Consumer Goods

Smart Bathroom Market

Smart Bathroom Market Size, Share, Growth & Industry Analysis, By Product Type (Smart Toilets, Smart Showers, Smart Faucets, Others), By Distribution Channel (Specialty Stores, Home Improvement Stores, Plumbing Supply Stores, Online Retailers), By End Use (Residential, Commercial), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR456

Market Definition

A smart bathroom is a technology-enhanced bathroom that integrates automation, Internet of Things (IoT) devices, and Artificial Intelligence (AI) for improved convenience, hygiene, and efficiency. These innovations provide personalized experiences, energy savings, and enhanced comfort while seamlessly connecting to smart home systems.

Smart Bathroom Market Overview

The global smart bathroom market size was valued at USD 7,650.0 million in 2023 and is projected to grow from USD 8,466.0 million in 2024 to USD 19,022.9 million by 2031, exhibiting a CAGR of 12.26% during the forecast period. This market is registering significant growth, driven by increasing consumer demand for convenience, hygiene, and energy efficiency.

Rapid urbanization, rising disposable incomes and the adoption of smart home technologies are fueling the market. Key innovations, such as smart toilets with bidet functions, touchless faucets, digital showers, and AI-powered voice controls, are enhancing user experiences while promoting water conservation through motion-sensor faucets, dual-flush toilets, and leak detection systems.

Major companies operating in the smart bathroom industry are KOHLER Co., Delta Faucet Company, TOTO, LTD, Duravit AG, Eros Sanitaryware, LIXIL Corporation, Laufen Bathrooms AG, Fortune Brands Innovations, Roca Sanitario, S.A, ASSA ABLOY, Jaquar, CERA, Cairngorm Capital Partners LLP, Jabra Sanitary Ware, and Swiss Madison.

Additionally, the integration of smart bathrooms with broader home automation systems and the increasing adoption of voice assistants are accelerating the market growth. The rising trend of luxury home renovations further contributes to the increasing adoption of smart bathroom products globally.

- For instance, in February 2024, Kohler introduced the PureWash E930 Bidet Toilet Seat, featuring adjustable water temperature and pressure, and contactless opening in a slim, modern design. The bidet seat integrates voice activation via Alexa or Google Home for hands-free control of the spray, dryer, and UV cleaning. Additional features include self-cleaning UV light, motion-activated opening/closing, adjustable warm-air drying, LED nightlight, and energy-saving functions, enhancing convenience, hygiene, and comfort in the bathroom.

.webp) Key Highlights:

Key Highlights:

- The smart bathroom industry size was valued at USD 7,650.0 million in 2023.

- The market is projected to grow at a CAGR of 12.26% from 2024 to 2031.

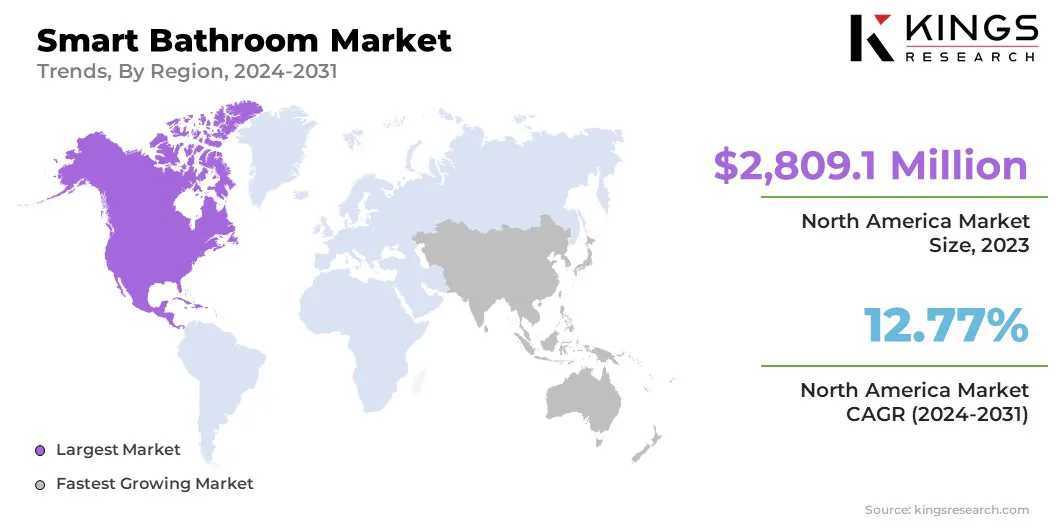

- North America held a market share of 36.72% in 2023, with a valuation of USD 2,809.1 million.

- The smart toilets segment garnered USD 3,572.5 million in revenue in 2023.

- The specialty stores segment is expected to reach USD 9,150.2 million by 2031.

- The residential segment is expected to reach USD 9,979.4 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.49% during the forecast period.

Market Driver

“Growing Consumer Preference for Convenience is Expanding the Market”

Consumer demand for convenience, hygiene, and personalized experiences is significantly propelling the smart bathroom market. With an increasing preference for touchless and automated systems, people are opting for solutions like sensor-based faucets, self-cleaning toilets, and smart showers that promote greater hygiene and reduce water waste.

The growing awareness of hygiene, especially in public and shared spaces, is also driving adoption, as users seek automated cleaning systems that require minimal manual effort.

Additionally, the rise in smart home integration is driving the market. Smart bathrooms are increasingly being integrated into broader home automation systems as consumers become more accustomed to interconnected home devices. This allows users to control everything from lighting and temperature to water usage and cleanliness directly from their smartphones or voice-controlled platforms.

With the advancements in IoT technology, innovative products such as app-controlled showers and voice-activated bidets have become more accessible, allowing for greater personalization of bathroom experiences while enhancing both user comfort and convenience.

- For instance, in February 2024, TOTO showcased its latest innovations at KBIS 2024, unveiling the NEOREST WX Wall-Hung Smart Bidet Toilet, the Soirée WASHLET+ S7A, and long-range IoT connectivity for smart restroom products. The Soirée WASHLET+ S7A enhances personal hygiene with customizable cleansing options. TOTO also introduced IoT-enabled plumbing solutions for remote monitoring and sustainability-focused designs.

Market Challenge

“High Costs and Data Privacy Concerns Hamper Market Growth”

Consumer adoption in the smart bathroom market can be hindered by the high costs and perceived complexity of these products. Many potential buyers are reluctant to invest in advanced bathroom technologies, due to their hefty price tags and the belief that these devices might be difficult to install or operate.

Manufacturers can simplify the setup process and offer affordable entry-level models to attract a broader audience. Privacy concerns around data security present another obstacle.

Many smart bathroom devices, such as smart toilets or mirrors, collect sensitive personal information, including health metrics like weight, heart rate, and even bathroom habits, which can raise fears about unauthorized access or misuse.

Companies can implement strong encryption methods to protect data, ensure that user data is stored locally rather than on cloud servers when possible, and offer clear, user-friendly privacy settings that allow customers to control what data is collected and shared.

Market Trend

“Integration of Voice-controlled Technology and AI is Rapidly Gaining Traction”

The integration of voice-controlled technology and AI in bathroom products is rapidly gaining traction in the smart bathroom market. Consumers are increasingly using voice commands to control various bathroom functions such as shower temperature adjustments, lighting, and toilet operations. This aligns with the broader trend of voice-assisted smart home systems, offering users a hands-free, more efficient experience.

Sustainability is another driving trend, with consumers prioritizing products that reduce water and energy consumption. Smart faucets, showerheads with water-saving features, and energy-efficient lighting are becoming more popular as individuals look to minimize their environmental impact. This growing emphasis on eco-conscious solutions is also supported by regulations encouraging the adoption of sustainable bathroom products.

- For instance, in February 2024, Kohler launched Anthem+, a smart shower system that controls water, steam, sound, and light through a single digital interface. It offers customizable presets, temperature zones, and spa experiences, along with KOHLER Konnect app integration for remote operation. Designed for convenience and luxury, Anthem+ enhances the at-home spa experience with smart technology and intuitive controls.

Smart Bathroom Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Smart Toilets, Smart Showers, Smart Faucets, Others |

|

By Distribution Channel |

Specialty Stores, Home Improvement Stores, Plumbing Supply Stores, Online Retailers |

|

By End Use |

Residential, Commercial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Smart Toilets, Smart Showers, Smart Faucets, Others): The smart toilets segment earned USD 3,572.5 million in 2023, due to increasing consumer preference for touchless technology, enhanced comfort features, and water-saving innovations.

- By Distribution Channel (Specialty Stores, Home Improvement Stores, Plumbing Supply Stores, and Online Retailers): The specialty stores segment held 48.33% share of the market in 2023, due to the availability of personalized customer service and a wide range of premium smart bathroom products catering to specific consumer preferences.

- By End Use (Residential, Commercial): The residential segment is projected to reach USD 9,979.4 million by 2031, owing to the rising adoption of smart homes and increasing consumer demand for luxury & convenience.

Smart Bathroom Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial smart bathroom market share of 36.72% in 2023, with a valuation of USD 2,809.1 million. The market in the region is driven by factors such as high consumer awareness, increasing adoption of smart home technologies, and a growing emphasis on water conservation and energy efficiency.

North America accounted for a substantial smart bathroom market share of 36.72% in 2023, with a valuation of USD 2,809.1 million. The market in the region is driven by factors such as high consumer awareness, increasing adoption of smart home technologies, and a growing emphasis on water conservation and energy efficiency.

The presence of key market players and a strong demand for luxury bathroom solutions in the U.S. and Canada further bolster market growth. Additionally, sustainable construction and smart infrastructure have fueled the adoption of smart toilets, touchless faucets, and automated shower systems.

The region is expected to maintain its dominant position in the global market, due to continuous technological advancements and increasing renovations of residential and commercial spaces.

- TOTO partnered with MachineQ to expand the adoption of its IoT-enabled smart restroom products across the U.S. The collaboration enhances restroom management by integrating TOTO’s smart-sensor flush valves, faucets, and soap dispensers with facility monitoring systems. Using MachineQ’s LoRaWAN network, the solution provides real-time data on water usage, maintenance needs, and user safety while improving operational efficiency.

The smart bathroom industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 13.49% over the forecast period. The region’s rapid growth is attributed to urbanization, rising disposable incomes, and increasing demand for smart home solutions in countries such as China, Japan, South Korea, and India.

Government initiatives supporting green buildings and smart city projects, particularly in China and India, are further driving the adoption of smart bathroom technologies. Additionally, changing consumer lifestyles, a growing preference for hygiene and convenience, and the expansion of luxury real estate are propelling the market.

Major manufacturers are increasingly investing in the region, leveraging advancements in IoT, AI-driven smart toilets, and water-efficient solutions to cater to the surging demand. Asia Pacific is poised to become a major hub for smart bathroom innovations in the coming years, due to the increasing population and technological progress.

Regulatory Frameworks

- In the U.S., the regulatory framework for smart bathroom products is governed by agencies such as the Environmental Protection Agency (EPA) and the Department of Energy (DOE), enforcing standards like WaterSense for water efficiency and ENERGY STAR for energy efficiency. The American National Standards Institute (ANSI) and the Occupational Safety and Health Administration (OSHA) also regulate safety, plumbing, and electrical compliance.

- In Europe, the European Union (EU) mandates compliance with the Ecodesign Directive and the Energy Performance of Buildings Directive (EPBD) to ensure water and energy efficiency in smart bathroom products.

- In China, the market operates under the regulatory oversight of the Standardization Administration of China (SAC) and the Ministry of Industry and Information Technology (MIIT). Regulations such as the China Compulsory Certification (CCC) ensure safety and efficiency, while water-saving standards align with national sustainability goals.

- In Japan, the Japan Industrial Standards (JIS) and the Ministry of Economy, Trade and Industry (METI) regulate smart bathroom products to ensure quality and performance. The country also promotes water efficiency through the Japan Water Conservation Standard and integrates smart technologies with the Internet of Things (IoT) under national digital transformation initiatives.

Competitive Landscape:

The global smart bathroom market is characterized by a large number of participants, including established corporations and rising organizations. Companies are focusing on technological advancements, integrating IoT, AI, and automation to enhance user experience, energy efficiency, and water conservation.

Product differentiation through smart features such as voice control, personalized presets, self-cleaning mechanisms, and connectivity with mobile apps is a key strategy to gain a competitive edge.

Additionally, manufacturers are investing in Research and Development (R&D) to introduce cutting-edge solutions like touchless faucets, smart mirrors, and bidet toilet seats with advanced hygiene functions.

Market participants are also expanding their global presence through strategic partnerships, mergers, acquisitions, and collaborations to strengthen distribution channels and enhance customer reach.

- In October 2024, Kohler and Samsung SmartThings announced their partnership to enhance water management and sustainability through smart home technology. This collaboration integrates Kohler’s Anthem smart showers with the SmartThings ecosystem, enabling users to monitor and manage their water consumption via the SmartThings app on Samsung Smart TVs, Family Hub, and mobile devices.

List of Key Companies in Smart Bathroom Market:

- KOHLER Co.

- Delta Faucet Company

- TOTO, LTD

- Duravit AG

- Eros Sanitaryware

- LIXIL Corporation

- Laufen Bathrooms AG

- Fortune Brands Innovations

- Roca Sanitario, S.A

- ASSA ABLOY

- Jaquar

- CERA

- Cairngorm Capital Partners LLP

- Jabra Sanitary Ware

- Swiss Madison

Recent Developments (New Product Launch/ New Technology Launch)

- In January 2025, HOROW introduced the T38 Smart Toilet, featuring an electric booster pump for efficient flushing, an advanced bidet system, a heated seat, a motion-activated lid, and a self-cleaning nozzle for enhanced hygiene and comfort. Its dual flush system, energy-saving modes, and LED night light make it a modern, eco-friendly choice for contemporary bathrooms.

- In February 2024, Kohler showcased Numi 2.0, its most advanced smart toilet, at the India Design 2024 exhibition, featuring voice assistant integration, heated personal cleansing, dual flush, motion-activated seat cover, and automatic UV sanitization to enhance hygiene and luxury.

- In February 2024, LG Electronics introduced innovative home solutions at KBIS 2024, including the Smart Bath and Shower Purifier for purified water with advanced filtration and real-time monitoring, the PuriCare HydroTower for air and humidity control, and system ironing with high-pressure steam for wrinkle-free clothes.

- In February 2024, Kohler introduced Rista, a 3D-printed bathroom sink that merges digital technology with traditional craftsmanship. The innovative 3D ceramic printing process replicates nature’s layering effects, resulting in a unique vessel design. The natural clay body with a clear glaze ensures a smooth, elegant finish, redefining modern bathroom esthetics.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)