Energy and Power

Oil and Gas Pump Market

Oil and Gas Pump Market Size, Share, Growth & Industry Analysis, By Pump Type (Centrifugal Pumps, Positive Displacement Pumps, Others), By Application (Upstream, Midstream, Downstream), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : April 2025

Report ID: KR1850

Market Definition

The market encompasses equipment and systems designed to facilitate the movement of fluids, including crude oil, natural gas, refined products, and other related materials, across various stages of the petroleum value chain.

Key pump types include centrifugal and positive displacement pumps, each serving distinct operational requirements. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Oil and Gas Pump Market Overview

The global oil and gas pump market size was valued at USD 8.12 billion in 2023 and is projected to grow from USD 8.40 billion in 2024 to USD 10.67 billion by 2031, exhibiting a CAGR of 3.47% during the forecast period.

Market growth is driven by the rising global energy demand, particularly from emerging economies, which necessitates increased exploration, production, and refining activities.

The expansion of pipeline infrastructure for transporting crude oil, natural gas, and refined products is further supporting market expansion, as it creates an ongoing need for high-performance and reliable pump systems to ensure efficient fluid movement

Major companies operating in the oil and gas pump Industry are Ingersoll Rand, The Gorman-Rupp Company, EBARA Corporation, KSB Limited, Halliburton, Nikkiso Co., Ltd., Xylem, Atlas Copco AB, Baker Hughes Company, Gardner Denver, Schmidt Industries, Inc., Flowserve Corporation, TRILLIUM FLOW TECHNOLOGIES, Sulzer Ltd, and Leistritz Pumpen GmbH.

Technological advancements, such as the integration of IoT and automation, are further contributing to market growth by enhancing pump efficiency, enabling real-time monitoring, and reducing maintenance costs.

As investments in both traditional and unconventional energy sources continue, the market for oil and gas pumps is set to witness sustained expansion in the forthcoming years.

- In February 2024, ITT Inc. announced a three-year agreement with ExxonMobil for the supply of API-610 centrifugal pump systems, related products, and engineered services. Valued at a minimum of USD 50 million, with a potential total of USD 80 million, this represents the largest single contract awarded to ITT’s Goulds Pumps. The agreement will support ExxonMobil’s operations, primarily in North America, by delivering heavy-duty pump systems and aftermarket services.

Key Highlights:

- The oil and gas pump industry size was recorded at USD 8.12 billion in 2023.

- The market is projected to grow at a CAGR of 3.47% from 2024 to 2031.

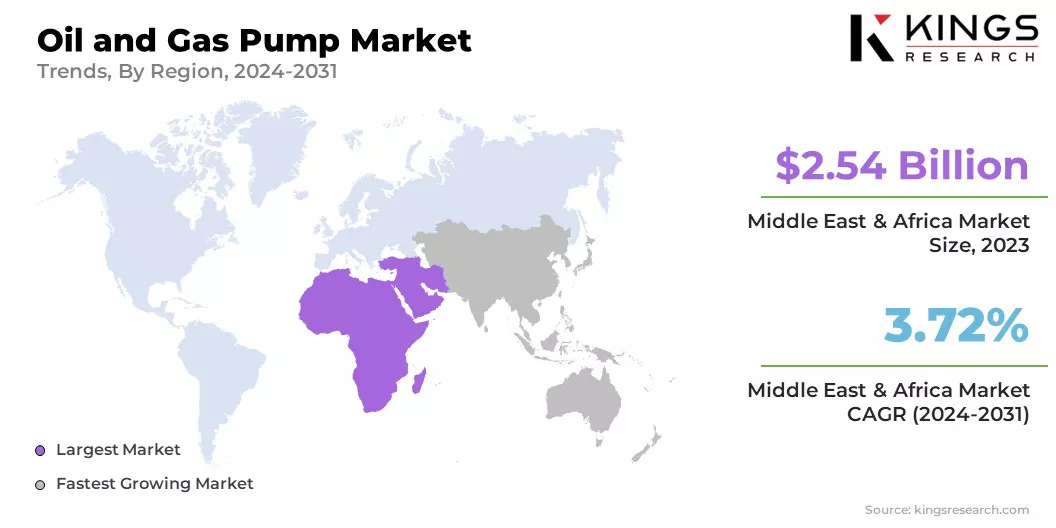

- Middle East & Africa held a share of 31.27% in 2023, valued at USD 2.54 billion.

- The centrifugal pumps segment garnered USD 2.87 billion in revenue in 2023.

- The upstream segment is expected to reach USD 4.45 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.00% during the forecast period.

Market Driver

"Expansion of Pipeline Infrastructure"

The growth of the oil and gas pump market is primarily fueled by the continued expansion of global pipeline infrastructure. As the demand for efficient and cost-effective transportation of crude oil, natural gas, and refined products increases, there is a growing need to develop new pipeline routes and upgrade existing networks.

This expansion requires a wide range of pumping systems to ensure consistent flow, pressure control, and operational safety across diverse terrains and long distances.

Pumps are essential for maintaining the integrity and efficiency of these networks, as energy companies aim to minimize downtime and reduce losses during transit. Moreover, the rising investments in pipeline infrastructure are boosting the widespread adoption of advanced and durable oil and gas pumps.

- In January 2025, the Ministry of Petroleum and Natural Gas reported that the length of operational natural gas pipelines in India has grown from 15,340 km in 2014 to 24,945 km as of September 30, 2024. Additionally, approximately 10,805 km of new pipelines are under development. Upon completion, these PNGRB/GoI-authorized project will fully integrate the national gas grid, connecting key demand and supply centers across the country.

Market Challenge

"Ensuring Longevity of Pump Systems"

A major challenge hindering the progress of the global oil and gas pump market is ensuring longevity of pump systems in extreme operational environments.

Pumps used in oil and gas extraction, transportation, and refining often operate in harsh conditions, such as high pressures, fluctuating temperatures, and exposure to corrosive fluids. These demanding environments can lead to premature wear and failure, resulting in costly downtime and increased maintenance efforts.

This challenge can be addressed through advancements in materials science and the development of corrosion-resistant, high-performance alloys and coatings for pump components.

Additionally, regular monitoring through smart technologies and predictive maintenance systems can help identify potential issues before they lead to failures, ensuring that pumps remain operational for longer periods and reducing overall maintenance costs.

Market Trend

"Adoption of Smart Pumping Technologies"

The significant trend influencing the oil and gas pump market is the adoption of smart pumping technologies, supported by the increasing demand for enhanced operational efficiency and reliability.

The integration of Internet of Things (IoT) and automation in pump systems is transforming the industry by enabling real-time monitoring and data analytics. These advancements allow operators to track pump performance, detect potential failures before they occur, and optimize energy consumption.

Predictive maintenance powered by smart technologies reduces downtime and maintenance costs, ensuring smoother and more cost-effective operations across the upstream, midstream, and downstream segments.

This trend is reshaping pumps management by providing a more proactive approach to maintenance and operational optimization, which is becoming essential in the highly competitive oil and gas industry.

- In October 2024, UAE-based AI innovators nybl and Space42, unveiled a satellite-enabled AI solution designed to optimize the efficiency and productivity of oil wells. This solution, developed through a collaboration with Thuraya, focuses on AI-powered Satellite Communications (SatComs) to enhance operations in the oil and gas industry. Following a six-month certification process on 27 oil wells, the solution successfully predicted potential failures of Electrical Submersible Pumps (ESP), reducing downtime and improving production. Additionally, the solution increased oil well output by 5%, extended pump lifespan by 20-30%, and improved reservoir, energy, and production management.

Oil and Gas Pump Market Report Snapshot

|

Segmentation |

Details |

|

By Pump Type |

Centrifugal Pumps, Positive Displacement Pumps, Others |

|

By Application |

Upstream, Midstream, Downstream |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Pump Type (Centrifugal Pumps, Positive Displacement Pumps, and Others): The centrifugal pumps segment earned USD 2.87 billion in 2023 due to their high efficiency, suitability for handling large volumes, and widespread use in refining and pipeline applications.

- By Application (Upstream, Midstream, and Downstream): The upstream held a share of 40.43% in 2023, attributed to rising exploration and production activities, particularly in offshore and shale reserves.

Oil and Gas Pump Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Middle East & Africa oil and gas pump market share stood at around 31.27% in 2023, valued at USD 2.54 billion. This dominance is primarily attributed to the region's substantial oil and gas reserves, ongoing investments in upstream exploration and production activities, and the presence of major oil-producing nations such as Saudi Arabia, the UAE, and Kuwait.

National oil companies and global players continue to invest heavily in infrastructure development, enhanced oil recovery projects, and pipeline expansions, creating a strong demand for high-performance pumping systems across all operational stages.

- In January 2024, the International Trade Administration reported that Saudi Arabia accounts for approximately 17 percent of global proven petroleum reserves and ranks among the top net exporters of petroleum. Additionally, it holds the second-largest proven oil reserves worldwide.

Asia Pacific oil and gas pump industry is poised to grow at a CAGR of 4.00% over the forecast period. This growth is bolstered by increasing energy demand, rapid industrialization, and growing investments in refining and petrochemical infrastructure across countries such as China, India, and Southeast Asian nations.

The region's expanding oil and gas distribution networks, along with government initiatives to enhance domestic production capacity, are fostering the adoption of advanced pump technologies to support both upstream and downstream operations.

Regulatory Frameworks

- In the U.S, the oil and gas pump market is influenced by regulatory frameworks set by agencies such as the Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA), which enforce standards for emissions control, equipment safety, and hazardous materials handling under regulation such as the Clean Air Act (CAA).

- In Europe, the market operates under the Machinery Directive (2006/42/EC) and the ATEX Directive (2014/34/EU), which govern the design and use of equipment intended for use in explosive atmospheres, ensuring compliance with strict safety and performance standards.

Competitive Landscape

Companies operating in the oil and gas pump industry are heavily investing in R&D to enhance pump efficiency, durability, and adaptability in extreme operating conditions.

There is a strong emphasis on developing advanced technologies such as smart and automated pumping systems to support remote monitoring, predictive maintenance, and improved operational control.

Strategic partnerships and collaborations with oilfield service providers and engineering firms are being adopted to expand project reach and offer integrated solutions.

Additionally, several participants are prioritizing capacity expansion and localization strategies to better serve regional markets, reduce lead times, and align with country-specific regulatory and technical standards. Acquisitions and mergers remain critical dor portfolio diversification and access to new customers or specialized technologies.

- In February 2024, Rodelta Pumps International BV (Rodelta) and SPP Pumps Ltd (SPP).The partnership combines SPP's century-long manufacturing excellence with Rodelta's advanced R&D capabilities. The alliance focuses on providing reliable, cost-effective pumps and systems for safety-critical applications across industries such as oil, gas, petrochemicals, biofuels, hydrogen, and carbon capture.

List of Key Companies in Oil and Gas Pump Market:

- Ingersoll Rand

- The Gorman-Rupp Company

- EBARA Corporation

- KSB Limited

- Halliburton

- Nikkiso Co., Ltd.

- Xylem

- Atlas Copco AB

- Baker Hughes Company

- Gardner Denver

- Schmidt Industries, Inc.

- Flowserve Corporation

- TRILLIUM FLOW TECHNOLOGIES

- Sulzer Ltd

- Leistritz Pumpen GmbH

Recent Developments (M&A/ Product Launch)

- In July 2024, Flowserve Corporation completed the acquisition of intellectual property and ongoing research and development related to NexGen Cryogenic Solutions’ cryogenic LNG submerged pump technology and systems. The acquisition also includes NexGen Cryo’s cold energy recovery turbine technology, aimed at enhancing performance across the LNG liquefaction, transportation, and regasification sectors.

- In June 2024, CIRCOR International, Inc. unveiled its IMO LB6D 3-screw pumps, developed specifically for Lease Automatic Custody Transfer (LACT) boost applications in the oil and gas sector. These pumps are designed to ensure high performance and precision while reducing operational costs, reflecting the company’s focus on delivering reliable and efficient fluid handling solutions for demanding industrial environments.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)