Healthcare Medical Devices Biotechnology

Single-Use Bioprocessing Market

Single-Use Bioprocessing Market Size, Share, Growth & Industry Analysis, By Product (Bioreactors, Tubing and Connectors, Pumps & Filters, Others), By Application (Upstream Processing, Downstream Processing, Others), By End-User (Biopharmaceutical Manufacturers, Research and Academic Institutions & Others), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1339

Market Definition

Single-use bioprocessing involves the use of disposable, pre-sterilized components and equipment in the manufacturing of biopharmaceuticals and biologics. These components, including bioreactors, filtration systems, bags, and tubing, are employed for a single production cycle and are discarded after use, eliminating the need for cleaning, sterilization, and validation of reusable equipment.

This approach offers benefits such as reduced risk of contamination, lower operational costs, faster setup times, and increased flexibility, making it an increasingly preferred in biomanufacturing processes, particularly for vaccines, cell and gene therapies, and monoclonal antibodies.

Single-Use Bioprocessing Market Overview

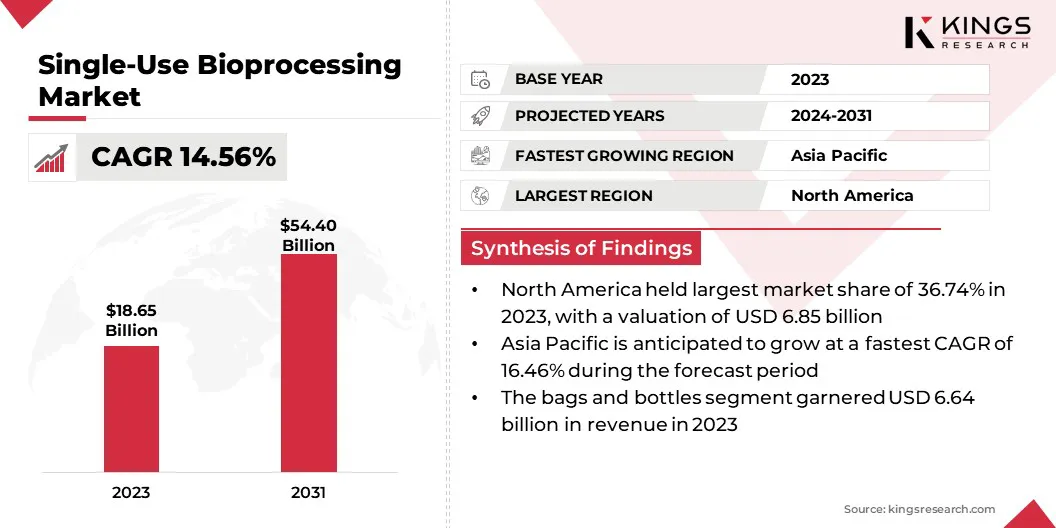

Global single-use bioprocessing market size was USD 18.65 billion in 2023, which is estimated to be valued at USD 21.01 billion in 2024 and reach USD 54.40 billion by 2031, growing at a CAGR of 14.56% from 2024 to 2031.

The growth of the market is driven by increasing demand for cost-effective and scalable production solutions, advancements in biopharmaceutical manufacturing, and the rising adoption of single-use technologies to minimize contamination risks and reduce operational costs. Additionally, strong government investments in biomanufacturing and the expanding biopharmaceutical sector further fuel market growth.

Major companies operating in the single-use bioprocessing market are DH Life Sciences, LLC, Merck KGaA, Thermo Fisher Scientific Inc., Saint-Gobain, Sartorius AG, 3M, Eaton, ALFA LAVAL, Lonza Group Ltd., Entegris, Parker Hannifin Corp., Avantor Inc., PBS Biotech Inc., Meissner Filtration Products, Eppendorf SE, and others.

The increasing demand for biopharmaceuticals due to the rising prevalence of chronic diseases is a significant factor contributing to the growth of the market.

- According to the Spanish Network of Cancer Registries (REDECAN), Spain recorded approximately 279,260 new cancer cases in 2023, with colorectal, lung, and urinary bladder cancers among the most prevalent.

This surge in cancer diagnoses highlights the urgent need for innovative treatments and therapies, creating a demand for single-use technologies and related products for drug development. The increasing focus on novel therapies for chronic conditions such as cancer is expected to further boost demand for single-use bioprocessing solutions.

Key Highlights:

- The single-use bioprocessing industry size was recorded at USD 18.65 billion in 2023.

- The market is projected to grow at a CAGR of 14.56% from 2024 to 2031.

- North America held a share of 36.74% in 2023, valued at USD 6.85 billion.

- The bags and bottles segment garnered USD 6.64 billion in revenue in 2023.

- The biopharmaceutical manufacturers segment is expected to reach USD 25.94 billion by 2031.

- The upstream processing segment is poised to grow at a robust CAGR of 15.49% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 16.46% over the projection period.

Market Driver

"Increased Investment in Cell Therapy Research and Development"

The expansion of cell therapy production and investment is fueling the growth of the single-use bioprocessing market. Cell therapies, including CAR-T cell therapies and stem cell treatments, have gained significant traction, attracting substantial investment from both private and public sectors.

Companies are allocating considerable resources to expand their cell therapy production capabilities, often leveraging single-use bioprocessing technologies for cost-effective scalability and flexibility. This surge in investment is enhancing production capacity, leading to their widespread adoption in the cell therapy manufacturing.

- According to Global Genes, as of 2023, 76 cell and gene therapies had been launched worldwide, more than double the number in 2013. Additionally, spending on cell and gene therapies reached $5.9 billion in 2023, reflecting a 38 percent increase compared to the previous year.

Market Challenge

"High Initial Investment in Single-Use Bioprocessing Systems"

A critical challenge impacting the growth of the single-use bioprocessing industry is the high initial investment required for these systems. The upfront costs can be prohibitive, particularly for smaller companies or those with limited financial resources.

To overcome this challenge, several companies are opting for a gradual adoption strategy, integrating single-use technologies in stages to manage capital expenses more effectively.

Additionally, efforts are being made to enhance the cost-efficiency of these systems, along with offering more flexible financing options, thereby reducing the financial strain and promoting broader adoption across the industry.

Market Trend

"Adoption of Single-Use Technologies to Mitigate Cross-Contamination"

The increasing adoption of single-use technologies by biopharmaceutical companies to minimize the risk of cross-contamination is expected to significantly fuel the growth of the single-use bioprocessing market.

- In April 2023, Cytiva, a U.S.-based company, introduced its X-platform bioreactors, designed to optimize single-use upstream bioprocessing operations. These bioreactors enhance process efficiency through improved production capabilities, ergonomic design, and streamlined supply chain operations.

This rapid adoption enables manufacturers to quickly adjust to evolving market demands and production schedules, boosting operational efficiency.

Single-Use Bioprocessing Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Bioreactors (Single-use stirred tank bioreactors (SUBs), Single-use wave bioreactors, Single-use perfusion bioreactors, Others), Tubing and Connectors (Silicone tubing, Fluoropolymer tubing, Connectors), Bags and Bottles (Harvest bags, Buffer bags, Storage bags), Pumps & Filters (Depth filters, Membrane filters, Peristaltic pumps, Diaphragm pumps, Others), Others |

|

By Application |

Upstream Processing (Cell culture, Fermentation, Cell growth, Cell Expansion), Downstream Processing (Cell harvesting, Cell lysis, Protein Purification), Others |

|

By End-User |

Biopharmaceutical Manufacturers, Research and Academic Institutions, |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product (Bioreactors, Tubing and Connectors, Bags and Bottles, Pumps & Filters, and Others): The bags and bottles segment earned USD 6.64 billion in 2023 due to their cost-effectiveness, flexibility in handling various volumes, and ability to minimize contamination risks.

- By Application (Upstream Processing, Downstream Processing, and Others): The upstream processing segment held a share of 42.21% in 2023, as a result of its critical role in the early stages of biopharmaceutical production, where single-use technologies offer enhanced efficiency, scalability, and cost-effectiveness for cell culture, media preparation, and fermentation processes.

- By End-User (Biopharmaceutical Manufacturers, Research and Academic Institutions, and Government Research Agencies): The biopharmaceutical manufacturers segment is projected to reach USD 25.94 billion by 2031, owing to the increasing demand for efficient, cost-effective, and scalable manufacturing solutions to meet the growing need for biopharmaceutical products.

Single-Use Bioprocessing Market Regional Analysis

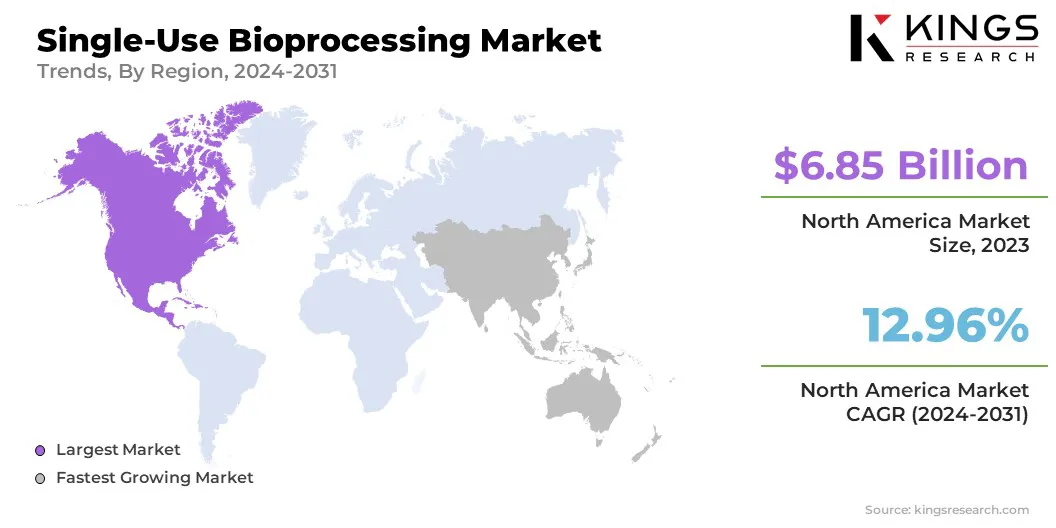

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America single-use bioprocessing market captured a share of 36.74% in 2023, valued at USD 6.85 billion. This is largely attributed to the increasing research and development spending, the presence of large manufacturing units, and the growing preference for disposable products.

The region’s well-established biopharmaceutical sector, along with the widespread availability of single-use assembly products from regional market leaders further supports this expansion.

Additionally, increased investment by the U.S. government in the bioprocessing industry, the presence of prominent industry players, and a rising number of product developments are expected to support regional market growth.

- In June 2023, the Canadian government announced an investment of approximately USD 2.1 billion in 36 biomanufacturing, vaccine, and therapeutics sectors across various provinces.

This investment is poised to strengthen the country's pandemic response and life sciences innovation, boosting demand for single-use technologies. By eliminating the need for expensive stainless-steel equipment and cleaning procedures, these technologies are expected to support regional market growth in the region.

Asia Pacific single-use bioprocessing industry is set to grow at a robust CAGR of 16.46% over the forecast period. This growth is propelled by rapid advancements in biomanufacturing technologies, increasing demand for biopharmaceuticals due to rising chronic disease prevalence, and strong government support for the life sciences and biopharmaceutical sectors.

Additionally, the expansion of healthcare infrastructure and the growing adoption of cost-effective, scalable production solutions among emerging markets in the region further contribute to domestic market growth.

Regulatory Framework:

- In the U.S., the Food and Drug Administration (FDA) oversees the regulation of single-use bioprocessing systems. Manufacturers must comply with the FDA's Current Good Manufacturing Practice (CGMP) regulations, which include requirements for equipment design, validation, and maintenance to ensure product quality and safety.

- In the UK, The Medicines and Healthcare Products Regulatory Agency (MHRA) enforces regulations related to the manufacture of medicinal products, including those utilizing single-use bioprocessing systems. Compliance with the EU's Good Manufacturing Practice (GMP) guidelines is mandatory, covering aspects such as equipment qualification and validation.

- In China, the National Medical Products Administration (NMPA) regulates the use of single-use bioprocessing technologies. Manufacturers are required to adhere to the Good Manufacturing Practice for Pharmaceutical Products, which includes standards for equipment used in the production of biologics.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates biomanufacturing processes. Manufacturers are required to adhere to the Drugs and Cosmetics Act and Rules, which include provisions for the use of equipment in the production of biologics.

- In Japan, The Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation of biomanufacturing practices. Manufacturers must comply with the Japanese GMP guidelines, which encompass requirements for equipment and facilities used in the production of pharmaceuticals, including single-use systems.

Competitive Landscape

The single-use bioprocessing industry is characterized by a number of participants, including both established corporations and established players. Market participants are adopting strategies such as product innovation and increased investment in research and development (R&D) to expand their market base.

By developing advanced and more efficient single-use systems, these companies aim to meet the growing demand for cost-effective, scalable biomanufacturing solutions.

Additionally, R&D initiatives focus on improving product performance, enhancing user experience, and addressing industry-specific challenges, which helps companies gain a competitive edge and contributes significantly to the market growth.

- In April 2024, SaniSure introduced Fill4Sure, a tailored single-use filling assembly aimed at accelerating drug time-to-market while enhancing security, efficiency, and repeatability in the drug product filling process. This assembly addresses key challenges in the fill-finish process, including high costs and limited speed, offering an effective solution to improve operational performance.

List of Key Companies in Single-Use Bioprocessing Market:

- DH Life Sciences, LLC

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Saint-Gobain

- Sartorius AG

- 3M

- Eaton

- ALFA LAVAL

- Lonza Group Ltd.

- Entegris

- Parker Hannifin Corp.

- Avantor Inc.

- PBS Biotech Inc.

- Meissner Filtration Products

- Eppendorf SE

Recent Developments (Product Launch)

- In June 2024, Thermo Fisher Scientific Inc. introduced biobased films, expanding its established Aegis and CX film offerings. These films, made from plant-based materials, enhance the sustainability of biologics therapy manufacturing by utilizing plant-based materials instead of fossil fuels, providing lower-carbon, biobased films for single-use technology bioprocessing containers (BPCs).

- In April 2024, Cytiva launched its Xcellerex magnetic mixer, a single-use mixing system specifically designed to tackle challenges in large-scale manufacturing of mAb, vaccines, and genomic medicines.

- In April 2023, Merck introduced its Ultimus Single-Use Process Container Film, known for its exceptional durability and leak resistance in bioprocessing liquid applications. The Ultimus film features a unique woven nylon structure, delivering superior bag strength, increased durability, and enhanced resilience.

- In September 2023, Getinge unveiled the AppliFlex ST GMP, an advanced single-use bioreactor system designed to bridge the gap between research and clinical production in cell and gene therapy, as well as mRNA production. Available in various sizes, this system delivers a complete cGMP manufacturing solution while maintaining high efficiency and ease of use.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership