BFSI

Retail Banking Market

Retail Banking Market Size, Share, Growth & Industry Analysis, By Type (Public Sector Banks, Private Sectors Banks, Foreign Banks, Others), By Service (Saving and Checking Account, Transactional Account, Personal Loan, Others), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR408

Retail Banking Market Size

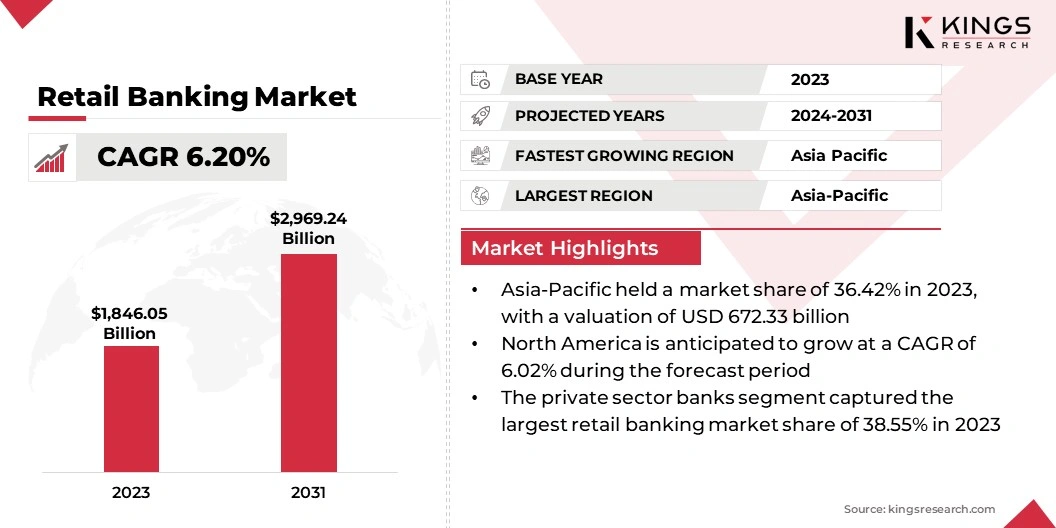

The global Retail Banking Market size was valued at USD 1,846.05 billion in 2023 and is projected to grow from USD 1,948.67 billion in 2024 to USD 2,969.24 billion by 2031, exhibiting a CAGR of 6.20% during the forecast period. Increasing adoption of mobile banking and rise of fintech collaboration are the major drivers for the market.

In the scope of work, the report includes services offered by companies such as The Hongkong and Shanghai Banking Corporation Limited, Deutsche Bank AG, Wells Fargo, JPMorgan Chase & Co., ICBC Co., Ltd., Barclays, Citigroup Inc., Mitsubishi UFJ Trust and Banking Corporation, China Construction Bank, Goldman Sachs, BNP Paribas, and others.

Retail banks can significantly enhance their operations and customer experiences by using Artificial Intelligence (AI) and Machine Learning (ML). These technologies can streamline a range of banking processes, from customer service to risk management. For instance, AI-powered chatbots can handle routine customer inquiries, freeing up human resources for more complex tasks. ML algorithms can be used to analyze vast amounts of customer data, enabling banks to offer personalized products and services that meet individual customer needs.

- Capgemini reports that only 6% of retail banks are prepared for large-scale AI-driven transformation, while 70% of bank CXOs plan to boost digital transformation investments by up to 10% in 2024.

AI and ML can also be instrumental in detecting and preventing fraudulent activities, as these technologies can quickly identify unusual patterns and behaviors that may indicate fraudulent transactions. AI-driven predictive analytics helps banks forecast customer behaviors and market trends, which allows improved decision-making.

By adopting AI and ML, retail banks can not only improve efficiency and reduce costs but also enhance customer satisfaction through tailored experiences. This opportunity offers a significant competitive advantage in a market where customer expectations for personalized and efficient services are constantly on the rise.

Retail banking, also known as consumer banking, offers banking services to individual customers rather than businesses or institutions. This branch of banking focuses on offering a range of financial products and services tailored to the needs of individual consumers. Retail banking services can include savings and checking accounts, personal loans, mortgages, credit and debit cards, and other financial products such as certificates of deposit (CDs) and retirement accounts.

Retail banks can offer both physical branch services and digital banking platforms, allowing customers to manage their finances conveniently. There are three main types of retail banks: commercial banks, credit unions, and savings and loan associations. Commercial banks can provide a broad range of services and are often large institutions with extensive networks.

Credit unions, on the other hand, are member-owned financial cooperatives that offer similar services to commercial banks but often with lower fees and better interest rates. Savings and loan associations primarily focus on accepting savings deposits and providing mortgage loans. Retail banking plays a crucial role in the financial system by providing individuals with access to essential financial services that help manage their daily financial activities and achieve long-term financial goals.

Analyst’s Review

The current landscape of the retail banking market reveals a dynamic environment where key players can adopt various strategies to maintain and enhance their market positions. Many companies are focusing on digital transformation initiatives to improve customer engagement and streamline operations. This shift toward digitalization is not just a response to changing consumer preferences but also a strategic move to reduce operational costs and enhance service efficiency.

Additionally, banks can emphasize customer-centric strategies, leveraging data analytics to offer personalized products and services. This focus on personalization can help banks differentiate themselves in a highly competitive market.

- In June 2024, Bitpanda expanded its collaboration with Deutsche Bank to offer real-time payment solutions in Germany, enhancing user experience with API-based account solutions and German IBANs. This initiative would strengthen Bitpanda’s position as a leading digital-asset trading platform in Europe.

Furthermore, the adoption of advanced technologies, such as AI, ML, and blockchain, can offer retail banks new avenues for innovation and growth. Companies are also exploring partnerships with fintech firms to accelerate innovation and expand their digital offerings.

However, regulatory compliance remains a significant challenge, requiring continuous adaptation and investment. Overall, the imperatives for key players in the retail banking market include embracing digital transformation, enhancing customer experience, and ensuring regulatory compliance to sustain growth and competitiveness.

Retail Banking Market Growth Factors

The increasing adoption of mobile banking is reshaping the retail banking market, as more consumers are turning to their smartphones for everyday financial transactions. Mobile banking provides customers with the convenience of managing their finances anytime and anywhere, making it a highly attractive option in today's fast-paced world. This trend is driven by the proliferation of smartphones and the widespread availability of high-speed internet, which are enabling banks to offer robust mobile applications with a wide range of functionalities.

Customers can check account balances, transfer funds, pay bills, and even apply for loans directly from their mobile devices. Banks are investing heavily in mobile app development to ensure these platforms are secure, user-friendly, and feature rich. The shift towards mobile banking is not only enhancing customer experience but also reducing the need for physical branches, leading to cost savings for banks. Furthermore, the real-time nature of mobile banking services is improving financial management for users by enabling instant access to their financial data.

Cybersecurity risks and data privacy concerns are among the most pressing challenges facing the retail banking industry today. With the increasing reliance on digital platforms for banking services, banks are becoming prime targets for cyberattacks, which can lead to significant financial losses and reputational damage. These risks are further exacerbated by the vast amounts of sensitive customer data, such as personal information, financial transactions, and account details that banks are required to protect.

A single breach can compromise this data, leading to identity theft, financial fraud, and loss of customer trust. Moreover, the regulatory landscape around data privacy is becoming more stringent. Governments are imposing stricter regulations on how banks handle and protect customer data. To mitigate these challenges, banks are investing in advanced cybersecurity measures, such as multi-factor authentication, encryption, and real-time monitoring systems, to detect and respond to threats promptly.

Additionally, they are adopting best practices for data governance and compliance to ensure that customer data is handled securely and in accordance with regulatory standards. These proactive measures are essential for banks to safeguard their operations and maintain the trust of their customers in an increasingly digital world.

Retail Banking Market Trends

The growing focus on financial inclusion is a significant trend in the global retail banking market, driven by the need to extend banking services to underserved and unbanked populations. Financial inclusion aims to provide access to essential financial services, such as savings accounts, credit, insurance, and payment systems, to individuals who are currently excluded from the formal financial system. This trend is gaining momentum as governments, international organizations, and financial institutions recognize the importance of financial inclusion in promoting economic development and reducing poverty.

- For instance, in March 2023, IDFC FIRST Bank participated in RBI's pilot project enabling offline payments, facilitating digital transactions even without network connectivity. This innovative payment solution, developed by Crunchfish under RBI's Regulatory Sandbox Program benefits both the merchants and customers.

Retail banks are responding to this trend by developing innovative products and services tailored to the needs of low-income and rural populations. These offerings often include microloans, mobile banking services, and low-fee accounts, which are designed to make banking more accessible and affordable.

Additionally, the rise of digital banking platforms is playing a crucial role in advancing financial inclusion, as they are enabling banks to reach remote areas and underserved communities without any physical presence. The focus on financial inclusion is expanding the customer base for retail banks which is contributing to broader economic growth and social development by equipping individuals with the financial tools they need to improve their livelihoods.

Segmentation Analysis

The global market has been segmented based on type, service, and geography.

By Type

Based on type, the market has been segmented into public sector banks, private sectors banks, foreign banks, and others. The private sector banks segment captured the largest retail banking market share of 38.55% in 2023, largely attributed to the aggressive adoption of digital technologies and customer-centric strategies.

Private banks are known for their agility in responding to market demands and their ability to innovate quickly. They are investing heavily in digital banking platforms, mobile applications, and AI-driven services to enhance customer experience, which are becoming increasingly vital in attracting and retaining customers.

Furthermore, private banks are focusing on expanding their product offerings to cater to a diverse range of customer needs, from personalized wealth management services to flexible loan products. Their emphasis on customer service, combined with competitive interest rates and a broader range of financial products, are helping them attract a larger customer base compared to public sector banks.

Additionally, private sector banks are implementing robust risk management frameworks that are improving their operational efficiency and financial stability, which are contributing to customer confidence and loyalty.

By Service

Based on service, the market has been classified into saving and checking account, transactional account, personal loan, and others. The transactional account segment is poised to record a staggering CAGR of 7.39% over the forecast period, driven by the increasing demand for seamless and convenient banking services.

Transactional accounts, which are used primarily for everyday banking activities such as deposits, withdrawals, and bill payments, are becoming more popular as consumers prioritize accessibility and ease of use. The growth of digital banking is playing a crucial role in this trend, since more consumers are shifting toward online and mobile platforms to manage their finances.

Banks are also enhancing their digital offerings, providing features like instant money transfers, real-time account updates, and integrated payment solutions that simplify everyday banking tasks. Furthermore, the rise of contactless payments and e-commerce is contributing to the increased use of transactional accounts, as consumers are relying on these accounts for quick and secure transactions. The competitive landscape is also encouraging banks to offer attractive features and low fees for transactional accounts, making them more appealing to a broader customer base.

Retail Banking Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific retail banking market share accounted for 36.42% and was valued at USD 672.33 billion in 2023, reflecting the region's dominance in the global retail banking landscape. This significant market share is attributed to the rapid economic growth in China, India, and Southeast Asian countries, where growth in middle-income groups is driving the demand for diverse financial products and services.

The region's large and increasingly affluent population is leading to a surge in retail banking activities, particularly in urban areas where consumers are seeking more sophisticated banking solutions.

Additionally, the widespread adoption of digital banking in Asia-Pacific is revolutionizing the way financial services are delivered, with many banks spearheading mobile banking innovations and digital payment systems. Government initiatives aimed at increasing financial inclusion are further contributing to the expansion of retail banking services, particularly in rural areas where access to traditional banking has been limited.

North America is expected to grow at the highest CAGR of 6.02% in the coming years, driven by the region's strong focus on digital transformation and customer-centric banking solutions. The retail banking sector in North America, particularly in the U.S. and Canada, is characterized by a high level of innovation, with banks investing heavily in artificial intelligence, machine learning, and blockchain to enhance operational efficiency and customer experience.

The region's mature banking infrastructure, coupled with a tech-savvy population, is enabling a seamless transition to digital banking, which is a key driver of this growth. Moreover, North American banks are increasingly focusing on personalized banking experiences, leveraging big data analytics to offer customized financial products that meet the specific needs of their customers.

Regulatory environment in the region, while stringent, is also supporting innovation, encouraging banks to adopt new technologies that improve security and compliance. Additionally, the rising demand for contactless payments and mobile banking solutions is accelerating the shift toward digital channels, further propelling the retail banking market.

Competitive Landscape

The global retail banking market report provides valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Retail Banking Market

- The Hongkong and Shanghai Banking Corporation Limited

- Deutsche Bank AG

- Wells Fargo & Company

- JP Morgan Chase & Co.

- Industrial and Commercial Bank of China ( Asia ) Limited

- Barclays Bank Plc

- Citigroup, Inc.

- Mitsubishi UFJ Financial Group, Inc.

- China Construction Bank

- Goldman Sachs Group

- BNP Paribas

Key Industry Developments

- June 2024 (Acquisition): HSBC Bank integrated Citi’s retail wealth management portfolio from mainland China, encompassing investment assets, deposits, and wealth customers across 11 major cities, into its Wealth and Personal Banking operations.

- February 2024 (Acquisition): Barclays Bank UK PLC is acquiring Tesco’s retail banking business and forming a long-term partnership to offer Tesco-branded credit cards, personal loans, and deposits, aligning with Barclays’ customer base and complementing existing strategic partnerships.

The global retail banking market has been segmented:

By Type

- Public Sector Banks

- Private Sectors Banks

- Foreign Banks

- Others

By Service

- Saving and Checking Account

- Transactional Account

- Personal Loan

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership