Automotive and Transportation

Recreational Boat Market

Recreational Boat Market Size, Share, Growth & Industry Analysis, By Type (Yachts, Sailboats, Personal Watercrafts, Inflatables, Others), By Propulsion (Internal Combustion Engine, Electric), By Application (Watersports, Fishing), and Regional Analysis, 2024-2031

Pages : 180

Base Year : 2023

Release : March 2025

Report ID: KR1486

Market Definition

The market encompasses the production, sale, and use of boats primarily designed for leisure, sports, and recreational activities. Unlike boats used for commercial or industrial purposes, these vessels are intended for personal use. The market includes a wide range of types, such as motorboats, sailboats, yachts, personal watercraft, and human-powered boats like kayaks and canoes.

Recreational Boat Market Overview

The global recreational boat market size was valued at USD 32.89 billion in 2023 and is projected to grow from USD 34.88 billion in 2024 to USD 55.75 billion by 2031, exhibiting a CAGR of 6.93% during the forecast period.

The market is witnessing significant growth, driven by increasing consumer demand for outdoor and water-based recreational activities. This expansion is primarily attributed to rising disposable incomes, expanding middle-class population, and increased preference for leisure activities such as boating, fishing, and water sports.

Major companies operating in the recreational boat market are Ferretti S.P.A, Brunswick Corporation, BENETEAU SA, Malibu Inc., Caterpillar, Yamaha Motor Corporation, MacGregor, Sunseeker, Azimut Benetti S.p.A, MasterCraft Boat Holdings, Inc., Bass Pro, BRP, Bryton, American Sail Inc, and White River Marine Group.

Advancements in boat design and technology, including eco-friendly propulsion systems and enhanced safety features, are further enhancing the appeal of recreational boating. The market is further benefitting from the rising popularity of luxury yachting and waterfront tourism, spurring the demand for high-end vessels.

- In January 2025, BENETEAU reinforced its commitment to sustainable pleasure boating by incorporating Elium® resin into the production of the Oceanis Yacht 60. This innovation aligns with the company's efforts to minimize environmental impact while ensuring high performance and an enhanced sailing experiences.

Key Highlights

- The recreational boat industry size was recorded at USD 32.89 billion in 2023.

- The market is projected to grow at a CAGR of 6.93% from 2024 to 2031.

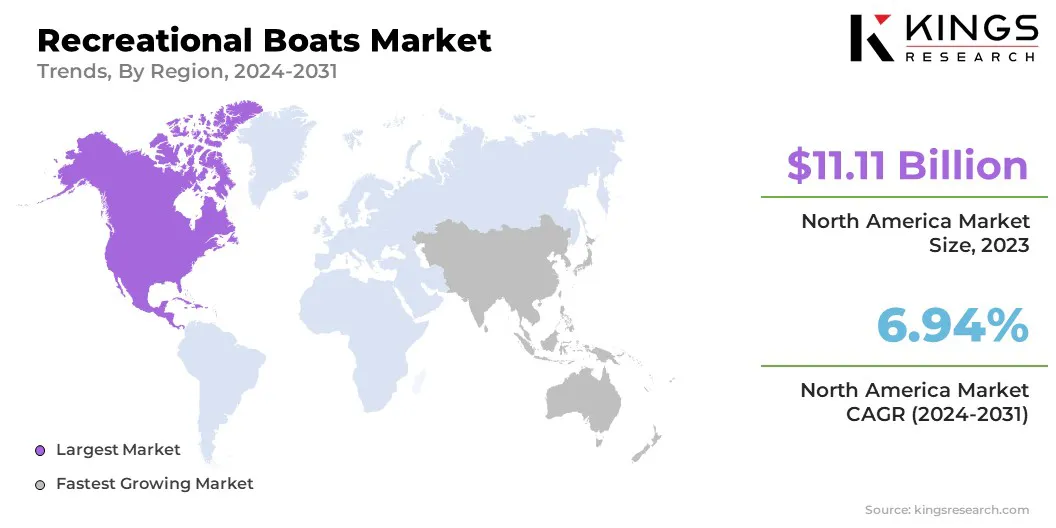

- North America held a share of 33.78% in 2023, valued at USD 11.11 billion.

- The yachts segment garnered USD 8.81 billion in revenue in 2023.

- The internal combustion engine segment is expected to reach USD 32.22 billion by 2031.

- The fishing segment is anticipated to witness the fastest CAGR of 6.98% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 7.86% through the projection period.

Market Driver

"Rising Popularity of Outdoor Activities"

The growing popularity of outdoor activities is boosting the expansion of the recreational boat market. As people seek to disconnect from digital life and engage with nature boating, fishing, and watersports have emerged as preferred leisure activities particularly among younger generations who prioritize experiences over material possessions.

The growing emphasis om wellness culture and active lifestyles further fuels demand. Additionally, social media’s promotion of scenic water-based experiences contributes to market growth by enhancing consumer interest in recreational boating.

- In February 2025, Lund Boats, a leading manufacturer of aluminum and fiberglass fishing boats, partnered with Indianapolis Colts wide receiver Michael Pittman Jr. in an exclusive brand collaboration. This collaboration aims to expand Lund’s presence in the Midwest by establishing new dealerships, enhancing distribution capabilities, and improving accessibility to Lund products and services.

Market Challenge

"Seasonality and Weather Dependence"

Seasonality and weather dependence pose a significant challenge to the development of the recreational boat market. Demand typically peaks during warmer months, with sales declining in colder climates due to shorter boating seasons.

Adverse weather, including storms and natural disasters, can further limit boating opportunities, deterring purchases, and cause vessel damage. These fluctuations create market uncertainty, restricting consistent growth for manufactured and retailers.

Manufacturers can address this challenge by developing boats suitable for year-round use, such aswinter-ready models for ice fishing or all-weather vessels. Introducing modular or compact boat designs that are easier to store and maintain during the off-season can enhance usability and increase sales.

Retailers can mitigate fluctuations by diversifying their business models, including boat rental or charter services, offering consumers access ownership commitments.

Expanding into regions with stable weather patterns or tapping into international markets can further reduce seasonal impacts. Through innovation, service flexibility, and global expansion, industry players can achieve more sustained, year-round growth.

Market Trend

"Increasing Adoption of Electric and Hybrid-Powered Boats"

The increasing focus on sustainability is leading to a nptable shift toward cleaner and greener boating options, influencing the recreational boat market. Electric boats, with zero emissions and quieter operations, are gaining popularity among eco-conscious consumers. Hybrid boats, combining traditional fuel engines with electric power, offer a sustainable alternative with extended range.

This trend is fueled by advancements in battery technology, government support for reen initiatives, and growing demand for sustainable leisure options.

- In January 2025, CRN launched its latest full-custom pleasure vessel, M/Y Amor à Vida, at the Ferretti Group Superyacht Yard. Constructed with a steel and aluminum displacement hull, the yacht was unveiled in a private ceremony.

Recreational Boat Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Yachts, Sailboats, Personal Watercrafts, Inflatables, Others |

|

By Propulsion |

Internal Combustion Engine, Electric |

|

By Application |

Watersports, Fishing |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Yachts, Sailboats, Personal Watercrafts, Inflatables, and Others): The yachts segment earned USD 8.81 billion in 2023 due to increasing demand for luxury vessels, enhanced onboard amenities, and the growing popularity of waterfront tourism.

- By Propulsion (Internal Combustion Engine, Electric): The internal combustion engine segment held a share of 57.87% in 2023, largely attributed to its established dominance in recreational boating, offering superior range, power, and availability compared to electric alternatives.

- By Application (Watersports and Fishing): The watersports segment is projected to reach USD 34.41 billion by 2031, owing to the growing popularity of water-based recreational activities such as wakeboarding, jet skiing, and surfing, along with increasing consumer interest in adventure sports.

Recreational Boat Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America recreational boat market captured a notable share of around 33.78% in 2023, valued at USD 11.11 billion. This dominance is reinforced by the region's well-established boating culture, expansive coastlines, and high disposable income.

The United States, in particular, is a major contributing significantly to this growtth, supported by a robust demand for recreational boating activities, such as fishing, watersports, and cruising. The presence of leading boat manufacturers and distributors, favorable year-round boating conditions, and substantial investments in recreational infrastructure, including marinas and boating facilities.

- In June 2024, Mercury Marine, a division of Brunswick Corporation, launched the Avator™ 75e and 110e electric outboards, expanding its all-electric propulsion lineup, which aincludes the Avator 7.5e, 20e, and 35e outboards.

Asia-Pacific recreational boat industry is poised to grow at a robust CAGR of 7.86% over the forecast period. This growth is supported by the rise in disposable incomes, rapid urbanization, and a growing middle class with a increasing interest in leisure activities.

The region's expanding tourism industry, particularly in coastal and island destinations, is further contributing to the growing demand for recreational boating. Governments in several Asia-Pacific nations are supporting this growth through investments in infrastructure, including marinas and recreational boating facilities.

Regulatory Frameworks:

- The European Commission's Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs oversees regulations within the recreational craft sector in Europe under the Recreational Craft Directive (RCD). The RCD establishes technical requirements for design, construction, and safety to ensure they meet environmental and safety standards before market entry.

- Globally, the International Maritime Organization (IMO), a United Nations agency, sets standards for vehicle safety, environmental compliance, including in the recreational boating sector.

- In the U.S., the United States Coast Guard (USCG) is responsible for regulating recreational boating safety through various laws, standards, and guidelines to ensures tcompliance with safety, environmental, and operational requirements.

- The Environmental Protection Agency (EPA) regulates recreational boats in the United States under the Clean Water Act (CWA) to protect water quality.

Competitive Landscape

Major players operating in the recreational boat industry focus on product differentiation through advanced technology, sustainable manufacturing practices, and customization options to attract consumers.

Major corporations invest heavily in research and development to improve boat performance, safety features, and environmental sustainability, while newer entrants often leverage cutting-edge technologies, such as electric propulsion and smart boating systems, to gain a competitive edge.

Companies frequently engage in strategic partnerships, mergers, and acquisitions to expand their market reach and diversify product portfolios.

- In July 2024, Le Boat and Groupe Beneteau's Delphia brand in Poland entered an agreement for Le Boat to invest over £100 million in its international fleet over the next decade.

List of Key Companies in Recreational Boat Market:

- Ferretti S.P.A

- Brunswick Corporation

- BENETEAU SA

- Malibu Inc.

- Caterpillar

- Yamaha Motor Corporation

- MacGregor

- Sunseeker

- Azimut Benetti S.p.A

- MasterCraft Boat Holdings, Inc.

- Bass Pro

- BRP

- Bryton

- American Sail Inc

- White River Marine Group

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Azimut|Benetti Group and SEA Index® signed a landmark agreement to reduce carbon emissions in the yachting industry. The collaboration underscores their shared dedication to innovation and eco-conscious practices.

- In February 2025, MasterCraft Boat Company, a subsidary of MasterCraft Boat Holdings, appointed Action Water Sports as its newest authorized MasterCraft dealer in the Dallas-Fort Worth (DFW) market.

- In 2025, Sunseeker International unveiled the next-generation Sunseeker Manhattan 68 (2025) at boot Düsseldorf 2025, showcasing its advanced craftsmanship, innovative design, and adaptable living spaces.

- In January 2025, European Boating Industry (EBI) and boot Düsseldorf extended their collaboration for an additional three years, continuing their partnership until 2028.

- In January 2025, BENETEAU and Alpine announced a strategic collaboration to enhance innovation through design and quality.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)