Print On Demand Market

Print On Demand Market Size, Share, Growth & Industry Analysis, By Product Type (Apparel, Home Decor, Accessories, Stationery, Others), By Offering (Software, Services), By End User (Businesses, Individuals), By Distribution Channel (Online Marketplaces, Direct-to-Consumer (DTC) Websites, Retail Stores), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR224

Print On Demand Market Size

The global Print On Demand Market size was valued at USD 8.03 billion in 2023 and is projected to grow from USD 9.79 billion in 2024 to USD 47.14 billion by 2031, exhibiting a CAGR of 25.18% during the forecast period. Environmental benefits of on-demand production and the ease of entry for small businesses are driving the growth of the market.

In the scope of work, the report includes services offered by companies such as Printful Inc., Canva, Cimpress plc, CustomCat, Gelato, Gooten, teelaunch, Zazzle, Inc., Redbubble, Printify, Inc., and others.

Incorporating eco-friendly materials into print on demand products presents a significant opportunity to attract the increasing number of environmentally conscious consumers. As sustainability increasingly influences purchasing decisions, companies that integrate biodegradable, recycled, or organic materials into their print on demand offerings are differentiating themselves in a highly competitive market.

For instance, using organic cotton in apparel or recycled paper for prints attract customers who prioritize eco-friendly products, thereby boosting sales and fostering brand loyalty. Additionally, the adoption of sustainable materials reduces the environmental impact of the print on demand industry, which has traditionally faced criticism for its waste generation and resource consumption.

- For instance, in May 2024, Gelato launched GelatoConnect, a platform designed to tackle environmental challenges associated with traditional manufacturing. By producing only when sold and ensuring 99% regional production and 87% local delivery, Gelato significantly reduces overproduction, transportation distances, costs, and carbon emissions.

This opportunity aligns with the broader trend toward corporate social responsibility (CSR), allowing companies to enhance their brand image by showcasing a commitment to sustainability. However, leveraging this opportunity requires careful sourcing of materials, ensuring that they meet quality standards and without increasing production costs, thereby maintaining profitability while contributing to environmental conservation.

Print on demand (POD) refers to a production process where products are only manufactured once an order is placed, eliminating the need for large inventories and reducing the risk of unsold stock. This business model is particularly popular in the customization market, where consumers seek unique and personalized items.

Print-on-demand services typically offer a range of product, including apparel such as t-shirts and hoodies, home decor items such as posters and wall art, and various accessories, including phone cases and tote bags. These products are often customizable, allowing customers to select designs, colors, and, in some cases, materials. Print on demand companies typically operate through e-commerce platforms, offering their services directly to end-users such as individual consumers, small businesses, and artists seeking to monetize their designs.

The distribution channel for these products primarily focuses on online sales, with companies either integrating with popular marketplaces or providing direct-to-consumer services through their websites. The end users of print on demand products are diverse, encompassing both individuals seeking personalized items and businesses requiring branded merchandise. The flexibility, cost-effectiveness, and low risk associated with the print on demand model have contributed to its growing popularity choice across various sectors.

Analyst’s Review

The print on demand market is witnessing significant growth, propelled by the increasing consumer demand for personalized products and the expansion of e-commerce platforms. Companies operating in this market are strategically focusing on broadening their product offerings, enhancing customization options, and improving operational efficiency to capture a larger market share.

One of the key strategies employed by market leaders is forming partnerships with e-commerce platforms and social media influencers to boost visibility and attract a broader customer base. Additionally, numerous companies are investing heavily in advanced printing technologies, such as 3D printing and direct-to-garment (DTG) printing, to improve product quality and expand into new product categories. The market is experiencing robust growth, with a notable shift toward sustainable practices playing a critical role.

- For instance, in April 2024, a research by VistaPrint and Wix revealed that 71% of small business owners independently handle their marketing efforts, balancing both print and digital strategies. Additionally, nearly 78% have explored new marketing tactics, including social media, branded merchandise, and email campaigns, to foster business growth.

Key industry players are increasingly adopting eco-friendly materials and processes to meet consumer demand for green products and to align with global sustainability trends. However, to sustain growth, these companies must address challenges such as managing quality control across different production locations and ensuring timely delivery despite the custom nature of the products. The ability to innovate in both product offerings and operational strategies is anticipated to be imperative for maintaining a competitive edge in this rapidly evolving market.

Print On Demand Market Growth Factors

On-demand production offers significant environmental benefits and supports the shift toward more sustainable manufacturing practices. Unlike traditional mass production, where products are manufactured in bulk and often lead to excess inventory, on-demand production generates items solely as they are ordered. This approach dramatically reduces waste by eliminating that need to discard or indefinitely store unsold products.

Moreover, on-demand production minimizes resource consumption, including raw materials, energy, and water, by eliminating the need for large-scale manufacturing setups that are often resource-intensive. Additionally, the localized nature of numerous on-demand production models lead to reduced carbon emissions, as products are often manufactured closer to the point of sale, thereby decreasing the need for long-distance shipping.

- For instance, in June 2023, Printful acquired Snow Commerce, thereby enhancing its ability to offer a comprehensive ecommerce solution that encompasses strategy, product creation, and international production and distribution.

This environmental efficiency has become increasingly important to consumers who are more eco-conscious and prefer to support brands that demonstrate a commitment to sustainability. By aligning production processes with environmental values, companies are reducing their ecological footprint while also enhancing their brand reputation, thus attracting a loyal customer base that prioritizes sustainability.

Longer fulfillment times present a significant challenge to the development of the print on demand market, where the custom nature of production highlights that products are manufactured only after an order has been placed. This result in delays, particularly when compared to traditional retail models where products are readily available in inventory.

In the present day market, customers today expect rapid delivery and any delays may lead to dissatisfaction, negatively impacting customer loyalty and repeat business. The challenge is further compounded by the potential for production bottlenecks, especially during peak periods such as holidays or sales events, where an influx of orders may overwhelm production capacity.

To mitigate this challenge, companies are implementing several strategies. Streamlining production processes through automation, optimizing supply chain management, and partnering with local manufacturing facilities to reduce shipping times are effective methods. Additionally, maintaining transparent communication with customers regarding expected delivery times and providing real-time tracking help manage expectations and enhance the overall customer experience. By addressing the fulfillment time challenge, companies are improving customer satisfaction and maintaining a competitive edge in the market.

Print On Demand Market Trends

The integration of advanced printing technologies is a notable trend reshaping the landscape of the print on demand market. Technologies such as direct-to-garment (DTG) printing, 3D printing, and sublimation printing have transformed the processes of product creation and customization. These innovations offer superior print quality, increased design flexibility, and the ability to produce detailed and complex patterns that were previously difficult to achieve.

For instance, DTG printing allows for full-color designs on textiles without the limitations of screen printing, while 3D printing expands the possibilities of customization into new product categories such as jewelry, home decor, and even footwear. This technological advancement enhances the quality and variety of products available to consumers. Additionally, it enhances the efficiency of the production process, leading to faster turnaround times and reduced costs, enabling companies to offer more personalized, high-quality products that meet the ever-growing consumer demand for uniqueness and individuality.

- For instance, in June 2024, ESP Colour integrated GelatoConnect’s comprehensive software into its procurement, workflow, and logistics. By consolidating its operations under GelatoConnect, ESP aims to enhance efficiency and maintain its position as the leading provider in the UK market for product selection.

This trend underscores the necessity for remaining at the forefront of technological innovation to sustain competitiveness in the dynamic and rapidly evolving print on demand market.

Segmentation Analysis

The global market is segmented based on product type, offering, end user, distribution channel, and geography.

By Product Type

Based on product type, the market is categorized into apparel, home decor, accessories, stationery, and others. The apparel segment captured the largest print on demand market share of 33.58% in 2023, largely attributed to the surging demand for personalized clothing and the widespread adoption of print on demand (POD) services within the fashion industry.

Consumers are increasingly seeking unique and customized apparel items, including t-shirts, hoodies, and jackets, that reflect their personal style, preferences, or affiliations. This trend has been particularly prominent among younger demographics who value individuality and self-expression, thus boosting the growth of the apparel segment. The convenience of online platforms for designing and ordering custom apparel online, coupled with advancements in printing technologies such as direct-to-garment (DTG) printing, has made it easier and more cost-effective for POD companies to meet this surging demand.

Additionally, the proliferation of social media has fueled this trend, with influencers and brands increasingly offering limited-edition or personalized merchandise that caters to specialized market segments. Furthermore, the apparel segment benefits from a high frequency of repeat purchases, as consumers regularly update their wardrobes. The ability of POD companies to offer a wide range of customizable apparel options has solidified the dominance of the apparel segment, thus reflecting the ongoing shift toward personalized fashion.

By Offering

Based on offering, the print on demand market is classified into software and services. The services segment is poised to record a staggering CAGR of 25.87% through the forecast period, primarily due to the increasing demand for comprehensive print on demand solutions that extend beyond just product manufacturing. This offering includes a range of value-added services such as design assistance, order fulfillment, inventory management, and logistics, which are becoming essential components of the print on demand ecosystem.

As an increasing number of entrepreneurs, small businesses, and independent creators enter the POD market, the need for end-to-end service providers capable of handling the entire supply chain, from design to delivery, has surged significantly. These services enable businesses to focus on marketing and customer engagement while outsourcing the complex and resource-intensive aspects of production and distribution.

Additionally, the rise of white-label services, where companies offer customizable products under a client's brand, has fueled the growth of the segment. The increasing reliance on technology, including automation and AI-driven tools for design and logistics management, is contributing to the rapid expansion of the services segment.

By Distribution Channel

Based on distribution channel, the market is divided into online marketplaces, direct-to-consumer (DTC) websites, and retail stores. The direct-to-consumer (DTC) websites garnered the highest revenue of USD 3.40 billion in 2023, propelled by the increasing preference among consumers for shopping directly from brands’ online platforms. This shift is supported by the growing demand for personalized and unique products, which DTC websites are well-equipped to offer through customizable options.

Consumers value the opportunity to interact directly with brands, as this often provides a more personalized shopping experience and access to exclusive products that are not available through traditional retail channels. Moreover, DTC websites provide brands with complete control over their pricing, marketing, and customer data, enabling them to tailor their offerings more precisely to meet consumer needs and preferences.

The convenience of shopping online, especially post-pandemic, has further boosted the sales of DTC, with consumers increasingly opting for the ease of browsing and purchasing from the comfort of their homes. Additionally, the rise of social media and digital marketing has made it easier for brands to reach and engage their target audiences directly, thereby increasing traffic to their DTC websites. This model supports faster feedback loops, allowing brands to quickly adapt to consumer trends and preferences, thus boosting segmental revenue.

Print On Demand Market Regional Analysis

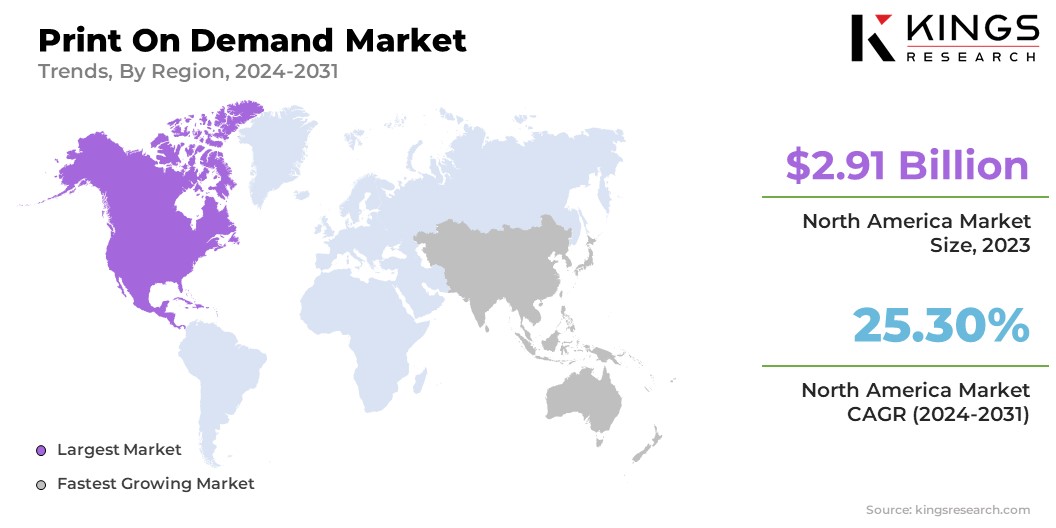

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America print on demand market accounted for a major share of 36.18% and was valued at USD 2.91 billion in 2023, making it the largest regional market globally. This dominance is largely attributed to the region’s advanced e-commerce infrastructure, the widespread adoption of digital printing technologies, and a strong consumer preference for customized products.

The United States, in particular, has been at the forefront of this growth, with a highly developed online retail sector and a culture that values individuality and personalization. The presence of numerous established print on demand platforms and companies in the region has solidified its leading position. These platforms offer a wide range of customizable products, including apparel and home decor. Additionally, North America market benefits from rising disposable income, allowing consumers to spend more on personalized and niche products, which are often priced at a premium.

The region’s robust logistics and fulfillment networks support the efficiency of print on demand services, ensuring timely delivery, which is a crucial factor in maintaining customer satisfaction. Furthermore, the rise of small businesses and independent creators leveraging print on demand platforms to sell unique products online has aided regional market expansion.

Asia-Pacific region is poised to grow at a staggering CAGR of 26.06% in the forthcoming years. This notable growth is majorly bolstered by the expanding e-commerce market in countries such as China, India, and Southeast Asia, where increasing internet penetration and mobile usage have made online shopping more accessible to millions of consumers. This surge in e-commerce activity is creating a conducive environment for print on demand services, as consumers in the region increasingly seek unique and customized products that reflect their individual tastes and cultural identities.

Additionally, the region’s large and youthful population, which is highly inactive on digital platforms and social media, is fueling the demand for personalized products, particularly in the fashion and accessories segments. The growing awareness and adoption of advanced printing technologies, coupled with the region’s competitive manufacturing landscape, are enabling companies to offer high-quality, affordable print on demand products. Moreover, the rise of local and regional print on demand platforms that cater specifically to the preferences and needs of Asian consumers is fostering domestic market growth.

Competitive Landscape

The global print on demand market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Print On Demand Market

- Printful Inc.

- Canva

- Cimpress plc

- CustomCat

- Gelato

- Gooten

- teelaunch

- Zazzle, Inc.

- Redbubble

- Printify, Inc.

Key Industry Developments

- August 2024 (Partnership): Gelato expanded its apparel offerings by incorporating premium brands such as Champion, Under Armour, and SOL’S. This strategic move strengthens Gelato’s position as the fastest-growing provider of high-quality, customizable apparel while promoting sustainability by addressing the challenges posed by fast fashion.

- March 2024 (Launch): Gelato launched GelatoConnect, a production print platform aimed at enhancing procurement, workflow, and logistics for printers. Operating in 32 countries with 140 sites, GelatoConnect is designed to optimize efficiency, quality, and profitability in a rapidly evolving digital printing market.

- February 2024 (Launch): Gooten introduced OrderMesh, an advanced order management platform. Designed for retailers, marketplaces, and eCommerce brands, OrderMesh streamlines order processing, expands product offerings, and reduces operational complexities and costs in made-to-order supply chains.

The global print on demand market is segmented as:

By Product Type

- Apparel

- Home Decor

- Accessories

- Stationery

- Others

By Offering

- Software

- Services

By End User

- Businesses

- Individuals

By Distribution Channel

- Online Marketplaces

- Direct-to-Consumer (DTC) Websites

- Retail Stores

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)