Network Packet Broker Market

Network Packet Broker Market Size, Share, Growth & Industry Analysis, By Bandwidth (1 Gbps & 10 Gbps, 40 Gbps, and 100 Gbps), By End-User (Enterprises, Service Providers, and Government Organizations), By Deployment (Fixed and Cloud), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR917

Network Packet Broker Market Size

The global Network Packet Broker Market size was valued at USD 958.4 million in 2023 and is projected to grow from USD 1,012.6 million in 2024 to USD 1,572.9 million by 2031, exhibiting a CAGR of 6.49% during the forecast period. The expansion of the market is driven by the increasing demand for enhanced network visibility and security.

Key factors supporting this expansion are the increasing proliferation of cyber threats and the growing complexity of IT infrastructures. Additionally, the emergence of trends such as AI and ML integration for advanced analytics and the widespread adoption of virtualized, cloud-native solutions for scalability and flexibility are fueling the growth of the market.

In the scope of work, the report includes solutions offered by companies such as Gigamon, NETSCOUT, Keysight Technologies, Tempest, VIAVI Solutions Inc., APCON, Inc., Garland Technology, Juniper Networks, Inc., Broadcom, Open Networking Foundation, and others.

The expansion of the network packet broker market is propelled by rising consumer preference for improved network visibility and security in response to the growing complexity of IT infrastructures and rising cyber threats. Key trends contributing to this expansion include the integration of AI and ML technologies, which enhance capabilities in analytics and automated threat detection.

- The Pew Research Center surveyed 11,004 U.S. adults from December 12-18, 2022, and found that 27% of Americans said they interacted with AI at least several times a day. Another 28% believed they interacted with it about once a day or several times a week.

Additionally, there is a noticeable shift toward virtualized and cloud-native solutions, catering to the surging need for scalability and flexibility in network operations. These trends underscore a fundamental evolution toward smarter, more adaptable network management solutions that are crucial for organizations seeking robust network performance and comprehensive cybersecurity measures in today's digital landscape.

A network packet broker (NPB) is a hardware or software device that intelligently manages and distributes network traffic. It captures and aggregates data packets from multiple network links, applies filters and processes these packets according to defined policies, and subsequently forwards them to monitoring, security, or analysis tools.

NPBs provide visibility into network traffic, optimize performance, facilitate security monitoring, and enable efficient troubleshooting by directing relevant traffic to appropriate tools without impacting the production network. They play a crucial role in enhancing network management and security operations within complex IT environments.

Analyst’s Review

The increasing prevalence of cyber threats and continual advancements in network packet broker technologies are stimulating the growth of the market.

- For instance, in March 14, 2024, Juniper Networks, a leader in AI-Native Networking, announced the next evolution of its global Juniper Partner Advantage (JPA) Program. Juniper's enhancement of its partner program, which leverages AIOps for managed networking services, significantly enhances reliability and agility, catering to the increasing customer demand for consistent and efficient networking solutions.

Moreover, Garland Technology's collaboration with Mira Security broadens its portfolio by incormporatinbg advanced decrypting technology, effectively addressing complex security challenges globally.

Advanced packet brokers, which integrate AI and ML, are pivotal in enhancing threat detection and network optimization capabilities, thereby meeting the growing demands of organizations to safeguard their infrastructure. These strategic moves are expanding product offerings and fostering the adoption of advanced packet broker solutions.

Network Packet Broker Market Growth Factors

The increasing complexity of IT infrastructures and the surge in cyber threats are highlighting the pressing need for advanced network visibility and security. Organizations are turning to network packet brokers to efficiently monitor, manage, and safeguard their networks.

These brokers are playing a crucial role in traffic analysis, by providing real-time insights into network performance and promptly identifying potential threats. By enhancing threat detection and enabling rapid incident response, network packet brokers contribute to the maintainance of robust security postures. This growing reliance on packet brokers to ensure network integrity and performance is aiding market growth, reflecting their essential role in modern network management.

- According to the Federation Bureau of Investigation, in 2023, IC3 received a record number of complaints from the American public, totaling 880,418. The reported potential losses exceeded USD 12.5 billion. This figure showed a nearly 10% rise in the number of received complaints and a 22% increase in reported loss compared to 2022.

However, the complexity and high costs associated with implementing these solutions presents a major challenge to the development of the network packet broker market, particularly posing barriers for small and medium-sized enterprises (SMEs).

The deployment and management of packet brokers require substantial investments in capital and specialized expertise, which may be challenging for SMEs to afford. To address this challenge, key players are innovating with more cost-effective solutions tailored to SME needs, such as scalable pricing models and cloud-hosted options.

They are further simplifying deployment processes, offering educational support, fostering partnerships, and providing tailored consulting services. These efforts aim to lower barriers to entry, empowering SMEs to leverage advanced packet broker technologies effectively and thereby spur market growth.

Network Packet Broker Market Trends

The rapid adoption of cloud computing and virtualization technologies is propelling the growth of the network packet broker market. As organizations transition their applications and data to the cloud and implement virtualized environments, there is a growing need for NPBs that effectively operate in these settings.

This demand is bolstering the development and deployment of cloud-native and virtualized NPB solutions, which offer essential network visibility and optimization capabilities tailored for dynamic cloud environments. By ensuring seamless monitoring and management of network traffic, these advanced NPBs are becoming essential for maintaining robust network performance and security.

The integration of AI and ML technologies into network packet brokers is profoundly reshaping network management practices. These advanced technologies enhance packet brokers by incorporating sophisticated analytics, automated threat detection, and predictive maintenance capabilities.

AI-driven packet brokers analyze large volumes of data in real-time, swiftly identifying security threats and performance anomalies to enhance network operations. This shift toward intelligent network management solutions is expected to boost market growth, as organizations increasingly prioritize effective network monitoring and security measures.

- For instance, in November 2023, NETSCOUT SYSTEMS, INC., in response to the increasingly complex threat landscape, launched Adaptive DDoS Protection for Arbor Edge Defense (AED) to mitigate DNS water torture attacks, which surged by 353% during the first half of 2023. This proactive approach underscores the growing demand for robust network packet brokers capable of safeguarding critical infrastructure from emerging cyber threats while ensuring optimal performance.

Segmentation Analysis

The global market is segmented based on bandwidth, end-user, deployment, and geography.

By Bandwidth

Based on bandwidth, the market is categorized into 1 Gbps & 10 Gbps, 40 Gbps, and 100 Gbps. The 1 Gbps & 10 Gbps segment led the network packet broker market in 2023, reaching a valuation of USD 490.0 million.

As data traffic continues to surge due to the proliferation of connected devices and digital applications, organizations require robust NPB solutions capable of effectively handling increasing bandwidth demands. NBPs with 1 Gbps bandwidth remain crucial for small to medium-sized enterprises (SMEs) and smaller network environments, where cost-effective solutions are paramount.

In addition, the segment benefits from the growing adoption of NBPs with 10 Gbps bandwidth among larger enterprises and data centers that require higher throughput and scalability. The segment is witnessing robust expansion as it addresses diverse network needs, including efficient traffic management, monitoring, advanced security, and compliance requirements.

By End-User

Based on end-user, the market is divided into enterprises, service providers, and government organizations. The enterprises segment captured the largest network packet broker market share of 51.12% in 2023.

Enterprises across various industries are increasingly adopting NPB solutions to enhance network visibility, optimize performance, and bolster cybersecurity measures. These solutions are crucial for managing complex IT infrastructures, ensuring efficient traffic distribution to monitoring and security tools, and facilitating compliance with regulatory requirements.

Enterprises benefit from the scalability of NPBs, which are capable of handling large volumes of data traffic across multiple network links. This capability supports seamless operations and enhances proactive threat detection. The surging demand for advanced NPB capabilities in enterprises is propelling segmental expansion.

By Deployment

Based on deployment, the market is categorized into fixed and cloud. The fixed segment is expected to garner the highest revenue of USD 960.3 million by 2031.

Fixed NPB solutions are specifically tailored for specific, non-adjustable network configurations. These solutions are typically deployed in environments where network characteristics are stable and predictable, such as traditional office settings or data centers with established infrastructure.

Fixed NPBs offer consistent performance and reliability, ensuring efficient traffic aggregation, filtering, and distribution to monitoring tools without the need for frequent adjustments. These NBPs caters primarily to organizations seeking cost-effective solutions for routine network management and security needs. This steady adoption in stable network environments, where flexibility is less critical compared to reliability and operational consistency bolsters segmental expansion.

Network Packet Broker Market Regional Analysis

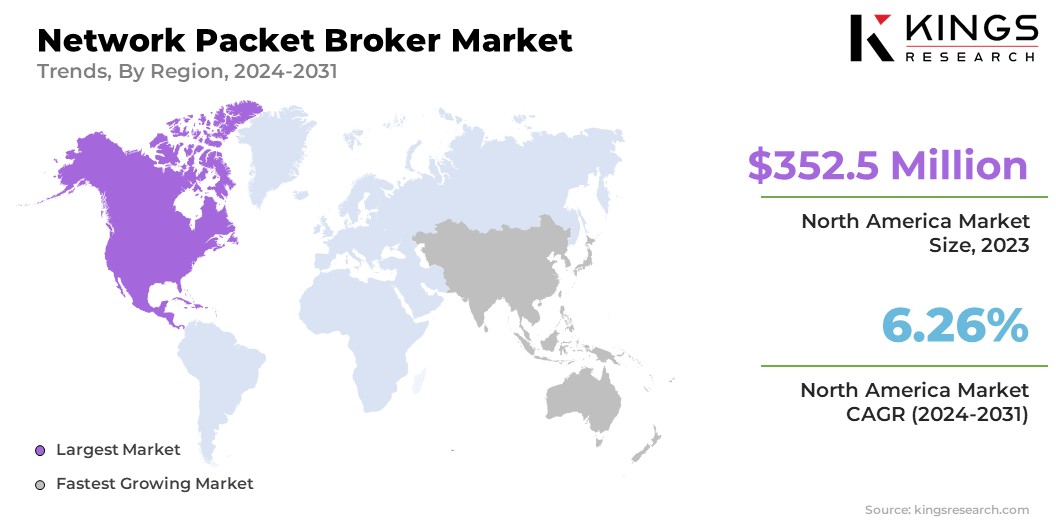

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America network packet broker market share stood around 36.78% in 2023 in the global market, with a valuation of USD 352.5 million. This notable expansion is largely attributed to robust technological adoption and stringent cybersecurity requirements across various industries. The region's advanced IT infrastructure and high concentration of enterprises propel significant demand for NPB solutions.

Key factors supporting this growth include increasing data traffic resulting from cloud adoption, the rising cyber threats that necessitate enhanced network visibility and security, and the requirements for regulatory compliance. North American enterprises leverage NPBs to optimize network performance, streamline monitoring processes, and fortify defenses against evolving threats. This region's proactive efforts toward network management and cybersecurity foster innovation and stimulate regional market expansion.

Asia-Pacific is anticipated to witness substantial growth at a robust CAGR of 7.03% over the forecast period. As countries across the region adopt cloud computing, IoT technologies, and digital transformation initiatives, the demand for NPB solutions is rising. Organizations seek advanced capabilities in network visibility, traffic optimization, and cybersecurity to manage complex data environments effectively.

Additionally, stringent regulatory requirements and increasing cyber threats underscore the pressing need for robust NPB deployments. This proactive approach toward enhancing network management and security positions Asia Pacific as a key region for NPBs.

Competitive Landscape

The global network packet broker market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Network Packet Broker Market

- Gigamon

- NETSCOUT

- Keysight Technologies

- Tempest

- VIAVI Solutions Inc.

- APCON, Inc.

- Garland Technology.

- Juniper Networks, Inc.

- Broadcom

- Open Networking Foundation

Key Industry Development

- October 2022 (Product Launch): Keysight Technologies, Inc., a leading technology company, introduced the new Vision 400 Series Network Packet Brokers. These advanced solutions are designed to provide enhanced visibility in high-speed 400G hybrid networks. This development underscores Keysight's commitment to addressing the growing demand for robust network monitoring and management capabilities in modern, high-speed network infrastructures.

The global network packet broker market is segmented as:

By Bandwidth

- 1 Gbps & 10 Gbps

- 40 Gbps

- 100 Gbps

By End User

- Enterprises

- Service Providers

- Government Organizations

By Deployment

- Fixed

- Cloud

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership