Consumer Goods

Oral Care Products Market

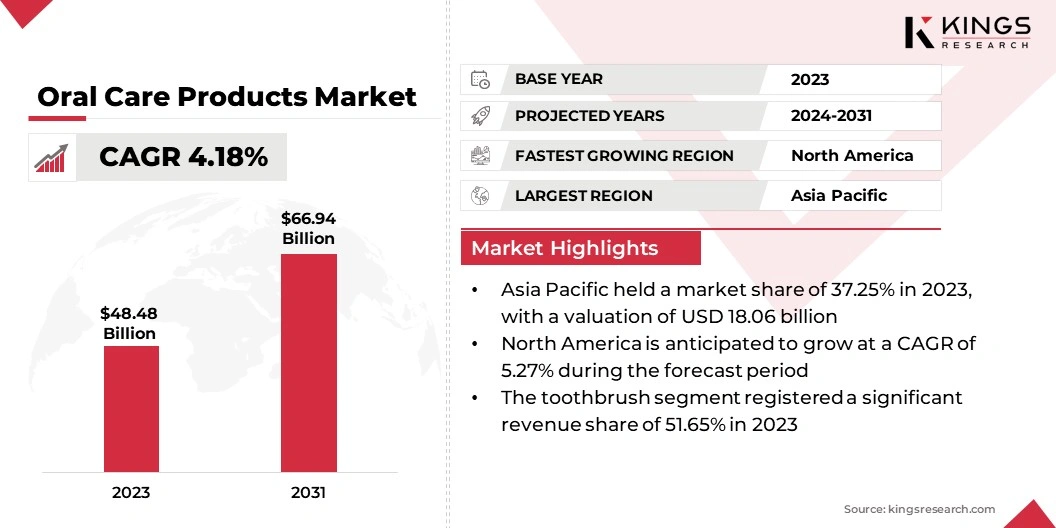

Oral Care Products Market Size, Share, Growth & Industry Analysis, By Product Type (Toothbrush, Toothpaste, Mouthwash, Others), By Application (Home, Dentistry), By Age Group (Kids, Adults, Geriatric) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR485

Oral Care Products Market Size

The global Oral Care Products Market was valued at USD 48.48 billion in 2023 and is projected to reach USD 66.94 billion by 2031, growing at a CAGR of 4.18% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Colgate-Palmolive Company, Procter & Gamble, Unilever, Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Sunstar Group, Koninklijke Philips N.V., Amway, Tom's of Maine, Inc., DENTAID and others.

The market for oral care products encompasses a wide variety of items, including toothpaste, toothbrushes, mouthwashes, dental floss, teeth whitening products, and specialized oral care solutions. These products are essential for maintaining good oral hygiene and preventing dental issues such as cavities, gum diseases, and bad breath. Toothpaste and toothbrushes are the most commonly used oral care products, while mouthwash and dental floss offer additional cleaning and freshness. Teeth whitening products are designed for individuals seeking a brighter smile, while specialized oral care solutions address specific problems such as sensitive teeth or dry mouth.

Innovation in oral care technologies, including the development of advanced toothpaste formulations, smart toothbrushes, and the incorporation of natural and organic ingredients, has been a notable trend. These advancements were intended to provide consumers with more effective and convenient options for maintaining optimal oral health.

Advanced toothpaste formulations offer benefits such as teeth whitening, enamel strengthening, and cavity prevention. Furthermore, smart toothbrushes have gained popularity, with features such as built-in timers and sensors that track brushing habits, ensuring a thorough clean. Additionally, the incorporation of natural and organic ingredients in oral care products appeals to consumers seeking more sustainable and eco-friendly options.

Analyst’s Review

The oral care products market has witnessed a growing demand for oral care products with natural and sustainable ingredients. Consumers are showing interest in eco-friendly packaging, cruelty-free products, and those without artificial additives. This shift in consumer preferences can be attributed to a growing awareness of the environmental impact of conventional oral care products. As awareness of the chemicals and plastic waste associated with traditional products grows, more people are actively seeking alternatives that align with their values. This trend has prompted many oral care brands to reformulate their products and adopt more sustainable practices to meet the evolving needs of their customers.

Market Definition

The oral care products market comprises a diverse and dynamic industry segment dedicated to the development, manufacturing, and distribution of products designed to maintain and enhance oral hygiene and health. These products are specifically formulated to address various aspects of dental care, including cleaning, protection against dental issues, and the promotion of overall oral well-being.

In recent years, there has been noteworthy expansion in the oral care industry due to various factors, including growing awareness regarding oral hygiene, higher disposable incomes, and advancements in dental technology. The oral care products market offers consumers a diverse range of oral care products, such as toothpaste, mouthwash, dental floss, and teeth whitening products, each designed to address specific needs and cater to individual preferences. This abundance of choices provides consumers with a wide selection of products to meet their oral care requirements.

Market Dynamics

Growing awareness among consumers regarding the importance of oral health and hygiene is a major factor driving the growth of the oral care products market. In recent years, there has been a noticeable shift in consumer behavior toward prioritizing oral health and hygiene. This growing awareness can be attributed to various factors, such as increased access to information through the Internet and social media platforms. As individuals become more conscious of the link between oral health and overall well-being, they are actively searching for products and services that promote good oral hygiene practices, leading to a surge in the demand for dental care products and regular dental check-ups.

Additionally, education campaigns by dental associations and professionals are expected to attract more health conscious consumers. These campaigns aim to educate the public about the benefits of regular dental check-ups and proper oral hygiene habits. As a result, individuals are more likely to prioritize their oral health and make informed decisions regarding the products and services they choose. This increased awareness and education ultimately lead to a healthier population with reduced dental issues and a better understanding of the importance of oral hygiene.

The cost of oral care products, especially those with specialized features or natural/organic ingredients, can be a challenge for some consumers. Affordability plays a significant role in the adoption and usage of oral care products, particularly among price-sensitive consumers. These consumers may opt for more affordable alternatives or delay purchasing oral care products altogether to save money.

As a result, they may compromise on the quality or effectiveness of the products they use, which could potentially impact their oral health in the long run. Manufacturers and retailers should consider offering more budget-friendly options or discounts to ensure that price-sensitive consumers have access to necessary oral care products without compromising their oral hygiene.

Segmentation Analysis

The global oral care products market is segmented based on product type, application, age group, distribution channel, and geography.

By Product Type

By product type, it is bifurcated into toothbrush, toothpaste, mouthwash & others. The toothbrush segment registered a significant revenue share of 51.65% in 2023. This growth can be attributed to the rising awareness of oral hygiene and the increasing prevalence of dental diseases. Furthermore, the availability of a wide range of toothbrushes with advanced features and improved cleaning capabilities is driving the demand for this product. With advancements in technology, electric toothbrushes are gaining popularity among consumers, thereby boosting the revenue growth of the toothbrush segment.

By Application

By application, it is bifurcated into home & dentistry. The home segment accounted for a substantial revenue share of 55.65% in 2023. This can be attributed to the increasing awareness about oral health among individuals and the convenience of using oral care products at home. Moreover, the rising number of dental clinics and healthcare facilities providing dental services at home has also contributed to the growth of the home segment in the oral care products market. With the increasing emphasis on preventive dental care and the availability of a wide range of oral care products for home use, the home segment is expected to continue its dominance in the oral care products market in the coming years.

By Distribution Channel

By distribution channel, it is bifurcated into hypermarket/supermarket, specialty stores, drug & pharmacy stores, online retailers & others. The online retailers segment is anticipated to grow at the fastest CAGR of 5.87% over the forecast period. This growth can be attributed to the increasing popularity of e-commerce platforms and the convenience they offer to consumers in purchasing oral care products.

Online retailers provide a wide range of options and competitive prices, attracting more customers to opt for online purchases. Moreover, the COVID-19 pandemic has further accelerated the growth of online sales as consumers prefer contactless shopping experiences. As a result, the online retailers segment is expected to witness significant growth in the oral care products market.

Oral Care Products Market Regional Analysis

Based on region, the global oral care products market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Asia-Pacific Oral Care Products Market share stood around 37.25% in 2023 in the global market, with a valuation of USD 18.06 billion. This considerable growth is mainly fostered by the rising awareness of oral hygiene in countries such as China and India, where populations are becoming more conscious of their dental health. Additionally, the growing middle-class population in the region has increased disposable income, allowing for greater affordability and accessibility to oral care products.

Furthermore, the presence of key market players in the Asia-Pacific region has contributed to the growth of the oral care products market. These companies have been actively launching innovative products and conducting extensive marketing campaigns to educate consumers about the importance of maintaining good oral hygiene. Moreover, the increasing prevalence of dental diseases and disorders, such as cavities, gum diseases, and oral cancer, has propelled the demand for oral care products in the region.

Whereas, North America is anticipated to grow at the fastest CAGR of 5.27% through the projected period owing to the high disposable income and greater awareness of oral health in the region. Additionally, the presence of well-established dental care infrastructure and a large geriatric population in North America are supporting the growth of the oral care products market. Furthermore, the rising popularity of cosmetic dentistry and the growing demand for advanced oral care technologies are expected to boost market development in North America. Overall, the global oral care products market is projected to experience steady growth in the upcoming years, driven by increasing consumer awareness and the growing importance of oral health.

Competitive Landscape

The global oral care products market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Oral Care Products Market

- Colgate-Palmolive Company

- Procter & Gamble

- Unilever

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Sunstar Group

- Koninklijke Philips N.V.

- Amway

- Tom's of Maine, Inc.

- DENTAID

Key Industry Developments

- February 2022 (Campaign) - Colgate-Palmolive Company, the global frontrunner in dental hygiene, has unveiled a public health campaign aimed at providing individuals with the tools to enhance their oral health knowledge, referred to as the Know Your OQ™ initiative.

- March 2023 (Product Launch) - Procter & Gamble (P&G) launched Crest Kids Color Changing Toothpaste, along with a line of Oral-B color-changing themed toothbrushes. This toothpaste, which has a bubble gum flavor, transforms from blue to pink within two minutes of brushing. It can be purchased online and at retailers across the U.S. for $3.99.

The Global Oral Care Products Market is Segmented as:

By Product Type

- Toothbrush

- Toothpaste

- Mouthwash

- Others

By Application

- Home

- Dentistry

By Age Group

- Kids

- Adults

- Geriatric

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug & Pharmacy Stores

- Online Retailers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership