Advanced Materials and Chemicals

Polyethylene Naphthalate Market

Polyethylene Naphthalate (PEN) Market Size, Share, Growth & Industry Analysis, By Application (Beverage Bottling, Packaging, Medical Containers, Electronics, Automotive Tires, and Others), By Grade (Food Packaging Grade, Industrial Grade, and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR892

Polyethylene Naphthalate Market Size

The global Polyethylene Naphthalate Market size was valued at USD 1,688.5 million in 2023 and is projected to grow from USD 1,765.2 million in 2024 to USD 2,520.7 million by 2031, exhibiting a CAGR of 5.22% during the forecast period. The market is expanding significantly due to increasing demand for sustainable packaging and its versatile applications in diverse sectors such as food, beverages, electronics, and automotive.

Despite facing competition from PET(Polyethylene Terephthalate), PEN's superior barrier properties and recyclability drive its rapid adoption in diverse industries globally. In the scope of work, the report includes products offered by companies such as TEIJIN LIMITED, EPC Engineering & Technologies GmbH, GTS Flexible Ltd., SASA Polyester Sanayi A.Ş, Kolon ENP, Merck KGaA, PPI Adhesive Products (C.E.) s.r.o., Indorama Ventures Public Company Limited, SKC Inc., FE Thin Films LLC, and others.

The polyethylene naphthalate market is characterized by its growing adoption in sustainable packaging solutions and its expanding applications across the food, beverages, electronics, and automotive sectors.

PEN's superior barrier properties, recyclability, and ability to withstand high temperatures boost its demand. As industries worldwide prioritize environmental sustainability and product integrity, PEN offers a compelling alternative to traditional plastics.

However, it faces competition from established materials such as PET and encounters challenges in scaling its market presence within the existing recycling infrastructures. Moreover, technological advancements and shifting consumer preferences toward lightweight, durable materials continue to propel the growth of the PEN market.

Polyethylene naphthalate is a polyester resin synthesized from naphthalene dicarboxylic acid and ethylene glycol. Known for its robustness, high thermal stability, and superior barrier properties against gases and moisture, PEN finds extensive use in packaging films, bottles, electronics, automotive components, and industrial fibers.

Its attributes enhance product durability and sustainability across diverse applications, reflecting its importance in industries requiring reliable and efficient materials for demanding environments and stringent performance standards.

Analyst’s Review

The global shift toward sustainable practices in automotive and packaging industries is a key factor fostering the growth of the polyethylene naphthalate market. The anticipated growth in the electric vehicle (EV) market and the expansion of the packaging industry are further driving increased demand for polyethylene naphthalate (PEN).

- According to IEA, the region aims for electric vehicles (EVs) to constitute 50% of new passenger cars and light trucks by 2030.

This underscores its significant impact on enhancing automotive performance and achieving ambitious sustainability targets. This growth is fueled by PEN's durability and reliability advantages, which are crucial for meeting stringent automotive standards.

- Moreover, according to the Packaging Industry Association of India (PIAI), India's packaging industry is anticipated to grow at an annual rate of 22%, reaching USD 204.81 billion by 2025. This growth highlights the PEN's major role in sustainable packaging solutions. These factors collectively propel the expansion of the PEN in alignment with global sustainability trends.

Polyethylene Naphthalate Market Growth Factors

The increasing consumption of packaged food and beverages fosters the demand for PEN as a material of choice for bottles, trays, and films. Its ability to withstand high temperatures while maintaining product integrity enhances its suitability for hot-fill applications and microwaveable packaging. Moreover, PEN's excellent gas barrier properties preserve freshness and flavor, meeting rigorous industry requirements.

As food safety regulations become increasingly stringent, PEN's reliability and versatility position it favorably in the competitive packaging landscape, thus bolstering market growth.

Despite its advantages, PEN faces competition from established plastics such as PET, which dominate the packaging industry. PET offers comparable properties in clarity, strength, and recyclability, which poses a major challenge to market penetration.

Moreover, PET's widespread adoption and well-established recycling infrastructure present hurdles for PEN in terms of gaining market acceptance and achieving scalability. Addressing these competitive pressures requires continued innovation, cost-effectiveness, and expanding applications to differentiate PEN in a highly competitive market landscape.

Polyethylene Naphthalate Market Trends

The increasing use of polyethylene naphthalate in protecting solar cells presents a significant opportunity for polyethylene naphthalate market growth. PEN's properties, including high thermal stability, excellent optical clarity, and resistance to harsh environmental conditions, make it an ideal material for encapsulating and protecting solar panels.

As the solar energy sector expands globally, spurred by the shift toward renewable energy sources and sustainability goals, the demand for durable and efficient materials such as PEN is expected to rise.

PEN's ability to enhance the longevity and performance of solar cells by shielding them from moisture, UV radiation, and mechanical damage positions it as a crucial component in advancing solar technology, thereby driving market development.

- According to IEA, Solar PV and wind power installations are projected to significantly exceed previous records by 2028, surpassing 710 GW, marking a substantial increase from the levels observed in 2022.

Polyethylene naphthalate is gaining immense traction due to its recyclability and potential for reducing carbon footprint in packaging. As environmental concerns rise globally, industries are shifting toward sustainable materials.

PEN offers enhanced barrier properties compared to traditional plastics, making it suitable for food packaging and beverage containers that require extended shelf life. Its robust chemical resistance and transparency further augment its appeal in various applications beyond packaging, including electronics and automotive sectors. These factors are slated to boost market growth.

Segmentation Analysis

The global market is segmented based on application, grade, and geography.

By Application

Based on application, the polyethylene naphthalate market is categorized into beverage bottling, packaging, medical containers, electronics, automotive tires, and others. The packaging segment garnered the highest revenue of USD 602.3 million in 2023.

This growth is largely attributable to increasing consumer demand for sustainable and eco-friendly packaging solutions, which has spurred innovation in materials such as polyethylene naphthalate, known for its recyclability and superior barrier properties.

Moreover, stringent regulations that promote the use of recyclable and biodegradable packaging stimulate adoption. Technological advancements enabling lightweight yet durable packaging options enhance efficiency throughout supply chains. Additionally, the expansion of e-commerce and convenience-oriented lifestyles necessitates robust packaging solutions, leading to increased demand.

By Grade

Based on grade, the market is divided into food packaging grade, industrial grade, and others. The industrial grade segment captured the largest polyethylene naphthalate market share of 56.78% in 2023. Industrial grade polyethylene naphthalate is renowned for its exceptional thermal stability, mechanical strength, and chemical resistance, which makes it ideal for demanding environments such as automotive, electronics, and construction.

The material's ability to withstand high temperatures and harsh conditions enhances product durability and performance, thereby reducing maintenance costs and improving operational efficiency. As industries continue to prioritize reliability and longevity in their equipment and components, the demand for industrial grade PEN is growing, propelling the expansion of the segment.

Polyethylene Naphthalate Market Regional Analysis

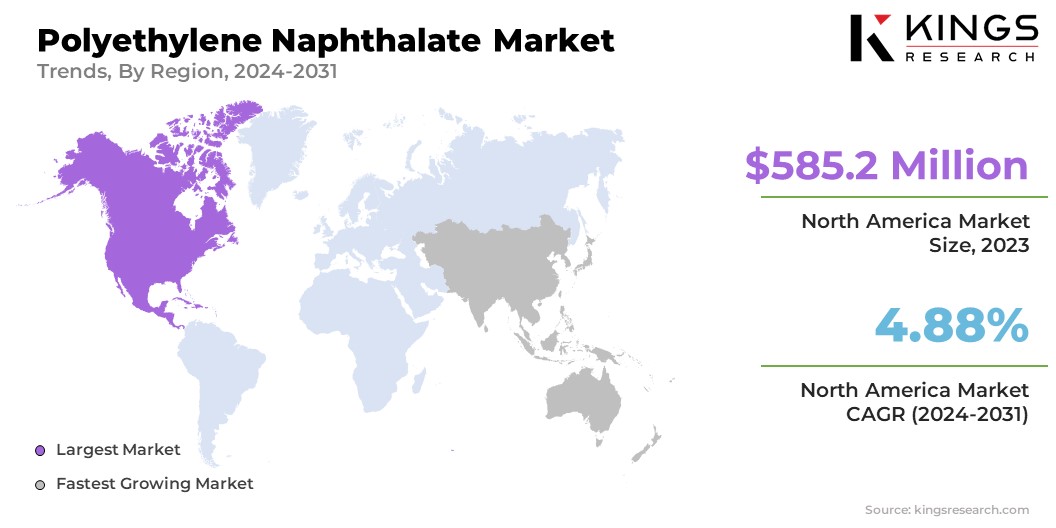

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America polyethylene naphthalate market share stood around 34.66% in 2023 in the global market, with a valuation of USD 585.2 million. The demand for polyethylene naphthalate is rising significantly across multiple sectors in the region. Its high mechanical and thermal properties make it crucial in electronic parts manufacturing, thereby contributing to its increasing adoption in the region.

As the trend toward electric vehicles (EVs) grows, PEN's use in high-performance rubber tires is expanding, fueled by its durability and reliability in demanding automotive applications.

Additionally, its role in producing shatterproof and lightweight bottles for beverages aligns with rising consumer preferences for sustainable and safe packaging solutions. FDA approval for food packaging further boosts PEN's market prospects in North America, aligning with regulatory trends favoring recyclable materials.

Asia-Pacific is anticipated to witness substantial growth at a CAGR of 6.03% over the forecast period. The region's expanding manufacturing and packaging industries, along with advancements in electronics and automotive sectors, drive significant demand for PEN. Increasing urbanization and a focus on sustainable and high-performance materials further support market growth.

As industries across countries in Asia-Pacific adopt PEN for its superior properties, such as high-temperature resistance and dimensional stability, the region continues to be a major contributor to the global PEN market.

Competitive Landscape

The global polyethylene naphthalate market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Polyethylene Naphthalate Market

- TEIJIN LIMITED

- EPC Engineering & Technologies GmbH

- GTS Flexible Ltd.

- SASA Polyester Sanayi A.Ş

- Kolon ENP

- Merck KGaA

- PPI Adhesive Products (C.E.) s.r.o.

- Indorama Ventures Public Company Limited

- SKC Inc.

- FE Thin Films LLC

The global polyethylene naphthalate market is segmented as:

By Application

- Beverage Bottling

- Packaging

- Medical Containers

- Electronics

- Automotive Tires

- Others

By Grade

- Food Packaging Grade

- Industrial Grade

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership