Energy and Power

Photovoltaic Module Testing and Certification Market

Photovoltaic Module Testing and Certification Market Size, Share, Growth & Industry Analysis, By Testing Type (Performance Testing, Environmental Testing, Safety Testing), By Certification Type (IEC Certifications, UL Certifications), By Service Provider (Independent Testing Laboratories, PV Module Manufacturers), By End-User and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : March 2025

Report ID: KR1427

Market Definition

The photovoltaic (PV) module testing and certification market focuses on the rigorous evaluation and certification of solar panels, ensuring they meet the performance, safety, and durability standards. With the increasing adoption of solar energy, there is a corresponding rise in the demand for reliable and high-quality PV modules.

Testing processes are essential as they assess solar panels' efficiency, power output, and environmental resilience. Certification affirms compliance with internationally recognized standards such as IEC (International Electrotechnical Commission) and UL (Underwriters Laboratories).

Photovoltaic Module Testing and Certification Market Overview

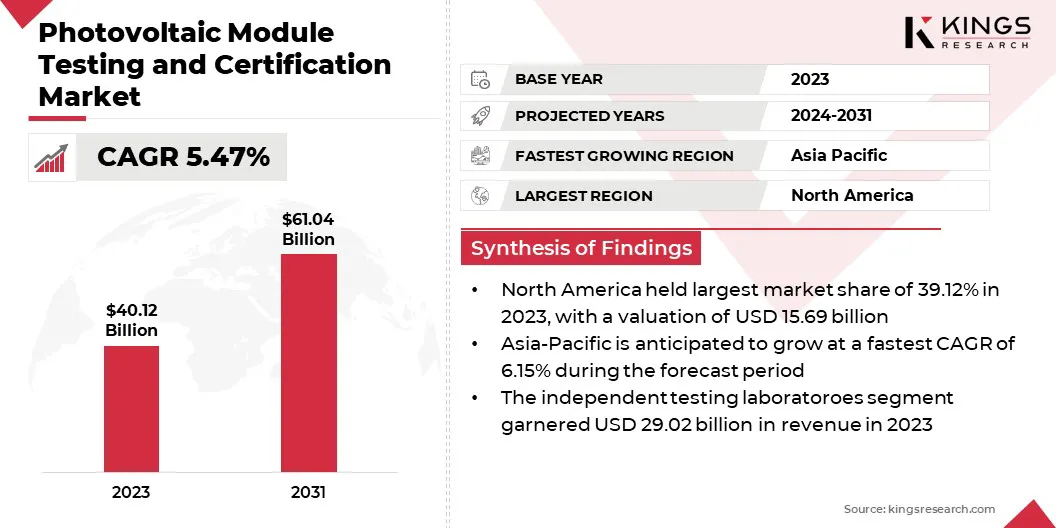

The global photovoltaic module testing and certification market size was valued at USD 40.12 billion in 2023 and is projected to grow from USD 42.04 billion in 2024 to USD 61.04 billion by 2031, exhibiting a CAGR of 5.47% during the forecast period.

Key factors driving the growth of this market are government regulations, advancements in technology, and an increasing need for dependable solar products. This market encompasses a diverse range of stakeholders, including manufacturers, testing laboratories, and system installers, who rely on certification to ensure product quality and safety. By reinforcing these standards, the market ultimately supports the broader adoption of renewable energy solutions.

Major companies operating in the global photovoltaic module testing and certification industry are TÜV Rheinland, TÜV SÜD, UL LLC, SGS Société Générale de Surveillance SA., Intertek Group plc, DNV GL, mbj solutions, VDE Prüf- und Zertifizierungsinstitut GmbH, OCA Global Corporate Service S.A., Solarif Group BV, RETC, LLC, PVEL LLC, CSA Group Testing & Certification Inc, Bureau Veritas, and KRD Global Group.

The market is witnessing notable growth, driven by the increasing demand for solar energy and the need for high-quality products. As solar power becomes vital for global energy strategies, manufacturers are intensifying their efforts to comply with rigorous performance and safety standards, thereby enhancing consumer trust and ensuring long-term operational efficiency.

This focus on quality has resulted in a significant investment in advanced testing technologies, which improve both the speed and accuracy of module assessments.

- In June 2024, TÜV Rheinland launched of its new PV Traceability Testing Service for Photovoltaic Modules at Intersolar, aimed at enhancing the transparency and quality in the photovoltaic (PV) module supply chain. The traceability testing service is based on the globally recognized ISO 9001 management system standard.

Key Highlights:

- The global photovoltaic module testing and certification market size was valued at USD 40.12 billion in 2023.

- The market is projected to grow at a CAGR of 5.47% from 2024 to 2031.

- North America held a market share of 39.12% in 2023, with a valuation of USD 15.69 billion.

- The performance testing segment garnered USD 16.89 billion in revenue in 2023.

- The IEC certifications segment is expected to reach USD 36.24 billion by 2031.

- The PV module manufacturers segment is anticipated to witness the fastest CAGR of 6.11% during the forecast period.

- The utility segment garnered USD 14.60 billion in revenue in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.15% during the forecast period.

Market Driver

"Government Regulations and Incentives"

Government regulations and incentives are essential drivers of growth in the photovoltaic (PV) module testing and certification market. These regulations ensure that solar modules adhere to stringent safety, performance, and environmental standards, essential for reliable and safe solar installations.

Standards such as IEC 61215 (performance) and IEC 61730 (safety) require comprehensive testing and certification of solar modules before they are brought to market, thereby enhancing consumer protection and ensuring quality assurance.

Furthermore, many countries impose certification requirements, such as the CE marking within the European Union and the UL listing in the United States, to confirm compliance with local regulatory standards. This further stimulates the market for PV module testing and certification.

- In December 2024, Saatvik Solar announced that its TOPCon (Tunnel Oxide Passivated Contact) modules have been certified by the Bureau of Indian Standards (BIS). This certification sets new benchmarks for solar technology in India.

Market Challenge

"Lack of Standardization Across Markets"

The lack of standardization across markets presents a considerable challenge within the photovoltaic (PV) module testing and certification market. While international standards such as IEC 61215 and IEC 61730 provide a foundational framework for assessing module performance and safety, individual countries often implement their own specific certification requirements.

For example, in the European Union, compliance with CE marking standards is mandatory, whereas, in the United States, UL certification is typically required. Furthermore, emerging markets like India adhere to local standards established by the Bureau of Indian Standards (BIS).

This variability in certification requirements results in a complex and fragmented landscape for manufacturers, who navigate numerous testing protocols and certification processes to effectively market their products globally.

To tackle the lack of standardization in the photovoltaic (PV) module testing and certification industry, a collaborative approach is crucial. Harmonizing global standards through organizations like the International Electrotechnical Commission (IEC) and Underwriters Laboratories (UL) can create universal guidelines for performance, safety, and quality.

This would allow manufacturers to meet consistent criteria across regions, reducing complexity and certification costs. Mutual Recognition Agreements (MRAs) between governments and certification agencies can further streamline the process by recognizing PV modules certified in one region across others, eliminating redundant testing. Promoting international cooperation on testing protocols will encourage consistent product quality and regulatory transparency.

Market Trend

"Advancement in Testing Technologies"

Recent advancements in testing technologies are enhancing the accuracy and reliability of photovoltaic module testing and certification market. Techniques like electroluminescence (EL) imaging and infrared thermography effectively detect internal defects, such as microcracks and degradation, that are not visible externally.

As bifacial solar modules gain popularity, new methods are being developed to assess their performance under varying real-world conditions. Improved thermal cycling and damp heat tests allow manufacturers to better understand the durability of solar panels over long-term environmental exposure. These innovations are vital for ensuring that future solar products meet higher standards for performance, efficiency, and longevity.

- In March 2024, MBJ Solutions introduced its new MBJ Module Tester, designed to simplify the process of PV module recycling. This innovative tool allows for efficient testing of solar modules at the end of their life cycle, helping to assess their potential for reuse or recycling, thereby supporting sustainability efforts in the solar industry and promoting a circular economy for photovoltaic technology.

Photovoltaic Module Testing and Certification Market Report Snapshot

|

Segmentation |

Details |

|

By Testing Type |

Performance Testing, Environmental Testing, Safety Testing, Mechanical Testing |

|

By Certification Type |

IEC Certifications, UL Certifications |

|

By Service Provider |

Independent Testing Laboratories, PV Module Manufacturers |

|

By End-User |

Residential, Commercial, Utility |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Testing Type (Performance Testing, Environmental Testing, Safety Testing, Mechanical Testing): The performance testing segment earned USD 16.89 billion in 2023 due to the increasing demand for verifying the efficiency and long-term reliability of solar modules under various operational conditions.

- By Certification Type (IEC Certifications, UL Certifications): The IEC certification segment held 59.12% of the market in 2023, due to its global recognition and widespread adoption for ensuring the performance and safety of photovoltaic modules.

- By Service Provider (Independent Testing Laboratories, PV Module Manufacturers): The independent testing laboratories is projected to reach USD 43.35 billion by 2031, owing to their critical role in providing unbiased, third-party validation of module performance and safety, which is essential for compliance with global standards.

- By End-User (Residential, Commercial, Utility): The commercial segment is anticipated to witness the fastest CAGR of 6.26% during the forecast period, driven by the increasing adoption of solar energy systems in businesses seeking to reduce operational costs and meet sustainability goals.

Photovoltaic Module Testing and Certification Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America photovoltaic module testing and certification market share stood at around 39.12% in 2023 in the global market, with a valuation of USD 15.69 billion. The market for photovoltaic module testing and certification in North America is driven by strict regulatory standards, government incentives, and a high demand for clean energy solutions.

In particular, the U.S. has experienced rapid growth in solar energy installations, supported by both federal and state-level policies that encourage the adoption of renewable energy. This has created a greater need for certified, high-quality photovoltaic modules, which ensure safety, performance, and compatibility with the electrical grid.

The increasing shift toward decentralized energy generation, along with the demand for solar power across residential, commercial, and industrial sectors, is expected to maintain North America's leadin the market over the forecast period.

- In October 2024, Kiwa PVEL and Kiwa PI Berlin collaborated on a new white paper: Raising the Bar for photovoltaic (PV) module testing and certification. The new guidelines outline requirements for assessing the safety, durability, and performance of PV modules to ensure they meet higher industry standards.

The photovoltaic module testing and certification industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.15% over the forecast period. This expansion is driven by the increasing adoption of solar energy and enhanced manufacturing capabilities, especially in countries like China, India, and Japan.

Investments in clean energy projects across the region, along with government policies and incentives that promote solar energy adoption, are accelerating the need for thorough testing and certification. This ensures that solar modules are reliable and safe.

The rising demand for high-efficiency modules such as bifacial and advanced cell technologies is driving the development of more sophisticated testing techniques in the region.

Regulatory Frameworks

- The Ministry of New and Renewable Energy (MNRE) in India provides comprehensive guidelines and schemes aimed at promoting the development and implementation of renewable energy projects, including solar energy

- The "Photovoltaic Module Reliability Workshop: Findings and Recommendations" by the National Renewable Energy Laboratory (NREL) emphasizes the need for standardized testing and certification to ensure the long-term reliability of solar modules.

- The Standards and Testing Quality Control (STQC) Directorate under the Ministry of Electronics and Information Technology (MeitY), Government of India, provides testing and certification services for solar photovoltaic (PV) modules to ensure compliance with national and international standards.

- The National Renewable Energy Laboratory (NREL) provides a comprehensive analysis of the reliability and performance of photovoltaic (PV) modules. It discusses existing standards like IEC 61215 (performance) and IEC 61730 (safety), emphasizing their role in ensuring the quality and longevity of solar modules.

Competitive Landscape

The global photovoltaic module testing and certification market is characterized by a number of participants, including both established corporations and rising organizations.

Key competitors are focusing on the expansion of their service offerings, investing in advanced testing technologies, and providing tailored solutions to address the evolving industry demands. This is particularly relevant as innovative solar technologies, such as bifacial modules and perovskite solar cells, continue to gain momentum.

Additionally, companies are partnering with manufacturers, regulatory bodies, and industry stakeholders to ensure compliance with rigorous global standards and to meet the growing need for comprehensive and dependable testing across diverse market segments.

- In December 2023, TÜV Rheinland issued the first-ever certification for photovoltaic (PV) modules under the IEC 63209 standard, achieved by DMEGC Solar. This international standard focuses on assessing the safety and performance of PV modules, ensuring they meet high levels of durability, reliability, and safety under various environmental conditions.

List of Key Companies in Photovoltaic Module Testing & Certification Market:

- TÜV Rheinland

- TÜV SÜD

- UL LLC

- SGS Société Générale de Surveillance SA.

- Intertek Group plc

- DNV GL

- mbj solutions

- VDE Prüf- und Zertifizierungsinstitut GmbH

- OCA Global Corporate Service S.A.

- Solarif Group BV

- RETC, LLC

- PVEL LLC

- CSA Group Testing & Certification Inc

- Bureau Veritas

- KRD Global Group

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, SGS announced the acquisition of RTI Laboratories, bolstering its environmental and PFAS testing capabilities. This acquisition enhances SGS’s ability to provide more comprehensive testing solutions, particularly in crucial areas like solar energy, where environmental testing and certification are essential for ensuring compliance with safety and sustainability standards.

- In October 2024, CSA Group announced the expansion of its testing capabilities by opening a new laboratory in Kunshan, China. This facility enhances CSA Group's ability to provide comprehensive testing and certification services for a wide range of industries, helping manufacturers meet global safety, performance, and regulatory standards.

- In March 2024, Renewable Energy Test Center (RETC) announced the successful acquisition of SolarPTL, a leading solar testing and certification laboratory. By combining capabilities, RETC and SolarPTL will provide clients with the industry’s best in the testing and certification of renewable energy products and systems.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)