Polypropylene Market Size

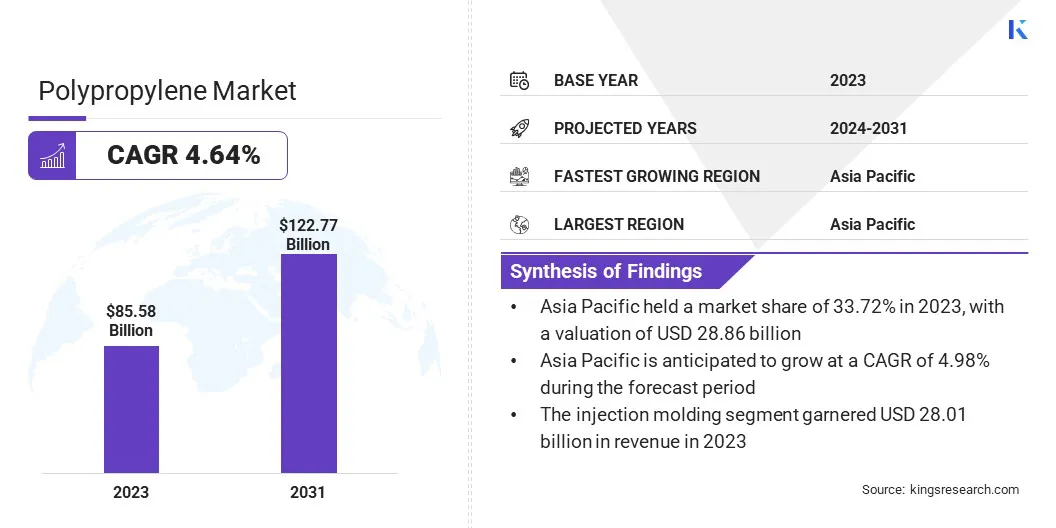

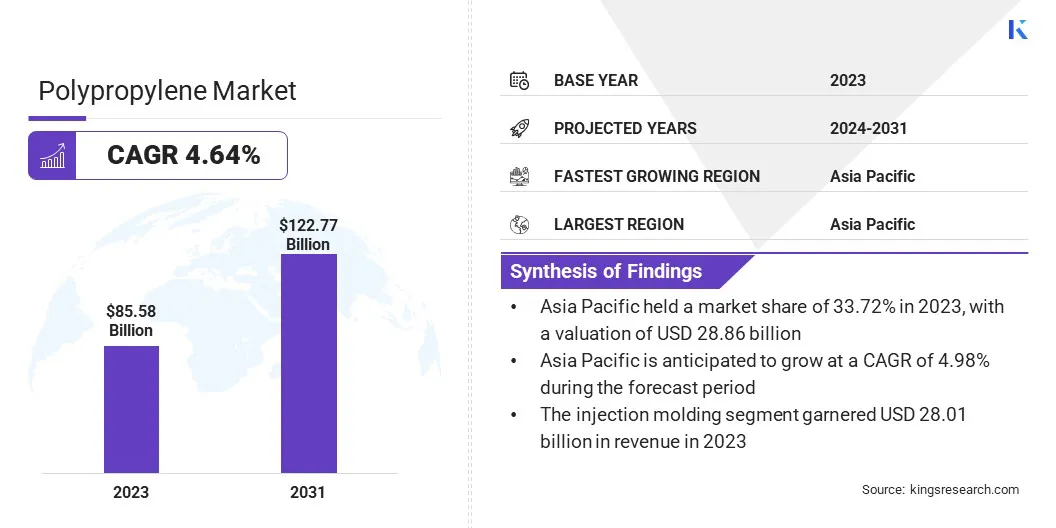

The global polypropylene market size was valued at USD 85.58 billion in 2023 and is projected to grow from USD 89.39 billion in 2024 to USD 122.77 billion by 2031, exhibiting a CAGR of 4.64% during the forecast period. Rapid urbanization and industrialization in emerging economies are driving the market.

The demand for construction materials, packaging, consumer products, and automotive components increases as urban populations grow. The cost-effectiveness and adaptability of Polypropylene (PP) make it an attractive option for manufacturers in these industries.

In the scope of work, the report includes products offered by companies such as SABIC, Exxon Mobil Corporation, BASF, INEOS, LG Chem, LyondellBasell Industries Holdings B.V., DuPont, Braskem, CNPC, Ducor Petrochemicals, and others.

The increasing preference for lightweight materials across industries is driving the polypropylene market. PP is valued for its low density and lightweight nature, making it ideal for applications where weight reduction is a priority.

Industries such as automotive, packaging, and consumer goods are adopting PP to reduce product weight, improve fuel efficiency, and optimize cost. This shift toward lighter materials, particularly in transportation and packaging sectors, is contributing to the continued expansion of the market globally.

PP is a versatile, thermoplastic polymer made from the polymerization of propylene monomers. It is known for its durable and chemically resistant properties, leading to its widespread use in various industries. PP is resistant to acids, bases, and solvents, and can be molded into different shapes, which enhances its versatility.

Additionally, PP is often used for medical applications due to its non-toxic and non-reactive nature. It is also recyclable, making it an environmentally friendly choice in many applications.

Analyst’s Review

Companies in the market are increasingly investing in research and development (R&D) to create more efficient catalysts that optimize polymerization processes. These innovations enable manufacturers to produce higher-quality PP at lower costs, which is a critical factor in improving production efficiency and meeting the growing global demand.

Moreover, the improved catalysts allow for the development of specialized PP grades with superior properties, such as enhanced strength, flexibility, and heat resistance, which are essential for applications across various industries.

- In June 2024, Stratasys and BASF formed a partnership to introduce a new PP material, SAF PP, specifically designed for use with the Stratasys H350 printer. SAF PP offers enhanced cost efficiency and superior part quality in powder bed fusion technologies. This innovative material delivers lower cost per part and exceptional surface esthetics compared to existing alternatives, while meeting the stringent requirements of high-volume production.

Additionally, the polypropylene market has registered significant support through the establishment of the Global Impact Coalition (GIC) in November 2023, a pivotal development that underscores the industry's commitment to sustainability. Originating from the World Economic Forum's Low-carbon Emitting Technologies (LCET) initiative, the GIC includes major players such as BASF, SABIC, Covestro, Mitsubishi Chemical Group, and Solvay.

This CEO-led coalition is focused on scaling innovative low-carbon technologies across chemical production and related value chains, driving significant advancements in reducing the carbon footprint during the PP manufacturing process.

Through partnerships and cutting-edge projects, the GIC is fostering net-zero advancements, ensuring that the market evolves in a more sustainable direction. The coalition's efforts to integrate environmentally friendly technologies into the production process are expected to reduce emissions and enhance the overall efficiency and competitiveness of the polypropylene market.

This collaboration highlights a shared commitment to sustainable industrial growth, which is increasingly shaping the future of PP production and contributing to market expansion.

Polypropylene Market Growth Factors

The automotive sector is a significant driver of the market.

- According to ACEA data from 2023, global car production reached 76 million units, marking significant growth of 10.2%. Additionally, global new car sales registered an increase of nearly 10%, rebounding strongly after a period of stability in 2022.

The excellent strength-to-weight ratio of PP makes it an ideal material for automotive applications. It is used extensively in manufacturing interior components, such as bumpers, dashboards, and seat trims, due to its durability, flexibility, and low cost.

The ongoing trend of lighter vehicles for improved fuel efficiency has further increased the demand for PP in the automotive industry, significantly contributing to the expansion of the polypropylene market.

- According to an analysis by the U.S. Department of Energy, reducing vehicle weight by 10% can lead to a 6%–8% improvement in fuel economy. Integration of lightweight components and high-efficiency engines using advanced materials into just one-quarter of the U.S. vehicle fleet can result in savings of over 5 billion gallons of fuel annually by 2030.

The consumer goods sector is registering robust growth, which is directly benefiting the polypropylene market. The versatility of PP, coupled with its cost-efficiency, makes it a preferred material for a wide range of household items, including containers, furniture, textiles, and personal care products.

The growing demand for functional, affordable, and durable consumer products is propelling the usage of PP. This demand surge is fueling the market, particularly in emerging economies where consumer goods markets are rapidly evolving.

However, the environmental concerns related to plastic waste and the slow degradation of PP products is restraining the growth of the market. Increasing regulatory pressure and consumer awareness regarding plastic pollution have led to stricter policies limiting the use of non-recyclable plastics.

Companies are investing in advanced recycling technologies, such as chemical recycling, to improve the recyclability of PP and reduce its environmental impact. Additionally, manufacturers are focusing on developing bio-based PP derived from renewable resources, offering a sustainable alternative. Collaborative initiatives promoting circular economy practices are also being adopted to ensure responsible production and waste management.

Polypropylene Industry Trends

Industries are increasingly shifting toward sustainability. The recyclability property of PP is a key trend fueling the market. As global awareness of environmental issues increases, manufacturers are seeking eco-friendly materials for packaging and product manufacturing.

PP is highly recyclable, which makes it an attractive alternative to other non-recyclable plastics. This has led to its increased demand, particularly from sectors focusing on sustainability initiatives. The growing preference for recyclable materials is boosting the polypropylene market, especially in environmentally conscious regions.

The ongoing global infrastructure development, coupled with the growing need for sustainable construction materials, has boosted the adoption of PP.

- According to the 2023 reports from the National Action Plans (NAPs) on Business and Human Rights, the global construction industry is projected to grow by USD 4.5 trillion, reaching USD 15.2 trillion over the next decade. China, India, the US, and Indonesia are expected to contribute 58.3% of this anticipated growth.

PP is increasingly used in construction applications such as pipes, insulation materials, and geotextiles, due to its durability, corrosion resistance, and cost-effectiveness. Its use in energy-efficient building materials, coupled with growing urbanization, continues to boost the demand for PP in the construction sector.

Furthermore, the non-toxic and chemical-resistant properties of PP make it highly suitable for medical and healthcare applications. The growth of the healthcare industry, particularly in medical packaging, surgical instruments, and medical devices, has fueled the demand for PP. Its ability to withstand sterilization processes without degrading ensures its suitability for medical applications.

Segmentation Analysis

The global market has been segmented based on type, process, end use, and geography.

By Type

Based on type, the market has been segmented into homopolymer and copolymer. The homopolymer segment led the polypropylene market in 2023, reaching the valuation of USD 57.57 billion. Homopolymer PP offers excellent strength, stiffness, and chemical resistance, which makes it suitable for use in the packaging, textiles, and automotive industries.

Its high melting point further enhances its performance in applications requiring heat resistance, including microwaveable food containers and industrial components. Additionally, the cost-effectiveness of homopolymer PP compared to other materials drives its adoption in high-volume production processes.

The segment's ability to deliver reliable performance in demanding applications positions it as a preferred choice, contributing significantly to its dominance in the market.

By Process

Based on process, the market has been classified into injection molding, blow molding, extrusion molding, and others. The injection molding segment secured the largest revenue share of 32.73% in 2023.

The lightweight, durable, and flexible properties of PP make it an ideal material for injection molding, enabling the production of components across the automotive, packaging, consumer goods, and healthcare industries. The process allows for rapid manufacturing of intricate designs with minimal material waste, aligning with the increasing demand for sustainable production practices.

Additionally, advancements in injection molding technologies, including automated systems and enhanced mold designs, have further optimized production efficiency and reduced costs.

By End Use

Based on end use, the market has been divided into packaging, automotive, construction, consumer goods, healthcare, electrical & electronics, and others. The packaging segment is poised for significant growth at a robust CAGR of 5.28% through the forecast period.

Due to its exceptional versatility, cost-effectiveness, and performance attributes, making it the preferred material for various packaging applications. The lightweight nature, durability, and resistance of PP to moisture, chemicals, and heat position it as an ideal choice for both flexible and rigid packaging solutions.

It is widely used in food & beverage packaging to preserve product freshness, extend shelf life, and ensure safety, which aligns with the rising consumer demand for packaged and convenience foods. Additionally, the increasing adoption of PP in e-commerce packaging for its strength and cost efficiency further fuels the market.

Polypropylene Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for around 33.72% share of the global polypropylene market in 2023, with a valuation of USD 28.86 billion. The rapid industrialization and urbanization across Asia Pacific are driving the market in the region.

- The United Nations Human Settlements Programme reports that Asia is home to over 54% of the global urban population, equating to more than 2.2 billion people. By 2050, the region’s urban population is projected to expand by an additional 1.2 billion, reflecting a 50% increase.

As emerging economies like China, India, and Southeast Asian countries continue to register rapid urban development, the demand for PP-based products in the construction, automotive, and packaging sectors is expanding. The increased need for infrastructure, consumer goods, and manufacturing products is fueling the demand for PP, contributing significantly to market growth.

Additionally, the increasing demand for consumer goods, e-commerce, and packaged food in Asia Pacific is significantly boosting the market. The versatility, lightweight, and cost-effectiveness properties of PP make it a preferred choice for packaging applications across the region. The rising disposable incomes and changing lifestyles of people in the region are boosting the demand for PP-based packaging solutions, leading to market growth.

The polypropylene market in Europe is poised for significant growth at a robust CAGR of 4.71% over the forecast period. Europe’s focus on renewable energy sources, such as wind, solar, and hydropower, is driving the need for advanced materials like PP, particularly in energy storage applications.

PP is increasingly used in the production of components for energy storage systems, such as batteries and capacitors. The growth of renewable energy initiatives is pushing for more efficient and sustainable energy storage solutions, boosting the demand for PP due to its durability, lightweight, and chemical resistance properties.

Additionally, the role of PP in energy-efficient infrastructure, including insulation and components for renewable energy installations, is contributing to the market’s expansion.

- The updated Renewable Energy Directive in 2023 has elevated the EU's binding renewable energy target for 2030 to at least 42.5%, up from the earlier goal of 32%, with an ambitious aim to achieve 45%. This represents a near doubling of the current share of renewable energy across the EU. The directive officially came into effect in all EU member states on November 20, 2023.

The European Union’s emphasis on reducing carbon emissions and promoting sustainability is driving industries to adopt eco-friendly materials like PP. The recyclability property of PP and its low environmental impact are boosting its adoption in the packaging, automotive, and construction sectors, contributing to the growth of the market.

Competitive Landscape

The global polypropylene market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create opportunities for the market growth.

List of Key Companies in Polypropylene Market

- SABIC

- Exxon Mobil Corporation

- BASF

- INEOS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- DuPont

- Braskem

- CNPC

- Ducor Petrochemicals

Key Industry Developments

- October 2024 (Collaboration): SABIC collaborated with B!POD, a business unit of SAES Getters for incorporating its ocean-bound plastic (OBP)-based polypropylene resin for container manufacturing. The selected material, SABIC PP 576P, is a high-gloss resin from the TRUCIRCLE portfolio, containing approximately 50% OBP feedstock.

- September 2024 (Launch): Braskemintroduced its innovative bio-circular PP under the brand name, WENEW. This groundbreaking solution represents a significant step toward sustainability in the restaurant and snack food industries. Braskem’s bio-circular PP is specifically designed to enhance circularity in the food sector by repurposing used cooking oil (UCO) as a key feedstock.

The global polypropylene market has been segmented as:

By Type

By Process

- Injection molding

- Blow molding

- Extrusion molding

- Others

By End Use

- Packaging

- Automotive

- Construction

- Consumer Goods

- Healthcare

- Electrical & Electronics

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America