Food and Beverages

Plant-Based Protein Market

Plant-based Protein Market Size, Share, Growth & Industry Analysis, By Source (Soy, Pea, Rice, Wheat, Others), By Type (Isolates, Concentrates, Textured), By Form (Dry, Liquid), By Application (Food & Beverages, Dietary Supplements, Animal Feed & Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR438

Market Definition

Plant-based proteins are derived from plant sources such as legumes, grains, nuts, seeds, and vegetables. These proteins serve as an alternative to animal-based proteins and are commonly found in foods like soy, pea, lentils, quinoa, chickpeas, and hemp.

Plant-based proteins are rich in essential nutrients, fiber, and antioxidants while being lower in saturated fat and cholesterol. They are widely used in vegetarian, vegan, and flexitarian diets, offering sustainable and environmentally friendly protein options for health-conscious consumers.

Plant-based Protein Market Overview

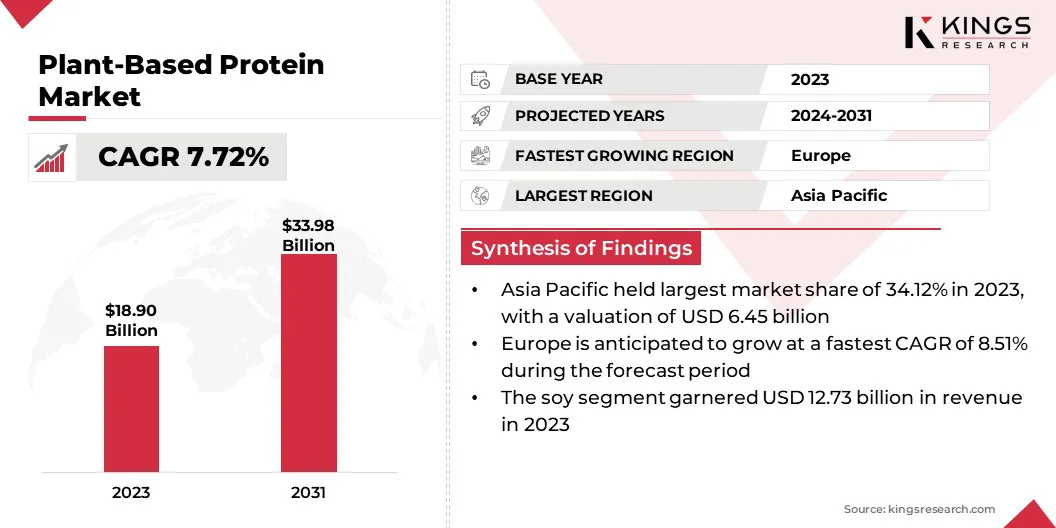

The global plant-based protein market size was valued at USD 18.90 billion in 2023 and is projected to grow from USD 20.19 billion in 2024 to USD 33.98 billion by 2031, exhibiting a CAGR of 7.72% during the forecast period.

The market is registering significant growth, driven by the increasing consumer awareness of health benefits associated with plant-based diets and the rising demand for sustainable food alternatives.

Additionally, advancements in food processing technologies are enhancing the texture and functionality of plant-based proteins, making them more appealing for diverse applications, including meat & dairy alternatives, dietary supplements, and functional beverages.

Major companies operating in the plant-based protein industry are Glanbia plc., ADM, Cargill, Incorporated., Kerry Group plc., Ingredion, Corbion, Roquette Freres, AGT Food & Ingredients Inc., Now Foods, FUJI OIL HOLDINGS INC., International Flavors & Fragrances Inc., Danone, BENEO, MusclePharm, and Burcon.

The growing emphasis on sustainability is accelerating the growth of the market. Consumers are becoming more conscious of the environmental impact of animal agriculture, including greenhouse gas (GHG) emissions, deforestation, and excessive water usage. Ethical concerns related to animal welfare are further driving the shift toward plant-based protein sources.

- The Good Food Institute's 2024 report highlights that most plant-based meat alternatives generate at least 70% fewer CO₂-equivalent emissions while requiring at least 70% less land and water compared to their animal-based counterparts.

Businesses are responding by investing in innovative, eco-friendly protein alternatives that align with consumer preferences. The increasing availability of sustainably produced plant-based protein products is reinforcing market expansion, attracting a diverse consumer base seeking ethical and environmentally responsible dietary options.

- In January 2025, Happy Plant Protein, a spinout from VTT Technical Research Centre of Finland, revolutionized plant-based protein production. Utilizing a patented process that incorporates standard extrusion technology, the company offers high-protein, high-fiber ingredients designed to be cost-efficient, sustainable, and adaptable for local food manufacturing.

Key Highlights:

Key Highlights:

- The plant-based protein industry size was valued at USD 18.90 billion in 2023.

- The market is projected to grow at a CAGR of 7.72% from 2024 to 2031.

- Asia Pacific held a market share of 34.12% in 2023, with a valuation of USD 6.45 billion.

- The soy segment garnered USD 12.73 billion in revenue in 2023.

- The textured segment is expected to reach USD 13.24 billion by 2031.

- The dry segment held 78.34% share of the market in 2023.

- The dietary supplements segment is poised for a robust CAGR of 10.75% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 8.51% during the forecast period.

Market Driver

"Growing Popularity of Plant-based Diets Propels Market Growth"

Increasing popularity of vegan, vegetarian, and flexitarian lifestyles is fueling the plant-based protein market. Consumers are actively seeking healthier dietary alternatives that offer high-quality protein without the health risks associated with excessive meat consumption.

The rising preference for plant-based diets is influencing food manufacturers to introduce protein-rich alternatives in various forms, including meat substitutes, dairy alternatives, and protein-enriched snacks.

The growing number of fitness-conscious individuals and wellness-driven consumers is further amplifying the demand for plant-based protein, driving companies to enhance product offerings with improved taste, texture, and nutritional value.

- According to the Good Food Institute's 2024 report, 27% of adults who consume plant-based meat do so regularly, with 73% eating these products at least two to three times per month.

Market Challenge

"High Production Costs and Scaling Limitations Limits Market Expansion"

A major challenge hindering the growth of the plant-based protein market is the high production costs associated with ingredient sourcing, processing technologies, and product formulation.

The complexity of extracting high-quality protein while maintaining taste, texture, and nutritional value leads to increased manufacturing expenses. Additionally, scaling production to meet growing consumer demand without compromising affordability remains a significant hurdle.

Companies are investing in advanced processing technologies such as high-moisture extrusion (HME) and precision fermentation to enhance efficiency and reduce costs. Strategic partnerships and supply chain optimization are also being prioritized to ensure steady raw material availability at competitive prices.

Furthermore, leading players are exploring local sourcing strategies and government collaborations to secure funding and incentives for scaling sustainable plant-based protein production.

Market Trend

"Expanding Retail Presence and Foodservice Adoption Boosts Market"

The increasing availability of plant-based protein products in mainstream retail channels and foodservice outlets is supporting market expansion. Supermarkets, convenience stores, and online platforms are offering a diverse range of plant-based protein options, making these products more accessible to consumers.

Leading quick-service restaurants and fast-food chains are incorporating plant-based protein into their menus to meet evolving consumer preferences. Partnerships between food manufacturers and foodservice providers are driving higher adoption rates, creating a significant opportunity for sustained growth within the plant-based protein market.

- The Plant Based Foods Organization's 2024 report highlights the latest U.S. retail sales trends in emerging plant-based categories and increasing market diversification. Plant-based meat and milk dominate sales while other categories make up a substantial 47%, reflecting shifting consumer preferences.

Plant-Based Protein Market Report Snapshot

|

Segmentation |

Details |

|

By Source |

Soy, Pea, Rice, Wheat, Hemp, Others |

|

By Type |

Isolates, Concentrates, Textured |

|

By Form |

Dry, Liquid |

|

By Application |

Food & Beverages, Dietary Supplements, Animal Feed, Personal Care & Cosmetics |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Source (Soy, Pea, Rice, Wheat, Hemp, Others): The soy segment earned USD 12.73 billion in 2023, due to its high protein content, superior functional properties, widespread availability, and extensive use in diverse applications, including meat alternatives, dairy substitutes, and nutritional supplements.

- By Type (Isolates, Concentrates, and Textured): The textured segment held 45.34% share of the market in 2023, due to its superior functional properties, including enhanced texture, water retention, and meat-like consistency.

- By Form (Dry and Liquid): The dry segment is projected to reach USD 26.16 billion by 2031, owing to its extended shelf life, cost-effectiveness, and versatility in applications such as protein powders, meat alternatives, and nutritional supplements.

- By Application (Food & Beverages, Dietary Supplements, Animal Feed, and Personal Care & Cosmetics): The dietary supplements segment is poised for significant growth at a CAGR of 10.75% through the forecast period, due to the rising consumer demand for protein-rich functional products that support muscle recovery, weight management, and overall health.

Plant-based Protein Market Regional Analysis

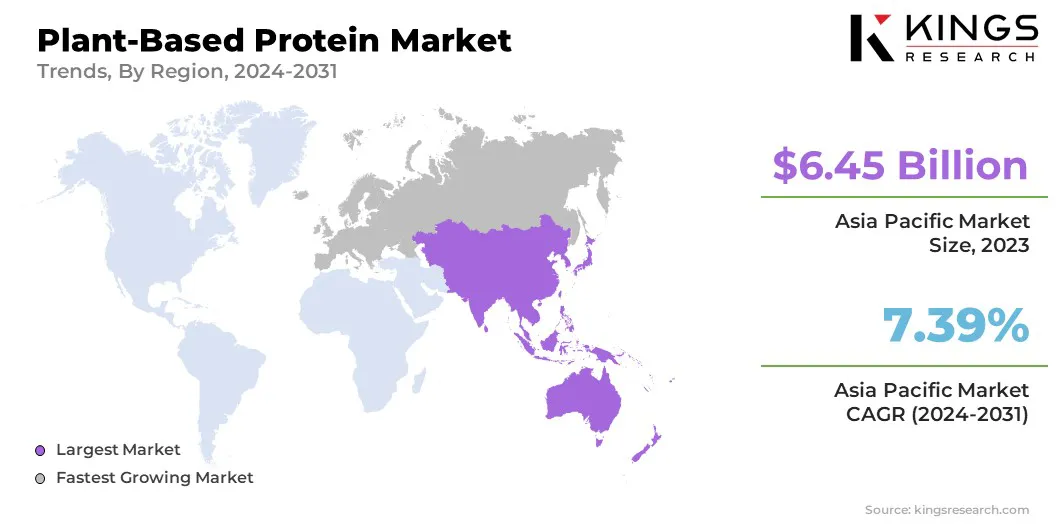

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 34.12% share of the plant-based protein market in 2023 in the global market, with a valuation of USD 6.45 billion. The integration of plant-based protein into traditional Asian cuisines is driving consumer acceptance and market expansion.

Asia Pacific accounted for around 34.12% share of the plant-based protein market in 2023 in the global market, with a valuation of USD 6.45 billion. The integration of plant-based protein into traditional Asian cuisines is driving consumer acceptance and market expansion.

Countries like China, India, and Japan have a long history of consuming plant-derived proteins such as tofu, tempeh, and seitan, making the transition to modern plant-based alternatives smoother.

Food brands are capitalizing on this by launching plant-based versions of culturally significant dishes, appealing to both health-conscious consumers and those seeking familiar flavors in a sustainable format.

The fast-paced urbanization across Asia Pacific is transforming dietary habits, leading to a surge in the demand for plant-based protein. Consumers in metropolitan areas are shifting toward healthier and more sustainable food choices, due to rising disposable incomes and increasing awareness of nutrition.

The demand for plant-based protein is particularly strong among younger demographics and working professionals seeking convenient, protein-rich alternatives. Food manufacturers are responding with innovative plant-based products tailored to regional tastes, accelerating market expansion.

- The 2023 report by the India Brand Equity Foundation (IBEF) projects significant growth in the plant-based food market in India. The plant-based meat sector, currently valued at approximately USD 30-40 million, is expected to reach USD 500 million. Meanwhile, the plant-based dairy market is anticipated to expand from USD 21 million to USD 63.9 million by 2024, reflecting a compound annual growth rate (CAGR) of 20.7%. The overall vegan food industry is forecasted to grow at a CAGR of 11.32% between 2022 and 2027.

The plant-based protein industry in Europe is poised for significant growth at a robust CAGR of 8.51% over the forecast period. European governments are actively promoting plant-based diets as part of broader sustainability and public health initiatives.

The European Green Deal and Farm to Fork Strategy emphasize the need to reduce dependency on animal agriculture, leading to policy-driven incentives for plant-based protein alternatives.

Some countries, such as Germany and the Netherlands, have integrated plant-based food promotion into national dietary guidelines, reinforcing consumer confidence in alternative protein sources.

Furthermore, the rapid expansion of private-label plant-based protein products is accelerating market growth in Europe. Leading supermarket chains, including Tesco, Carrefour, and Lidl, have launched extensive private-label lines of plant-based meat, dairy, and ready-to-eat meals at competitive prices.

Private-label offerings are making plant-based protein more affordable and accessible to a broad consumer base, particularly in price-sensitive regions of Southern and Eastern Europe.

The retail sector’s strong push for plant-based alternatives, supported by improved supply chain logistics, is further strengthening market penetration across urban and rural areas.

- The 2024 report by the Good Food Institute reveals that plant-based food sales across six European countries reached USD 5.88 billion in 2023, reflecting a 5.5% increase from 2022. During the same timeframe, the volume of plant-based food sold registered 3.5% growth.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees plant-based proteins under the Federal Food, Drug, and Cosmetic Act. The FDA requires that plant-based products are safe, properly labeled, and not misleading to consumers. Labeling terms such as "milk" or "meat" for plant-based alternatives have been subjects of debate, leading to state-level regulations and ongoing discussions about federal standards.

- The European Food Safety Authority (EFSA) regulates plant-based proteins under the General Food Law. Products must undergo safety assessments and comply with labeling regulations to ensure that they are safe for consumption and accurately represented. The EU has specific guidelines for novel foods, which may apply to certain plant-based protein products.

- Following Brexit, the UK established its own regulatory framework for food safety. The Food Standards Agency (FSA) is responsible for ensuring that plant-based proteins meet safety standards and are correctly labeled. The UK has been supportive of alternative proteins, funding research, and including cultivated meat in national biotechnology plans.

- In China, the National Health Commission (NHC) regulates plant-based proteins under the Food Safety Law. Products must meet safety standards, and any novel ingredients require approval. China has shown interest in alternative proteins, with government support for Research and Development (R&D) in plant-based proteins.

- Japan's Ministry of Health, Labour, and Welfare (MHLW) oversees plant-based proteins. In 2021, Japan issued guidelines allowing plant-based products to use terms like "meat," "milk," and "eggs" on labels, provided they include modifiers such as "plant-based" or "dairy-free." The country is also investigating the safety of cultivated meat to establish clear regulatory frameworks.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates plant-based proteins under the Food Safety and Standards Act. Products must adhere to safety and labeling standards. India has a significant vegetarian population, and the government supports the development of plant-based protein sources.

- The Ministry of Food and Drug Safety (MFDS) regulates plant-based proteins. In 2022, South Korea amended its regulatory framework to include ingredients from cell and microbial cultures, inviting applications from companies in the alternative protein sector.

Competitive Landscape:

The global plant-based protein market is characterized by a large number of participants, including both established corporations and rising organizations. Key market players are implementing strategies focused on innovation and new product development to align with sustainability goals and the growing demand for environmentally friendly food options.

Companies are investing in research to enhance the taste, texture, and nutritional profile of plant-based proteins while reducing resource consumption and carbon footprints.

- In October 2024, Burcon NutraScience introduced Puratein, a high-purity canola protein developed as an effective alternative to eggs in food production. This innovative plant-based ingredient replicates the functional properties of eggs, offering comparable binding, emulsifying, and foaming capabilities. Designed for applications in baked goods, sauces, and various food products, Puratein aligns with the industry’s shift toward sustainable and functional plant-based solutions.

Strategic partnerships, acquisitions, and expansion into emerging markets further strengthen their market position. These players are driving the market and meeting the evolving preferences of environmentally conscious consumers by prioritizing sustainability-driven product development and leveraging advanced food technologies.

List of Key Companies in Plant-based Protein Market:

- Glanbia plc.

- ADM

- Cargill, Incorporated.

- Kerry Group plc.

- Ingredion

- Corbion

- Roquette Freres

- AGT Food & Ingredients Inc.

- Now Foods

- FUJI OIL HOLDINGS INC.

- International Flavors & Fragrances Inc.

- Danone

- BENEO

- MusclePharm

- Burcon

Recent Developments (Partnerships/Agreements/New Product Launch)

- In November 2024, Ingredion Incorporated and Lantmännen announced a long-term partnership to address the growing demand in the European market for competitively priced, sustainably sourced, and high-quality pea protein isolates. As part of the initiative, Lantmännen is investing over USD 108.86 million in a cutting-edge production facility in Sweden, with Ingredion contributing to the development of a specialized portfolio of plant-based protein isolates derived from yellow peas. The state-of-the-art facility is expected to be operational by 2027.

- In February 2024, the company introduced four multifunctional pea proteins designed to enhance taste, texture, and innovation in plant-based foods and high-protein nutritional products. This expansion of its established NUTRALYS plant protein portfolio provides food manufacturers with new and improved formulation possibilities, supporting the development of high-quality, sustainable plant-based products.

- In November 2024, Danone launched a kid-friendly plant-based milk under its Silk brand. The new product, Silk Kids, marks the brand’s first plant-based beverage specifically formulated for children. Silk Kids offers at least 10% more of the daily value per serving of essential nutrients, including protein, vitamin D, potassium, riboflavin, phosphorus, iodine, and choline, compared to Silk Original Almondmilk.

- In February 2024, International Flavors & Fragrances Inc. (IFF) made a strategic investment in high-moisture extrusion (HME) technology from Coperion, a global leader in extrusion solutions. This investment aims to strengthen IFF’s ability to develop innovative plant-based meat analogues, enhancing support for its customers in the alternative protein sector.

- In December 2024, Burcon NutraScience Corp., a leading supplier of plant-based proteins, introduced Peazazz C, a new pea protein derived from yellow field peas using its advanced purification technology. This high-purity protein isolate is designed for diverse applications, including beverages, dairy alternatives, baked goods, nutrition bars, lifestyle nutrition products, meal replacements, and vegetarian & vegan offerings.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)