Nuclear Decommissioning Market

Nuclear Decommissioning Market Size, Share, Growth & Industry Analysis, By Reactor Type (Pressurized Water Reactor, Boiling Water Reactor, Gas-Cooled Reactor, and Others), By Capacity (Below 100 MW, 100 MW -1000MW, and Above 1000 MW), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR803

Nuclear Decommissioning Market Size

Global Nuclear Decommissioning Market size was recorded at USD 9.38 billion in 2023, which is estimated to be at USD 10.28 billion in 2024 and projected to reach USD 21.51 billion by 2031, growing at a CAGR of 11.12% from 2024 to 2031. In the scope of work, the report includes services offered by companies such as Orano, Babcock International Group PLC, Westinghouse Electric Company LLC, AECOM, Studsvik AB, Bechtel Corporation, Nuvia, Manafort Brothers Incorporated, BWX Technologies. Inc., EDF Energy, and others.

The widespread adoption of digital twin technology in the nuclear decommissioning market is significantly reshaping the methodologies employed in the planning and implementation of these projects. Digital twins are virtual replicas of physical assets, processes, or systems, enabling real-time simulation, monitoring, and optimization.

In nuclear decommissioning, digital twins allow for the creation of precise 3D models of nuclear facilities, including all infrastructure and radioactive materials. This technology facilitates detailed planning and scenario analysis, helping engineers and project managers visualize and address potential challenges before they arise.

The ability to simulate various decommissioning steps ensures that safety protocols are rigorously tested and optimized, thereby reducing risks to both workers and the environment. Additionally, digital twins provide a platform for continuous monitoring, allowing for real-time adjustments and ensuring that the decommissioning process stays on track and within budget.

The integration of digital twin technology is further bolstered by the pressing need for enhanced safety, efficiency, and cost-effectiveness in decommissioning projects, responding to stringent regulatory requirements and the complex nature of dismantling aging nuclear infrastructure.

Nuclear decommissioning refers to the process of safely closing and dismantling nuclear power plants and other nuclear facilities upon reaching the end of their operational lifespan or becoming obsolete. This process involves several critical steps: such as decontamination, dismantling, waste management, and site remediation. It ensures that all radioactive materials are securely removed and disposed of and that the site is restored to a condition safe for other uses.

Nuclear reactors, which are the core components of these facilities, come in various types such as pressurized water reactors (PWRs), boiling water reactors (BWRs), and gas-cooled reactors (GCRs), each with different structural and operational characteristics that impact the decommissioning approach. The capacity of these reactors, which is typically measured in megawatts (MW), ranges significantly, thereby influencing the scale and complexity of decommissioning efforts.

Large reactors, often exceeding 1,000 MW, present considerable challenges in terms of the volume of radioactive materials and the extent of structural dismantling required. The comprehensive decommissioning process is crucial for mitigating environmental and health risks associated with residual radioactivity and for repurposing or safely abandoning former nuclear sites.

Analyst’s Review

The global nuclear decommissioning market is poised to witness significant growth, mainly fueled by an aging fleet of nuclear reactors and stringent environmental regulations. As nuclear facilities worldwide approach the end of their operational lives, the demand for comprehensive decommissioning services is set to rise substantially.

- Key players in this market are focusing on several strategic imperatives to capitalize on growth opportunities and mitigate challenges. These companies are heavily investing in technological innovations, such as advanced robotics, AI, and digital twin technology, to enhance safety, efficiency, and cost-effectiveness in decommissioning processes.

By leveraging these technologies, firms streamline operations, reduce human exposure to hazardous environments, and improve project accuracy. Moreover, standardizing and modularizing decommissioning tasks allow for more predictable outcomes and cost reductions. This strategy further facilitates scalability, enabling companies to handle multiple projects while maintaining consistent quality and safety standards. By focusing on these strategic imperatives, prominent players are well-positioned to lead and innovate in the burgeoning nuclear decommissioning market.

Nuclear Decommissioning Market Growth Factors

The global demand for nuclear decommissioning services is significantly boosted by the aging fleet of nuclear reactors, with numerous reactors approaching or having already surpassed their intended operational lifespans. Most nuclear reactors were constructed in the mid-to-late 20th century, particularly during the 1970s and 1980s, and they are nearing the end of their planned operational periods of 40 to 50 years. As these reactors age, they face increasing risks of structural failures, safety issues, and inefficiencies.

The necessity to maintain high safety standards and comply with stringent regulatory requirements underscores the urgency to decommission these aging facilities. Moreover, the operational costs associated with maintaining and upgrading older reactors often outweigh the benefits, making decommissioning a more economically viable option. This trend is particularly evident in regions such as Europe and North America, where many reactors are increasingly being scheduled for decommissioning.

Additionally, public concern over the potential hazards posed by outdated nuclear facilities is prompting governments and companies to prioritize decommissioning. The growing focus on transitioning to renewable energy sources further aligns with the decommissioning of old nuclear plants, thereby facilitating the shift toward a more sustainable and safer energy landscape.

Managing and disposing of radioactive waste presents major challenges to the development of the nuclear decommissioning process, primarily due to the hazardous nature of the materials involved. Radioactive waste includes various forms of contaminated materials, such as spent nuclear fuel, reactor components, and contaminated soil and water, all of which pose significant health and environmental risks. The primary challenge lies in ensuring the safe containment, transportation, and long-term storage of these materials to prevent radiation exposure and contamination.

High-level radioactive waste, which remains hazardous for thousands of years, requires secure, geologically stable storage solutions that withstand natural disasters, human interference, and other potential risks over extended periods. Additionally, the process of conditioning and packaging waste for disposal require adherence to rigorous safety and regulatory standards, thereby complicating waste management efforts. The limited availability of suitable disposal sites, coupled with public opposition to storing radioactive materials, exacerbates the challenge.

Nuclear Decommissioning Market Trends

The advancement in robotics and automation is significantly transforming the nuclear decommissioning landscape, resulting in enhanced safety, efficiency, and precision in decommissioning activities. Robots equipped with advanced sensors, AI, and machine learning capabilities are increasingly being deployed to perform complex tasks in hazardous environments. This integration reduces the need for human intervention, thereby minimizing the risk of radiation exposure. These robotic systems navigate confined and contaminated spaces, dismantle structures, and handle radioactive materials with a level of precision and consistency that surpasses human capabilities.

Additionally, automation technologies are streamlining various aspects of the decommissioning process, from planning and simulation to real-time monitoring and data analysis. Automated systems continuously monitor radiation levels, structural integrity, and other critical parameters, enabling proactive decision-making and timely interventions. The integration of these technologies is supported by the pressing need to enhance operational safety, reduce project timelines, and lower costs associated with manual labor and human safety measures.

Segmentation Analysis

The global market is segmented based on reactor type, capacity, and geography.

By Reactor Type

Based on reactor type, the market is segmented into pressurized water reactor, boiling water reactor, gas-cooled reactor, and others. The pressurized water reactor segment captured the largest nuclear decommissioning market share of 43.56% in 2023, largely attributed to its widespread adoption and extensive presence within the global nuclear power industry.

Pressurized water reactors (PWRs) are the most commonly used type of nuclear reactors, accounting for nearly two-thirds of all operational nuclear power plants worldwide. This extensive deployment creates a substantial demand for decommissioning services as many of these reactors reach the end of their operational lives.

- The mature technology and historical preference for PWRs in numerous countries, particularly in the U.S., France, and Russia, contribute to the large volume of reactors entering the decommissioning phase.

Additionally, the well-documented operational history and established regulatory frameworks for PWRs facilitate more predictable and standardized decommissioning processes. The expansion of the segment is further propelled by the extensive infrastructure and expertise available for managing PWR decommissioning projects, allowing for efficient scaling and execution. Furthermore, the decommissioning of PWRs often involves complex and high-value contracts.

By Capacity

Based on capacity, the nuclear decommissioning market is classified into below 100 MW, 100 MW - 1000MW, and above 1000 MW. The above 1000 MW segment is poised to record a staggering CAGR of 12.11% through the forecast period, mainly due to the increasing decommissioning needs of large-scale nuclear power plants that have been operational for several decades.

These high-capacity reactors, built during the peak of nuclear energy expansion in the 1970s and 1980s, are reaching the end of their planned operational lifespans and are scheduled for decommissioning. The sheer size and complexity of decommissioning these large reactors require substantial investments and advanced technological solutions, contributing to the growth of this segment.

Furthermore, the regulatory landscape is becoming increasingly stringent, necessitating meticulous planning and execution of decommissioning activities to ensure compliance with safety and environmental standards. The high costs associated with decommissioning large reactors, including the management and disposal of substantial amounts of radioactive waste, further drive segmental growth. Moreover, the expertise and specialized equipment required for dismantling and safely handling the components of these large reactors are fostering innovations and advancements in decommissioning technologies.

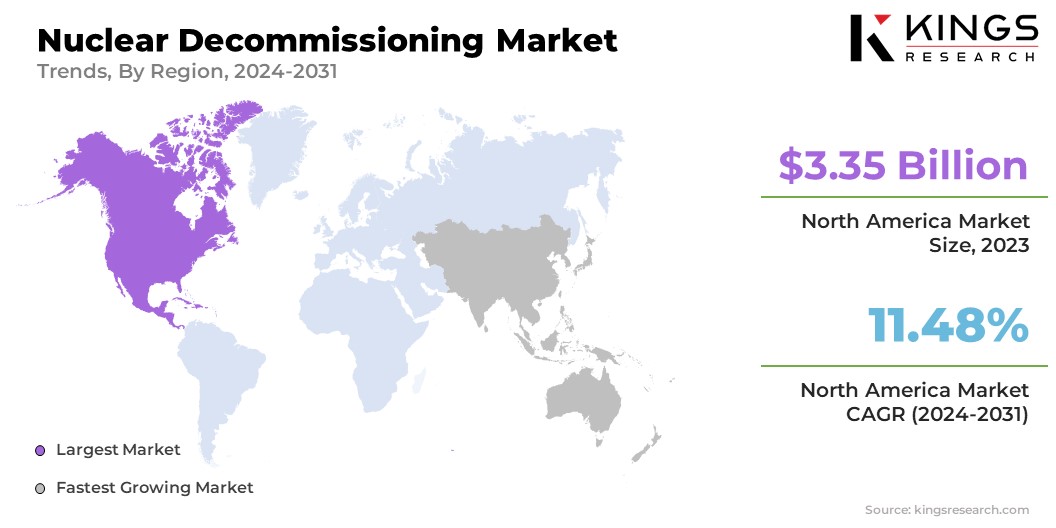

Nuclear Decommissioning Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America Nuclear Decommissioning Market share stood around 35.67% in 2023 in the global market, with a valuation of USD 3.35 billion. This dominant market position is largely spurred by the extensive number of aging nuclear reactors across the U.S. and Canada that are reaching the end of their operational lifespans. The stringent regulatory environment in North America, combined with a strong commitment to environmental and public safety, has accelerated the decommissioning process.

Additionally, the presence of major decommissioning service providers and advanced technological infrastructure in the region facilitates efficient and effective decommissioning operations. The significant financial resources allocated by both governmental bodies and private sector stakeholders for decommissioning projects underscore the region's commitment to maintaining high safety standards and mitigating environmental risks. Furthermore, North America's experience and established protocols in handling complex decommissioning projects contribute to solidifying its leading market position.

Asia-Pacific is projected to grow at the highest CAGR of 12.40% in the forthcoming years. This rapid growth is primarily attributed to the increasing number of nuclear reactors in countries such as Japan, South Korea, China, and India, many of which are approaching the end of their operational lifespans. Japan plays a crucial role in this growth due to its extensive decommissioning projects initiated after the Fukushima Daiichi nuclear disaster.

- Additionally, as countries in the region advance their nuclear energy policies, there is a major emphasis on establishing robust decommissioning frameworks to ensure safe and efficient decommissioning practices.

The region's growing focus on adopting advanced technologies and developing specialized expertise to handle the unique challenges of decommissioning various reactor types is propelling domestic market growth. Moreover, favorable governmental initiatives and substantial investments in decommissioning infrastructure are supporting Asia-Pacific nuclear decommissioning market expansion.

Competitive Landscape

The nuclear decommissioning market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Nuclear Decommissioning Market

- Orano

- Babcock International Group PLC

- Westinghouse Electric Company LLC

- AECOM

- Studsvik AB

- Bechtel Corporation

- Nuvia

- Manafort Brothers Incorporated

- BWX Technologies. Inc.

- EDF Energy

Key Industry Development

- December 2023 (Investment): Orano completed the segmentation, packaging, and removal of the 35-foot nuclear reactor vessel and its internal components in less than two years. This achievement marked a significant milestone in the CR3 accelerated decommissioning project with NorthStar, accomplished safely and without any lost-time accidents.

The global nuclear decommissioning market is segmented as:

By Reactor Type

- Pressurized Water Reactor

- Boiling Water Reactor

- Gas-Cooled Reactor

- Others

By Capacity

- Below 100 MW

- 100 MW - 1000MW

- Above 1000 MW

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)