ICT-IOT

Private 5G network Market

Private 5G Network Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Frequency (Sub-6 GHz, mmWave), By Spectrum (Licensed, Unlicensed/Shared), By Vertical (Manufacturing, Healthcare, Retail , Others), By End User, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : February 2025

Report ID: KR1291

Market Definition

Private 5G networks refer to secure, customized wireless communication infrastructures designed for exclusive use, typically within enterprises, campuses, or industrial settings. These networks function independently from public cellular networks, granting organizations complete control over network management, security, and performance.

Private 5G technologies provide high-speed, low latency, and reliable communication, supporting diverse applications such as IoT, critical communications, and enterprise data transfer.

Businesses, organizations, and local governments across various sectors are adopting cellular technology in the form of private 5G networks. These sectors include manufacturing, transportation, logistics, utilities retail, agriculture, and those involved in smart city projects.

Private 5G Network Market Overview

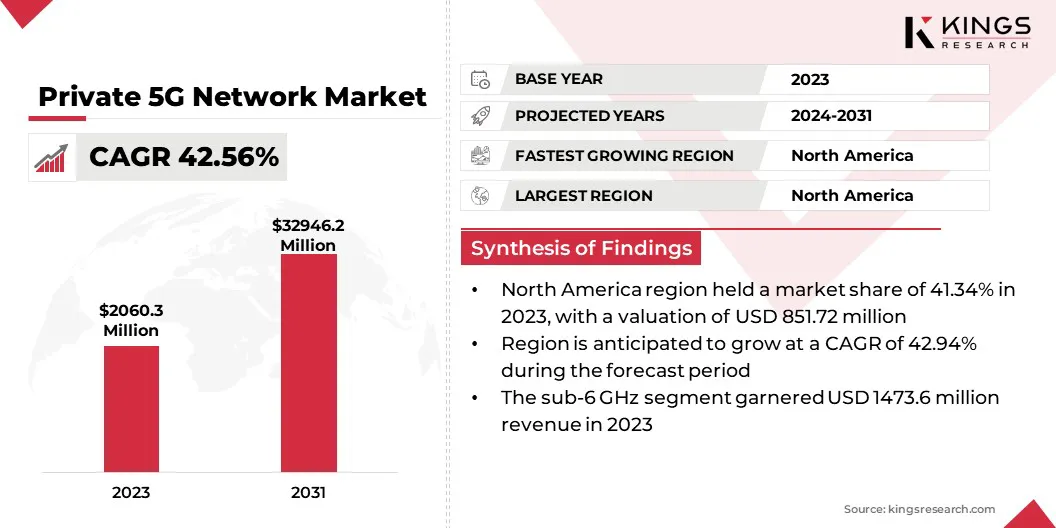

The global private 5G network market size was valued at USD 2060.3 million in 2023 and is projected to grow from USD 2753.6 million in 2024 to USD 32946.1 million by 2031, exhibiting a CAGR of 42.56% during the forecast period.

The increase in adoption of private 5G networks and the growing demand for secure, high-performance connectivity in industries such as manufacturing, healthcare, and logistics are driving the market.

Businesses increasingly rely on connected devices and IoT applications, requiring reliable, low-latency network infrastructure for seamless communication and data transfer, efficient operations, real-time decision-making, and the ability to support advanced technologies such as automation and Artificial Intelligence (AI).

Furthermore, the market presents significant opportunities, particularly with the growing adoption of Industry 4.0 and the digital transformation of industrial operations.

The integration of advanced technologies like connected devices, edge computing, and smart sensors demands reliable, high-performance networks, which is anticipated to fuel the market. The market provides the necessary capabilities to support these applications, especially in mission-critical environments.

- In December 2024, Burgos announced the establishment of Castilla y León's first industrial 5G and exoskeletons laboratory, which aims to boost business competitiveness through advanced technologies, positioning Burgos at the forefront of Industry 4.0 and fostering new industrial activities based on technological prototypes.

Major companies operating in the private 5g network market are Telefonaktiebolaget LM Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Juniper Networks, Inc., Verizon Communications Inc., AT&T Inc., Deutsche Telekom AG, Vodafone Group Plc, BT Group plc, Mavenir Systems, Inc., and T-Systems International GmbH.

Additionally, government initiatives promoting smart cities and industrial automation are encouraging investments in private network solutions. A notable regulatory framework supporting private 5G networks is the FCC's CBRS (Citizens Broadband Radio Service) framework in the U.S. It governs the 3.5 GHz band, which is allocated for shared use between federal incumbents, licensed operators, and general users. Furthermore, the three-tier spectrum access model ensures spectrum availability for private 5G networks while protecting incumbent users.

Key Highlights:

- The private 5G network market size was valued at USD 2060.3 million in 2023.

- The market is projected to grow at a CAGR of 56% from 2024 to 2031.

- North America held a market share of 34% in 2023, with a valuation of USD 851.7 million. Additionally, the market in the region is anticipated to grow at a CAGR OF 42.94% during the forecast period.

- The hardware segment generated the highest revenue of USD 832.2 million in 2023.

- The sub-6 GHz segment is expected to reach USD 9 million by 2031.

- The licensed segment dominated the market with 61.34% market share in 2023.

- The manufacturing segment is expected to grow with the highest CAGR of 43.65%.

Market Driver

"Rising Adoption of IoT and Connected Devices Across Industries"

The rising adoption of IoT and connected devices across industries has fundamentally transformed how businesses operate by enabling real-time data collection, automation, and enhanced decision-making.

In manufacturing, IoT plays a pivotal role in enabling predictive maintenance, reducing downtime, and optimizing supply chain management through real-time monitoring and analytics. Smart factories powered by IoT integrate devices, sensors, and robotics with cloud platforms to ensure seamless data flow and operational efficiency.

Similarly, in healthcare, IoT-driven solutions like remote patient monitoring, wearable health devices, and telemedicine platforms have revolutionized patient care by enhancing accessibility and efficiency. These advancements cater to the growing demand for personalized, data-driven healthcare solutions.

Beyond manufacturing and healthcare, IoT adoption has surged in industries like logistics, retail, and energy. Connected devices facilitate smart inventory management in retail, enhance fleet tracking in logistics, and improve energy efficiency in utilities through smart grids and meters.

The integration of IoT with private 5G networks further amplifies its potential by ensuring secure, low-latency communication and scalability for mission-critical applications.

Recent innovations, such as edge computing and AI integration, are reshaping IoT's impact, allowing industries to process data closer to the source for faster decision-making and reduced bandwidth usage. As industries embrace Industry 4.0, IoT adoption is expected to continue driving operational efficiency and innovation across sectors.

- In November 2024, Oracle integrated AT&T's IoT connectivity and network APIs into its Enterprise Communications Platform, enabling Oracle Cloud customers to manage and gather near real-time data from IoT devices across various industries, including consumer, industrial business, and telehealth. These initiatives highlight the critical role of IoT in driving innovation and efficiency across diverse sectors.

Market Challenge

"High Initial Deployment Costs for Private 5G Infrastructure"

Deploying private 5G networks involves substantial initial costs, encompassing infrastructure setup, equipment procurement, and integration with existing systems. For instance, AWS Private 5G pricing indicates that the cost for 30 days per radio unit is $3,905.50, which can be adjusted based on the number of units and the commitment period.

These expenses can be significant, especially for small and medium-sized enterprises (SMEs) with limited budgets. Additionally, the complexity of integrating new 5G infrastructure with existing systems and processes can lead to increased costs and extended deployment timelines.

Some companies are adopting neutral host network sharing models, which can reduce deployment costs. This approach allows multiple operators to share infrastructure, thereby lowering individual investment requirements.

Furthermore, outsourcing private 5G as a service enables businesses to avoid large initial costs and focus on core activities, with providers managing network deployment and maintenance. These strategies offer viable alternatives to traditional deployment models, making private 5G networks more accessible to a broader range of enterprises.

Market Trend

"Collaborations Between Telecom Operators and Enterprises for 5G Rollouts"

Collaborations between telecom operators and enterprises are pivotal for the successful rollout of 5G networks, enabling the development of tailored solutions that meet specific business requirements.

Telecom operators bring extensive network infrastructure and technical expertise, while enterprises offer insights into industry-specific needs and use cases. This synergy facilitates the creation of customized 5G services, such as private networks, that enhance operational efficiency and support digital transformation initiatives.

- In January 2025, ZTE and Bitel partnered to enhance Peru's telecom sector, focusing on improving digital infrastructure and connectivity to bridge the urban-rural divide. This collaboration marks a significant step in the evolution of Peru's telecom landscape, providing unprecedented connectivity and addressing the digital divide between urban and rural regions.

- In October 2024, Ericsson and VNPT, one of Vietnam's leading telecommunications operators, announced a partnership to deploy 5G technology. This collaboration aims to accelerate the rollout of 5G services in Vietnam, enhancing network capabilities and supporting the country's digital transformation efforts.

Private 5G Network Market Report Snapshot

| Segmentation | Details |

| By Component | Hardware (Radio Access Network, Core Network, Backhaul & Transport), Software, Services (Installation & Integration, Data Services, Support & Maintenance) |

| By Frequency | Sub-6 GHz, mmWave |

| By Spectrum | Licensed, Unlicensed/Shared |

| By Vertical | Manufacturing, Healthcare, Transportation and Logistics, Energy and Utilities, Retail, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 832.3 million in 2023, due to advanced 5G infrastructure, including base stations and small cells.

- By Frequency (Sub-6GHz, mm Wave): The sub-6GHz segment held 71.53% share of the market in 2023, due to its superior coverage and penetration capabilities, making it more suitable for industries with complex environments. It provides a balance of speed and range, ideal for large-scale industrial applications.

- By Spectrum (Licensed, Unlicensed/Shared): The licensed segment is rapidly growing with a CAGR of 42.81%, fueled by its reliability and low interference.

- By Vertical (Manufacturing, Healthcare, Transportation and Logistics, Energy and Utilities, Retail, Others): The manufacturing segment is projected to reach USD 8935.0 million by 2031, owing to the adoption of private 5G networks in automation, robotics, and IoT to enhance productivity and efficiency.

Private 5G Network Market Regional Analysis

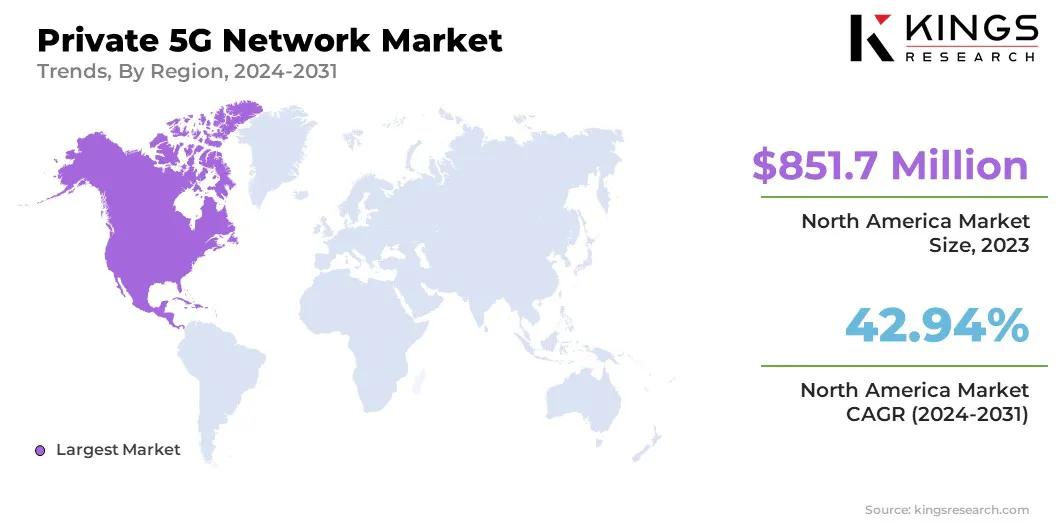

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 41.34% share of the private 5G network market, which was valued at USD 851.7 million in 2023. The market in the region is also projected to grow at a significant CAGR of 42.94% in the coming years. The market’s dominant share is attributed to the presence of various private 5G solution providers present in the region.

Heavy investments in deploying private 5G network infrastructure are fueling the overall market growth in the region. Beyond industrial applications, private 5G is gaining traction in smart cities and educational institutions across North America.

For example, universities are deploying private 5G to enable advanced research and improve campus connectivity, while municipalities use it for smart traffic management, efficient energy grids, and enhanced public safety, driving adoption in non-industrial sectors.

Europe is emerging as a significant player in the private 5G network industry with USD 626.0 million market value in 2023, driven by strong government support and strategic investments in advanced digital infrastructure.

Initiatives such as the European Union’s (EU) “Digital Europe Programme” and funding under the “Recovery and Resilience Facility” are accelerating the adoption of private 5G across industries. Countries like Germany, the UK, and France are leading the charge, with a focus on industrial automation, smart manufacturing, and logistics.

Additionally, Europe’s emphasis on sustainability is fostering the integration of private 5G in green energy projects, such as smart grids and renewable energy management systems.

The region also benefits from the presence of key telecom operators and technology providers, including Nokia, Ericsson, and Deutsche Telekom, which are driving innovation and deployment of tailored 5G solutions. Europe's automotive sector is a standout, with private 5G networks enabling advancements in autonomous driving, connected vehicle systems, and smart traffic solutions.

Moreover, the region’s push for secure and localized data processing aligns with the deployment of private 5G networks, especially in sectors like healthcare and public safety. This focus on digital sovereignty and advanced applications positions Europe as a key growth hub in the private 5G landscape.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The regulatory framework in North America, particularly in the U.S., is shaped by initiatives from the Federal Communications Commission (FCC). The FCC has allocated dedicated spectrum bands like CBRS (3.5 GHz) for private networks, allowing enterprises to deploy and operate 5G solutions efficiently. This shared spectrum model has encouraged innovation and adoption by reducing costs for businesses. Canada, too, has opened up spectrum bands to facilitate private 5G deployments, with a focus on expanding coverage in rural and industrial areas.

- The EU has established a harmonized regulatory framework to support private 5G adoption. The EU's "Digital Europe Programme" and national policies like Germany's allocation of the 3.7–3.8 GHz spectrum for private industrial use have enabled enterprises to access dedicated frequencies for deploying secure 5G networks. Many countries, including the UK, France, and the Netherlands, are also issuing localized spectrum licenses to ensure that enterprises can deploy 5G networks tailored to their needs while adhering to stringent data protection regulations like GDPR.

- In Asia Pacific, regulatory bodies are actively fostering private 5G growth by allocating dedicated spectrum and encouraging partnerships. For instance, Japan has allocated spectrum in the 28 GHz band for private 5G networks, focusing on industrial automation and smart city initiatives. Similarly, South Korea’s government supports private 5G deployments in manufacturing and healthcare by subsidizing infrastructure development. India has recently opened up spectrum allocation for enterprises, marking a significant shift in policy to support Industry 4.0 and digital transformation.

- In the Middle East, countries like the UAE and Saudi Arabia are leading with government-backed initiatives to deploy private 5G in smart cities and industrial zones. Regulatory bodies have provided enterprises access to spectrum licenses, fostering innovation in sectors like logistics and energy. In Africa, while private 5G adoption is still nascent, governments are working with telecom operators to ensure spectrum availability for enterprise use, particularly in mining and agriculture sectors, to drive economic growth.

- The regulatory landscape in Latin America is evolving, with countries like Brazil and Mexico allocating spectrum for private 5G networks. Governments are collaborating with operators to deploy infrastructure in industrial parks and manufacturing zones.Challenges like high costs and infrastructure limitations persist; however, regulatory efforts are focused on bridging the digital divide and promoting enterprise-led 5G adoption.

Competitive Landscape

The private 5G network market is highly competitive, with both established companies and newer entrants vying for market leadership. Key providers of private 5G network solutions across various industries include Ericsson, Huawei, Nokia, Cisco Systems, NEC, Samsung and ZTE.

These companies offer a wide range of products and services, such as network infrastructure, software, and consulting services. Alongside the top players, notable secondary participants include Verizon Business, AT&T, Deutsche Telekom, Orange, and Telefonica. These players invest heavily in R&D, fueling intense competition and fostering innovation in the market.

Companies are increasingly forming collaborations and partnerships to develop advanced solutions and strengthen their market positions. The private 5G network industry is expected to grow rapidly in the coming years, driven by factors such as the rising adoption of industrial automation, increasing demand for secure and reliable communication, and need for high-speed connectivity in remote areas.

The market is also registering the rise of niche players and startups specializing in private 5G solutions for specific industries or regions. Companies like Mavenir, Rakuten Symphony, and Parallel Wireless are gaining traction by offering open RAN and software-defined solutions that reduce deployment costs and increase flexibility.

These players are challenging traditional market leaders by focusing on affordability and scalability, appealing to small and medium-sized enterprises (SMEs) looking to adopt private 5G.

- For instance, in 2023 Microsoft acquired Affirmed Networks, and Juniper Networks partnered with Ericsson, underscoring the growing trend of tech firms entering the 5G space. Additionally, regional collaborations are prominent in markets like Europe and Asia Pacific, where local telecom operators and enterprises team up to deploy private 5G tailored to regulatory and industrial needs.

- In October 2024, Nokia and NTT DATA expanded their global private 5G partnership with a new deployment in Brownsville, Texas. This collaboration aims to deliver innovative, secure, and scalable private 5G solutions to accelerate transformation globally across airports and smart cities. The deployment in Brownsville is expected to revolutionize the city's public safety, operational scalability, and business-critical processes, enabling a transformation into a smart and safe city.

List of Key Companies in Private 5G Network Market:

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- ZTE Corporation

- Cisco Systems, Inc.

- NEC Corporation

- Juniper Networks, Inc.

- Verizon Communications Inc.

- AT&T Inc.

- Deutsche Telekom AG

- Vodafone Group Plc

- BT Group plc

- Mavenir Systems, Inc.

- T-Systems International GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Telefónica and Siemens partnered to advance the digitalization and automation of Spain's industrial sector. This initiative leverages technologies such as IoT, 5G networks, and AI to create intelligent production ecosystems, enhancing processes in manufacturing and infrastructure sectors.

- In March 2024, SoftBank Corp. announced the service launch of its Private 5G (dedicated type). This service allows local governments, organizations, and other enterprises to build 5G customized networks on their premises with a dedicated base station. The service is optimal for customers who require low latency and advanced network solutions, making it suitable for smart factory applications.

- In October 2024, NEC Corporation partnered with Cisco to launch a new private 5G network solution to their customers. This new offering combines Cisco's 5G Standalone (SA) Core and Cloud Control Centre with NEC's validated radio network and systems integration services. Designed to cater to diverse customer needs, the solution is now market-ready and aims to accelerate 5G adoption for enterprises.

- In December 2023, Telefonaktiebolaget LM Ericsson announced its partnership with Orange. The collaboration aims to offer B2B customers the opportunity to deploy their own private 5G network.

- In September 2023, Deutsche Telekom announced the launch of its new private 5G network solution, the ‘Campus Network Smart.’ The solution, launched in partnership with Microsoft Corporation, is part of Deutsche Telekom’s strong 5G private network portfolio. The Campus Network Smart solution is cloud-based, scalable, and incorporates a pay-as-you-grow model.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)