Healthcare Medical Devices Biotechnology

Polyphenols Market

Polyphenols Market Size, Share, Growth & Industry Analysis, By Product (Grape Seed, Green Tea, Apple, Peach, Citrus, Olive, Others), By Application (Functional Beverages, Functional Foods, Dietary Supplements, Cosmetics & Toiletries, Animal Feed, Dyes Other), and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : January 2025

Report ID: KR1246

Market Definition

Polyphenols are beneficial plant compounds with antioxidant properties. They are reducing agents as well and protect the tissues in the body against oxidative stress & associated pathologies such as coronary heart disease, inflammation, and cancers.

Polyphenols are also known for their potential health benefits, such as improving heart health, reducing inflammation, and supporting brain function. They are abundant in plants and are structurally diverse. Polyphenols include phenolic acids, ellagitannin, tannic acid, and flavonoids, some of which have been used previously to dye garments.

Polyphenols Market Overview

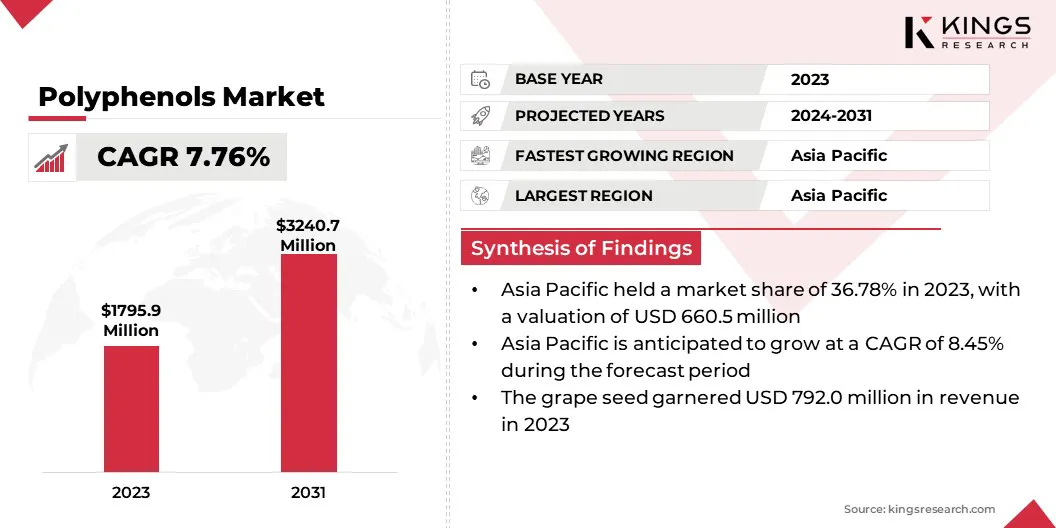

Global Polyphenols Market size was valued at USD 1795.9 million in 2023, which is estimated to be valued at USD 1920.5 million in 2024 and reach USD 3240.7 million by 2031, growing at a CAGR of 7.76% from 2024 to 2031.

The market has been growing rapidly, spurred by the awareness of health benefits among consumers and a growing need for natural plant-based ingredients across industries. Polyphenols are gaining popularity, due to their antioxidant, anti-inflammatory, and potential disease-preventing properties, making them highly sought after in sectors like food & beverages, nutraceuticals, cosmetics, and pharmaceuticals.

Grape seed extract, a concentrated source of polyphenols, particularly proanthocyanidins, has emerged as a key contributor to this market expansion. The demand for polyphenol-rich products, including functional foods, supplements, and beverages, continues to rise as more consumers embrace healthier diets, further propelling the market.

- For instance, in November 2024, a study published in the journal Frontiers in Nutrition reinforced that the Mediterranean diet, characterized by healthy, plant-based foods, fats, and moderate consumption of animal products, has demonstrated significant neuroprotective potential. The diet is rich in antioxidants, vitamins, and polyphenol.

The polyphenols market is growing, driven by products like grape seed, green tea, citrus, and berries. Key applications of polyphenols include functional beverages, foods, and dietary supplements focused on health benefits such as immune and cardiovascular support.

Additionally, polyphenols are used in cosmetics, toiletries, and animal feed, fueled by the increasing demand for natural, health-oriented products.

- For instance, in June 2024, One A Day launched Age Factor Cell Defense, a dietary supplement designed to help defend against cellular aging from the inside. This supplement, featuring olive polyphenols, supports cellular health—the starting point of aging.

Key Highlights:

- The global polyphenols market size was recorded at USD 1795.9 million in 2023.

- The global market is projected to grow at a CAGR of 7.76% from 2024 to 2031.

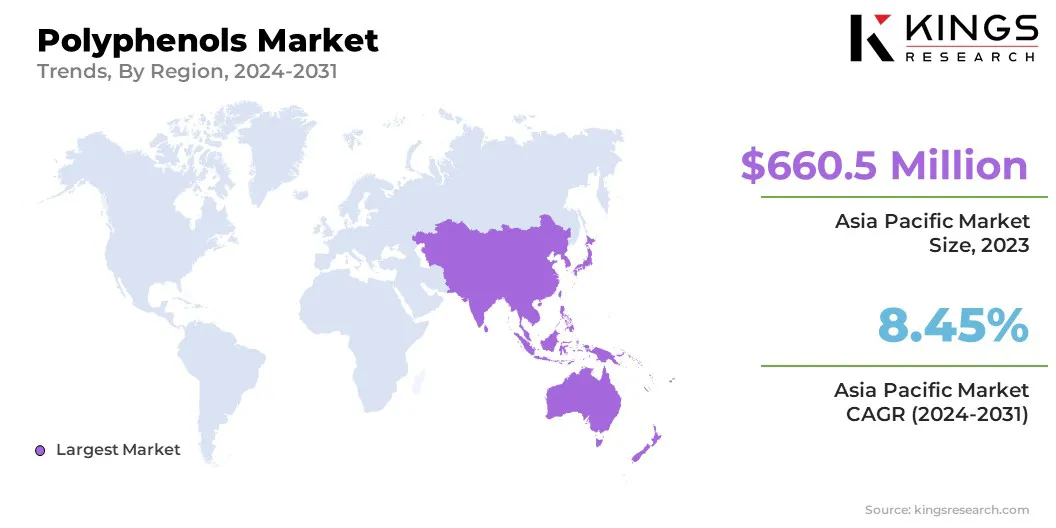

- Asia Pacific held a market share of 36.78% in 2023, with a valuation of USD 660.5 million. Additionally, it is anticipated to grow at a CAGR of 8.45% during the forecast period.

- The grape seed segment garnered USD 792.0 million in revenue in 2023.

- The functional foods segment is expected to reach USD 1180.5 million by 2031.

Market Driver

"Consumer awareness and AI integration"

Increasing awareness of the health benefits of polyphenols, such as antioxidant, anti-inflammatory, and disease-preventing properties, is driving consumer demand for polyphenol-rich products like functional foods, beverages, and dietary supplements.

Additionally, the demand for plant-based ingredients such as polyphenols is on the rise, with the growing consumer preference for natural and clean-label products. Consumers are constantly looking for alternative options to synthetic additives and chemicals.

- In January 2024, Maolac launched its AI-powered system, Moreka, which analyzes scientific literature to identify functional proteins from natural sources. This innovative platform aims to accelerate the development of effective, bioavailable, and cost-efficient nutraceuticals, enhancing precision and meeting the growing demand for preventive health supplements.

These advancements in AI are driving further innovation in nutraceuticals, enabling the identification and optimization of polyphenol formulations, ultimately enhancing product development.

Market Challenge

"Limited bioavailability and high production cost"

The polyphenol market faces significant challenges. The limited bioavailability of polyphenols hinders their absorption in the body and reduces their effectiveness in health-focused products such as fortified foods, beverages, and wellness supplements. Thus, companies are investing in advanced technologies like nanoencapsulation to improve the absorption and stability of polyphenols.

- For instance, in April 2024, Biotrex Nutraceuticals discussed the growing potential of advanced delivery systems, such as nanoencapsulation and liposomal technology, to enhance the absorption and bioavailability of key nutrients. These innovations enable the development of more convenient product formats, such as functional beverages and gummies, offering companies a competitive edge and generating growth opportunities in the polyphenols market.

Additionally, high production costs are associated with extracting polyphenols from natural sources like fruits, seeds, and plants. These complex extraction processes lead to elevated production expenses, which can impact the affordability and accessibility of polyphenol-rich products.

In response, manufacturers are focused on optimizing extraction methods to reduce costs and enhance scalability, making polyphenol-based products more accessible to a broader market.

Market Trend

"Vegan trends and preventative health"

A key trend in the polyphenol market is the increasing demand for natural, plant-based ingredients, driven by consumer preferences for clean-label and vegan products. Polyphenol-rich ingredients from sources like grapes, tea, and berries are gaining popularity in foods, cosmetics, and personal care products as health-conscious and ethically-minded consumers seek plant-derived solutions.

- For instance, in January 2024, a study revealed that the vegan population in the UK increased by 1 million in just one year, reflecting a significant shift toward plant-based diets. This growth has led to a rising demand for plant-based products, including polyphenol-rich foods, beverages, and cosmetics

The growing demand for functional ingredients in food, skincare, and supplements is accelerating the growth of the polyphenol market. Consumers are focusing on preventative health and overall wellness. This shift is prompting companies to invest in advanced research and technology to unlock the full potential of polyphenols, expanding their applications across diverse sectors.

Polyphenols Market Report Snapshot

| Segmentation | Details |

| By Product | Grape Seed, Green Tea, Apple, Peach, Citrus, Olive, Berries, Cocoa & Coffee Beans, Potatoes, Others |

| By Application | Functional Beverages, Functional Foods, Dietary Supplements, Cosmetics & Toiletries, Animal Feed, Dyes, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Grape Seed, Green Tea, Apple, Peach, Citrus, Olive, Berries, Cocoa & Coffee Beans, Potatoes, Others): The grape seed segment earned USD 792.0 million in 2023, due to its applications and advanced use in functional foods & beverages and dietary supplements.

- By Application (Functional Beverages, Functional Foods, Dietary Supplements, Cosmetics & Toiletries, Animal Feed, Dyes, Others): The functional foods segment held 34.28% of the polyphenols market in 2023, due to the growing demand for custom cell lines for biologics and gene therapies.

Polyphenols Market Regional Analysis

Asia Pacific accounted for a substantial market share of 36.78% and was valued at USD 660.5 million in 2023. This market leadership is primarily driven by robust government support, significant investments from emerging biotechnology companies, and growing consumer awareness of the health benefits associated with polyphenols.

The rising demand for natural, plant-based ingredients across various sectors, including food & beverages, cosmetics, and dietary supplements, is propelling the polyphenols market in this region.

- In September 2023, a study conducted by scientists at the Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR) highlighted the potential of Berberine, which can modulate the ferroptosis-AD axis, offering a novel therapeutic approach for Alzheimer's disease.

The region’s rapid growth is further supported by an expanding middle class, increasing health consciousness, and a strong shift toward functional foods and wellness products. Key markets in countries like China, India, and Japan are accelerating the adoption of polyphenol-rich ingredients, leveraging both traditional and modern innovations in product formulations.

Government initiatives, along with favourable regulatory environments, are facilitating market development and enhancing the accessibility of polyphenol-based products.

Europe is the second fastest-growing region with the CAGR of 8.11% in the global polyphenols market. The growing interest in polyphenols in Europe is fueled by increasing government support for research on the health benefits of plant-based ingredients, coupled with stringent regulations that ensure product safety and quality.

The European market benefits from a strong emphasis on sustainability, clean-label products, and increasing consumer demand for natural ingredients with proven health benefits. Countries like Germany, France, and the UK are leading the charge, where polyphenols are being incorporated into functional foods, beverages, and skincare products.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

The regional regulatory framework of the polyphenol market is shaped by distinct regional factors, including government oversight, industry standards, and market demands for natural ingredients.

The market in North America is primarily influenced by rigorous regulatory standards established by entities such as the U.S. Food and Drug Administration (FDA) and Health Canada. These agencies enforce strict safety and efficacy regulations for polyphenol-rich products in food, beverages, and dietary supplements.

The increasing consumer demand for clean-label and natural products have further driven the need for transparent labelling practices and comprehensive safety assessments, fueling the market.

Regulatory bodies such as the European Food Safety Authority (EFSA) in Europe impose stringent guidelines on the use of polyphenols, particularly concerning health claims and functional ingredient approval.

European regulations place a strong emphasis on non-GMO sourcing, sustainability, and clean-label certifications, which align with the growing demand for plant-based ingredients. These regulations are accelerating the adoption of polyphenol-rich products in the region's food, beverage, and cosmetics sectors.

The polyphenols market in Asia Pacific is expanding rapidly with evolving regulatory frameworks. In countries like China, Japan, and India, government initiatives and increasing investments in biotechnology are helping to establish clearer guidelines for the use pf polyphenol in functional foods and personal care products.

Regulatory structures are still developing; however, industry collaborations and rising consumer interest in plant-based, natural ingredients are driving the market.

Competitive Landscape:

The global polyphenol market is characterised by a large number of participants, including established corporations and rising organisations.

Key market players are continuously innovating to meet the rising demand for natural, plant-based ingredients across various industries, including health supplements, functional foods, beverages, and cosmetics. These organizations are leveraging their expertise in food science, natural ingredients, and consumer trends to capitalize on the growing consumer preference for healthier products.

In addition to product innovation, companies are forming strategic partnerships and collaborations with other industry players to advance the science behind polyphenols and their therapeutic applications. This enables businesses to strengthen their R&D efforts, explore new extraction techniques, and improve the bioavailability of polyphenols in various consumer products.

List of Key Companies in Polyphenols Market:

- ADM

- Cargill, Incorporated

- dsm-firmenich

- Nestlé S.A.

- Indena S.p.A.

- BASF

- Givaudan

- Tata Sons Private Limited.

- International Flavors & Fragrances Inc.

- Herbalife International of America, Inc.

- MMP Europe

- Amway Corp.

- Kemin Industries, Inc.

- Clariant

- Others

Recent Developments:

- In November 2024, Group Berkem launched RECELLCL'IN, a new active ingredient dedicated to the cosmetic market. This active extract of passiflora, locally and sustainably sourced, features an innovative mechanism of action designed specifically for oily and acne-prone skin. The launch represents a new innovation from Groupe Berkem's R&D teams within the Health, Beauty, and Nutrition business area.

- In October 2024, Phytessence Wassai, a new botanical extract, was launched. This ingredient is quantified in polyphenols, 80% naturally derived, COSMOS approved, and preservative-free, offering a sustainable and effective solution for various cosmetic and personal care applications.

- In September 2024, MintyBright Nu was launched, a new ingredient designed to enhance skin brightening from within. This innovative product aims to offer a natural solution for improving skin tone and radiance, providing an internal approach to skin lightening and contributing to the growing demand for wellness-driven skincare solutions.

- In July 2024, ADM launched a new line of gummy supplements designed to elevate the wellness experience by incorporating clinically studied ingredients. With the growing demand for convenient health solutions, these gummies cater to consumers who seek both great taste and nutritional benefits. The company found that 57% of consumers find gummies easier to take regularly and 65% prefer their delightful taste.

- In July 2024, Brenntag Specialties Nutrition entered into an exclusive distribution agreement for EpiCor with Cargill, aiming to expand the availability of EpiCor, a scientifically backed ingredient known for its immune health benefits, in the global market. The collaboration focuses on enhancing access to this clinically studied ingredient across various nutraceutical applications.

- In June 2024, Kaffe Bueno introduced KLEANSTANT, its latest innovation in personal care ingredients, launched at in-cosmetics Global in Paris. This new product entered the surfactant market, which is registering significant growth due to the rising demand for sustainable and eco-friendly products. KLEANSTANT reflects Kaffe Bueno’s commitment to providing innovative, environmentally conscious solutions for the personal care industry.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)