Pyrethrin Market

Pyrethrin Market Size, Share, Growth & Type Analysis, By Type (50% Pyrethrin, 20% Pyrethrin and Others), By Application (Household Products, Public Hygiene (Surface or Space Treatments), Animal Health and Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR774

Pyrethrin Market Size

Global Pyrethrin Market size was recorded at USD 63.1 million in 2023, which is estimated to be at USD 66.1 million in 2024 and projected to reach USD 101.1 million by 2031, growing at a CAGR of 6.25% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Sumitomo Chemical, Bayer AG, Botanical Resources Australia Pty Ltd, ENDURA, China Shaanxi Whedon-Herbage Technology Co.,Ltd, Zhejiang Rayfull Chemicals Co.,Ltd., Pestech Australia Pty Ltd, Scintex Australia., Forestry Distributing a Horizon Company, KAPI Limited, and others.

The growing demand for environmentally friendly pest control solutions, coupled with the increasing adoption of pyrethroids, represents a crucial factor in the pest management industry. This trend is driven by increased awareness regarding sustainability and health concerns among consumers, as well as evolving regulatory landscapes that emphasize the importance of ecological responsibility. This expansion is further fueled by rising focus on research and innovation in the industry.

The progress of the pyrethrin is propelled by the rising demand for effective pest control solutions. Pyrethrins, which are derived from chrysanthemum flowers, are widely used in agriculture, public health, and household applications due to their effectiveness against a broad spectrum of insects while posing lower risks to human health and the environment compared to conventional pesticides. The market is characterized by a notable shift toward bio-based and eco-friendly alternatives, fueled by stringent regulatory policies promoting the implementation of sustainable pest management practices. Additionally, advancements in formulation technologies and the development of novel pyrethroid compounds are improving product efficacy, thereby increasing their adoption across diverse industries.

Pyrethrins are a group of naturally occurring pesticides derived from chrysanthemum flowers, specifically certain species of the genus Chrysanthemum. These compounds are extracted and formulated to be utilized as insecticides and pest control agents. Pyrethrins are known for their effectiveness in targeting a wide range of insects, including mosquitoes, fleas, flies, moths, ants, and other pests. Pyrethrins are increasingly favored over organochlorides and organophosphates due to their superior and persistent toxic effects on insects while being less harmful to humans.

Furthermore, their biodegradable nature makes them a preferred choice over synthetic pyrethroids, which are analogs of naturally occurring pyrethrin. Pyrethrins are becoming a preferred alternative to conventional pesticides in various applications, thus contributing to the advancement of eco-friendly pest control methods.

Analyst’s Review

The pyrethroids market is witnessing significant growth and evolution due to numerous factors such as increasing demand for pest control solutions, regulatory shifts, and advancements in formulation technologies. Pyrethroids, known for their lower toxicity and biodegradability compared to traditional pesticides, are well-positioned to meet this demand. Key manufacturers are leveraging this trend by investing heavily in research and development to enhance the efficacy and sustainability of pyrethroid formulations. This includes the development of novel formulations with improved persistence and targeting capabilities, while also ensuring minimal impact on non-target organisms and the environment.

Furthermore, manufacturers are actively responding to regulatory changes concerning pesticide use, particularly in regions with stringent standards such as Europe. Compliance with evolving regulations is crucial for market access and consumer acceptance. Key manufacturers are investing resources to obtain regulatory approvals, conduct safety assessments, and ensure product stewardship to maintain market competitiveness and consumer trust.

Pyrethrin Market Growth Factors

The rising incidence of vector-borne diseases such as malaria and chikungunya is a significant factor fueling the growth of the pyrethrin market. These diseases, transmitted by mosquitoes and other insects, pose substantial health risks globally, particularly in tropical and subtropical regions. Pyrethrins, known for their effectiveness against mosquitoes and other disease-carrying vectors, play a crucial role in vector control programs aimed at preventing the spread of such diseases.

- For instance, according to WHO, between 1 January and 4 March 2023, a total of 113,447 cases of chikungunya were reported in the Region of the Americas, resulting in 51 deaths. This represents a four-fold increase in cases and deaths compared to the same period in 2022, which recorded 21,887 cases and eight deaths.

As the prevalence and impact of malaria, chikungunya, and other vector-borne diseases continue to increase, there is an increasing emphasis on integrated vector management strategies that include the use of environmentally friendly insecticides such as pyrethrins. Furthermore, the emergence of insecticide-resistant mosquito populations underscores the importance of diversified and sustainable pest control methods, leading to the increased demand for pyrethrins.

Growing resistance among mosquitoes to pyrethroid insecticides is anticipated to pose a major challenge in malaria control efforts. The development and recommendation of ITNs with dual active ingredients represent a strategic response to combat insecticide resistance and maintain the effectiveness of malaria prevention interventions.

- For instance, the widespread use of insecticide-treated nets (ITNs) has been instrumental in substantially reducing malaria cases across Africa during the initial 15 years of this century. Nearly 70% of this reduction is attributed to the effective deployment and utilization of ITNs, which serve as a critical barrier against mosquitoes transmitting malaria.

This market trend underscores the importance of adapting to evolving challenges in vector control by introducing novel technologies. Initiatives such as the New Nets Project, supported by the Global Fund and Unitaid, are expected to play a crucial role in supporting market development and ensuring the affordability of the new ITNs. Investments in research, market interventions, and cost-effectiveness studies are likely to stimulate market expansion.

Pyrethrin Market Trends

A significant trend shaping the market landscape is the growing demand for organic pest control solutions, propelled by rising concerns regarding environmental sustainability and human health. Pyrethrins, derived from chrysanthemum flowers, are gaining widespread recognition as effective organic insecticides, with increased utilization observed in both agricultural and residential sectors. In agriculture, pyrethrin-based products remain popular as farmers increasingly seek safer and eco-friendlier alternatives to conventional chemical insecticides.

Pyrethrins offer a compelling solution due to their low toxicity to humans, animals, and beneficial insects, while effectively controlling a wide range of pests. Advances in extraction methods and formulation technologies are contributing to the enhanced efficacy of pyrethrin-based products. Manufacturers are investing extensively in research and development to improve the stability and efficiency of pyrethrin formulations, thus ensuring higher performance and longer-lasting results in pest control applications.

An emerging trend in the pyrethrin market is the increasing adoption of integrated pest management (IPM) practices across various industries. Integrated pest management emphasizes the use of multiple pest control strategies, including biological, cultural, and mechanical methods, in addition to judicious pesticide applications such as pyrethrins. This approach aims to minimize pesticide use while effectively managing pest populations.

Pyrethrins, derived from natural sources such as chrysanthemum flowers, align well with IPM principles due to their low environmental impact and selective toxicity against pests. As sustainability concerns continue to drive the demand for eco-friendly pest control solutions, pyrethrins are gaining significant traction as a key component of IPM programs in agriculture, public health, and residential settings.

Segmentation Analysis

The global pyrethrin market is segmented based on type, application, and geography.

By Type

Based on type, the market is categorized into 50% pyrethrin, 20% pyrethrin and others. The 50% pyrethrin segment garnered the highest revenue of USD 28.5 million in 2023. The 50% pyrethrin formulation serves as a powerful tool for integrated pest management across diverse sectors, offering robust pest control capabilities while aligning with sustainability and safety objectives. Its versatility and effectiveness make it a preferred choice for addressing pest challenges in agriculture, public health, animal care, residential areas, and industrial settings, This reflects the growing demand for eco-friendly pest control solutions with minimal environmental impact.

The 50% pyrethrin formulation is a versatile insecticide product widely utilized across various industries and applications where a potent insecticidal effect is required. In agriculture, this formulation is essential for protecting crops against a broad spectrum of pests such as aphids, caterpillars, and mites, Its significance is particularly notable in fruit and vegetable farming, as well as in large-scale field crop cultivation. Public health agencies leverage 50% pyrethrin formulations in mosquito control programs to combat mosquito-borne diseases, while urban pest management professionals use it to control nuisance pests in residential and commercial settings. Various applications of pyrethrin are likley to support the growth of the segment in the foreseeable future.

By Application

Based on application, the market is divided into household products, public hygiene (surface or space treatments), animal health, and others. The household products segment captured the largest market share of 51.18% in 2023. Pyrethrin plays an essential role in household pest control strategies, providing homeowners with effective and environmentally friendly solutions to manage common pests and ensure comfortable and healthy living spaces. Pyrethrin is a key ingredient in household pesticides and spray products used to control a range of pests commonly encountered indoors, including mosquitoes, flies, cockroaches, and ants. These household formulations leverage the insecticidal properties of pyrethrin to effectively combat pests while minimizing risks to human health and the environment.

Furthermore, pyrethrin-containing household pesticides are valuable for controlling ant populations indoors. These products are applied to entry points and trails to deter ants from entering living spaces, thereby aiding in maintaining pest-free environments. Consumers value pyrethrin-based household products for their efficacy in pest control and relatively low toxicity to humans and pets, thereby boosting the growth of the segment.

Pyrethrin Market Regional Analysis

Based on region, the global Pyrethrin market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

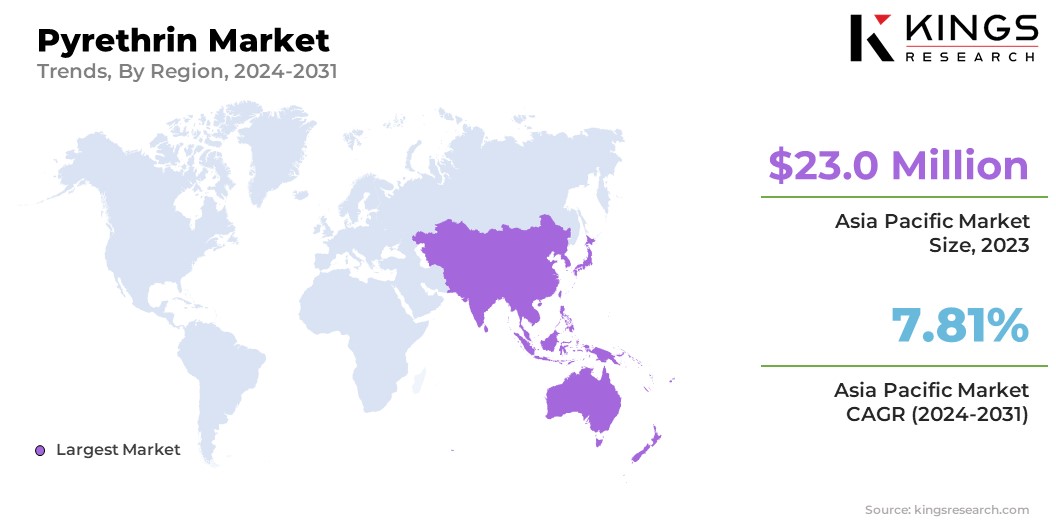

The Asia Pacific Pyrethrin Market share stood around 36.45% in 2023 in the global market, with a valuation of USD 23.0 million. The region's dominance in the pyrethrin market is attributed to expansive and diverse agricultural landscape. The substantial production of staple crops such as rice, wheat, fruits, vegetables, oilseeds, and pulses creates a high demand for effective pest control solutions, with pyrethroids emerging as a preferred choice. The tropical and subtropical climates prevalent in numerous Asian regions provide ideal conditions for the proliferation of pests, particularly Lepidoptera, which necessitates extensive use of pyrethroids to safeguard crop yields.

Furthermore, region focus on maximizing agricultural productivity to meet the food requirements of its growing population serves as a significant factor for the widespread adoption of pyrethroids. These insecticides offer a cost-effective pest control solution, that aligns with the budget constraints of small and medium-sized farmers in the region. These factors are likely to solidify the region's leading position in the global market.

Europe generated substantial revenue of USD 13.9 million in 2023. This growth is facilitated by a several factors such as diverse agricultural practices, stringent regulatory standards, and a commitment to sustainable pest management. Europe's stringent regulatory environment influences the adoption of pyrethroids. The region upholds rigorous standards for pesticide use, emphasizing the protection of human health and the environment.

Pyrethroids are favored for their relatively low toxicity to mammals and birds, as well as their biodegradability, which aligns with the region's sustainability goals in agriculture. The adoption of integrated pest management (IPM) practices further drives the use of pyrethroids in Europe. Farmers integrate pyrethroids into holistic pest management strategies that incorporate biological controls, crop rotation, and habitat management to reduce reliance on chemical pesticides and minimize ecological disruption, thereby supporting regional market progress.

Competitive Landscape

The global pyrethrin market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Pyrethrin Market

- Sumitomo Chemical

- Bayer AG

- Botanical Resources Australia Pty Ltd

- ENDURA

- China Shaanxi Whedon-Herbage Technology Co.,Ltd

- Zhejiang Rayfull Chemicals Co.,Ltd

- Pestech Australia Pty Ltd

- Scintex Australia.

- Forestry Distributing a Horizon Company

- KAPI Limited

Key Industry Developments

- December 2022 (Collaboration): BASF, in collaboration with MedAccess, completed the shipment of 35 million Interceptor G2 nets to fight malaria. These nets were treated with a combination of pyrethroid and pyrrole compounds. This initiative demonstrated the commitment of industry leaders to innovative solution.

The Global Pyrethrin Market is Segmented as:

By Type

- 50% Pyrethrin

- 20% Pyrethrin

- Others

By Application

- Household Products

- Public Hygiene (Surface or Space Treatments)

- Animal Health

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership