Automotive and Transportation

Occupant Classification System Market

Occupant Classification System Market Size, Share, Growth & Industry Analysis, By Sensor (Pressure Sensor, Seat Belt Sensor, Others), By Component (Airbag Control Unit, Sensor, Others), By Technology (Wired, Wireless), Vehicle Type (Passenger Cars, Commercial Vehicles), By End-User (OEMs, Aftermarket) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR1002

Occupant Classification System Market Size

The global Occupant Classification System Market size was valued at USD 2,812.4 million in 2023 and is projected to grow from USD 2,978.5 million in 2024 to USD 4,657.0 million by 2031, exhibiting a CAGR of 6.59% during the forecast period.

The growth of the market is driven by stringent automotive safety regulations, ongoing advancements in sensor technologies, and the increasing demand for advanced vehicle safety features.

In the scope of work, the report includes solutions offered by companies such as Aptiv, Autoliv, Continental AG, Flexpoint Sensor Systems, Inc., Nidec Elesys Americas Corp., Robert Bosch GmbH, IEE Smart Sensing Solutions, ZF Friedrichshafen AG, AISIN CORPORATION, DENSO CORPORATION., and others.

The expansion of the market is primarily fueled by advancements in automotive safety regulations and the increasing integration of smart technologies in vehicles. Governments worldwide are mandating the use of advanced safety features to reduce road fatalities, thus propelling the demand for occupant classification systems.

Additionally, the rise of autonomous and semi-autonomous vehicles requires sophisticated safety mechanisms, thereby boosting market growth. Surging consumer demand for enhanced safety and comfort features in automobiles further contributes to the development of the market. The proliferation of electric and hybrid vehicles, many of which come equipped with advanced safety systems as standard features, is another critical factor aiding market growth.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of motor vehicles increased by 10.27% in 2023 compared to 2022.

The occupant classification system market is experiencing robust growth due to the expanding automotive industry and the enforcement of stringent safety regulations. Occupant classification systems, which detect the presence and type of occupants in a vehicle, play a crucial role in enhancing passenger safety.

They enable the deployment of airbags and other safety mechanisms more effectively, thereby minimizing injury risks during accidents. Asia-Pacific region is witnessing rapid growth owing to the increasing production and sales of automobiles. Technological advancements and continuous innovation in sensor technology are expected to fuel the growth of the market.

The market encompasses technologies designed to identify and classify occupants in a vehicle to optimize safety mechanisms. These systems utilize sensors, including weight sensors, seatbelt tension sensors, and pressure sensors, to determine the size, weight, and position of occupants. The data collected is used to control airbag deployment, ensuring it is tailored to individual occupants' characteristics, thereby enhancing safety.

These systems are integral to modern automotive safety, ensuring compliance with regulatory standards and enhancing vehicle safety ratings. The market includes both hardware and software components, which are integrated into vehicles by original equipment manufacturers (OEMs) and aftermarket suppliers.

Analyst’s Review

The occupant classification system market is witnessing substantial advancements due to manufacturers’ efforts to develop innovative and cost-effective solutions. Key industry players are focusing on integrating artificial intelligence and wireless technologies to enhance system accuracy and efficiency.

New products with advanced sensor technologies are being introduced to address the growing demand for safer and smarter vehicles. To capitalize on market opportunities, manufacturers are advised to continue investing in research and development, particularly in AI and sensor technologies. Collaboration with technology firms further stimulate innovation in the market.

- For instance, in September 2023, Autoliv China and Great Wall Motor (GWM) collaborated to enhance automotive safety by developing advanced technologies, including an overhead passenger airbag and a zero-gravity seat for autonomous vehicles. This partnership, which built on their longstanding relationship, focused on innovation and sustainability by incorporating eco-friendly materials such as bio-PET and bio-leather. The alliance aimed to advance safety features and redefine the driving experience.

Additionally, remaining proactive in adapting to regulatory changes and aligning product offerings with safety standards are likely to be crucial for maintaining a competitive edge in this evolving market.

Occupant Classification System Market Growth Factors

The increasing emphasis on vehicle safety is a significant factor augmenting the development of the market. Regulatory bodies are continually updating safety standards, highlighting the need for advanced safety features in vehicles. Occupant classification systems play a crucial role in adhering to these regulations by ensuring the accurate deployment of airbags and other safety mechanisms.

Automotive manufacturers are incorporating these systems to comply with safety standards and improve their safety ratings. The growing consumer demand for safer vehicles is further compelling manufacturers to integrate advanced occupant classification systems, thereby aiding market growth.

A notable challenge hindering the development of the occupant classification system market is the high cost associated with advanced sensor technologies. These systems require sophisticated sensors to accurately detect and classify occupants, which significantly increases production costs.

To overcome this challenge, manufacturers are investing heavily in research and development to create cost-effective sensor technologies without compromising accuracy and reliability.

Additionally, economies of scale achieved through mass production and technological advancements are contributing to a reduction of costs. Moreover, collaboration with technology firms and suppliers leads to the development of innovative solutions that lower costs while maintaining high safety standards.

Occupant Classification System Industry Trends

The integration of artificial intelligence (AI) into occupant classification systems represents a prominent trend in the market. AI algorithms are being increasingly used to enhance the accuracy and functionality of these systems. By analyzing various data points such as weight, seating position, and movement patterns, AI is providing more precise occupant classification, leading to better safety outcomes.

This trend is further fueled by the pressing need for advanced safety features in autonomous and semi-autonomous vehicles. Additionally, the use of AI enables continuous improvement and adaptation of occupant classification systems, making them more responsive to diverse passenger profiles and situations.

The growing shift toward electric and hybrid vehicles is significantly influencing the occupant classification system market. These vehicles often come equipped with advanced safety features as standard, including occupant classification systems. A transition to sustainable and environmentally friendly transportation options is leading to the widespread adoption of electric and hybrid vehicles, thereby boosting the demand for advanced safety technologies.

This trend is further supported by government incentives and policies that promote the use of green vehicles. As the electric vehicle market grows, the integration of sophisticated safety systems, including occupant classification, is becoming increasingly critical to meet consumer expectations and adhere to regulatory requirements.

Segmentation Analysis

The global market is segmented based on sensor, component, technology, organization size, end-user, and geography.

By Sensor

Based on sensor, the market is categorized into pressure sensor, seat belt sensor, and others. The pressure sensor segment led the occupant classification system market in 2023, reaching a valuation of USD 1,284.4 million. This notable expansion is attributed to its crucial role in ensuring accurate occupant detection and classification.

Pressure sensors offer high reliability and precision, which are essential for the effective deployment of safety mechanisms such as airbags. Their ability to detect variations in occupant weight and position enhances vehicle safety by enabling tailored airbag deployment.

The rising demand for advanced safety features in modern vehicles is boosting the adoption of pressure sensors. Additionally, regulatory mandates that require enhanced occupant safety measures are contributing to the growth of the segment, making pressure sensors a preferred choice among automotive manufacturers.

By Component

Based on component, the market is classified into airbag control unit, sensor, and others. The sensor segment is poised to witness significant growth at a robust CAGR of 8.39% through the forecast period (2024-2031). This growth is stimulated by the increasing need for advanced safety and comfort features in vehicles.

Sensors are critical components in occupant classification systems, providing the necessary data for accurate occupant detection. The continuous advancements in sensor technology, leading to improved accuracy and functionality, are propelling segmental growth. Furthermore, the integration of sensors in electric and autonomous vehicles, which require sophisticated safety systems, is supporting the growth of the segment.

By Technology

Based on technology, the market is segmented into wired and wireless. The wireless segment secured the largest market share of 64.22% in 2023, mainly due to its flexibility, ease of installation, and reduced wiring complexity. Wireless occupant classification systems offer enhanced connectivity and seamless integration with other vehicle systems, positioning them as a preferred choice among automotive manufacturers.

The increasing adoption of advanced wireless communication technologies in vehicles is fostering the growth of the segment. Moreover, wireless systems support the development of smart and connected cars, which aligns with the industry's shift toward autonomous and semi-autonomous vehicles.

Occupant Classification System Market Regional Analysis

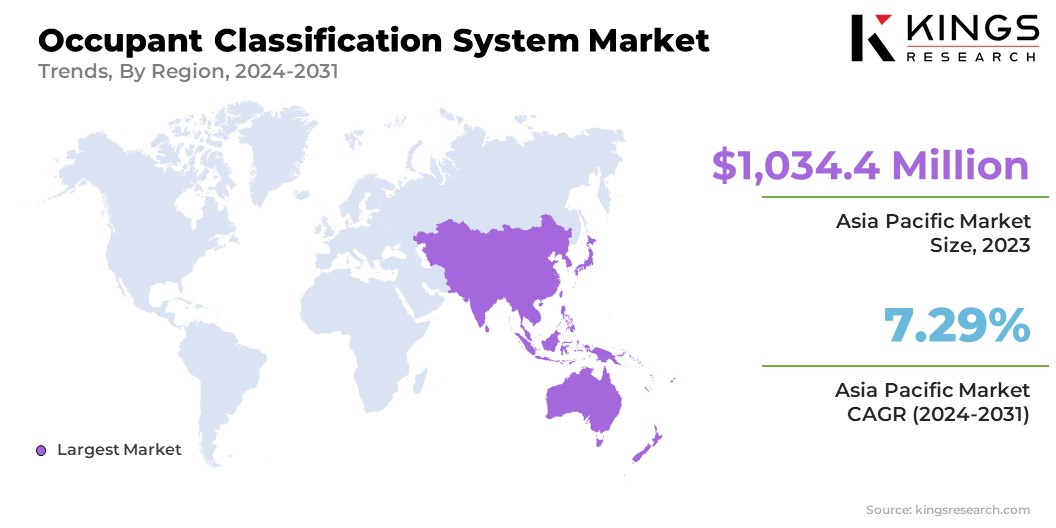

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific occupant classification system market captured a substantial share of around 36.78% in 2023, with a valuation of USD 1,034.4 million. This dominance is reinforced by the region's substantial automotive production and sales volume.

Countries such as China, Japan, and India are major automotive hubs, with a high demand for vehicles equipped with advanced safety features. The region's robust manufacturing infrastructure and increasing investments in automotive technologies are supporting regional market growth.

Additionally, rising disposable incomes and rapid urbanization are leading to higher rates of vehicle ownership in the region. Government regulations mandating enhanced vehicle safety standards are also contributing to the expansion of Asia-Pacific market.

Europe is poised to experience significant growth at a CAGR of 6.68% through the projection period. This considerable expansion is bolstered by stringent safety regulations and a strong focus on advanced automotive technologies. The European Union’s strict vehicle safety standards require the integration of sophisticated safety systems, including occupant classification.

Additionally, Europe’s automotive industry is characterized by high degree of innovation and a strong emphasis on research and development. The growing adoption of electric and autonomous vehicles in the region is further fueling the demand for advanced occupant classification systems.

Competitive Landscape

The global occupant classification system market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Occupant Classification System Market

- Aptiv

- Autoliv

- Continental AG

- Flexpoint Sensor Systems, Inc.

- Nidec Elesys Americas Corp.

- Robert Bosch GmbH

- IEE Smart Sensing Solutions

- ZF Friedrichshafen AG

- AISIN CORPORATION

- DENSO CORPORATION.

Key Industry Developments

- July 2024 (Launch): ZF LIFETEC introduced the ACR8.S, a compact, seat-integrated active belt tensioner, designed to enhance comfort and safety by adjusting belt pressure and repositioning occupants before a crash. The ACR8.S supports connected and automated driving by providing features such as reversible tensioning during critical maneuvers and tactile warnings for driver alerts. This system integrated with vehicle sensors to optimize safety and driving pleasure, particularly benefiting designs without a B-pillar and future automated driving concepts.

- June 2024 (Launch): Autoliv developed airbag cushions made from 100% recycled polyester, resulting in a significant reduction in greenhouse gas emissions. In collaboration with supply chain partners, Autoliv created yarns, fabrics, and cushions that adhered to standard safety requirements while reducing GHG emissions by approximately 50%. This innovation supports Autoliv's goal of achieving net-zero emissions by 2040 and expands its global product portfolio with an eco-friendly airbag cushion.

The global occupant classification system market is segmented as:

By Sensor

- Pressure Sensor

- Seat Belt Sensor

- Others

By Component

- Airbag Control Unit

- Sensor

- Others

By Technology

- Wired

- Wireless

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By End-User

- OEMs (Original Equipment Manufacturers)

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership