Healthcare Medical Devices Biotechnology

Scaffold Technology Market

Scaffold Technology Market Size, Share, Growth & Industry Analysis, By Material (Synthetic Polymers, Natural Polymers, Biodegradable Materials, Others), By Technology (Nanofiber-based Scaffolds, Hydrogels, Freeze-drying, Electrospinning, Others), By Application (Tissue Engineering, Regenerative Medicine, Others), By End user, and Regional Analysis, 2024-2031

Pages : 200

Base Year : 2023

Release : April 2025

Report ID: KR1784

Market Definition

The market encompasses a range of biomaterial platforms and engineered systems used to support cell growth, tissue development, and regenerative medicine applications. It includes products and solutions designed for tissue engineering, drug discovery, and 3D cell culture.

The market involves research institutions, biotech firms, and medical device companies focused on developing therapeutic and diagnostic innovations. The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Scaffold Technology Market Overview

The global scaffold technology market size was valued at USD 1,665.2 million in 2023 and is projected to grow from USD 1,889.3 million in 2024 to USD 5,142.4 million by 2031, exhibiting a CAGR of 15.38% during the forecast period.

This market is registering robust growth, driven by the increasing adoption of regenerative medicine and tissue engineering in clinical and research settings. The demand for advanced solutions to support tissue repair and regeneration continues to grow as the global burden of chronic diseases, trauma injuries, and age-related degenerative conditions rises.

Technological advancements in biomaterials, nanotechnology, and 3D bioprinting have significantly improved the structural and functional properties of scaffolds, allowing for more precise cell growth and integration.

Major companies operating in the scaffold technology industry are Arch Therapeutics, Inc., ETS Tech Holdings, LLC., Organogenesis Inc, Smith+Nephew, BD, Molecular Matrix, Inc., PELOBIOTECH GmbH, Vericel Corporation, NuVasive, Inc., Stryker, PolyNovo Limited, PolyMedics Innovations, Acera Surgical Inc., Imbed Biosciences, and Anika Therapeutics, Inc.

This has broadened the application of scaffolds beyond tissue engineering to include drug development, cancer research, and organoid modeling. The expanding focus on personalized medicine has also accelerated the development of patient-specific scaffolds, enhancing therapeutic outcomes.

Additionally, increasing funding from public and private sectors, along with growing collaborations between research institutions and biotech firms, is fostering innovation and commercialization in the field.

- In May 2024, Takara Bio USA, Inc. launched the Lenti-X Transduction Sponge, the first commercial dissolvable microfluidic transduction enhancer based on scaffold technology. Developed in collaboration with Dr. Yevgeny Brudno's lab at NC State, the sponge utilizes a calcium-crosslinked alginate scaffold to enhance lentiviral gene delivery by colocalizing cells and virus within its 3D macroporous structure, offering a biocompatible, efficient alternative to traditional transduction methods.

Key Highlights

- The scaffold technology industry size was valued at USD 1,665.2 million in 2023.

- The market is projected to grow at a CAGR of 15.38% from 2024 to 2031.

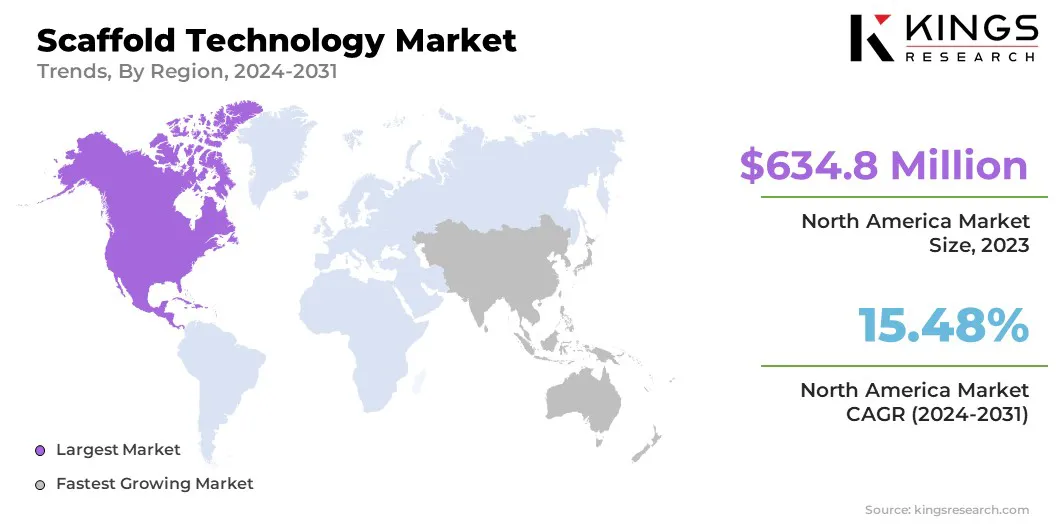

- North America held a market share of 38.12% in 2023, with a valuation of USD 634.8 million.

- The synthetic polymers segment garnered USD 601.0 million in revenue in 2023.

- The freeze-drying segment is expected to reach USD 1,419.2 million by 2031.

- The tissue engineering segment is expected to reach USD 2,005.9 million by 2031.

- The biotechnology & pharmaceutical companies segment is expected to reach USD 2,122.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.68% during the forecast period.

Market Driver

"Rising Clinical Acceptance and Chronic Disease Burden"

The scaffold technology market is registering significant expansion, fueled by the global rise in chronic conditions such as cardiovascular diseases, musculoskeletal disorders, diabetes, and cancer and the consequent higher volume of surgical interventions and tissue damage cases requiring effective repair and regeneration.

Scaffold technologies, which serve as three-dimensional structures to support cell attachment and tissue formation, have become crucial in improving healing outcomes in these patients. The demand is particularly strong in sectors like orthopedics, wound care, and cardiovascular repair, where tissue regeneration is a key aspect of recovery.

Simultaneously, clinical validation of scaffold technologies has played a vital role in enhancing their adoption. Over the years, scaffold-based products have shown consistent performance in promoting tissue regeneration, reducing complications, and improving patient recovery times.

Several peer-reviewed studies and clinical trials highlight their benefits, such as biocompatibility, resorbability, and targeted drug delivery, which boosts confidence among surgeons and healthcare institutions. This rising clinical trust is increasing the utilization of existing scaffold solutions and accelerating innovation & regulatory approvals, further propelling the market.

- In November 2024, Abbott announced two-year data from the LIFE-BTK clinical trial at the VIVA 2024 conference, demonstrating the long-term efficacy of its FDA-approved Esprit BTK Everolimus Eluting Resorbable Scaffold System for treating peripheral artery disease (PAD) below the knee. The results showed a 48% reduction in repeat procedures compared to balloon angioplasty, with 90.3% of patients avoiding reintervention at 24 months.

Market Challenge

"High Manufacturing Costs and Scalability Issues"

A significant challenge facing the scaffold technology market is the high cost of manufacturing and difficulties in scaling production while maintaining consistency and quality. Scaffold fabrication, particularly involving advanced biomaterials, intricate microstructures, or patient-specific designs, requires precision engineering and sophisticated equipment.

Technologies like electrospinning, 3D bioprinting, and freeze-drying, although effective, are capital-intensive and often yield low throughput, making large-scale production economically challenging.

Moreover, ensuring batch-to-batch consistency in structure, porosity, mechanical strength, and biodegradability is complex, especially when transitioning from laboratory-scale to commercial manufacturing. These inconsistencies can affect the scaffold’s clinical performance and delay regulatory approval or market adoption.

Companies are increasingly investing in automated, modular manufacturing platforms and exploring cost-effective biomaterials that can be produced at scale without compromising on performance.

Market Trend

"Synthetic & Bioresorbable Scaffolds and 3D Printing Advancements"

The scaffold technology market is registering a transformative shift driven by the growing adoption of synthetic & bioresorbable scaffolds and rapid advancements in biomaterials and 3D printing technologies.

Synthetic and bioresorbable scaffolds offer controlled degradation rates, reduced risk of immunogenicity, and better mechanical properties tailored for specific applications.

Unlike traditional biological scaffolds, synthetic and resorbable options eliminate the need for secondary surgeries to remove implants and allow the body’s tissues to gradually replace the scaffold over time, improving long-term outcomes.

- In April 2024, Abbott announced that the U.S. Food and Drug Administration (FDA) approved its everolimus-eluting bioresorbable scaffold, Esprit BTK, for the treatment of below-the-knee (BTK) infrapopliteal lesions. The approval, based on the LIFE-BTK clinical study, marks the first FDA authorization for a dedicated device to treat BTK lesions and signifies a major advancement in bioresorbable scaffold technology for PAD.

Simultaneously, innovations in biomaterials and 3D printing technologies are enabling the design of highly customized, patient-specific scaffolds with improved functionality.

New biomaterial formulations are enhancing scaffold strength, flexibility, and bioactivity, while 3D printing allows for precise architectural control, optimizing pore size, shape, and distribution to mimic natural tissue structures.

These technological advancements are accelerating the development of next-generation scaffolds, expanding their application across a wider range of therapeutic areas.

Scaffold Technology Market Report Snapshot

|

Segmentation |

Details |

|

By Material |

Synthetic Polymers, Natural Polymers, Biodegradable Materials, Others |

|

By Technology |

Nanofiber-based Scaffolds, Hydrogels, Freeze-drying, Electrospinning, Others |

|

By Application |

Tissue Engineering, Regenerative Medicine, Drug Discovery, Stem Cell Research, Others |

|

By End user |

Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, Hospitals & Diagnostic Centers, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Material (Synthetic Polymers, Natural Polymers, Biodegradable Materials, Others): The synthetic polymers segment earned USD 601.0 million in 2023, due to their high mechanical strength, ease of fabrication, and wide availability for diverse biomedical applications.

- By Technology (Nanofiber-based Scaffolds, Hydrogels, Freeze-drying, Electrospinning, and Others): The nanofiber-based scaffolds segment held 28.12% share of the market in 2023, due to their superior surface area, enhanced cell adhesion properties, and ability to mimic the extracellular matrix.

- By Application (Tissue Engineering, Regenerative Medicine, Drug Discovery, Stem Cell Research, and Others): The tissue engineering segment is projected to reach USD 2,005.9 million by 2031, owing to the growing demand for organ & tissue regeneration solutions and advancements in scaffold-supported therapies.

- By End user (Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, Hospitals & Diagnostic Centers, and Others): The biotechnology & pharmaceutical companies segment is projected to reach USD 2,122.7 million by 2031, owing to increased R&D investments and widespread adoption of scaffolds for drug screening and therapeutic development.

Scaffold Technology Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America scaffold technology market share stood around 38.12% in 2023, with a valuation of USD 634.8 million. This dominance is primarily attributed to the presence of leading biotechnology & pharmaceutical companies actively investing in scaffold-based research and commercialization.

The region benefits from strong infrastructure in biomedical research, advanced academic institutions, and high adoption of emerging technologies such as 3D bioprinting and nanofiber scaffolds.

The U.S., in particular, plays a critical role with its established network of tissue engineering labs and a high volume of clinical trials utilizing scaffold systems. Furthermore, the increasing prevalence of degenerative diseases and organ failure cases has accelerated the demand for regenerative medicine, further reinforcing North America’s leadership in the market.

Asia Pacific scaffold technology industry is expected to register the fastest growth in the market, with a projected CAGR of 16.68% over the forecast period. This growth is attributed to the expanding biomedical research capabilities, particularly in countries such as China, Japan, and South Korea.

These nations are heavily investing in regenerative medicine hubs and partnerships between universities and biotech firms, fueling scaffold innovation and application. China’s rapid infrastructure development in biomanufacturing and its strategic focus on cell therapy & personalized medicine are key accelerators.

Additionally, the increasing focus on stem cell research and rising healthcare investments across Southeast Asia are contributing to the growing regional demand for scaffold technologies in both research and therapeutic applications.

Regulatory Frameworks

- In the U.S., scaffold technologies intended for therapeutic use are regulated by the Food and Drug Administration (FDA), where they may be classified as medical devices, biologics, or combination products depending on their composition and function.

- In the European Union (EU), scaffold-based products are regulated under the Medical Device Regulation if used as medical devices.

- In China, scaffold technologies for clinical use fall under the regulatory purview of the National Medical Products Administration (NMPA), which requires pre-market approval and clinical evaluation for safety and efficacy.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates scaffold products under the Act on the Safety of Regenerative Medicine and the Pharmaceutical and Medical Device Act (PMD Act) when used in regenerative applications.

- In India, the Central Drugs Standard Control Organization (CDSCO) oversees scaffold technologies, particularly those involving human use, under the Drugs and Cosmetics Act and Rules, requiring clinical trial approval.

Competitive Landscape

The scaffold technology industry is characterized by companies striving to enhance their market presence through innovation, strategic partnerships, and portfolio diversification.

Key players are heavily investing in R&D to develop advanced scaffold materials and fabrication techniques, such as nanofiber scaffolds and bioactive hydrogels that offer improved biocompatibility and structural support for tissue regeneration.

Many are focusing on expanding their offerings in 3D cell culture systems and organoid models to cater to the growing demand from pharmaceutical and academic research sectors.

Collaborations with research institutions and clinical centers are common, aimed at accelerating the development and validation of next-generation scaffold platforms. Several market players are pursuing mergers and acquisitions to strengthen their technological capabilities and enter new geographic markets.

Additionally, companies are increasingly emphasizing customization, offering tailored scaffold solutions for specific applications in regenerative medicine, oncology, and drug screening. These strategies are shaping a dynamic and innovation-driven competitive landscape in the market.

- In February 2025, Levee Medical announced the successful close of its oversubscribed Series B financing, securing over USD 10 million. The funding will advance the development of the Voro Urologic Scaffold, an absorbable device aimed at reducing post-prostatectomy urinary incontinence, and support ongoing clinical studies, including the ARID feasibility study and an upcoming U.S. pivotal trial.

List of Key Companies in Scaffold Technology Market:

- Arch Therapeutics, Inc.

- ETS Tech Holdings, LLC.

- Organogenesis Inc

- Smith+Nephew

- BD

- Molecular Matrix, Inc.

- PELOBIOTECH GmbH

- Vericel Corporation

- NuVasive, Inc.

- Stryker

- PolyNovo Limited

- PolyMedics Innovations

- Acera Surgical Inc.

- Imbed Biosciences

- Anika Therapeutics, Inc.

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In March 2025, Levee Medical received FDA approval to initiate the ARID II pivotal clinical trial under an Investigational Device Exemption (IDE) to evaluate the Voro Urologic Scaffold for the treatment of post-prostatectomy stress urinary incontinence. The randomized controlled study aims to assess the safety and effectiveness of the scaffold in men undergoing robotic-assisted radical prostatectomy.

- In March 2025, BD (Becton, Dickinson and Company) announced the first patient treated in its IDE clinical trial evaluating the bioabsorbable GalaFLEX LITE Scaffold for reducing capsular contracture recurrence during breast implant revision surgery. The pivotal STANCE study is intended to support FDA Premarket Approval and demonstrates BD’s commitment to advancing tissue reconstruction using P4HB-based scaffold technology.

- In February 2025, Teleflex Incorporated announced its agreement to acquire the Vascular Intervention business of BIOTRONIK SE & Co. KG. The acquisition includes BIOTRONIK’s Freesolve, a sirolimus-eluting Resorbable Metallic Scaffold (RMS) that received CE Mark in 2024.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)