Healthcare Medical Devices Biotechnology

Nanomedicine Market

Nanomedicine Market Size, Share, Growth & Industry Analysis, By Product (Nanoparticles, Nanorobots, Nanoshells, Nanotubes, Liposomes, others), By Application (Drug Delivery, Diagnostics, Cancer Therapy, Regenerative Medicine, Antimicrobial Treatment), By End User (Hospitals & Clinics, Research Institutes), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : February 2025

Report ID: KR1295

Market Definition

Nanomedicine refers to the use of nanotechnology in medicine, where nanoparticles or nanomaterials are employed for diagnosis, treatment, monitoring, and prevention of diseases.

This field focuses on utilizing the unique properties of nanoscale materials such as their small size, high surface area, and ability to interact with biological systems at a molecular level to develop more effective and targeted therapies, improve drug delivery, and enhance diagnostic tools.

Nanomedicine Market Overview

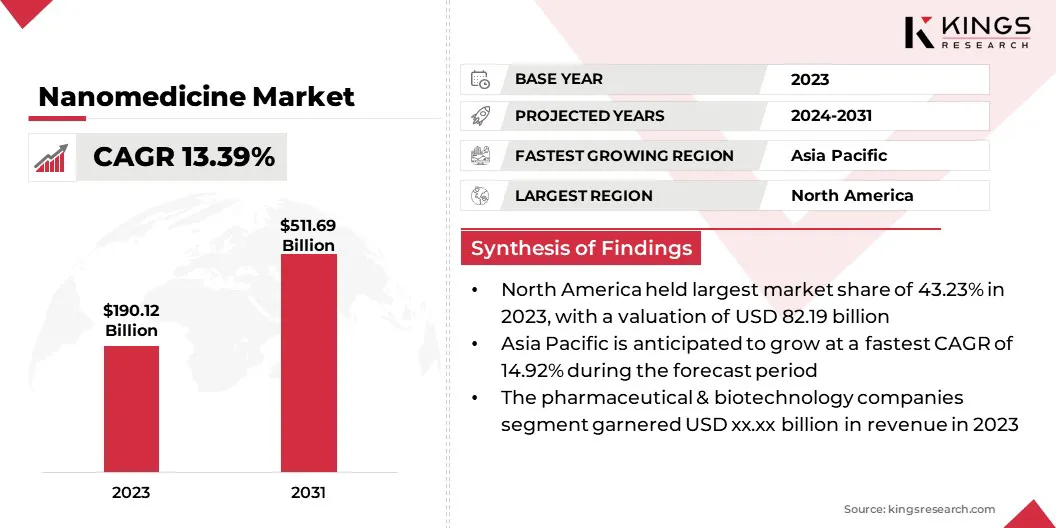

The global nanomedicine market size was valued at USD 190.12 billion in 2023 and is projected to grow from USD 212.26 billion in 2024 to USD 511.69 billion by 2031, exhibiting a CAGR of 13.39% during the forecast period.

The market is registering significant growth, driven by advancements in nanotechnology and its increasing application in drug delivery, diagnostics, and targeted therapies. The rise in chronic diseases, aging populations, and the demand for personalized medicine are contributing to this expansion.

Nanomedicine's ability to enhance the efficacy and precision of treatments, along with its potential to minimize side effects, is fueling its adoption across various therapeutic areas, including oncology, cardiovascular diseases, and infectious diseases.

Major companies operating in the nanomedicine market are Jazz Pharmaceuticals, Inc., Enovis Corporation, Gilead Sciences, Inc., Johnson & Johnson Services, Inc., Novartis AG, GlaxoSmithKline plc., Merck KGaA, Sanofi, Zylö Therapeutics, and Generation Bio Co..

The market is also benefiting from the growing research and development (R&D) activities, alongside increasing investments from pharmaceutical and biotechnology companies, which are shaping the future of healthcare through innovative nanotechnology-based solutions.

- In June 2024, Sanofi expanded its collaboration with the Anderson Lab at Massachusetts Institute of Technology to enhance mRNA therapies. This partnership combines Sanofi’s drug development expertise with the Anderson Lab’s lipid nanoparticle technology to improve the delivery of mRNA-based treatments for genetic diseases, advancing the field of nanomedicine.

Key Highlights:

- The global nanomedicine market size was valued at USD 190.12 billion in 2023.

- The market is projected to grow at a CAGR of 13.39% from 2024 to 2031.

- North America held a market share of 43.23% in 2023, with a valuation of USD 82.19 billion.

- The nanoparticles segment garnered USD 85.99 billion in revenue in 2023.

- The drug delivery segment is expected to reach USD 129.82 billion in 2031.

- The pharmaceutical & biotechnology companies segment is expected to reach USD 235.83 billion in 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 14.92% during the forecast period.

Market Driver

"Technological Advancements in Nanotechnology"

Technological advancements in nanotechnology, particularly in lipid nanoparticles (LNPs) and mRNA technology are significantly driving the nanomedicine market. The success of LNPs in delivering mRNA-based vaccines, such as those used for COVID-19, has opened new avenues for targeted drug delivery, enhancing treatment effectiveness while minimizing side effects.

- In July 2024, AmplifyBio formalized a partnership with Stephen Burgess, Ph.D. (AvaBurg LLC), to provide expertise in lipid nanoparticle (LNP) formulations for efficient mRNA delivery. The collaboration aims to optimize lipid-based systems, enhancing stability, biocompatibility, and delivery of mRNA therapeutics.

This innovation, combined with increased R&D investments from both public and private sectors, is accelerating the development of novel therapeutic solutions, particularly in areas like cancer, neurological disorders, and gene therapies.

Moreover, the convergence of nanotechnology and biotechnology is further propelling the market by creating cutting-edge solutions that integrate biologically derived molecules with nanomaterials, enabling highly targeted and efficient treatments.

This synergy between nanotechnology and biotechnology is paving the way for personalized and advanced therapies, making nanomedicine a rapidly expanding field with immense potential for future growth.

Market Challenge

"Complex Manufacturing Processes and Lack of Standardized Regulatory Frameworks"

One of the primary challenges is the complexity of manufacturing and scaling nanomaterials, especially lipid nanoparticles used in drug delivery systems, which require precise control oversize, distribution, and surface properties.

This complexity often results in high production costs, making it difficult for smaller companies to compete in the market. Additionally, the lack of standardized regulatory frameworks and clear guidelines for nanomedicine approval poses a significant challenge.

Regulatory agencies like the FDA and EMA are still adapting to the rapidly evolving field, which can result in delays in bringing innovative nanomedicines to market. Safety concerns, particularly regarding the potential long-term effects of nanoparticles on human health and the environment, remain a key hurdle, due to limited data on the biocompatibility and toxicity of these materials.

Moreover, the integration of nanomedicine into existing healthcare systems can be slow, as medical professionals and patients may be hesitant to adopt these new technologies without sufficient evidence of their efficacy and safety.

Market Trend

"Increasing Use of LNPS for Drug Delivery"

One prominent trend is the increasing use of lipid nanoparticles (LNPs) for drug delivery, particularly in the development of mRNA-based therapies. LNPs have gained attention for their ability to effectively encapsulate and deliver nucleic acids to target cells, revolutionizing vaccine development and gene therapies.

Another trend is the growing focus on personalized medicine, where nanomedicines are being tailored to individual patients based on their genetic makeup, improving treatment efficacy and minimizing side effects.

The trend of collaborations between pharmaceutical companies and academic research institutions to advance the development of nanomedicine technologies is increasing, particularly in the areas of cancer treatment and regenerative medicine.

- For instance, in February 2024, UT Southwestern Medical Center partnered with Pfizer Inc. to develop RNA-enhanced delivery technologies for genetic medicine therapies, utilizing nanoparticles such as lipid nanoparticles. This collaboration aims to accelerate the development of new RNA-based treatments and delivery systems.

Nanomedicine Market Report Snapshot

| Segmentation | Details |

| By Product | Nanoparticles (Polymeric Nanoparticles, Liposomes, Solid Lipid Nanoparticles, Dendrimers, Gold Nanoparticles, Magnetic Nanoparticles, Quantum Dots), Nanorobots, Nanoshells, Nanotubes, Liposomes(Multilamellar Liposomes, Unilamellar Liposomes), others |

| By Application | Drug Delivery (Targeted Drug Delivery, Controlled Drug Release, Gene Therapy, Vaccine Delivery), Diagnostics (In Vivo Imaging, Biosensors), Cancer Therapy (Chemotherapy, Immunotherapy, Others), Regenerative Medicine (Tissue Engineering Stem Cell Therapy), Antimicrobial Treatment |

| By End User | Hospitals & Clinics, Research Institutes, Pharmaceutical & Biotechnology Companies |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Nanoparticles, Nanorobots, Nanoshells, Nanotubes, Liposomes, and others): The nanoparticles segment earned USD 85.99 billion in 2023, due to their increasing use in drug delivery systems, enhanced by their ability to improve bioavailability and target specific cells.

- By Application (Drug Delivery, Diagnostics, Cancer Therapy, and Regenerative Medicine, and Antimicrobial Treatment): The drug delivery segment held 45.65% share of the market in 2023, due to the growing demand for more effective and targeted therapies, with nanoparticles enhancing drug stability, bioavailability, and precision in treating diseases like cancer and genetic disorders.

- By End User (Hospitals & Clinics, Research Institutes, and Pharmaceutical & Biotechnology Companies): The pharmaceutical & biotechnology companies segment is projected to reach USD 235.83 billion by 2031, owing to the increasing demand for innovative drug delivery systems, personalized medicine, and the growing adoption of nanomedicine in drug development and therapeutic applications..

Nanomedicine Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial nanomedicine market share of 43.23% and was valued at USD 82.19 billion in 2023. The region benefits from a robust healthcare infrastructure, advanced R&D activities, and significant healthcare spending.

The demand for nanomedicine is bolstered by increasing investments in R&D, alongside a growing need for targeted drug delivery systems and personalized medicine.

North America is home to several leading players in the pharmaceutical and biotechnology industries, which continue to drive the development and commercialization of nanomedicines. The region also enjoys strong government support and favourable regulatory frameworks, facilitating the growth of nanotechnology in healthcare.

The market in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 14.92%. This growth is largely driven by the increasing healthcare needs of a rapidly aging population and the rising prevalence of chronic diseases across the region.

Additionally, substantial investments in biotechnology and nanotechnology research, coupled with growing collaborations with global pharmaceutical companies, are accelerating the adoption of nanomedicine.

The region’s expanding healthcare expenditure and advancements in drug delivery technologies are improving access to cutting-edge treatments. Emerging economies such as China and India are playing a significant role in the adoption of innovative healthcare solutions, further contributing to the rapid growth of the market in Asia Pacific.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the FDA regulates nanomedicine. The FDA's Office of Regulatory Affairs (ORA) ensures that FDA-regulated products that use nanotechnology comply with regulations. The FDA uses existing statutory and regulatory authorities to regulate nanotechnology products.

- In Europe, the primary regulatory authority governing nanomedicine is the European Medicines Agency (EMA), which applies its general medicinal product legislation to regulate nanomedicines for human use, providing specific scientific guidelines for their evaluation and marketing authorization applications.

- In China, the primary regulatory authority governing nanomedicine is the National Medical Products Administration (NMPA), which oversees the regulation of pharmaceuticals, medical devices, and cosmetics, including those utilizing nanotechnology.

- In India, nanomedicine is regulated by the Department of Science and Technology (DST) in collaboration with the Ministry of Health and Family Welfare, while the Central Drug Standard Control Organization (CDSCO) oversees clinical aspects. However, there are no specific regulations for nanotechnology, and existing drug regulations are applied considering the properties of nanomaterials.

- In Australia, the Therapeutic Goods Administration (TGA) is the primary regulatory authority governing nanomedicine, as it oversees all therapeutic goods including medicines and medical devices, which encompasses nanomedicine products as well.

Competitive Landscape:

The nanomedicine market is characterized by a large number of participants, including both established corporations and rising organizations.

This market represents an exciting and rapidly evolving field within healthcare, combining advanced nanotechnology with medical applications to improve the diagnosis, treatment, and prevention of diseases.

Over recent years, significant progress has been made in utilizing nanomedicine for a variety of medical purposes, from targeted drug delivery to diagnostic imaging. The market is highly competitive, with a diverse range of players working to unlock the potential of nanotechnology in healthcare.

Large pharmaceutical companies and biotech firms are heavily investing in the development of nanomedicine. These companies are focusing on the creation of lipid nanoparticles, dendrimers, and liposomes, which are widely used for drug encapsulation and delivery.

These advancements allow for the encapsulation of therapeutic agents such as chemotherapy drugs or RNA-based therapies and their targeted delivery to specific sites in the body.

- In January 2025, Ardena and RiboPro formed a strategic alliance to enhance RNA-based health treatments. Combining Ardena’s expertise in LNP-mRNA manufacturing with RiboPro’s proprietary portfolio of mRNA technologies, offering a unique end-to-end solution for advanced mRNA and lipid nanoparticle (LNP) production, the partnership aims to accelerate drug development and reduce manufacturing risks, advancing nanomedicine therapies to patients faster.

List of Key Companies in Nanomedicine Market:

- Jazz Pharmaceuticals, Inc.

- Enovis Corporation

- Gilead Sciences, Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- GlaxoSmithKline plc.

- Merck KGaA

- Sanofi

- Zylö Therapeutics

- Generation Bio Co.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Ardena announced the full GMP approval of its expanded nanomedicine facility in Oss, Netherlands. This approval, granted by the Dutch Healthcare Authority, allows Ardena to manufacture nanomedicines and supports its mission to bring innovative therapies to the market.

- In November 2024, Sapienza University’s NanoDelivery Lab, with support from CERIC-ERIC, developed lipid nanoparticles that can transport large DNA molecules, improving gene therapy effectiveness. The engineered particles, designed to evade the immune system, offer potential for correcting genetic defects and treating cancer.

- In September 2024, Cytiva launched its RNA delivery LNP kit, designed for use with the NanoAssemblr Ignite and Ignite+ systems. This addition to the GenVoy-ILM product line aims to accelerate mRNA & saRNA vaccine development and enhance nanomedicine applications.

- In August 2024, Evonik partnered with KNAUER to enhance the scaling process for lipid nanoparticle (LNP) formulations used in mRNA and gene therapies. The collaboration aims to reduce pre-clinical development times and improve the efficiency of LNP production, accelerating the time to market for nucleic acid-based medicines.

- In August 2024, VION Biosciences announced the acquisition of Echelon Biosciences, a leading supplier of lipid-based excipients and lipid nanoparticles. The acquisition enhances VION's platform, expanding its product line and moving the company closer to supporting drug manufacturing in the mRNA and gene therapy sectors.

- In July 2023, Nanobiotix and Janssen Pharmaceutica NV announced a global licensing, co-development, and commercialization agreement for the investigational nanomedicine NBTXR3. The partnership focuses on advancing NBTXR3, a potential first-in-class radioenhancer in the field of nanomedicine, for the treatment of various cancers, including solid tumors like head and neck cancer and metastatic cancers.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)