Healthcare Medical Devices Biotechnology

Research Antibodies Market

Research Antibodies Market Size, Share, Growth & Industry Analysis, By Antibody (Monoclonal Antibodies, Polyclonal Antibodies), By Product (Primary Antibodies, Secondary Antibodies), By Antibody Source (Mouse, Rabbit, Goat, Other), By Technology, By Application and Regional Analysis, 2024-2031

Pages : 250

Base Year : 2023

Release : January 2025

Report ID: KR1232

Research Antibodies Market Size

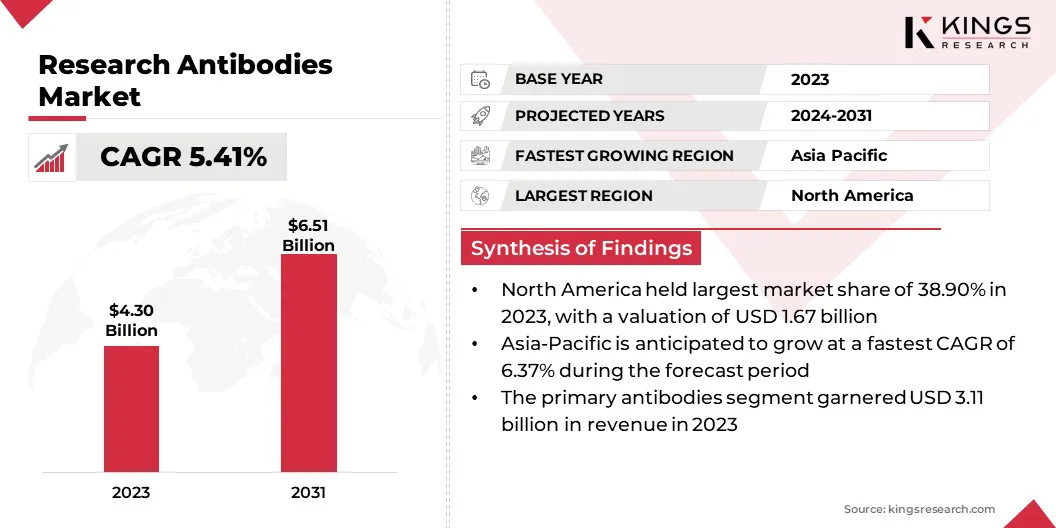

The global research antibodies market size was valued at USD 4.30 billion in 2023 and is projected to grow from USD 4.50 billion in 2024 to USD 6.51 billion by 2031, exhibiting a CAGR of 5.41% during the forecast period. The market is experiencing steady growth due to the rising research and development activities and the rapid surge in cancer cases.

In the scope of work, the report includes services offered by companies such as Abcam Plc., Becton, Dickinson and Company, Bio-Techne Corporation, Cell Signalling Technology, Inc., Jackson ImmunoResearch Inc., Merck KGaA, PerkinElmer, Inc., Proteintech Group, Inc., Santa Cruz Biotechnology Inc., Thermo Fisher Scientific, Inc., and others.

The rapid advancements in proteomics and genomics research are boosting the growth of the market. Proteomics, the study of proteins and their functions, and genomics, the complete DNA set of an organism, are essential for understanding the biological processes and disease mechanisms.

These fields require highly specific and reliable antibodies for protein identification, functional analysis, and gene expression studies. The growing incidence of diseases such as cancer, autoimmune diseases, and neurological disorders has increased the demand for research antibodies in diagnostics and drug development.

Additionally, innovations in antibody production technologies, including recombinant antibodies and monoclonal antibodies, have improved specificity and reproducibility, enhancing their research applications.

- For instance, in December 2024, DNAnexus, Inc., a leading provider of enterprise platforms for precision health data, and Panomics, Inc., a pioneer in AI-driven omics data management and discovery for biopharma, announced a partnership. This partnership aims to deliver a robust, integrated multi-omics data management and analysis solution for biopharma organizations, enhancing workflows in transcriptomics and proteomics data analysis to advance biomarker discovery and drug repurposing.

Research antibodies are specialized proteins that bind specific antigens, such as proteins, peptides, or other molecules, for use in scientific investigations. These antibodies are critical in various fields of research, including immunology, cell biology, and molecular biology, as they enable the detection, quantification, and localization of target molecules in complex biological samples.

Available in monoclonal and polyclonal forms, research antibodies are designed to recognize unique epitopes with high specificity and affinity.

These antibodies are extensively employed in experimental techniques such as western blotting, immunohistochemistry, flow cytometry, and enzyme-linked immunosorbent assays (ELISA), providing insights into protein function, cellular processes, and disease mechanisms.

Analyst’s Review

Significant investment in pharmaceutical research is fueling the development of research antibodies for extensive therapeutic applications. Companies are allocating substantial resources toward advancing technologies to enhance efficiency and specificity. M&A activities are facilitating consolidation, allowing key players to expand their global footprint and improve operational efficiency.

Key players must expand their therapeutic range and strenghthen research capabilities to address complex diseases such as cancer, neurological diseases, and infectious diseases.

- For instance, in February 2023, Roche launched the IDH1 R132H (MRQ-67) rabbit monoclonal primary antibody, along with the ATRX rabbit polyclonal antibody, to aid in evaluating mutation status in patients with brain tumors.

Research Antibodies Market Growth Factors

The increasing prevalence of chronic diseases such as cancer, diabetes, cardiovascular diseases, and neurodegenerative disorders is propelling the growth of the research antibodies market. This has led to an increasing demand for sophisticated diagnostic and therapeutic solutions.

The role of research antibodies in illuminating the underlying mechanisms of such diseases is invaluable for the development of targeted therapies and diagnostic tools. The growing emphasis on personalized medicine and the necessity of precise biomarkers to measure disease progression further support the adoption of research antibodies.

Moreover, advances in biotechnology and increasing investments in life sciences research are aiding this growth, leading to the discovery of new antibodies with improved specificity and sensitivity. Companies are further introducing novel cancer treatments, contributing to market expansion.

- For instance, in September 2023, Panacea Venture, in collaboration with the University of Texas MD Anderson Cancer Center, announced the establishment of Manaolana Oncology Inc., a newly formed enterprise dedicated to the research and development of antibody-based therapeutics targeting novel cancer antigens. Leveraging MD Anderson's cutting-edge antibody production technologies and robust intellectual property portfolio, Manaolana Oncology aims to advance innovative monoclonal antibodies (mAbs) and other antibody-based therapies, with the goal of accelerating their progression into clinical trials to address various cancer indications.

The research antibodies market faces challenges related to the complexities of antibody development, including batch-to-batch variability that affects the reproducibility of experiments and issues in validating the antibody for specific applications, reulting in unreliable results.

Moreover, the lenghthy and costly process of developing high-quality antibodies further exacerbates these challenges. Additionally, stringent testing and optimization to ensure specificity and avoid cross-reactivity contribute to research delays.

These challenges can be addressed by adopting solutions such as recombinant antibody technologies that ensure consistent quality and specificity, as well as automation and advanced screening techniques to streamline the validation process, reducing variability and improving reliability.

Research Antibodies Industry Trends

Advancements in single-cell analysis have significantly influenced the research antibodies market by offering precise insights into cellular functions and behaviors.

With the growing demand for personalized medicine and targeted therapies, single-cell analysis has become essential for studying cell population heterogeneity. Innovations in technologies such as single-cell RNA sequencing, flow cytometry, and mass cytometry have enhanced the ability to profile individual cells, leading to the discovery of novel biomarkers and therapeutic targets.

- For instance, in January 2025, Researchers at St. Jude Children's Research Hospital developed a machine-learning algorithm capable of scaling with single-cell data collections to provide more accurate results.

The increasing demand for specialized research antibodies targeting unique molecular markers at the single-cell level is boosted by the expanding applications in immunology, oncology, and neurobiology.

As the need to detect and analyze rare cell populations with high sensitivity grows,manufacturers are focusing on producing high-quality, reproducible, and customized antibodies to support advanced single-cell research. This trend is stimulating the expansion of the research antibodies market.

Increasing demand for immunotherapies and targeted treatments is highlighting the need for innovative antibody-based medicines. Therapeutic antibodies offer advantages such as reduced side effects, high specificity, and the potential for personalized treatment.

This trend is accelerating research and development efforts to create new antibody therapies, including monoclonal antibodies and antibody-drug conjugates, which aim to meet unmet medical needs and improve patient outcomes across various diseases.

Segmentation Analysis

The global market has been segmented based on antibody, product, antibody source, technology, application, and geography.

By Antibody

Based on antibody, the market has been bifurcated into monoclonal antibodies and polyclonal antibodies. The monoclonal antibodies segment led the research antibodies industry in 2023, reaching a valuation of USD 2.86 billion. Monoclonal antibodies are derived from a single cell clone and are highly specific to a single epitope on an antigen.

Due to their exceptional specificity and consistency across production batches, they are ideal for applications such as molecular biology research, diagnostics, and therapies that require precise target identification. They are generated from multiple B cell clones, enabling them to recognize various epitopes on an antigen.

The production of monoclonal antibodies typically involves immunizing animals with the target antigen. This rising application of monoclonal antibodies is fostering the growth of the segment.

By Product

Based on product, the research antibodies market has been categorized into primary antibodies and secondary antibodies. The primary antibodies segment captured the largest revenue share of 72.34% in 2023.

Primary antibodies are designed to bind specifically to a target antigen and are widely used in various analytical techniques, including flow cytometry, enzyme-linked immunosorbent assay (ELISA), immunohistochemistry (IHC), immunofluorescence (IF), and Western blotting due to their selective binding properties. This growing use is contributing significantly to the expansion of the segment.

By Antibody Source

Based on antibody source, the market has been segmented into mouse, rabbit, goat, and others. The mouse segment is expected to garner the highest revenue of USD 2.56 billion by 2031.

Mouse-derived antibodies, particularly monoclonal antibodies, are extensively utilized in the biotech and pharmaceutical sectors due to their exceptional specificity, high affinity, and consistent performance. These antibodies are integral to applications in diagnostics, therapeutic research, and drug development.

Their prevalence is largely attributed to advancements in hybridoma technology, enabling scalable production processes. Additionally, the availability of well-characterized mouse models and the ease of genetic engineering significantly enhance their utility in immunology and biomedical research.

By Technology

Based on technology, the market has been categorized into immunohistochemistry, immunofluorescence, western blotting, flow cytometry, immunoprecipitation, and enzyme - linked immunoassay. The immunohistochemistry segment captured the largest share of 25.45% in 2023.

Immunohistochemistry is commonly used in small-scale studies due to its cost-effectiveness and simplicity. Its adoption is increasing in clinical and high-throughput research settings due to improved reproducibility, efficiency, and reduced human error. Advances in multiplex immunohistochemistry allow simultaneous detection of multiple biomarkers, enhancing tissue analysis in oncology, neuroscience, and immunology.

The growing demand for precise biomarker visualization, coupled with advancements in image analysis software, is driving innovations in immunohistochemistry technology.

- For instance, in March 2023, Paige announced the integration of Mindpeak’s advanced artificial intelligence (AI) algorithms for qunatifying immunohistochemical biomarkers into its platform. Mindpeak, a software company specializing in image analysis, developed AI algorithms designed for the analysis of immunohistochemistry slides, particularly for lung and breast tissue, now accessible for Paige’s platform. This integration enhances the traditional IHC method, which was previously limited to single-parameter evaluations, with AI-driven approach.

By Application

Based on application, the market has been segmented into infectious diseases, immunology, oncology, stem cells, neurobiology, food & beverages, and others. The oncology segment garnered the highest revenue of USD 1.24 billion in 2023.

Antibodies are widely utilized in oncology for applications such as cancer biomarker discovery, immunohistochemistry, flow cytometry, and therapeutic target validation. The rising demand for personalized medicine and targeted therapies has further fueled the adoption of research antibodies in this field.

Additionally, advancements in antibody technologies, such as monoclonal and recombinant antibodies, have enhanced the accuracy and reliability of cancer research.

Research Antibodies Market Regional Analysis

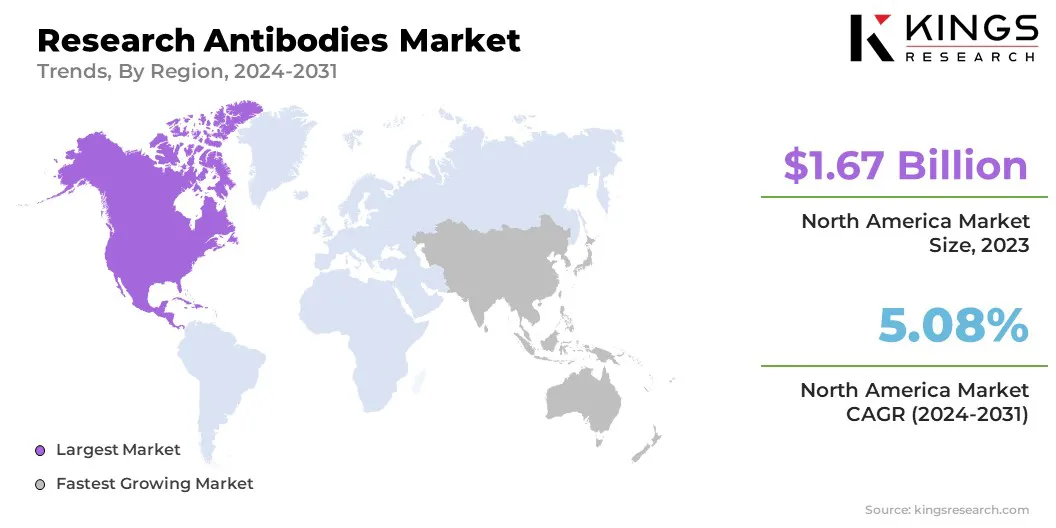

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America research antibodies market accounted for the largest share of 38.90 % in 2023, valued at USD 1.67 billion. This dominance is reinforced by advanced healthcare infrastructure, strong research and development (R&D) capabilities, and a presence of pharmaceutical and biotechnology companies.

The U.S. leads the market, fueled by the growing demand for personalized medicine, increasing funding for scientific research, and ongoing advancements in biotechnology. Furthermore, the regional market benefits from high healthcare spending and a robust regulatory framework that supports the development of novel therapeutics.

Canada also contributes to market growth with its expanding biotechnology sector and increasing investment in research and innovation. Additionally, the prevalence of chronic diseases and a rising focus on precision medicine are expected to boost demand for research antibodies.

- For instance, in February 2023, Charles River Laboratories International, Inc. launched its first Enzyme-Linked Immunosorbent Assay (ELISA) Kit for detecting residual host cell proteins in CHO-based biotherapeutics. The kit delivers industry-leading performance, with a sensitivity of 0.1 ng/mL and 90% antibody coverage.

Asia-Pacific research antibodies market is anticipated to witness the fastest growth at a CAGR of 6.37% over the forecast period. Increasing investments in healthcare and biotechnology, rising research activities, and a growing demand for personalized medicine are stimulating this rapid growth.

Countries such as China, India, Japan, and South Korea are at the forefront of the growth in the life sciences and biotechnology sectors. China, in particular, is experiencing significant progress in life sciences research and biotech, propelled by favorable government initiatives and a strong emphasis on innovation.

Japan and South Korea are making significant advancements in research and development, supported by advanced research facilities and well-established healthcare systems. The increasing number of academic and private research institutions in these regions are further boosting the demand for high-quality antibodies.

Competitive Landscape

The global research antibodies market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Research Antibodies Market

- Abcam Plc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Cell Signalling Technology, Inc.

- Jackson ImmunoResearch Inc.

- Merck KGaA

- PerkinElmer, Inc.

- Proteintech Group, Inc.

- Santa Cruz Biotechnology Inc.

- Thermo Fisher Scientific, Inc.

Key Industry Developments

- July 2023 (Acquisition): Bio-Techne Corporation acquired Lunaphore. The acquisition aims to strengthen the company’s leadership in spatial biology, particularly in translational and clinical research.

- July 2023 (Partnership): Cell Signaling Technology (CST) partnered with Lunaphore to facilitate the use of CST antibodies on Lunaphore's COMET platform, enhancing fully automated spatial biology.

- February 2023 (Partnership): Cell Signaling Technology (CST) partnered with Bio-Techne to incorporate Bio-Techne's Simple Western validation with CST antibodies.

The global research antibodies market has been segmented as:

By Antibody

- Monoclonal Antibodies

- Polyclonal Antibodies

By Product

- Primary Antibodies

- Secondary Antibodies

By Antibody Source

- Mouse

- Rabbit

- Goat

- Other

By Technology

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- Enzyme - linked Immunoassay

By Application

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership