others. The positron emission tomography segment led the molecular imaging market in 2023, reaching a valuation of USD 1.52 billion, mainly due to advancements in technology and rising healthcare investments.

Innovations such as improved detector materials and higher-resolution imaging enhance diagnostic accuracy and efficiency. The increasing prevalence of cancer and neurological disorders boosts the demand for PET’s precise imaging capabilities, which are crucial for early detection and monitoring.

Additionally, the growing application of neurology in the treatment of diseases such as Alzheimer’s are fueling segmental expansion. Substantial investments in healthcare infrastructure further propel the adoption of PET technology, positioning the segment for substantial growth as advancements continue in both clinical and research settings.

By Application

Based on application, the market is categorized into cardiovascular, neurology, oncology, respiratory, and others. The oncology segment captured the largest molecular imaging market share of 45.64% in 2023. The increasing global incidence of cancer fosters the demand for advanced imaging technologies that enable early detection, precise staging, and effective treatment planning.

Technological advancements, such as improved radiotracers and hybrid imaging systems, enhance the accuracy and sensitivity of cancer diagnostics, thereby facilitating better visualization of tumors. Additionally, the growing shift toward personalized medicine in oncology is fueling the need for molecular imaging to tailor treatments based on individual tumor characteristics and responses.

Increased investment in research and development further supports the development of new imaging agents and techniques, thus augmenting the expansion of the segment.

By End-Users

Based on end-users, the market is categorized into hospitals, diagnostic imaging centers, and ambulatory surgical centers. The hospitals segment is expected to garner the highest revenue of USD 4.69 billion by 2031.

Rising patient volumes due to an increasing global population and higher chronic disease prevalence necessitate the implementation of advanced imaging technologies for accurate and efficient diagnostics. Technological advancements, such as enhanced imaging resolution and faster acquisition times, are further propelling demand within hospital settings.

- In July 2023, Mirada Medical, a leader in advanced visualization software, announced the expansion of its embedded partnership program to include RamSoft, the developer of the Imaging EMR OmegaAI. Mirada Medical, known for its advanced visualization applications that enhance cancer care, had seen its technology adopted in over 2,000 hospitals worldwide. This partnership with RamSoft aimed to broaden access to Mirada’s technology and expedite cancer diagnosis and treatment globally.

Additionally, the expansion of healthcare infrastructure and a growing focus on precision medicine is increasing the adoption of molecular imaging systems. These developments collectively contribute to segmental growth, as hospitals invest in cutting-edge technologies to improve patient care and diagnostic capabilities.

Molecular Imaging Market Regional Analysis

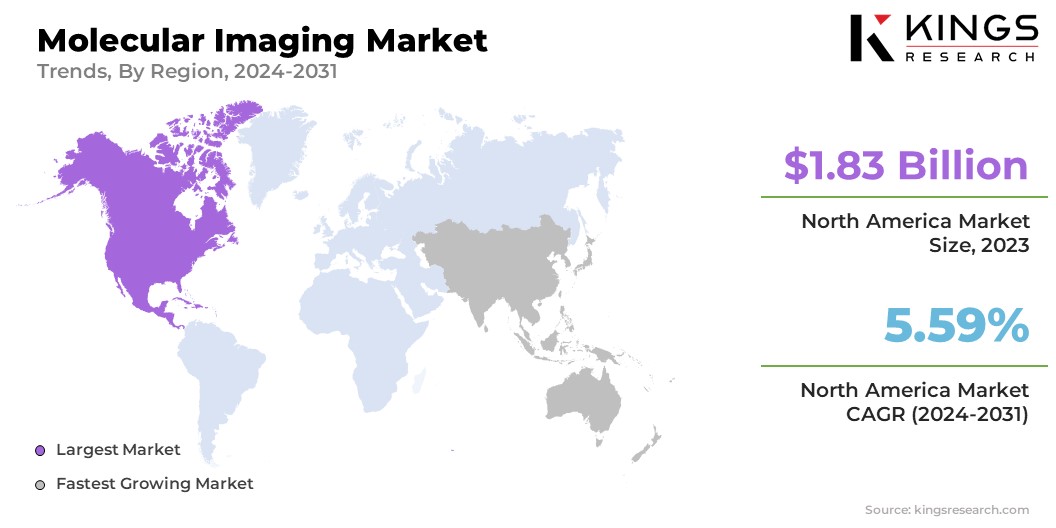

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America molecular imaging market share stood around 39.12% in 2023 in the global market, with a valuation of USD 1.83 billion. The regional market benefits from a robust healthcare infrastructure, extensive research and development activities, and high healthcare expenditure.

The presence of major market players and continuous technological advancements further fuel domestic market growth. Increased investment in healthcare technology and the rising demand for advanced diagnostic solutions are further contributing to this notable expansion.

- In February 2023, Lantheus, a prominent U.S.-based medical imaging manufacturer, acquired Cerveau Technologies, Inc. This acquisition included Cerveau's MK-6240, a second-generation F-18-labeled PET imaging agent specifically designed to target Tau tangles associated with Alzheimer's disease. This move highlights the region's dedication to enhancing diagnostic technologies and tackling intricate medical challenges.

The combination of these factors positions North America as a key market for molecular imaging.

Asia-Pacific is anticipated to witness substantial growth at a CAGR of 7.14% over the forecast period. Rapid advancements in healthcare infrastructure and increasing investments in medical technology are enhancing the availability and quality of molecular imaging services.

The expansion of healthcare facilities and modernization of existing hospitals contribute to the growing adoption of advanced imaging technologies. Additionally, the rising prevalence of chronic diseases and an aging population are generating a strong demand for precise diagnostic tools, including molecular imaging.

Furthermore, the increasing frequency of product launches and collaborations between regional and global players are accelerating the introduction of innovative imaging solutions.

- For instance, in February 2023, FUJIFILM India Private Limited, a manufacturer of imaging products, launched the Prime open MRI device APERTO Lucent, along with two new diagnostic ultrasound models, the Arietta 850 DeepInsight and Arietta 650 DeepInsight.

The rising frequency of product launches and strategic collaborations between regional and global players is significantly accelerating the introduction of innovative imaging solutions, thus driving the market growth in the region.

Competitive Landscape

The global molecular imaging market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Molecular Imaging Market

- Hermes Medical Solutions

- Bruker

- GE HealthCare

- Fujifilm Holdings Corp.

- Koninklijke Philips N.V.

- Siemens Healthcare Private Limited

- Carestream Health

- Esaote SpA

- Positron Corporation

- Medisco Ltd.

Key Industry Development

- July 2024 (Product Launch): Positron Corporation, launched its latest innovation, NeuSight PET-CT 3D 64 slice scanner, in the US and North American markets. This cutting-edge PET-CT technology establishes new benchmarks in imaging accuracy, patient comfort, and operational efficiency, offering significant advantages to nuclear cardiology practices and hospitals.

The global molecular imaging market is segmented as:

By Modality

- Molecular Ultrasound Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Nuclear Magnetic Resonance (NMR) Spectrometer

- Others

By Application

- Cardiovascular

- Neurology

- Oncology

- Respiratory

- Others

By End-Users

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership