Advanced Materials and Chemicals

Polystyrene Market

Polystyrene Market Size, Share, Growth & Industry Analysis, By Application (Packaging, Building & Construction, Automotive, Electrical & Electronic, Others), By Type [General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Expandable Polystyrene (EPS)], and Regional Analysis, 2024-2031

Pages : 140

Base Year : 2023

Release : December 2024

Report ID: KR1171

Polystyrene Market Size

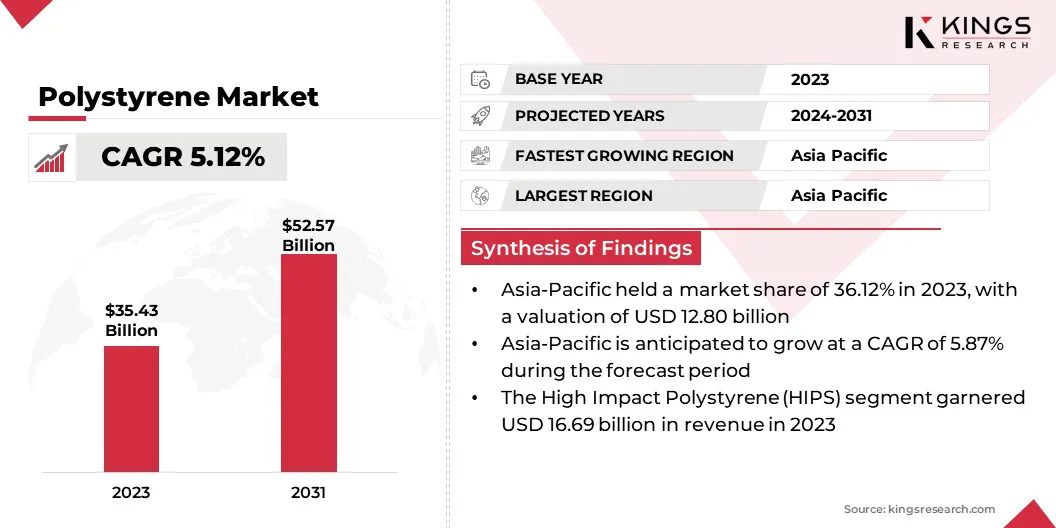

The global Polystyrene Market size was valued at USD 35.43 billion in 2023 and is projected to grow from USD 37.06 billion in 2024 to USD 52.57 billion by 2031, exhibiting a CAGR of 5.12% during the forecast period.

The growth of the market is driven by its widespread applications across various industries, including packaging, construction, automotive, electronics, and e-commerce, where its versatility, cost-effectiveness, and insulating properties fuel demand in both consumer and industrial sectors.

In the scope of work, the report includes products offered by companies such as INEOS Capital Limited, TotalEnergies, Formosa Chemicals & Fibre Corp, Alpek S.A.B. de C.V., Innova, Synthos, SIBUR International GmbH, HIRSCH Servo AG, Epsilyte LLC, Atlas Roofing Corporation, and others.

The polystyrene market is a key segment of the global plastics industry, primarily due to its widespread use in different industries. Polysterene, known for its versatility, is available in solid, foam, and expanded polystyrene (EPS) forms, catering to a variety of applications.

The market is characterized by a large number of manufacturers producing both general-purpose and high-impact variants. Polystyrene is valued for its cost-effectiveness, ease of molding, and insulating properties, making it an essential material in numerous industries. The market is evolving with advancements in production processes, material development, and recycling technologies.

- On July 8, 2024, Polystyvert, a leader in recycling technologies and the circular economy of styrenic plastics such as polystyrene and ABS, announced the completion of the first tranche of its Series B funding, raising over $16 million. This investment will support the establishment of Polystyvert's first commercial plant in Québec for recycling heavily contaminated polystyrene waste. Backed by investors from Europe and North America, the company is set to strengthen its leadership in styrenic plastics recycling, leveraging its patented dissolution and purification technology. The second funding tranche is expected to help the company reach a total of USD 30 million.

The polystyrene market encompasses the production and supply of polystyrene, a widely used plastic material known for its versatility and cost-effectiveness By segmenting the market into distinct forms and applications, manufacturers can tailor products to specific requirements, such as packaging, insulation, and electronic components.

The ability to customize offerings ensures that polystyrene meets the requirements of both consumer products and specialized industrial applications.

Analyst’s Review

The polystyrene market is poised to witness sustained growth, largely propelled by rising demand in packaging, construction, and automotive sectors. Increasing e-commerce and the need for protective, lightweight packaging is boosting it's use in shipping. In construction, its insulation properties are supporting energy-efficient building trends.

Technological advancements, particularly in recycling and sustainable production, are enhancing its environmental appeal. Manufacturers are investing in innovation and production methods to stay competitive and meet evolving market demands, positioning the market for long-term expansion.

- In October 2024, Carlisle Companies Incorporated acquired Plasti-Fab, a leading provider of Expandable Polystyrene (EPS) insulation. This strategic move enhances Carlisle’s vertically integrated polystyrene capabilities, expands its geographic reach in the U.S. and Canada, and aligns with its Vision 2030 growth strategy.

Polystyrene Market Growth Factors

Expanding electronics industry is contributing significantly to the growth of the polystyrene market, largely attributed to its widespread use in electrical housings, insulation, and protective packaging. Polystyrene’s lightweight, durable, and insulating properties make it ideal for safeguarding sensitive electronic components from heat and electrical interference.

As electronic devices advance, the demand for efficient, cost-effective materials such as polystyrene grows. Additionally, the growing emphasis on sustainability by electronics manufacturers is boosting the adoption of recycled and eco-friendly polystyrene solutions.

- In January 2024, Samsung Electronics highlighted its commitment to sustainability at the Consumer Electronics Show (CES) in Las Vegas. The company highlighted innovations such as recycled plastic walls made from r-ABS, derived from Styrofoam packaging. Samsung's emphasis on incorporating recycled materials into its product lifecycle aligns with the growing demand for eco-friendly solutions in the electronics industry.

Polystyrene contains styrene, a chemical associated with serious health risks, including cancer, impairment, and nervous system damage, posing a significant challenge to market growth. To address this challenge, companies can invest in safer alternatives to styrene-based materials, such as bio-based plastics or recycled polystyrene.

Additionally, adopting advanced manufacturing techniques to minimize the release of harmful chemicals and improve worker safety can help reduce health risks, improving safety for both consumers and employees.

Polystyrene Industry Trends

The rise of e-commerce has increased the demand for lightweight, protective packaging, boosting the use of expanded polystyrene (EPS) in shipping materials. As online shopping grows, efficient packaging that ensures product safety during transit and reduces shipping costs is crucial. Polystyrene's excellent cushioning properties make it ideal for protecting fragile items.

This increased demand is prompting manufacturers to optimize production processes and improve recyclability, meeting the need for cost-effective and environmentally-conscious solutions in the e-commerce sector.

As environmental concerns intensify, the polystyrene market is experiencing a shift toward sustainable production practices. Companies are increasingly investing in recycling technologies to reduce waste and improve material reuse, such as chemical recycling and mechanical recycling methods.

Additionally, there is a growing focus on developing bio-based alternatives to traditional petroleum-derived polystyrene. These innovations aim to reduce the environmental impact of polystyrene products, enhance their recyclability, and meet consumer demand for eco-friendly materials, making sustainability a key factor in the market's evolution.

- In September 2023, TotalEnergies announced plans to construct a mechanical recycling unit at its Grandpuits site near Paris. The facility is designed to produce 30,000 tons of high-value compounds annually, incorporating up to 50% recycled plastic. This initiative highlights the growing industry focus on recycling technologies and sustainable production practices.

Segmentation Analysis

The global market has been segmented based on application, type, and geography.

By Application

Based on application, the market has been segmented into packaging, building & construction, automotive, electrical & electronic, and others. The packaging segment led the polystyrene market in 2023, reaching a valuation of USD 13.37 billion.

Polystyrene is widely used in the packaging industry due to its versatility, cost-effectiveness, and excellent protective properties. It is lightweight and durable, providing effective cushioning and insulation to safeguard products during shipping. Its moldability allows for custom packaging solutions, making it ideal for fragile items.

With moisture resistance and cost-efficiency, polystyrene remains a preferred choice for manufacturers and consumers. Despite environmental concerns, its recyclability and emerging sustainable alternatives support its continued use in packaging.

- In July 2024 Versalis, the chemical division of Eni, introduced a new range of recycled polystyrene for under the Reference brand for food packaging. Developed in partnership with Forever Plast, these grades are produced using Versali’s Newer technology, compliant with EU food contact regulations and approved by the FDA for safe use.

By Type

Based on type, the market has been classified into general purpose polystyrene (GPPS), high impact polystyrene (HIPS) and expandable polystyrene (EPS) . The high impact polystyrene (HIPS) segment secured the largest revenue share of 47.12% in 2023.

HIPS is favored for its optimal combination of strength, rigidity, and impact resistance. Unlike standard polystyrene, HIPS offers superior toughness, making it ideal for cost-effective, durable applications. It is easy to process, and mold into complex shapes, which is especially beneficial in industries such as packaging, automotive, and consumer goods.

Furthermore, HIPS provides good thermal stability and environmntal resistance. This versatility positions as a reliable, and affordable, choice for manufacturers.

Polystyrene Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific polystyrene market accounted for a substantial share of around 36.12% in 2023, with a valuation of USD 12.80 billion. this expansion is largely attributed to strong economic growth in countries such as China, India, and Southeast Asia.

The booming construction and packaging industries are contributing significantly to this growth, with rising demand for insulation materials and protective packaging, particularly in food and consumer goods. Favorable government policies and incentives further boost regional market growth, promoting investments in manufacturing and infrastructure.

Abundant raw materials and labor enable cost-effective production, solidifying the regiob as a crucial hub for polystyrene consumption across multiple industries.

- In April 2023, Idemitsu Kosan advanced sustainable plastic production in Malaysia by supplying biomass naphtha for styrene-based biomass plastics under ISCC PLUS certification. This initiative aligns with the goal of achieving carbon-neutral society by 2050 and strengthens a stable supply chain in Malaysia to reduce environmental impact and promote circular resource solutions.

Europe polystyrene market is set to witness significant growth over the forecast period at a CAGR of 5.12%. This growth is propelled by its well-developed infrastructure and established supply chains, which ensure efficient production and distribution.

The region experiences strong demand from key industries such as automotive, electronics, and packaging. Europe's focus on sustainability, coupled with stringent environmental regulations, fosters the adoption of eco-friendly practices, including recycling and bio-based polystyrene alternatives.

As a mature market, Europe is focused on steady growth while meeting high environmental standards, positioning itself as a leading region in sustainable polystyrene solutions and advancing production and recycling technologies.

Competitive Landscape

The global polystyrene market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Polystyrene Market

- INEOS Capital Limited

- TotalEnergies

- Formosa Chemicals & Fibre Corp

- Alpek S.A.B. de C.V.

- Innova

- Synthos

- SIBUR International GmbH

- HIRSCH Servo AG

- Epsilyte LLC

- Atlas Roofing Corporation.

Key Industry Developments

- January 2023 (Acquisition): NexKemia, a Canada-based expandable polystyrene manufacturer and subsidiary of Integreon Global, acquired Eco-Captation, a leading polystyrene waste recycling company in Prévost, Quebec. Eco-Captation specializes in post-consumer recycled materials and uses AI-powered optical sorting technology alongside a smooth mechanical recycling process to transform plastic waste into high-quality raw materials. This acquisition emphasizes NexKemia’s commitment to sustainable practices and enhancing polystyrene recycling.

The global polystyrene market is segmented as:

By Application

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronic

- Others

By Type

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership