Pet Grooming Products Market

Pet Grooming Products Market Size, Share, Growth & Industry Analysis, By Product Type (Shampoos and Conditioners, Combs and Brushes & Others), By Pet Type (Dog, Cat, Others), By Distribution Channel (Pet Specialty Stores, Veterinary Clinics, Online Retailers), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1048

Pet Grooming Products Market Size

The global Pet Grooming Products Market size was valued at USD 14.19 billion in 2023 and is projected to grow from USD 14.97 billion in 2024 to USD 22.88 billion by 2031, exhibiting a CAGR of 6.25% during the forecast period. The global market is significantly driven by the increasing humanization of pets, leading to higher spending on grooming products.

This trend is further supported by the rise in pet adoption. In the scope of work, the report includes products offered by companies such as Groomer’s Choice, Tecla Company Inc. (Resco Pet Products), Spectrum Brands Inc., Petco Animal Supplies, Inc., Coastal Pet Products, Compana, 4-Legger, World 4 Pets, Earthwhile Endeavors, Inc., SynergyLabs, and others.

Moreover, technological advancements in the pet grooming industry have played a significant role in driving the pet grooming products market growth. The development of smart grooming tools, such as automated brushes and clippers with sensors, appeals to tech-savvy pet owners, looking for innovative ways to care for their pets.

These tools often come equipped with features that enhance the grooming experience, such as adjustable settings for different coat types and integrated vacuum systems that minimize mess. The convenience and efficiency offered by these advanced products have made them increasingly popular, contributing to the expansion of the market.

Pet grooming products are specialized items and tools designed for the care and maintenance of a pet's hygiene and appearance. These products include shampoos, conditioners, brushes, combs, nail clippers, dental care items, and grooming wipes, among others. They are used to clean, groom, and maintain the health of a pet's skin, fur, nails, and teeth, ensuring overall well-being and reducing the risk of infections or other health issues.

Pet grooming products cater to various types of pets, including dogs, cats, and smaller animals, and range from basic grooming essentials to premium, organic, and technologically advanced items.

Analyst’s Review

With more families embracing pet ownership, the emphasis on comprehensive pet care, including regular grooming, has intensified. Pet insurance is becoming a key factor in this trend, as it frequently covers various health and wellness services, grooming being a significant component.

This financial support encourages pet owners to invest in high-quality grooming products, ensuring their pets' health and hygiene. These factors are expected to propel the demand for advanced grooming solutions

- According to the Insurance Information Institute, pet insurance premiums in the U.S. totaled USD 3.9 billion in 2023. By the end of the year, nearly 5.7 million pets were insured, marking a 17% increase compared to 2022.

Moreover, the market is benefiting from continuous innovations in pet grooming products. Companies are introducing eco-friendly, organic, and specialized grooming solutions that cater to the specific needs of different pet breeds and conditions.

These advancements meet the growing demand for safe and effective grooming products and align with the preferences of a more informed and health-conscious consumer base. Pet owners today are looking for products that enhance their pets’ appearance and contribute to their overall well-being.

- In February 2024, Dogtopia, a dog daycare and spa service in the U.S., introduced a line of specially formulated shampoos, conditioners, and deodorizing sprays for dogs. This collection includes oatmeal and aloe vera-based shampoos and conditioners designed to promote soft and shiny coats.

Pet Grooming Products Market Growth Factors

The growth in disposable income across various regions is a significant factor driving the global market growth. As household incomes rise, especially in developing economies, consumers gain more financial flexibility to spend on non-essential items, including pet grooming products.

This increased purchasing power has led to a higher demand for premium grooming products, as pet owners are willing to invest in high-quality items that enhance their pets' health and appearance. Additionally, with more disposable income, there is a greater inclination to indulge pets with luxury grooming experiences, further driving the market.

The rise in disposable income is particularly impactful in emerging markets, where a growing middle class is increasingly adopting Westernized pet care practices, fueling growth in the grooming products sector.

- In July 2024, personal income rose by USD 75.1 billion, reflecting a 0.3% increase at a monthly rate, according to the U.S. Bureau of Economic Analysis report. Disposable personal income (DPI) also grew by USD 54.8 billion, or 0.3%. Additionally, personal consumption expenditures (PCE) saw a notable rise of USD 103.8 billion, representing a 0.5% increase, highlighting continued growth in consumer spending.

Moreover, the expansion of e-commerce and online retail platforms has significantly contributed to the growth of the pet grooming products market. The convenience of shopping online, coupled with a wide variety of products, has made it easier for pet owners to access grooming products from around the world.

Online platforms offer detailed product descriptions, customer reviews, and competitive pricing, which help consumers make informed purchasing decisions. Additionally, the rise of subscription services that deliver grooming products directly to consumers' homes has further driven market growth. These services offer personalized product recommendations and the convenience of automatic refills, making it easier for pet owners to maintain a regular grooming routine for their pets.

- According to the International Trade Administration, global B2C e-commerce revenue is projected to increase from USD 3.6 trillion in 2023 to USD 5.5 trillion by 2027, reflecting a steady CAGR of 14.4%.

However, the growth of the market is expected to be restrained by high costs associated with premium products, and the availability of counterfeit or low-quality products that impact consumer trust. To overcome these challenges, companies are expanding their product portfolios to include a range of pricing options, making grooming products more accessible to a wider audience.

They are also enhancing quality control measures and adopting transparent labeling to build consumer trust and differentiate their products from counterfeit items. Additionally, companies are seeking sustainable sourcing of raw materials and compliance with regulations to ensure product safety and continued market growth.

Pet Grooming Products Market Trends

The surge in pet adoption has significantly contributed to the growth of the market. With more people working from home and seeking companionship during lockdowns, there was a notable increase in pet ownership across the globe. This rise in the number of pets has led to a greater demand for grooming products.

New pet owners, looking to ensure the health and appearance of their pets, are investing in a variety of grooming supplies, from basic brushes and combs to more specialized products like dental care items and paw balms. This trend is expected to continue as the adoption rates remain high.

- According to HealthforAnimals, over 50% of the global population is believed to have a pet at home. In the U.S., EU, and China alone, families own more than half a billion dogs and cats.

Additionally, rising urbanization rate is another critical factor contributing to the growth of the pet grooming products market. With more people moving to urban areas, pet ownership in cities has surged, leading to a higher demand for grooming products tailored to urban pet needs. Urban environments often expose pets to pollutants, dust, and others that necessitate more frequent grooming to maintain their health and cleanliness.

Moreover, limited space in urban settings lead many pet owners to opt for smaller breeds, which often require regular grooming to manage their coats and overall hygiene. The urban lifestyle also encourages pet owners to seek convenient grooming solutions, such as mobile grooming services and home grooming kits, which cater to the busy schedules of city dwellers.

Segmentation Analysis

The global market has been segmented on the basis of Product Type, Pet Type, Distribution Channel, and geography.

By Product Type

Based on product type, the market has been segmented into shampoos and conditioners, combs and brushes, dental care products, nail care products, and others. The shampoos and conditioners segment held the largest pet grooming products market share in 2023, valued at USD 4.93 billion due to its essential role in maintaining pet hygiene and health, which pet owners prioritize.

These products are part of regular grooming routines, and are used to address dirt, odor, and skin conditions, which are common concerns among pet owners. The growing awareness of the benefits of using specialized shampoos and conditioners tailored to different skin types, fur textures, and specific needs like flea control further drives the product demand.

Additionally, the trend of natural and organic ingredients in pet care products has led to increased sales of premium shampoos and conditioners, solidifying their dominance in the market.

By Pet Type

Based on pet type, the pet grooming products market has been classified into dog, cat, and others. The dog segment secured the largest revenue share of 56.71% in 2023, due to a high level of care and attention that dog owners provide to their pets. Dogs typically require more frequent grooming compared to other pets, such as cats, due to their larger size, varied coat types, and outdoor activity levels, which expose them to dirt, allergens, and parasites.

This leads to a higher demand for a wide range of grooming products, including shampoos, conditioners, brushes, and flea treatment products. Additionally, the strong emotional bond between dog owners and their pets drives spending on premium grooming products, further fueling the market's growth. With dogs being the most popular pets globally, their dominance in the grooming market is reinforced by both necessity and consumer willingness to invest in their well-being.

By Distribution Channel

Based on distribution channel, the market has been divided into pet specialty stores, veterinary clinics, and online retailers. The online retailers segment is expected to witness significant growth at a robust CAGR of 6.91% over the forecast period.

The convenience of online shopping, combined with high availability of products, appeals to a growing number of pet owners who prefer the ease of having products delivered directly to their homes. Online platforms also offer competitive pricing, frequent discounts, and the ability to compare products across different brands, which attracts cost-conscious consumers.

Additionally, the rise of subscription services and personalized recommendations has further fueled the growth of this segment, as these services cater to the evolving needs and preferences of pet owners.

Pet Grooming Products Market Regional Analysis

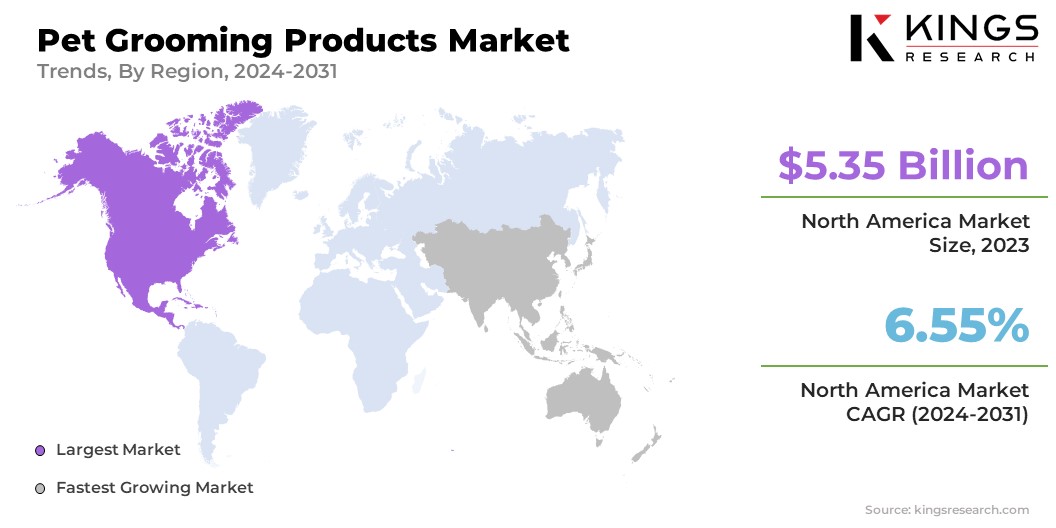

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America Pet Grooming Products market share stood at around 37.71% in 2023 in the global market, with a valuation of USD 5.35 billion. The high disposable income of consumers in North America is a significant factor driving the market. With greater financial resources, pet owners are willing to spend on premium and luxury grooming products.

This includes organic and natural products, as well as high-end grooming tools and accessories. The willingness to invest in the best possible care for pets is particularly evident in the U.S. and Canada, where pet owners view grooming as an essential aspect of overall pet health and wellness. Their financial capacity to spend on high-quality products is also a key driver of market growth in the region.

- According to the American Pet Products report2024, USD 147 billion was spent on pets in the U.S. in 2023, with expenditures projected to reach USD 150.6 billion in 2024.

The North American market is also driven by the availability and adoption of innovative and advanced grooming products. Technological advancements have led to the development of smart grooming tools, such as automated brushes, clippers with sensors, and grooming apps that guide pet owners through the entire grooming process.

These products appeal to tech-savvy consumers, looking for efficiency and convenience in pet care. Additionally, the market in North America is characterized by a strong focus on research and development, leading to the continuous introduction of new products that cater to the specific needs of different breeds and pet types, further driving market growth.

The Asia Pacific market is estimated to register significant growth at a robust CAGR of 6.78% over the forecast period. The rapidly growing middle-class population and the rising disposable incomes are expected to drive the market.

As more consumers achieve higher income levels, they are able to spend more on non-essential items, such as pet grooming products. This increase in disposable income has led to greater demand for premium grooming products, along with natural and organic options, which are perceived as safer and healthier for pets.

Middle-income groups in China, India, and Indonesia are experiencing significant growth, which is fueling the expansion of the pet grooming market as these consumers seek out high-quality products for their pets.

The expansion of pet specialty retail chains and e-commerce platforms across Asia-Pacific is making pet grooming products more accessible to a broader consumer base. The region has seen a surge in the number of pet specialty stores that offer a wide range of grooming products for diverse needs of pet owners.

Moreover, the growing popularity of e-commerce platforms, in China and India, has made it easier for consumers to purchase grooming products online. The convenience of online shopping and the ability to access a variety of brands and products, is driving the growth of the market in the region.

- According to the International Trade Administration in 2024, the e-commerce market in the Asia-Pacificwas valued at USD 19.3 trillion in 2023 and is expected to reach USD 28.9 trillion by 2026.

Competitive Landscape

The global pet grooming products market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares in different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Pet Grooming Products Market

- Groomer’s Choice

- Tecla Company Inc. (Resco Pet Products)

- Spectrum Brands Inc.

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- Compana

- 4-Legger

- World 4 Pets

- Earthwhile Endeavors, Inc.

- SynergyLabs

Key Industry Developments

- August 2023 (Product Launch): Veterinary Formula, a subsidiary of SynergyLabs recognized for its vet-recommended, science-driven pet health and wellness products, unveiled its rebrand at SUPERZOO 2023. The rebrand includes a modern update to the packaging of its supplements, treats, and grooming products. The new packaging design features QR codes that direct customers to the company’s website, where they can access product information, reviews, and video resources.

- June 2023 (Business Expansion): Petcolaunched its new Union Square flagship in New York City,a unique, one-stop health and wellness destination for pets. This expansive, two-story, 25,000-square-foot pet care center integrates Petco's top physical and digital services, featuring a stylish grooming salon, a full-service veterinary hospital, a JustFoodForDogs kitchen, and a curated selection of merchandise, providing a comprehensive pet care experience.

The global pet grooming products market has been segmented:

By Product Type

- Shampoos and Conditioners

- Combs and Brushes

- Dental Care Products

- Nail Care Products

- Others

By Pet Type

- Dog

- Cat

- Others

By Distribution Channel

- Pet Specialty Stores

- Veterinary Clinics

- Online Retailers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership