Healthcare Medical Devices Biotechnology

Pharmaceutical Packaging Market

Pharmaceutical Packaging Market Size, Share, Growth & Industry Analysis, By Material (Plastics & Polymers, Paper & Paperboard, Glass, Aluminum Foil, Others) By Type (Primary, Secondary, Tertiary) By End-User and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : January 2025

Report ID: KR1218

Pharmaceutical Packaging Market Size

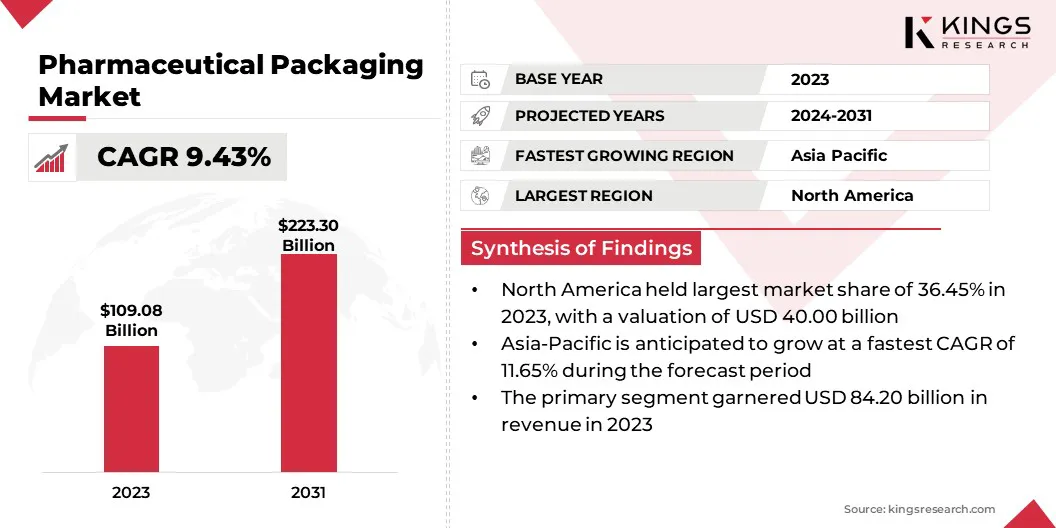

The global pharmaceutical packaging market size was valued at USD 109.08 billion in 2023 and is projected to grow from USD 118.8 billion in 2024 to USD 223.3 billion by 2031, exhibiting a CAGR of 9.43% during the forecast period. The market is registering steady growth, due to the surging demand for pharmaceutical products and the growing focus on health awareness.

In the scope of work, the report includes services offered by companies such as Amcor plc, AptarGroup, Inc., Becton Dickinson and Company, Berry Global Inc., Comar, Drug Plastics & Glass Co. Inc., Gerresheimer AG, SGD Pharma, West Pharmaceutical Services Inc., WestRock Company, and others.

The increasing incidence of chronic conditions such as cancer, obesity, diabetes, and cardiovascular diseases is driving the demand for pharmaceutical products and innovative solutions. Additionally, the need for advanced and efficient packaging solutions that ensure the safety and effectiveness of pharmaceutical products is growing, driving the pharmaceutical packaging market.

- According to American Hospital Association, 133 million Americans or 40% of the total population of the U.S. are affected by chronic diseases.

The growing geriatric population and sedentary lifestyles are leading to an increased prevalence of chronic diseases. Several companies are focusing on developing patient-friendly packaging solutions such as single-dose vials, pre-filled syringes, and blister packs.

Pharmaceutical packaging is the process of packaging pharmaceuticals and related products in specialized materials that assure their safety, identification, and delivery. Plastics, glass, aluminum, paper, and cardboard are among the most often used materials, each chosen for its distinct qualities and usefulness for a certain application.

Materials are chosen based on their compatibility with the product, ability to protect against external impacts, and regulatory compliance. Technological advancements and the rising demand for drugs and medicines are driving the market.

Analyst’s Review

Companies in the market are utilizing technologies like blister packaging technology, cloud, blockchain, NFC tags, tamper evident technologies, and child-resistant technologies. Companies are employing technologies such as robotics and automation to enhance efficiency and assure consistent quality.

Companies are also investing in research and development (R&D) to fulfil consumer demands. Merger and acquisition (M&A) activities are also driving consolidation, allowing key players to expand their global footprint and improve operational efficiency.

- In October 2024, Bormioli Pharma, a developer of pharmaceutical packaging solutions, formed a partnership with Chiesi Group, a biopharmaceutical company that specializes in R&D. Bormioli Pharma will provide Carbon Capture PET bottles for the packaging of a drug, intended to prevent and treat seasonal and perennial allergic rhinitis as well as vasomotor rhinitis.

Pharmaceutical Packaging Market Growth Factors

The growing adoption of generic drugs is driving the market. Healthcare costs are rising continously. Patients and healthcare providers are inclined toward generic drugs/medicines, owing to their affordability, which led to a surge in consumption of generic drugs/medicines.

Hence, companies are focusing on developing cost-effective packaging solutions to assure product safety, increase shelf life, and enhance patient convenience. Packaging innovations such as child-resistant closures, and tamper-evident seals are becoming crucial in generic drugs/medicines.

Rising emphasis on environmental responsibility and sustainability has increased the need for eco-friendly packaging solutions. Thus, companies in the pharmaceutical packaging market are launching products and collaborating with other companies, reducing their carbon footprint and plastic waste.

- For instance, in October 2024, SCHOTT Pharma, a leader in drugs containment and delivery systems, partnered with Schreiner MediPharm, an expert in functional label solutions, and Körber Pharma, a global leader in pharmaceutical technology, to develop an innovative blister-free syringe concept.

The market faces challenges related to the increasing counterfeit in pharmaceutical products. Counterfeit pharmaceutical products are false medicines which contain fake or no active ingredients. These products enter in the supply chain illegally, which makes it difficult to verify and track their authenticity.

A significant factor contributing to this issue is third-shift packaging, where contract manufacturers produce unauthorized batches and sell authentic packaging to counterfeiters. Thus, companies are adopting advanced packaging solutions such as RFID tags, holograms, tamper-evident seals, and serial numbers to track and trace pharmaceutical products.

Pharmaceutical Packaging Industry Trends

Development of innovative pharmaceutical packaging systems is fueling the market. Novel packaging processes developed for assisting modern drug compositions as drug delivery technology advanced. These packaged solutions offer precise dose, controlled release, and increased medical efficacy.

The new packaging includes prefilled inhalers and syringes designed for single-dose vaccines. These products are an alternative to regular syringes and vials. Prefilled inhalers and syringes are intended to prevent packed pharmaceutical products from getting into direct touch with external environments or the patient, that reduces infection.

They also save waste and improve patient compliance by allowing for self-administration of regulated doses. Their acceptance is fueled by a geriatric population and the rise of diseases such as diabetes and asthma.

- For instance, in April 2024, Berry Global, a leader in patient-centered healthcare solutions, has launched the BerryHaler, a dual-chamber dry powder inhaler (DPI) with a dose counter. The new technology is intended to improve patient access and assure efficient delivery of combination drugs.

Surging utilization of AI in pharmaceutical packaging is fostering the pharmaceutical packaging industry growth. AI technologies are used to enhance, accuracy, efficiency, and safety in the packaging processes. These systems evaluate historical data, demand predictions, and storage conditions to determine the appropriate quantity and type of packaging needed.

These systems can facilitate real-time quality control, minimizing errors and ensuring compliance. Machine learning algorithms enable predictive maintenance of packaging machinery, lowering downtime, and operational costs. Smart packaging solutions incorporated with AI are used to monitor product integrity, enhance supply chain visibility, and detect false products in packaging.

Segmentation Analysis

The global market has been segmented based on material, type, end-user, and geography.

By Material

Based on material, the market has been categorized into plastics & polymers, paper & paperboard, glass, aluminum foil, and others. The plastics & polymers segment led the pharmaceutical packaging industry in 2023, reaching a valuation of USD 45.6 million.

Numerous types of plastics materials such as polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), and polyethylene terephthalate (PET) are utilizing for manufacturing pharmaceutical products like sachets, cartridges, tubes, pouches, syringes, bottles, vials, and closures, owing to their physical and chemical properties such as lightweight, high strength, and good chemical resistance.

These plastics are available in versatile sizes & shapes with molding capabilities. Companies in the market are unveiling innovative and sustainable plastics for safe pharmaceutical packaging.

- For instance, in February 2023, Berry Global Healthcare is launching a comprehensive bundle solution designed to help customers leverage the growing demand for child-resistant (CRC) and tamper-evident (TE) packaging in the pharmaceutical markets for syrups and liquid medicines.

By Type

Based on distribution channel, the market has been segmented into primary, secondary, and tertiary. The primary segment captured the largest market share of 76.70% in 2023. Primary packaging such as tubes, bottles, vials and ampoules directly come in contact with drugs and protect them from a chemical composition.

This packaging is crucial for maintaining the shelf life and stability of pharmaceutical products. Common material used for this packaging include non-reactive substances such as PVC and aluminum. The design and material choices for primary packaging can improve patient compliance by offering ease of use, convenience, and accurate dosing.

Additionally, this packaging assists in providing information like dosage instructions, batch numbers, and expiration dates ensuring the traceability of the product.

By End-user

Based on end-user, the market has been categorized into pharma manufacturing, contract packaging, retail pharmacy, institutional pharmacy, and others. The pharma manufacturing segment is expected to garner the highest revenue of USD 143.8 million by 2031.

Pharmaceutical producers are liable for producing large quantities of drugs and medicines items, which involves the usage of significant amounts of packaging materials to sustain their production levels. Many pharmaceutical manufacturers incorporated packaging operations into their manufacturing processes.

By handling packaging internally, these companies have more control over the supply chain, boost efficiency, and ensure the availability of packaging materials matched to their specific product requirements. Pharmaceutical manufacturers often have specific packaging needs based on the formulation and dose forms of their medications.

Pharmaceutical Packaging Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for the largest pharmaceutical packaging market share of 36.45% in 2023, with a valuation of USD 40.0 billion. Advancements in the healthcare infrastructure and rising demand for pharmaceuticals are driving the market in the region. Surging consumer awareness about secure & sustainable packaging solutions boosted the adoption of eco-friendly and recyclable materials, such as paper and cardboard.

Rise in biologics and specialty drugs increased the demand for advanced packaging solutions for pharmaceutical products.The U.S. government has implemented regulations for pharmaceutical packaging.

- The Food and Drug Administration (FDA) regulates that pharmaceutical packaging labels provide details such as usage instructions, dosage, warnings, and a list of ingredients.

These regulations ensure consumer safety and enhance the adoption of innovative packaging technologies in the pharmaceutical industry.

The market in Asia Pacific is anticipated to register significant growth at a CAGR of 11.65% over the forecast period. Rising geriatric population, disposable income, and increasing focus on healthcare are driving the market. Countries such as China, Japan, Singapore, and Malaysia have a state-of-the-art medical infrastructure, which increases the demand for pharmaceutical products.

Companies in the market are focusing on innovative packaging for pharmaceutical products like vials, bottles, blister packs, and syringes. China is a leader in the manufacturing of active pharmaceutical ingredients (APIs) and the world's second-largest pharmaceutical sector overall.

The Government of China launched the 'Made in China 2025' initiative, which established various goals, including achieving self-sufficiency in pharmaceutical production.

Competitive Landscape

The global pharmaceutical packaging market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in R&D, establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Pharmaceutical Packaging Market

- Amcor plc

- AptarGroup, Inc.

- Becton Dickinson and Company

- Berry Global Inc.

- Comar

- Drug Plastics & Glass Co. Inc.

- Gerresheimer AG

- SGD Pharma

- West Pharmaceutical Services Inc.

- WestRock Company

Key Industry Developments

- July 2023 (Launch): Constantia Flexibles launched a new pharmaceutical packaging solution, REGULA CIRC, which features coldform foil. This packaging replaces traditional PVC with a PE sealing layer, reducing plastic usage and increasing the aluminum content.

- July 2023 (Launch): Südpack launched its PharmaGuard blister packaging, made from PP. This innovative product provides exceptional protection against water vapor, UV rays, and oxygen.

The global pharmaceutical packaging market is segmented as:

By Material

- Plastics & Polymers

- Paper & Paperboard

- Glass

- Aluminum foil

- Others

By Type

- Primary

- Secondary

- Tertiary

By End-user

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy

- Institutional Pharmacy

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership