Energy and Power

Pulsed Power Systems Market

Pulsed Power Systems Market Size, Share, Growth & Industry Analysis, By Type (Capacitor-based Pulsed Power Systems, Inductor-based Pulsed Power Systems, Others), By Voltage (Low-voltage Pulsed Power Systems, High-voltage Pulsed Power Systems), By Application, and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR1411

Market Definition

The pulsed power systems market involves technologies that generate high-power electrical pulses for various applications, including medical devices, defense, industrial processing, and energy storage.

These systems deliver rapid, controlled bursts of energy, offering efficiency and precision for tasks like material processing, electromagnetic pulse weapons, and advanced medical treatments like ablation therapies.

Pulsed Power Systems Market Overview

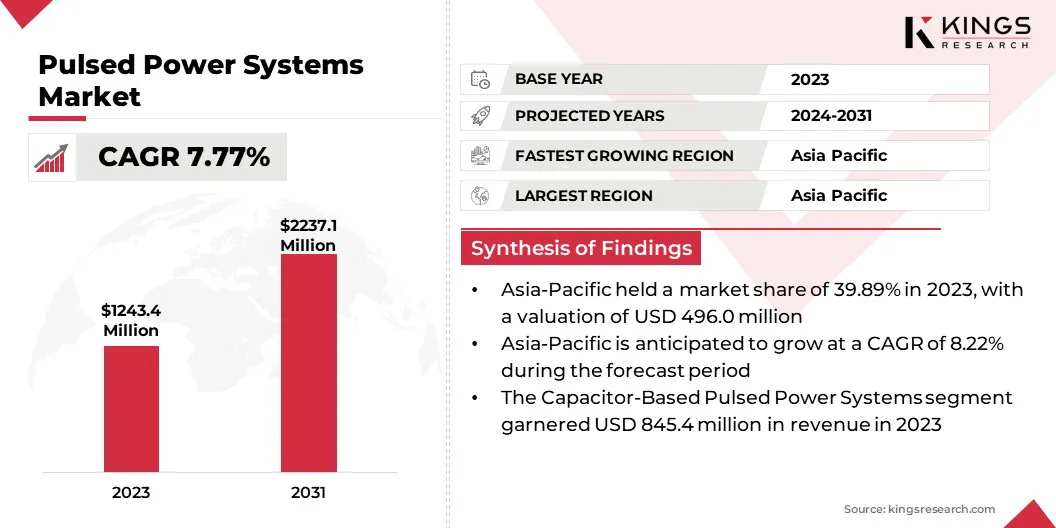

The global pulsed power systems market size was valued at USD 1243.4 million in 2023, which is estimated to be valued at USD 1324.8 million in 2024 and reach USD 2237.1 million by 2031, growing at a CAGR of 7.77% from 2024 to 2031.

Increasing demand for these systems in defense and security applications is a major growth driver of the market. These systems are crucial for technologies like directed energy weapons, electromagnetic railguns, and advanced radar systems, fueling their adoption in the military.

Major companies operating in the global pulsed power systems Industry are Scientific Applications & Research Associates, Inc, Advanced Energy, ITOPP, Eagle Harbor Technologies, RI Research Instruments GmbH, ScandiNova, General Atomics, Mitsubishi Electric Corporation, ABB, TDK Corporation, XP Power, Spellman High Voltage Electronics Corporation, MATSUSADA PRECISION Inc., Delta Electronics, Inc, and AMETEK Inc.

The market is registering significant advancements, particularly in high-energy applications like defense, energy, and scientific research. These systems offer precise control over energy delivery, enabling innovations in fields such as directed energy weapons, fusion energy research, and advanced materials processing.

Pulsed power systems are becoming integral in enhancing performance, efficiency, and reliability across diverse sectors. Their role in modern defense infrastructure and energy solutions positions them as critical components in future technological developments.

- In June 2024, GM Defense, in collaboration with the University of Texas at Arlington and the Naval Surface Warfare Center, initiated the EEVBEDE project. The initiative focuses on testing GM’s Ultium Platform for dynamic energy discharge, advancing energy storage technologies for the use of pulsed power systems in the military.

Key Highlights:

- The global pulsed power systems market size was valued at USD 1243.4 million in 2023.

- The market is projected to grow at a CAGR of 7.77% from 2024 to 2031.

- Asia Pacific held a market share of 39.89% in 2023, with a valuation of USD 496.0 million.

- The capacitor-based pulsed power systems segment garnered USD 845.4 million in revenue in 2023.

- The high-voltage pulsed power systems segment is expected to reach USD 1493.9 million by 2031.

- The defense and security segment is anticipated to register the fastest CAGR of 8.26% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 7.81% during the forecast period.

Market Driver

"Advancements in Electronics and Semiconductors"

Advances in electronics and semiconductor technologies are driving the pulsed power systems market.

- In February 2025, the Semiconductor Industry Association (SIA) reported a 19.1% increase in global semiconductor sales in 2024, with continued growth projected for 2025.

The development of high-power semiconductors and advanced switching devices enhances the efficiency, reliability, and performance of pulsed power systems.

These improvements enable more precise control of energy delivery, making pulsed power solutions increasingly viable in a range of industrial applications, including materials processing, energy storage, and defense. Pulsed power systems are expected to register wider adoption across diverse sectors as technology progresses.

- In January 2025, Helion raised $425 million in Series F funding to advance its Polaris fusion prototype. The investment focuses on high-power semiconductors and pulse-power components, accelerating efforts to develop the first commercial fusion power plant and boosting the market.

Market Challenge

"High Development Costs"

High development costs are a significant challenge in the pulsed power systems market, particularly for advanced applications like fusion energy. Designing and manufacturing these systems involves substantial investments in research, development, and the production of specialized components like high-power capacitors and semiconductors.

A potential solution lies in increasing collaborations between industry players, governments, and research institutions to share costs and resources. Additionally, advancements in modular designs and supply chain optimization could help reduce production costs and accelerate the commercialization of these systems.

Market Trend

"Advancing Medical Technologies and Improving Patient Outcomes"

Pulsed power systems are gaining traction in the health sector for their use in advanced medical technologies, particularly in imaging, radiation therapy, and sterilization processes.

Their ability to deliver high-energy pulses with precision makes them ideal for applications such as cancer treatment through particle beam therapy and improving the effectiveness of diagnostic imaging systems. This trend is fueled by the demand for non-invasive, targeted treatments and efficient energy delivery in medical equipment, which enhances patient outcomes and reduces recovery times.

- In October 2024, Advanced Imaging of Montana became the first facility in the U.S. to install Siemens Healthineers’ Somatom Pro.Pulse dual-source CT scanner. This affordable, AI-powered system enhances cardiac imaging, improves workflow efficiency, reduces power consumption, and ensures precise patient positioning, meeting the growing demand for advanced diagnostic capabilities.

Pulsed Power Systems Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Capacitor-based Pulsed Power Systems, Inductor-based Pulsed Power Systems, Others |

|

By Voltage |

Low-voltage Pulsed Power Systems, High-voltage Pulsed Power Systems |

|

By Application |

Industrial, Medical, Defense and Security, Scientific Research |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Capacitor-based Pulsed Power Systems, Inductor-based Pulsed Power Systems, Others): The capacitor-based pulsed power systems segment earned USD 845.4 million in 2023, due to the rising demand for energy-efficient solutions in various industrial applications.

- By Voltage (Low-voltage Pulsed Power Systems, High-voltage Pulsed Power Systems): The high-voltage pulsed power systems segment held 65.55% share of the market in 2023, driven by their efficiency in large-scale industrial applications.

- By Application (Industrial, Medical, Defense and Security, Scientific Research): The industrial segment is projected to reach USD 1018.8 million by 2031, owing to the increasing need for high-power energy systems in manufacturing processes.

Pulsed Power Systems Market Regional Analysis

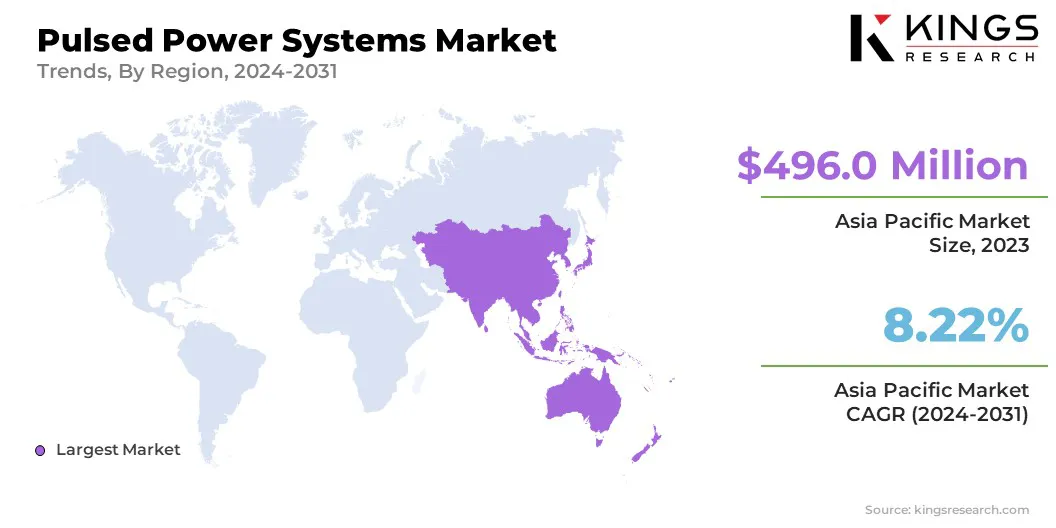

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a pulsed power systems market share of around 39.89% in 2023, with a valuation of USD 496.0 million. Asia Pacific dominates the market, accounting for a significant market share due to rapid industrialization and increasing investments in high-tech manufacturing in the region.

The demand for pulsed power systems in sectors such as energy, defense, and materials processing has fueled this growth. Additionally, countries like China, Japan, and India have registered considerable expansion in advanced technologies, including high-voltage power systems, further driving the adoption of pulsed power solutions across various industries in the region.

The pulsed power systems Industry in North America is poised for significant growth at a CAGR of 7.81% over the forecast period. North America is projected to be the fastest-growing region in the market, driven by technological advancements and a focus on clean energy solutions.

The increasing adoption of pulsed power systems in healthcare, defense, and scientific research is fueling the market in the region. Furthermore, the rise of government initiatives and funding for energy-efficient technologies, alongside the presence of key market players in the U.S. and Canada, is expected to propel the market in the region over the coming years.

- In May 2024, Mayo Clinic, U.S. successfully used FDA-approved pulsed field ablation (PFA) technology for atrial fibrillation treatment, marking a breakthrough in electrophysiology. PFA utilizes high-energy pulses for targeted tissue ablation, offering safer, faster procedures with fewer risks.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices. It regulates the medical applications of pulsed power systems.

- The European Medicines Agency (EMA) is a decentralised agency of the European Union (EU). It is responsible for the scientific evaluation, supervision and safety monitoring of medicines. It regulates medical applications such as pulsed ablation systems.

Competitive Landscape:

The global pulsed power systems market is characterized by a large number of participants, including established corporations and rising organizations. Studies conducted by companies in the market typically focus on evaluating the efficacy and safety of these technologies, particularly in high-stakes applications like medical treatments and energy generation.

These studies assess key performance metrics, including precision, reliability, and potential risks, to ensure that the systems meet regulatory standards and provide effective, secure solutions for various industries.

- In January 2025, Pulse Biosciences announced promising results from its first-in-human feasibility study of the Nanosecond Pulsed Field Ablation (nsPFA) 360° Cardiac Catheter System, demonstrating high efficacy in treating atrial fibrillation (AF) with strong pulmonary vein isolation and efficient workflow.

List of Key Companies in Pulsed Power Systems Market:

- Scientific Applications & Research Associates, Inc

- Advanced Energy

- ITOPP

- Eagle Harbor Technologies

- RI Research Instruments GmbH

- ScandiNova

- General Atomics

- Mitsubishi Electric Corporation

- ABB

- TDK Corporation

- XP Power

- Spellman High Voltage Electronics Corporation

- MATSUSADA PRECISION Inc.

- Delta Electronics, Inc

- AMETEK Inc

Recent Developments (Launch/Partnership)

- In November 2024, Mitsubishi Electric, in collaboration with RIKEN and IMS, developed a high-energy, sub-nanosecond deep ultraviolet laser system achieving 235 millijoules pulse energy. This compact, portable system aids accelerator R&D, advancing laser technology for various fields.

- In August 2024, Allianz Partners India and Pulse Energy announced a strategic partnership to enhance the electric vehicle (EV) ownership experience. This collaboration integrates Allianz’s mobility network with Pulse Energy’s platform, offering seamless charging, real-time support, and range anxiety solutions.

- In March 2024, bp unveiled its first U.S. bp pulse EV charging Gigahub at its Houston headquarters. The site, featuring 24 DC fast chargers, aims to support faster EV adoption by providing reliable, high-speed charging for EV drivers.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership