Market Definition

The multi energy systems industry focuses on integrating electricity, heat, gas, and renewable energy sources to enhance efficiency, sustainability, and reliability. These systems enable sector coupling, fostering synergies between energy carriers through technologies such as power-to-gas, power-to-heat, and energy storage.

By leveraging smart grids and decentralized energy management, MES optimizes resource utilization, reduces emissions, and supports the transition to a resilient and sustainable energy infrastructure.

Multi Energy Systems Market Overview

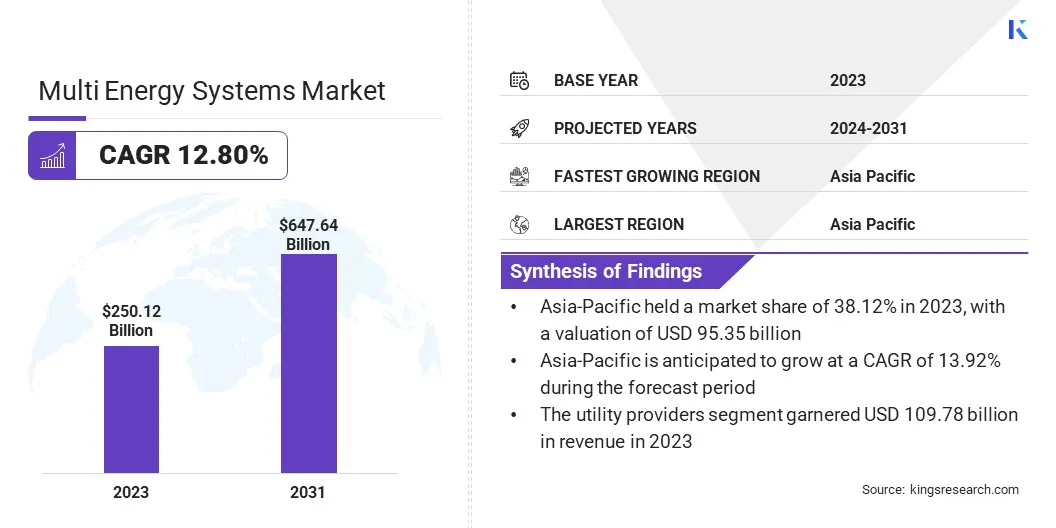

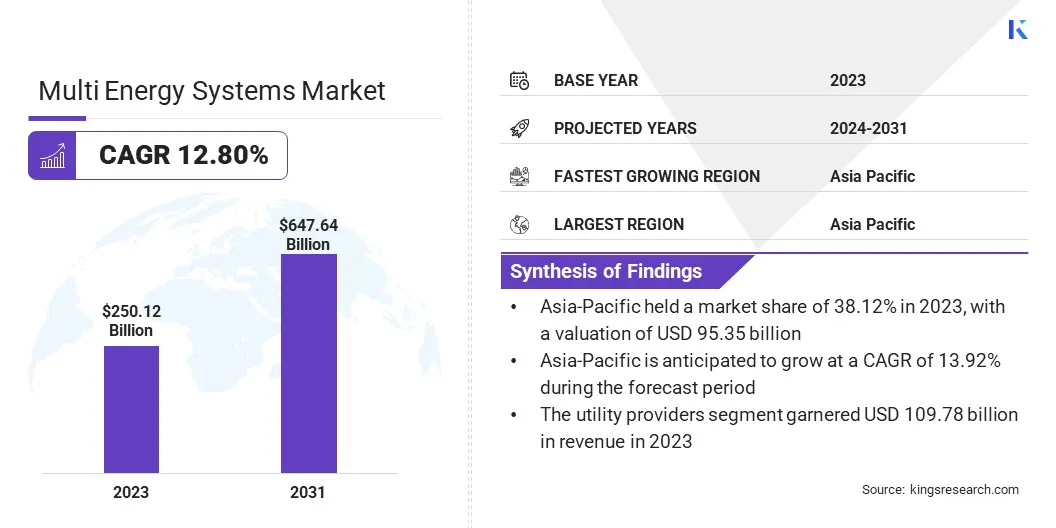

The global multi energy systems market size was valued at USD 250.12 billion in 2023 and is projected to grow from USD 278.79 billion in 2024 to USD 647.64 billion by 2031, exhibiting a CAGR of 12.80% during the forecast period.

The growth of the market is primarily driven by the increasing adoption of renewable energy sources, advancements in smart grid technology, and the growing demand for efficient energy management solutions. Furthermore, governments worldwide are implementing favorable policies and incentives to facilitate the integration of clean energy, thereby accelerating market expansion.

Technological advancements in energy storage, digitalization, and grid modernization are significantly enhancing the efficiency and reliability of multi-energy systems.

Major companies operating in the multi energy systems industry are Siemens Energy, General Electric Company, Vestas, ABB, First Solar, Enel Green Power S.p.A, Solar Frontier Europe GmbH, KYOCERA Corporation, Hitachi, Ltd, Mitsubishi Electric Corporation, Rockwell Automation, Schneider Electric SE, Emerson Electric Co., Johnson Controls, and others.

- In November 2023, TotalEnergies acquired 1.5 GW of flexible gas-fired power generation capacity in Texas from TexGen for USD 635.1 million. The acquisition includes three power plants near Dallas and Houston, aimed at balancing the intermittency of renewable energy sources and meeting growing energy demand. This move strengthens TotalEnergies' renewable capacity and trading capabilities in the Texas market.

Key Highlights:

Key Highlights:

- The multi energy systems industry size was recorded at USD 250.12 billion in 2023.

- The market is projected to grow at a CAGR of 12.80% from 2024 to 2031.

- Asia-Pacific held a share of 38.12% in 2023, valued at USD 95.35 billion.

- The renewables segment garnered USD 84.49 billion in revenue in 2023.

- The power generation systems segment is expected to reach USD 250.55 billion by 2031.

- The industrial sector segment is anticipated to witness the fastest CAGR of 15.04% over the forecast period

- Asia Pacific is estimated to grow at a CAGR of 13.92% through the projection period.

Market Driver

“Growing Energy Demand & Security Concerns”

Rising global energy demand and security concerns are boosting the growth of the multi energy systems market. Urbanization, industrial growth, and electrification are leading to increased consumption, particularly in emerging economies. Geopolitical tensions, fuel disruptions, and extreme weather expose vulnerabilities in traditional energy supply chains.

Multi-energy systems integrate renewables, natural gas, hydrogen, and storage to enhance stability, flexibility, and grid resilience. By diversifying energy sources and optimizing distribution, these systems strengthen energy security and support long-term sustainability goals.

- In February 2025, P2X Solutions launched Finland’s first commercial green hydrogen plant in Harjavalta, marking a major milestone in the country’s hydrogen economy. The 20 MW plant produces green hydrogen to help industries reduce emissions, particularly in shipping, aviation, and heavy industry. P2X Solutions plans larger hydrogen plants in Joensuu (40 MW) and Oulu (100 MW) and promotes early adoption of green hydrogen for competitive advantage.

Market Challenge

“Integration Complexity in Multi-Energy Systems”

A major challenge limiting the expansion of the multi energy systems market is integration complexity. These systems must efficiently combine electricity, heating, cooling, and fuels while balancing supply and demand in real time.

This requires advanced digital infrastructure, smart grids, and energy storage solutions, which can be costly and technically difficult to implement. Additionally, interoperability between different energy sectors and technologies remains a barrier to widespread adoption.

Overcoming integration complexity in multi-energy systems requires investing in smart grids, AI-driven energy management, and IoT technologies to enable seamless coordination between electricity, heating, and fuel systems.

Governments must establish standardized policies and regulatory frameworks to ensure interoperability across different energy sectors. Expanding energy storage solutions such as batteries, hydrogen storage, and thermal systems enhances reliability.

Fostering cross-sector collaboration among utilities, industries, and technology providers boosts innovation, while decentralized energy generation through microgrids and local renewables improves flexibility and resilience.

Market Trend

“Expansion of Battery Storage Solutions”

The expansion of battery storage solutions presents a significant trend in the multi energy systems market, supported by the increasing adoption of renewable energy sources and the imperative for grid stability.

As solar and wind power generation remains variable, advanced battery storage systems play a critical role in balancing supply and demand, ensuring a reliable and resilient energy infrastructure. The declining costs of lithium-ion batteries, coupled with advancements in solid-state and flow battery technologies, are enhancing the feasibility of large-scale storage projects.

- In January 2023, Neoen began construction of the 200 MW / 400 MWh Blyth Battery in South Australia. This project strengthens regional energy storage, enhancing renewable integration, grid stability, and backup power while optimizing supply during peak demand.

Multi Energy Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Energy Source

|

Petroleum, Coal, Renewables, Natural Gas, Biomass, Others

|

|

By Component

|

Energy Management Systems (EMS), Power Generation Systems, Energy Storage Systems, Distribution Systems

|

|

By End-User

|

Residential Consumers, Commercial Establishments, Industrial Sector, Utility Providers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Energy Source (Petroleum, Coal, Renewables, Natural Gas, Biomass, and Others): The renewables segment earned USD 84.49 billion in 2023, fueled by increasing investments and government support for sustainable energy sources such as solar, wind, and hydropower.

- By Component (Energy Management Systems (EMS), Power Generation Systems, Energy Storage Systems, and Distribution Systems): The power generation systems segment held a share of 40.54% in 2023, mainly due to the growing demand for renewable energy sources, advancements in energy efficiency, and increased investments in decentralized generation systems, enhancing grid stability and reducing reliance on fossil fuels.

- By End-User (Residential Consumers, Commercial Establishments, Industrial Sector, and Utility Providers): The utility providers segment is projected to reach USD 255.29 billion by 2031, propelled by the increasing demand for reliable, sustainable energy, and the integration of renewables and energy storage solutions to enhance grid flexibility and resilience.

Multi Energy Systems Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific multi energy systems market captured a substantial share of around 38.12% in 2023, valued at USD 95.35 billion. This growth is facilitated by rapid industrialization, rising energy demand, and increasing investments in renewable energy and energy storage solutions.

Key countries such as China, India, and Japan are at the forefront of accelerating the transition to sustainable energy and enhancing grid stability through the integration of smart grids and renewables.

Key countries such as China, India, and Japan are at the forefront of accelerating the transition to sustainable energy and enhancing grid stability through the integration of smart grids and renewables.

- In July 2023, Mitsubishi Corporation, NTT Anode Energy, and Kyushu Electric Power launched a 1.4 MW / 4.2 MWh grid-scale battery storage system in Fukuoka Prefecture, Japan. This system is designed to minimize solar power curtailment and enhance the utilization of renewable energy by storing surplus solar power, addressing energy supply-demand imbalances. This initiative supports Japan's 2050 carbon neutrality target.

North America multi energy systems industry is likely to grow at a robust CAGR of 12.92% over the forecast period. This growth is fueled by increasing investments in renewable energy infrastructure, energy storage solutions, and the development of smart grids. Government incentives and a major focus on sustainability contribute to the region’s energy transition efforts.

For instance, the California Long Duration Energy Storage Program supports the development and deployment of long-duration energy storage systems to address grid reliability challenges. This program focuses on enhancing grid flexibility, integrating renewable energy sources, and providing clean energy storage solutions.

By advancing energy storage technology, it seeks to meet California's clean energy goals and foster a transition to 100% carbon-free energy.

Regulatory Frameworks:

- The United Nations Industrial Development Organization (UNIDO) Module 3 on Energy Regulation provides an introduction to energy regulation, focusing on the importance of regulation in achieving economic efficiency, consumer protection, and environmental sustainability.

- The International Energy Agency (IEA) is an intergovernmental organization that promotes energy security, sustainability, and global cooperation in addressing energy challenges. It provides policies and recommendations to ensure the world’s transition to cleaner, more affordable energy while tackling energy-related environmental issues.

- The Federal Energy Regulatory Commission (FERC) is responsible for regulating interstate electricity, natural gas, and oil markets in the U.S. FERC ensures reliable energy infrastructure, promotes competitive markets, and supports the integration of renewable energy sources.

- The National Renewable Energy Laboratory (NREL) is a U.S. government research facility focused on advancing renewable energy and energy efficiency technologies. NREL supports the development of solutions related to solar, wind, hydrogen, bioenergy, energy storage, and grid modernization.

- The Clean Energy Council (CEC) is a key Australian body advocating for the transition to clean energy. It supports industry growth through policy advocacy, education, and training programs, while promoting renewable energy solutions such as solar, wind, and storage.

Competitive Landscape

The global multi energy systems market is characterized by a number of participants, including both established corporations and emerging players. To gain a competitive edge, organizations must innovate by adopting advanced technologies, building strategic alliances, and focusing on sustainability.

Companies should prioritize the development of renewable energy solutions, energy storage technologies, and smart grid systems while complying with evolving regulations. This approach improves efficiency, increases market share, and aligns with the growing demand for clean energy solutions.

- In September 2023, Ørsted and Terra Solar teamed up to develop a 400 MW solar project in India. This partnership focuses on integrating solar power with battery storage solutions, aiming to enhance grid stability and increase the availability of renewable energy. The collaboration is a significant step in Ørsted's commitment to renewable energy and sustainable growth.

List of Key Companies in Multi Energy Systems Market:

- Siemens Energy

- General Electric Company

- Vestas

- ABB

- First Solar

- Enel Green Power S.p.A

- Solar Frontier Europe GmbH

- KYOCERA Corporation

- Hitachi, Ltd

- Mitsubishi Electric Corporation

- Rockwell Automation

- Schneider Electric SE

- Emerson Electric Co.

- Johnson Controls

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, SSE and Siemens Energy have announced a partnership under the Mission H2 Power initiative to develop gas turbines capable of running on 100% hydrogen. This collaboration aims to decarbonize SSE’s Keadby 2 Power Station in North Lincolnshire and support the UK's energy security goals. The project will integrate Siemens' cutting-edge turbine technology with SSE's low-carbon generation strategy to accelerate the use of hydrogen-fired power stations.

- In July 2024, TotalEnergies and SSE partnered to launch Source, a new player in the electric vehicle (EV) charging market. The initiative focuses on deploying fast-charging solutions across the UK, supporting the transition to clean energy and the increasing demand for EV infrastructure.

- In May 2024, Equinor partnered with Standard Lithium to acquire a 45% share in two lithium project companies located in Southwest Arkansas and East Texas. This collaboration aims to advance lithium extraction through Direct Lithium Extraction (DLE) technology, which offers a more sustainable alternative to traditional methods.

- In January 2023, Metal One Corporation and Clean Energy Systems (CES) formed a partnership to accelerate decarbonization in the global steel industry. By utilizing CES's carbon capture technology, the initiative seeks to reduce emissions from steel production and promote the use of green steel, aligning with Metal One’s commitment to net-zero industrial practices.

Key Highlights:

Key Highlights: Key countries such as China, India, and Japan are at the forefront of accelerating the transition to sustainable energy and enhancing grid stability through the integration of smart grids and renewables.

Key countries such as China, India, and Japan are at the forefront of accelerating the transition to sustainable energy and enhancing grid stability through the integration of smart grids and renewables.