Position and Proximity Sensors Market Size

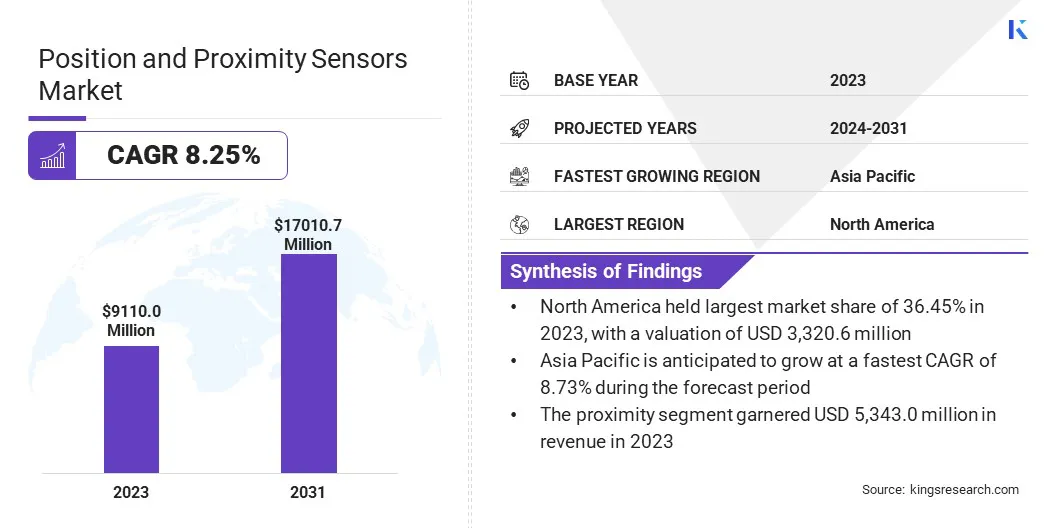

The global Position and Proximity Sensors Market size was valued at USD 9,110.0 million in 2023 and is projected to grow from USD 9,764.1 million in 2024 to USD 17,010.7 million by 2031, exhibiting a CAGR of 8.25% during the forecast period.

The increasing adoption of position and proximity sensors in automotive, manufacturing, and security applications to provide automation and safety is driving their demand. This demand is further fueled by the rise of robotics and digitization.

In the scope of work, the report includes products offered by companies such as Azbil Corporation, Leuze electronic Pvt. Ltd., Panasonic Corporation, Pepperl+Fuchs GmbH, Balluff Automation India Pvt. Ltd., Keyence Corporation, Infineon Technologies AG, Honeywell International Inc, STMicroelectronics, TE Connectivity, and others.

The market is pivotal across various industries, such as manufacturing, robotics, automotive, consumer devices, printing, and medical care. These sensors efficiently detect object locations, monitor movements, and ensure system control.

In manufacturing settings, they can track object position and movement, while in robotics, they assist in collision detection. These sensors aid automotive systems in precise operations and help consumer devices in proximity detection and touch sensing. In addition, position sensors are used in medical care to monitor the human body in real-time.

Position and proximity sensors are devices that detect the location or presence of objects without physical contact. These sensors are crucial for automation, as they help machines know where things are or if something is near.

Further advancement of position and proximity sensors will likely benefit industries like manufacturing, automotive, robotics, and healthcare by improving efficiency, safety, and automation.

As these sensors become more advanced, they will enable precise control, reduce errors, and increase productivity. In return, industries will drive further innovation and demand for these sensors, creating a cycle of growth and technological advancement for both the sensors and their supporting industries.

Analyst’s Review

The position and proximity sensors market is expanding due to the rise of the Industrial Internet of Things (IIoT) and advanced automation across factories. These sensors offer real-time monitoring by collecting and transmitting data, which allows early fault detection and remote factory oversight.

Technological advancements, miniaturization of electronics, and improvements in wireless communication are boosting market growth. The demand for precise, real-time insights and improvement in production lines is driving the adoption of these sensors in modern industrial processes.

Position and Proximity Sensors Market Growth Factors

Several key factors dictate the growth of the position and proximity sensors market. The rapid adoption of automation systems is a major factor driving the growth of position and proximity sensors. Automation systems increasingly rely on these sensors to detect objects and trigger processes, particularly in industries with strict quality standards and repeatable manufacturing requirements.

Proximity sensors are often critical in ensuring precise control and high operational efficiency. They are also widely used in urban infrastructure to maintain facilities and respond to accidents and crises. The rise of multi-sensor vehicles offering safety and navigation further drives market demand.

Technological development in sensor capabilities, along with the growing need for smart cities and efficient production systems, are key contributors to the continued growth of the position and proximity sensor market.

- For example, in the Mercedes-Benz S-Class, position and proximity sensors are used in systems like PARKTRONIC to detect obstacles during parking, and Active Lane Keeping Assist, which monitors road markings for lane guidance. The extended environmental sensors, including four cameras, enable the vehicle to identify parking spaces defined by lines for automated parking.

Position and proximity sensors face challenges like high development and manufacturing costs due to significant investment required for advanced sensors. Additionally, the lack of standards in measuring precision and accuracy makes it hard to maintain quality.

A potential solution is setting universal standards and collaborative industry efforts to reduce production costs through shared research and streamlined manufacturing processes.

Position and Proximity Sensors Industry Trends

The position and proximity sensors market is experiencing significant growth across various industries, which is mainly driven by technological advancements and increased demand.

In the consumer electronics segment, the rise of smart devices like smartphones, laptops, and smart home products has spurred the demand for proximity sensors, enabling features such as touchless controls and user detection. Similarly, urbanization is increasing the need for proximity sensors in smart city applications, such as traffic management, security systems, and building automation.

Innovations like Time of Flight (ToF) sensors are providing more accurate and reliable measurements, enhancing applications in the field of robotics, agriculture, and industrial automation. These advancements are expected to continue driving market growth, with increased adoption in sectors seeking enhanced efficiency and safety.

- In November 2024, Elliptic Labs launched its AI Virtual Proximity Sensor in the Redmi Note 14 Series smartphones. This advanced sensor detects when a user holds the phone to their ear during a call, automatically turning off the display and disabling touch functionality to prevent accidental touch. The sensor also helps conserve battery life. With over 500 million devices already utilizing this technology, the integration of Elliptic Labs' proximity sensor in the Redmi Note 14 Series highlights the growing use of AI-powered sensors to enhance smartphone usability and efficiency.

In robotics, position sensors are primarily used for precise movement control and navigation, especially in industrial, medical, and logistics applications. Meanwhile, the agriculture sector is embracing position sensors for precision farming, monitoring crop health, and automating machinery for improved efficiency. The manufacturing sector uses inductive proximity sensors for process automation, quality control, and assembly line monitoring.

As automation grows, the demand for these sensors will expand. The automotive industry is another major end user segment that utilizes position sensors in safety features, navigation systems, and autonomous driving technologies. As the industry transitions to electric and self-driving vehicles, the need for advanced position sensors will continue to rise.

Segmentation Analysis

The global market has been segmented based on end-use industry, sensor type, and geography.

By End-use Industry

Based on end-use industry, the market has been segmented into automotive, industrial automation, consumer electronics, healthcare, and others. The automotive segment led the position and proximity sensors market in 2023, reaching a valuation of USD 3,491.0 million.

Position and proximity sensors play a crucial role in the automotive industry, particularly with the rise of advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous vehicles. These sensors are designed for collision detection, adaptive cruise control, parking assistance, and lane-keeping assistance, and enhancing safety and driving precision.

With increasing safety standards and regulations, position and proximity sensors are set to meet these requirements by enabling real-time monitoring of the vehicle's surroundings.

The demand for EVs is further driving sensor integration, as they improve battery management, energy efficiency, and overall vehicle performance. As autonomous driving technology advances, these sensors are expected to become vital for accurate navigation and obstacle avoidance.

- Ford uses position and proximity sensors in the 2024 Mustang Mach-E to enhance its driver assistance features. These sensors are typically integrated into systems such as park assist, adaptive cruise control, and lane-keeping assistance. They help detect nearby objects, monitor vehicle surroundings, and ensure safer, more efficient driving experiences by preventing collisions and providing real-time feedback on proximity to obstacles. These sensors play a crucial role in the Mach-E’s Advanced Driver Assistance Systems (ADAS).

By Sensor Type

Based on technology, the market has been bifurcated into position and proximity. The position segment is poised for significant growth at a CAGR of 8.99% over the forecast period. Position sensors are the fastest-growing sensors due to their critical role in providing accurate and reliable measurements in various applications.

As automotive, robotics, and manufacturing industries increase their reliance on precise control and automation, the demand for position sensors is slated to rise. Their ability to detect and track movement with precision makes them essential for optimizing performance, improving safety, and enabling complex systems to operate efficiently. As automation and technology evolve, the need for advanced position sensors becomes more pronounced, driving their market.

Position and Proximity Sensors Market Regional Analysis

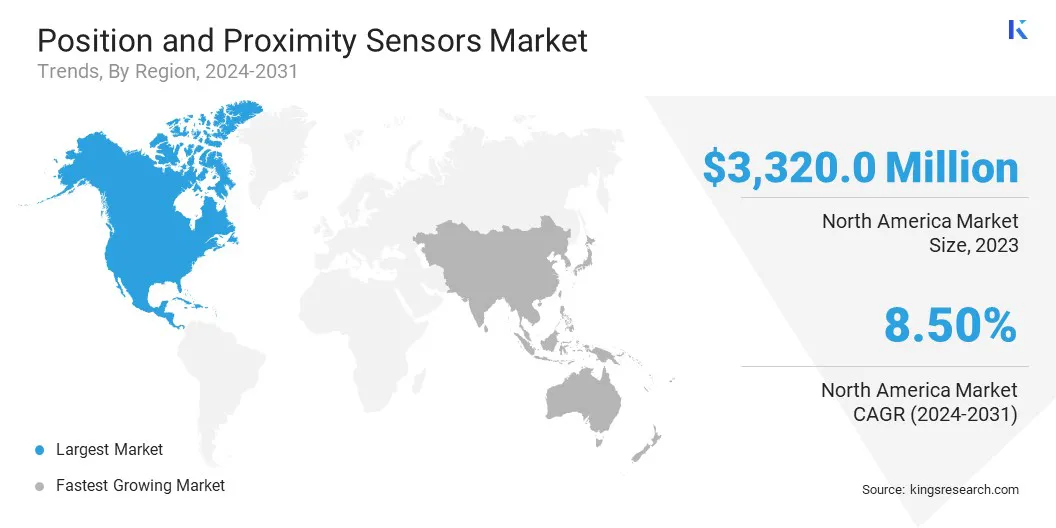

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America emerged as the leading region in the position and proximity sensors market, attaining a valuation of USD 3,320.6 million in 2023. North America is the leading region for position and proximity sensors due to its strong presence in automotive and aerospace industries.

Significant investments in research and development drive innovation, particularly in the automotive sector, where advancements in autonomous vehicles and ADAS technologies are accelerating sensor demand.

The region also benefits from growth in aerospace, defense, and healthcare, with increasing adoption of sensors in medical devices and manufacturing automation. These factors, combined with technological advancements, will help position North America as a leader in the market.

Asia-Pacific is expected to be the fastest-growing region at a CAGR of 8.73% over the forecast period. This region features a high demand for position and proximity sensors due to strong industrial growth in countries like China, India, Japan and South Korea. These countries focus heavily on automation, IoT initiatives, and technological advancements, supported by government investments.

The region's rapid industrialization, rising demand for consumer electronics, and increased adoption of electric vehicles further fuel the product demand. Additionally, the expanding manufacturing sector in Asia Pacific drives the need for precise and reliable sensors, solidifying the region's leadership in the global market.

- In September 2023, ROHM introduced the RPR-0720, a compact proximity sensor designed for a broad range of applications. This sensor is versatile, capable of detecting attachment or detachment, and monitoring various conditions. Its compact size and reliability makes it ideal for use across diverse industries, meeting the growing demand for precise, efficient sensing in a variety of environments.

Competitive Landscape

The global position and proximity sensors market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Position and Proximity Sensors Market

- Azbil Corporation

- Leuze electronic Pvt. Ltd.

- Panasonic Corporation

- Pepperl+Fuchs GmbH

- Balluff Automation India Pvt. Ltd.

- Keyence Corporation

- Infineon Technologies AG

- Honeywell International Inc

- STMicroelectronics

- TE Connectivity

Key Industry Developments

- October 2023 (Launch): Maxic launched the M3102, a miniature, low-power proximity sensor integrated with skin recognition technology. This advanced sensor enhances security by detecting skin touch, offering efficient, accurate performance across a variety of applications with minimal energy consumption.

- April 2024 (Partnership): Honeywell and Lilium formed a partnership to provide custom position sensors for the Lilium Jet, an all-electric eVTOL aircraft. These sensors, crucial for engine positioning during takeoff, enhance safety and enable precise vertical-to-horizontal movement. This partnership reflects Honeywell's role in advancing sustainable air mobility.

The global position and proximity sensors market has been segmented:

By End-use Industry

- Automotive

- Industrial Automation

- Consumer Electronics

- Healthcare

- Others

By Sensor Type

- Position

- Proximity

- Ultrasonic

- Inductive

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America