Semiconductor and Electronics

PTC Battery Heater Market

PTC Battery Heater Market Size, Share, Growth & Industry Analysis, By Product Type (Air-based, Liquid-based), By Electric Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Power Rating (Below 500W, 500W - 2kW), By Battery Type (Lithium-Ion Batteries, Nickel-Metal Hydride Batteries), and Regional Analysis, 2024-2031

Pages : 210

Base Year : 2023

Release : March 2025

Report ID: KR1417

Market Definition

The PTC (Positive Temperature Coefficient) battery heater market involves the design, development, and application of heating systems that utilize PTC technology to maintain batteries within optimal operating temperature ranges.

PTC heaters are self-regulating devices, wherein the heating output automatically adjusts according to the surrounding temperature, thereby preventing battery performance degradation in cold conditions.

PTC Battery Heater Market Overview

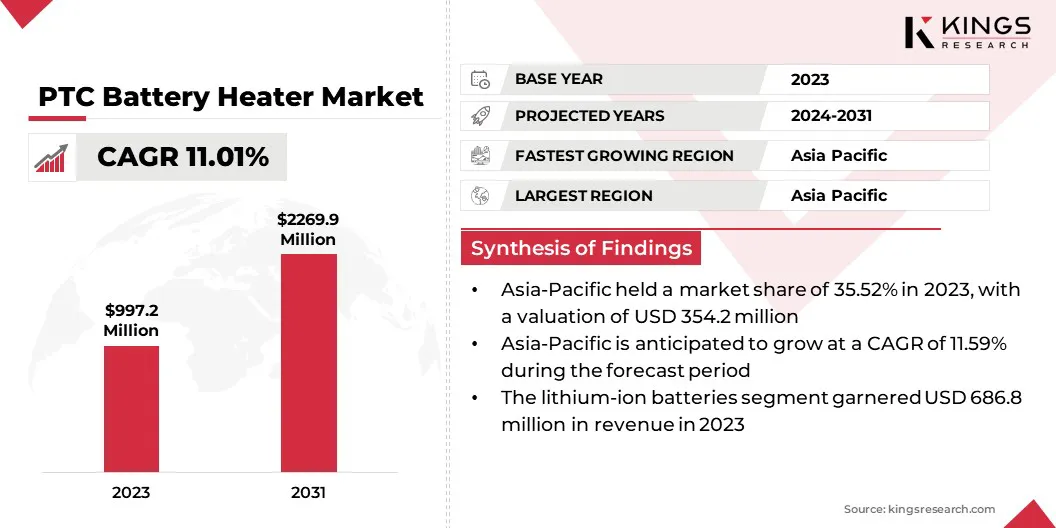

The global PTC battery heater market size was valued at USD 997.2 million in 2023 and is projected to grow from USD 1092.3 million in 2024 to USD 2269.9 million by 2031, exhibiting a CAGR of 11.01% during the forecast period.

This is primarily attributed to the increasing adoption of electric vehicles (EVs), advancements in battery technologies, and the rising demand for efficient energy storage solutions across various industries. The need for effective thermal management systems to optimize battery performance, particularly in low-temperature environments, is propelling the demand for PTC heaters.

Major companies operating in the global PTC battery heater industry are Taiwan King Lung Chin PTC Co., Ltd. (KLC Corporation), Celanese Corporation, Eberspächer, TEKRA, LLC., Skyworks Solutions, Inc., NXP Semiconductors., Spheros Germany GmbH, Renesas Electronics Corporation., Hyundai Motor Group, Delta Electronics, Inc., Vishay Intertechnology, Inc., Infineon Technologies AG, EVE Energy Co., Ltd., Valeo, and NIDEC CORPORATION.

Furthermore, the growing emphasis on sustainable energy solutions and energy-efficient technologies is expected to support the market expansion. The market is likely to register substantial growth as regulatory standards on energy efficiency become more stringent and consumer preferences shift toward environmentally sustainable technologies.

Key market participants are increasingly investing in research and development to provide advanced, cost-effective, and energy-efficient PTC heating solutions, which will contribute to the overall growth of the market during the forecast period.

- In February 2025, Eberspächer will present its comprehensive portfolio of heating and cooling systems designed to ensure comfort and safety in construction machinery across all temperature conditions. As a thermal management expert, the company will showcase solutions tailored for electric, hybrid, and conventional drives, highlighting their ability to optimize performance and maintain reliability in challenging environments.,

Key Highlights

- The global PTC battery heater market size was valued at USD 997.2 million in 2023.

- The market is projected to grow at a CAGR of 11.01% from 2024 to 2031.

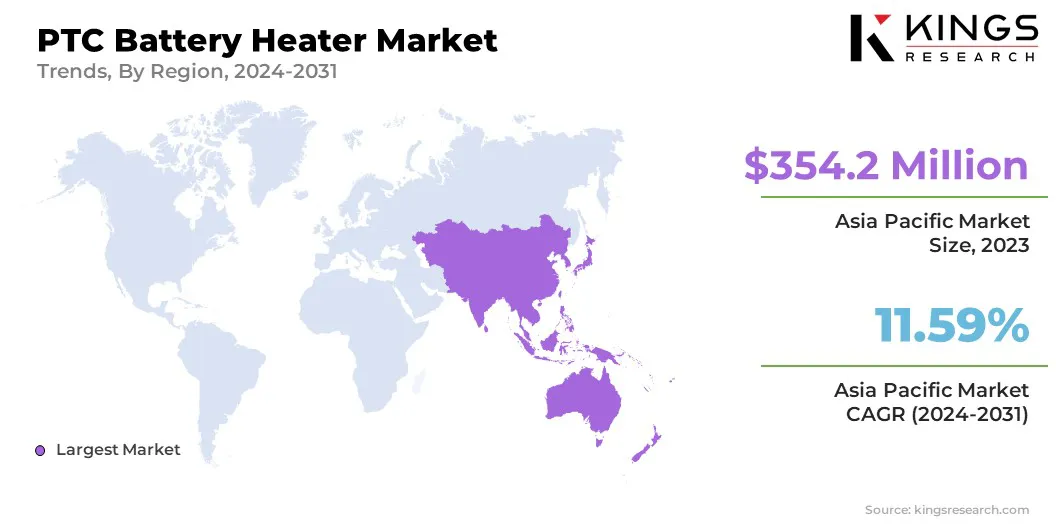

- Asia Pacific held a market share of 35.52% in 2023, with a valuation of USD 354.2 million.

- The air-based segment garnered USD 563.2 million in revenue in 2023.

- The passenger vehicle segment is expected to reach USD 1364.5 million by 2031.

- The 500W – 2kW segment is anticipated to register the fastest CAGR of 11.64% during the forecast period.

- The lithium-ion batteries garnered USD 686.8.8 million in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 11.35% during the forecast period.

Market Driver

"Advancements in Battery Technologies Propel the Market"

Advancements in battery technology, particularly in high-energy-density batteries like lithium-ion and solid-state batteries, have driven the demand for PTC battery heaters. These batteries offer higher storage capacity and longer ranges for EVs.

PTC heaters are critical in maintaining the optimal operating temperature of these batteries during both charging and discharging cycles, preventing overheating or damage caused by extreme cold.

The demand for efficient, self-regulating thermal solutions like PTC heaters is expected to grow as battery technologies continue to evolve and become integral to applications in EVs, renewable energy systems, and consumer electronics.

- In November 2024, Renesas Electronics Corporation, a leading provider of semiconductor solutions, unveiled the world’s first “8-in-1” proof of concept (PoC) for E-Axle systems in EVs. Developed with Nidec Corporation, it integrates key components like a motor, inverter, and OBC. A live demonstration will be held at electronica 2024 in Munich.

Market Challenge

"High Initial Cost is Hindering the Market"

A significant challenge in the PTC battery heater market is the high initial cost associated with integrating these systems into battery management solutions. PTC heaters provide essential benefits in maintaining optimal battery temperatures and enhancing performance; however, the upfront investment required for their implementation particularly in EVs and renewable energy storage applications can be considerable.

This high cost may discourage manufacturers from adopting the technology, especially in price-sensitive markets. Furthermore, the integration process can be complex, as PTC heaters need to be carefully calibrated to work seamlessly with various battery types, adding to the overall expense and making it a key obstacle to widespread adoption.

Advancements in materials and manufacturing processes can reduce production costs, while economies of scale will lower unit prices as demand increases. Government incentives, such as subsidies and tax breaks, can further offset initial investments.

Strategic partnerships between companies can also distribute development costs, making the technology more cost-effective. Emphasizing the long-term return on investment, including extended battery life and improved performance, can justify the upfront expense. Standardizing or modularizing PTC heating solutions can simplify integration and reduce costs, facilitating broader adoption across industries.

Market Trend

"Integration with Smart Battery Management Systems is a Crucial Trend"

A significant trend in the PTC battery heater market is the integration with smart battery management systems. As battery technologies evolve, particularly in EVs and renewable energy storage applications, there is an increasing need for precise and dynamic temperature regulation.

Integrating PTC heaters with advanced battery management systems allows for real-time monitoring and adjustment of the battery’s temperature, optimizing performance, enhancing safety, and extending battery life.

This trend is gaining momentum as manufacturers prioritize more efficient and automated systems that ensure batteries operate within their optimal temperature range, improving both energy efficiency and overall reliability.

- In October 2023, Valeo, a global leader in COâ‚‚ reduction and thermal management solutions, will showcase its latest innovations for buses at APTA Expo 2023 in Orlando, FL. Focused on zero-emission efficiency, Valeo will present all-electric air conditioning systems, including REVO-E Global, REVO-E RAC, and a high-performance e-split system for electric mini and school buses.

PTC Battery Heater Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Air-based, Liquid-based |

|

By Electric Vehicle Type |

Passenger Vehicles, Commercial Vehicles, Electric Two-wheelers |

|

By Power Rating |

Below 500W, 500W - 2kW, Above 2kW |

|

By Battery Type |

Lithium-Ion Batteries, Nickel-Metal Hydride (NiMH) Batteries, Solid-State Batteries |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Air-based, Liquid-based): The air-based segment earned USD 563.2 million in 2023, due to its cost-effectiveness, ease of integration, and widespread use in EVs and energy storage systems.

- By Electric Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electric Two-wheelers): The passenger vehicles segment held 60.65% share of the market in 2023, due to the growing demand for electric cars, driven by environmental concerns, government incentives, and advancements in battery technology.

- By Power Rating (Below 500W, 500W - 2kW, Above 2kW): The below 500W segment is projected to reach USD 852.4 million by 2031, owing to its widespread use in small-scale applications such as electric two-wheelers and portable energy storage systems, where lower power requirements are sufficient.

- By Battery Type (Lithium-Ion Batteries, Nickel-Metal Hydride (NiMH) Batteries, Solid-State Batteries): The lithium-ion batteries segment is anticipated to witness the fastest CAGR of 11.43% during the forecast period, driven by their widespread use in EVs, renewable energy storage systems, and consumer electronics due to their high energy density, longer lifespan, and cost efficiency.

PTC Battery Heater Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a PTC battery heater market share of around 35.52% in 2023, with a valuation of USD 354.2 million. Asia Pacific’s dominance in the market can be attributed to the rapid EV adoption, particularly in countries like China, Japan, and South Korea, where major automotive manufacturers are investing heavily in EV production and innovation.

The region’s expanding renewable energy sector, coupled with an increasing demand for efficient energy storage solutions, further drives the need for reliable battery thermal management. The presence of key battery manufacturers and technological advancements in the region also contribute to the robust market growth.

Moreover, supportive government policies, such as subsidies for EVs and renewable energy initiatives, continue to create a favorable environment for the adoption of PTC heaters in various applications, ensuring continued market expansion.

- In May 2024, Hyundai Motor Group enhanced EV efficiency with its advanced heat pump technology, which repurposes waste energy to boost performance by over 10% in low temperatures compared to traditional systems. Effective thermal management is essential for maintaining optimal lithium-ion battery temperatures, typically between 20–35°C, using cooling systems similar to those in internal combustion engine vehicles.

The PTC battery heater industry in North America is poised for significant growth at a robust CAGR of 11.35% over the forecast period, driven by the increasing adoption of EVs, particularly in the U.S. and Canada.

Strong government support through incentives and regulations aimed at reducing carbon emissions is further accelerating the transition to electric mobility. The growing focus on energy storage solutions for renewable energy systems, coupled with advancements in battery technologies, is contributing to the rising demand for PTC battery heaters.

The presence of major automotive and technology companies in the region is also fostering innovation in battery thermal management systems, further fueling the market.

Regulatory Frameworks

- The IEC 62133:2017 standard specifies safety requirements for portable sealed secondary lithium-ion and nickel-based batteries, particularly focusing on their performance, charging, discharging, and temperature management.

- The Energy Star certification is a widely recognized label that identifies energy-efficient products, helping consumers and businesses reduce energy consumption and environmental impact. Products must meet strict performance standards set by the U.S. Environmental Protection Agency (EPA) to earn the Energy Star label, ensuring that they deliver superior energy efficiency without sacrificing performance.

- The California Energy Commission (CEC) sets and enforces standards for energy efficiency in buildings, appliances, and equipment, including the regulation of energy storage systems and EV components, to ensure a sustainable and clean energy future for California.

- The RoHS Directive (Restriction of Hazardous Substances) is a European Union (EU) regulation that limits the use of specific hazardous materials in electrical and electronic equipment. It aims to protect human health and the environment by reducing the presence of harmful substances such as lead, mercury, and cadmium in products.

Competitive Landscape

The global PTC battery heater market is characterized by several participants, including established corporations and rising organizations. Key market players focus on technological innovation, product diversification, and strategic partnerships to maintain a competitive edge.

Established companies often leverage their extensive experience in battery management systems and thermal regulation technologies, while newer entrants bring innovative solutions to cater to evolving market demands, particularly in emerging sectors such as EVs and renewable energy.

Companies are increasingly investing in research and development to improve the efficiency, cost-effectiveness, and sustainability of PTC heaters, while focusing on expanding their geographic reach through mergers, acquisitions, and collaborations.

- In May 2023, Celanese introduced the new Micromax PTC085 Carbon Ink at SMTconnect 2023 in Nuremberg, Germany. The Micromax advanced PTC thick film ink formulation has been qualified by Alper, enabling the design of high-performance, thin, flexible film heaters. This innovative ink formulation offers efficient, self-regulating heating, making it ideal for various applications, including electronics and automotive industries.

List of Key Companies in PTC Battery Heater Market:

- Taiwan King Lung Chin PTC Co., Ltd. (KLC Corporation)

- Celanese Corporation

- Eberspächer

- TEKRA, LLC.

- Skyworks Solutions, Inc.

- NXP Semiconductors.

- Spheros Germany GmbH

- Renesas Electronics Corporation.

- Hyundai Motor Group

- Delta Electronics, Inc.

- Vishay Intertechnology, Inc.

- Infineon Technologies AG

- EVE Energy Co., Ltd.

- Valeo

- NIDEC CORPORATION

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Infineon Technologies AG and lithium battery manufacturer Eve Energy Co., Ltd signed an MoU to develop advanced battery management system solutions for the automotive market. Infineon will provide a complete chipset, enhancing EVE Energy’s system with improved safety, reliability, cost efficiency, and optimized EV battery performance.

- In October 2024, Vishay Intertechnology launched the PTCEL High Energy series of inrush current limiting PTC thermistors. Engineered for enhanced performance in automotive and industrial charge/discharge circuits, these devices offer up to 340 J energy handling—five times higher than competitors—while providing a broad R25 range and high voltage capability for superior efficiency in high-temperature environments.

- In March 2023, Audi, in collaboration with Porsche, developed the Premium Platform Electric (PPE) to expand its all-electric model portfolio and strengthen its position in sustainable premium mobility. For its next-generation EVs, Audi redesigned key powertrain components, including an 800-volt air PTC heater, which enhances heating efficiency and directly supports interior climate control, minimizing heat losses.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)