Advanced Materials and Chemicals

Polyethylene Market

Polyethylene Market Size, Share, Growth & Industry Analysis, By Type (Low-density Polyethylene, High-density Polyethylene, Linear Low-density Polyethylene), By End Use (Packaging, Construction, Automotive & Others), and Regional Analysis, 2024-2031

Pages : 150

Base Year : 2023

Release : December 2024

Report ID: KR1151

Polyethylene Market Size

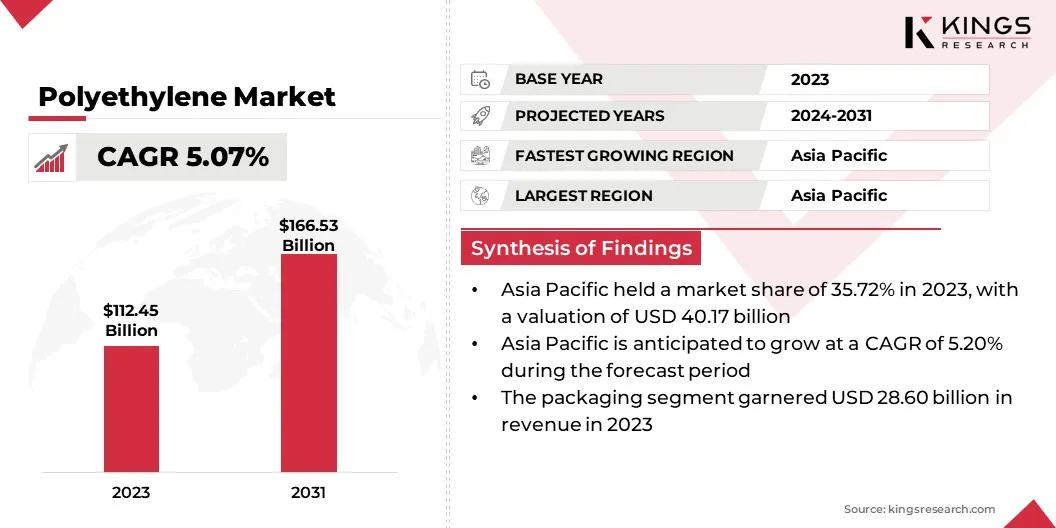

The global Polyethylene Market size was valued at USD 112.45 billion in 2023 and is projected to grow from USD 117.79 billion in 2024 to USD 166.53 billion by 2031, exhibiting a CAGR of 5.07% during the forecast period.

The rising demand for polyethylene in the packaging industry is contributing significantly to the growth of the market. Its affordability, durability, and flexibility make it a preferred choice for food packaging, protective films, grocery bags, and containers. The industry is witnessing a notable shift toward efficient, innovative, and sustainable packaging solutions, further boosting demand.

In the scope of work, the report includes products offered by companies such as BASF, Borealis AG, Dow, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation., CNPC, SABIC, Formosa Plastic Group, China Petrochemical Corporation (Sinopec), and others.

The development of advanced polyethylene types such as linear low-density polyethylene (LLDPE), ultra-high molecular weight polyethylene (UHMWPE), and other specialized variants, is fueling market expansion. These advanced polyethylene variants offer superior strength, durability, and flexibility, making them ideal for various industrial applications.

Industries such as automotive, healthcare, and electronics are increasingly adopting these advanced materials, further contributing to the growth of the polyethylene market.

Polyethylene is a versatile, lightweight, and durable thermoplastic polymer made from the polymerization of ethylene gas. It is widely used globally due to its affordability, chemical resistance, flexibility, and ease of processing.

Available in forms such as low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE), each serves different industrial and commercial purposes. Common uses include packaging materials, construction supplies, automotive components, electronics, medical devices, and agricultural applications.

Analyst’s Review

Companies are actively adopting strategic initiatives to address growing sustainability concerns and meet shifting consumer preferences, supporting the expansion of the polyethylene market. A major focus is developing eco-friendly alternatives, such as bio-based polyethylene, and advancing innovative recycling technologies to minimize waste.

To support these efforts, companies are investing heavily in research and development to improve recycling processes and enhance production efficiency.

- In March 2024, Dow and Procter & Gamble formed a joint development agreement (JDA) to advance recycling technology. This collaboration aims to efficiently transform hard-to-recycle plastic packaging into high-quality recycled polyethylene with minimal greenhouse gas emissions.

Furthermore, businesses are expanding their production capacities and forming strategic partnerships to strengthen supply chain operations. These concerted efforts are enabling companies to innovate, adapt to environmental policies, and meet the increasing demand for sustainable, customized polyethylene solutions across industries.

Polyethylene Market Growth Factors

The automotive industry's focus on reducing emissions and improving fuel efficiency increases the demand for lightweight materials, thereby propelling the growth of the polyethylene market.

- The U.S. Department of Energy's analysis highlights that a 10% reduction in vehicle weight can lead to a 6%–8% improvement in fuel economy. Incorporating lightweight components and high-efficiency engines into one-quarter of the U.S. vehicle fleet could save over 5 billion gallons of fuel annually by 2030.

Its unique properties, including strength, flexibility, and environmental resistance, make it suitable for automotive applications. Polyethylene is widely used in fuel tanks, pipes, and various interior and exterior components.

The energy sector, particularly renewable energy projects, is generating significant demand for polyethylene. Applications such as protective coatings, cable insulation, and piping systems rely on polyethylene's chemical resistance and durability.

Additionally, polyethylene is utilized in offshore oil exploration, wind turbine installations, and solar power farms due to its ability to withstand challenging environmental conditions.

- Nordex, a leading German turbine manufacturer, produces approximately one-third of its blades in-house. As part of its commitment to sustainability, the company has set a goal to develop fully recyclable turbine blades by 2032. To support this initiative, Nordex has expanded its use of fully recycled polyethylene terephthalate (PET) foams in blade production.

This rising demand from renewable and traditional energy initiatives is boosting the expansion of the market.

However, the environmental concerns associated with plastic waste and its impact on ecosystems are hindering the growth of the market. The non-biodegradable nature of traditional polyethylene contributes to rising waste levels and stricter government regulations worldwide.

To address this challenge, companies are adopting innovative solutions to mitigate this challenge. Investments in advanced recycling technologies, such as chemical recycling, are prioritized to enhance the reusability of polyethylene.

Additionally, companies are developing bio-based and biodegradable alternatives to traditional polyethylene to align with sustainability goals. Strategic partnerships and R&D efforts are improving supply chain efficiency and reducing environmental footprints, thereby aiding market expansion.

Polyethylene Industry Trends

Polyethylene's superior insulating properties and chemical resistance have led to its growing use in the electronics industry. It is commonly used in cable coatings, connectors, and other electronic components due to its ability to protect against moisture, heat, and electrical interference.

The demand for lightweight, cost-effective, and high-performance materials in electronic manufacturing is propelling the expansion of the market. Technological innovations in the production of polyethylene are stimulating the growth of the polyethylene market. These advancements enable the development of specialized polyethylene types that meet specific industrial needs, such as enhanced strength and flexibility.

- In March 2024, research scientists at Dow unveiled an innovative polyethylene (PE) architecture featuring a distinctive long-chain branched structure. This advancement enhances asset flexibility while offering the potential to significantly lower carbon emissions in large-scale polyethylene production.

Such innovations in manufacturing processes improve efficiency, strengthen competitiveness, and fuel market progress.

Segmentation Analysis

The global market has been segmented based on type, end use, and geography.

By Type

Based on type, the market has been segmented into low-density polyethylene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethylene (LLDPE).

The high-density polyethylene (HDPE) segment led the polyethylene market in 2023, reaching a valuation of USD 44.61 billion. HDPE is characterized by high strength, durability, and chemical resistance, making it a preferred material for industries such as packaging, construction, and automotive.

Its use in producing rigid containers, pipes, and geomembranes highlights its versatility and reliability in demanding environments. Additionally, HDPE’s recyclability aligns with the increasing global emphasis on sustainable materials, thereby fostering its adoption.

By End Use

Based on end use, the market has been classified into packaging, construction, automotive, healthcare, consumer electronics, and others. The construction segment is poised to significant growth, registering a robust CAGR of 5.54% through the forecast period.

Polyethylene is widely used in pipes, insulation materials, geomembranes, and protective sheeting, which are essential for water management systems, energy-efficient structures, and road construction. The material’s durability, flexibility, and resistance to chemicals make it a preferred choice for various construction needs.

Rising investments in smart city projects, urban infrastructure, and housing developments are propelling demand, thereby aiding segmental growth.

Polyethylene Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific polyethylene market accounted for a significant share of around 35.72% in 2023, with a valuation of USD 40.17 billion. Rapid urbanization and extensive infrastructure projects are leading to increased demand for polyethylene in construction and related sectors.

- According to the Asian Development Bank, urbanization in the region is expected to increase the urban population by 1.1 billion by 2040, fueling demand for advanced foodservice infrastructure and appliances to cater to the evolving consumer preferences and higher consumption patterns in cities.

Applications such as pipes, insulation materials, and geomembranes are integral to these projects. Governments in Asia Pacific are prioritizing infrastructure expansion, particularly in transportation, housing, and water management, supporting sustained growth in polyethylene market.

Asia Pacific’s dominance in the global electronics manufacturing sector is bolstering regional market expansion. The material's insulating properties are essential for cable coatings and electronic components. Rapid advancements in electronic technologies and growing exports are bolstering regional market growth.

The Europe market is set to witness significant growth, recording a robust CAGR of 5.11% over the forecast period. This expansion is largely attributed to the European Union's stringent plastic waste management regulations and commitment to a circular economy.

Companies are adopting advanced recycling technologies and producing bio-based polyethylene to meet sustainability goals. These efforts align with rising consumer demand for eco-friendly packaging, fueling domestic market expansion.

Additionally, European governments are introducing policies to promote the production and use of sustainable materials. Subsidies, grants, and partnerships are fostering the demand for polyethylene solutions that align with regional environmental goals. These initiatives are strengthening Europe’s role as a leader in sustainable material production.

Competitive Landscape

The global polyethylene market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Polyethylene Market

- BASF

- Borealis AG

- Dow

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation.

- CNPC

- SABIC

- Formosa Plastic Group

- China Petrochemical Corporation (Sinopec)

Key Industry Developments

- April 2024 (Expansion): SINOPEC secured a 30% stake in Kazakhstan's polyethylene production venture. The initiative, valued at approximately USD 7.7 billion, involves the development of an integrated gas chemical complex with an annual production capacity of 1.25 million tonnes. It is set to account for 1% of the global polyethylene production capacity.

- June 2024 (Expansion): BASF commenced constructing a polyethylene (PE) plant at its Verbund site in Zhanjiang, China. With an annual production capacity of 500,000 metric tons, the facility is set to meet China's growing demand for polyethylene in China, with Operations slated to begin in 2025.

The global polyethylene market has been segmented as:

By Type

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Linear Low-density Polyethylene (LLDPE)

By End Use

- Packaging

- Construction

- Automotive

- Healthcare

- Consumer Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership