Consumer Goods

Personal Care Packaging Market

Personal Care Packaging Market Size, Share, Growth & Industry Analysis, By Material (Plastics, Paper, Glass, Metal), By Product Type (Bottles & Jars, Bags & Pouches, Tubes, Boxes & Cartons, Others), By Application and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR564

Personal Care Packaging Market Size

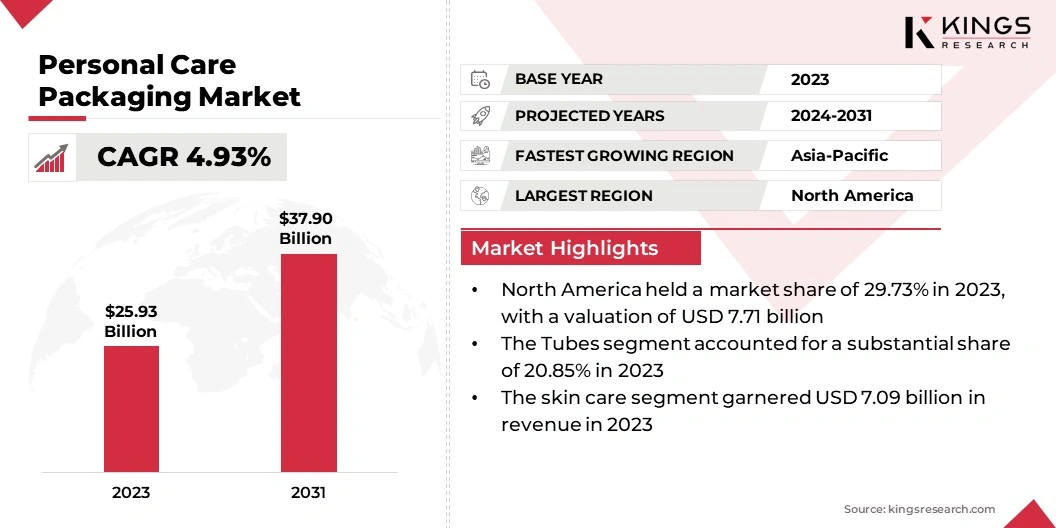

The global Personal Care Packaging Market size was valued at USD 25.93 billion in 2023 and is projected to reach USD 37.90 billion by 2031, growing at a CAGR of 4.93% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Amcor plc, Albea Group, AptarGroup, Inc., Berry Global Inc., Crown, Graham Packaging Company, Greif, Huhtamäki Oyj, Reynolds Packaging, Sonoco Products Company and others.

The personal care packaging market is growing substantially backed by evolving consumer preferences, prevalent regulatory dynamics, and technological innovations. Key drivers underpinning this growth include high consumer awareness regarding personal hygiene and grooming, particularly in emerging economies experiencing rapid urbanization and rising disposable incomes. Additionally, the growing geriatric population and increasing emphasis on wellness and self-care further bolster the demand for a diverse array of personal care products, thereby propelling the need for innovative packaging solutions.

Another key factor impacting industry development is the escalating focus on sustainability and environmental stewardship. With mounting concerns regarding plastic pollution and carbon footprint, stakeholders across the value chain are prioritizing eco-friendly packaging alternatives. This has caused a shift toward recyclable, biodegradable, and compostable materials, along with the increased focus on the exploration of novel biomaterials derived from renewable sources. Moreover, technological advancements are fostering unprecedented levels of customization, convenience, and functionality in personal care packaging.

Smart packaging solutions, encompassing features, such as RFID tags, NFC-enabled labels, and augmented reality (AR) integration, are gaining traction, facilitating enhanced consumer engagement and product differentiation. However, regulatory complexities, including stringent safety and labeling requirements, pose compliance hurdles for industry participants. Additionally, fluctuating raw material prices and supply chain disruptions remain major concerns, necessitating strategic agility and risk mitigation measures.

Analyst’s Review

The personal care packaging market is on an upward trajectory, fueled by a combination of factors such as demographic shifts with disposable income, a global focus on self-care and wellness, and the increasing number of eco-conscious consumers demanding sustainable solutions. Key players are capitalizing on opportunities such as online channels and personalized product experiences, all while navigating challenges such as material regulations and the ever-evolving sustainability landscape. Innovation will be key for differentiating themselves and capturing a loyal customer base in this competitive market.

Market Definition

The personal care packaging market refers to the global ecosystem encompassing the development, production, distribution, and trade of packaging solutions specifically designed for personal care products. This includes various stakeholders like manufacturers, converters, suppliers of raw materials, distributors, and retailers.

Additionally, it includes a broad range of items such as bottles, jars, tubes, pouches, pumps, and dispensers. The market caters to various personal care product categories, including skincare, haircare, cosmetics, oral care, and others. Materials employed in personal care packaging span plastics, glass, paperboard, metal, and bio-based alternatives. This personal care packaging market plays a crucial role in ensuring product integrity, extending shelf life, and contributing to the overall brand experience for consumers.

Market Dynamics

The escalating emphasis on sustainability is anticipated to foster personal care packaging market growth on a macroeconomic scale. Consumers are becoming increasingly conscious of environmental issues, leading to a surge in the demand for packaging solutions that minimize ecological impact. This trend was corroborated by a Nielsen study, which found that 73% of global consumers are willing to pay more for sustainable packaging.

Consequently, brands are under pressure to adopt eco-friendly alternatives such as recyclable plastics, biodegradable materials, and innovative packaging designs that reduce waste. Government regulations further amplify this trend, with initiatives like extended producer responsibility (EPR) programs incentivizing companies to prioritize sustainable packaging practices. As sustainability continues to gain traction as a key purchasing criterion, it is driving significant innovation and investment in sustainable packaging solutions across the personal care industry.

The proliferation of e-commerce is reshaping the personal care packaging landscape. With online sales of personal care products projected to grow exponentially, packaging requirements are evolving to meet the demands of digital retail channels. Unlike traditional brick-and-mortar stores, e-commerce packaging must prioritize durability, compactness, and aesthetics to withstand shipping and provide a memorable unboxing experience. With manufacturers vying for consumers' attention in the digital marketplace, innovative packaging designs and materials that cater to the unique needs of e-commerce are becoming increasingly essential for success.

Additionally, the growing demand for customization and personalization is presenting a significant opportunity for the personal care packaging market. Consumers are increasingly seeking products that align with their individual preferences and identities, driving brands to offer personalized packaging options. This trend extends beyond traditional mass-produced packaging to include bespoke designs, monogramming, and limited-edition packaging collaborations with artists or influencers. By leveraging digital printing technologies and agile manufacturing processes, packaging providers can capitalize on this opportunity to offer tailored packaging experiences that resonate with consumers and foster brand loyalty.

Segmentation Analysis

The global personal care packaging market is segmented based on material, product type, application, and geography.

By Material

Based on material, the market is categorized into plastics, paper, glass, and metal. Plastic material held the largest share of 33.15% in 2023 and is estimated to dominate over 2024-2031. The versatility and adaptability of plastics make them a preferred choice for packaging various personal care products, ranging from cosmetics to toiletries. Plastic packaging offers manufacturers flexibility in design, allowing for innovative shapes and sizes that enhance product differentiation and shelf appeal.

Additionally, the lightweight nature of plastic packaging reduces transportation costs and carbon footprint, aligning with the growing emphasis on sustainability in the industry. Despite increasing scrutiny on single-use plastics, advancements in recyclable and biodegradable plastic materials mitigate environmental concerns, further bolstering their market demand. Moreover, the convenience and durability of plastic packaging resonate well with consumers, contributing to its sustained popularity.

By Product Type

Based on product type, the market is categorized into bottles & jars, bags & pouches, tubes, boxes & cartons, and others. The Tubes segment accounted for a substantial share of 20.85% in 2023 and is anticipated to experience the highest CAGR of 7.03% between 2024 and 2031. The convenience and portability offered by tubes align with evolving consumer lifestyles, characterized by on-the-go beauty and personal care routines. Tubes provide ease of use and application for various products such as creams, gels, and lotions, enhancing their appeal to consumers seeking practicality and functionality in packaging.

Moreover, the rise of premiumization and customization trends in the personal care industry has spurred the demand for tubes as a preferred packaging format. Brands leverage tubes to showcase their products in sleek, modern designs, while offering options for personalized labeling and branding to enhance product differentiation and consumer engagement.

Additionally, advancements in tube packaging technologies, including innovative dispensing mechanisms and sustainable materials, contribute to their continued growth. Eco-friendly alternatives such as biodegradable tubes address environmental concerns and resonate with eco-conscious consumers, further driving adoption.

By Application

Based on application, the market is classified into body care, hair care, oral care, skin care, and others. Skin care dominated the market with USD 7.09 billion in revenue in 2023. The growing consumer awareness of skincare routines, fueled by aging populations and rising penetration of skin care products in remote areas, is impelling the demand for skincare products. Packaging solutions tailored to skincare formulations play a pivotal role in product differentiation, which is driving the growth of the market for skin care packaging.

However, body care applications are anticipated to register faster expansion at a CAGR of 6.65% over the forecast period backed by shifting consumer preferences. With a growing focus on holistic personal care, including body care routines, manufacturers are innovating formulations and packaging designs tailored to this segment, directly contributing to the projected growth in the demand for body care packaging. Furthermore, advancements in formulation technologies directly impact packaging requirements, driving the uptake of packaging solutions that ensure product efficacy and shelf appeal within both skin care and body care segments.

Personal Care Packaging Market Regional Analysis

Based on region, the global personal care packaging market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Personal Care Packaging Market share stood around 29.73% in 2023 in the global market, with a valuation of USD 7.71 billion. The region stands as a mature and highly competitive market for personal care packaging, characterized by a strong emphasis on innovation, sustainability, and brand differentiation. The region's affluent consumer base, coupled with a robust retail infrastructure and high disposable incomes, is boosting the demand for premium and eco-friendly packaging solutions.

Market players in North America are at the forefront of sustainability initiatives, with an increasing focus on recyclable materials, bioplastics, and reduced carbon footprint. Additionally, the region's dynamic regulatory landscape, including stringent safety standards and labeling requirements, influences packaging design and material choices. E-commerce is also a significant driver of regional market growth, with online sales of personal care products witnessing rapid expansion.

Asia-Pacific accounted for a substantial share of more than 27% in 2023 and is projected to witness the highest CAGR over 2024-2031. The Asia-Pacific region is emerging as a lucrative and rapidly evolving market for personal care packaging, driven by robust economic growth, rapid urbanization, and changing consumer lifestyles. With a burgeoning middle class and increasing purchasing power, countries like China, India, and Southeast Asian nations are witnessing a surge in demand for personal care products and packaging solutions.

Market dynamics in Asia-Pacific are characterized by a diverse range of consumer preferences, cultural influences, and regulatory frameworks, necessitating localized strategies and product offerings. Sustainable packaging is gaining traction in the region, driven by increasing environmental awareness and government initiatives to curb plastic pollution.

Moreover, increasing usage of e-commerce platforms, particularly in densely populated urban centers, is presenting new opportunities for packaging providers to innovate and cater to the unique requirements of online retail channels. Manufacturers are focusing on implementing growth strategies to grow in the regional businesses.

Competitive Landscape

The global personal care packaging market will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their respective market shares across different regions. Companies are undertaking effective strategic initiatives involving expansions & investments, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, which could pose new opportunities for market growth.

List of Key Companies in Personal Care Packaging Market

- Amcor plc

- Albea Group

- AptarGroup, Inc.

- Berry Global Inc.

- Crown

- Graham Packaging Company

- Greif

- Huhtamäki Oyj

- Reynolds Packaging

- Sonoco Products Company

Key Industry Developments

- January 2024 (Acquisition) - Innovative Beauty Group (IBG), owned by Albéa, completed the acquisition of Roberts Beauty, a Los Angeles-based full-service provider specializing in custom-designed packaging and turnkey solutions. With This move, IBG aimed to strengthen its presence on the U.S. West Coast.

The Global Personal Care Packaging Market is Segmented as:

By Material

- Plastics

- Paper

- Glass

- Metal

By Product Type

- Bottles & Jars

- Bags & Pouches

- Tubes

- Boxes & Cartons

- Others

By Application

- Body Care

- Hair Care

- Oral Care

- Skin Care

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership