Automotive and Transportation

Smart Port Market

Smart Port Market Size, Share, Growth & Industry Analysis, By Technology (Automation and Robotics, Blockchain, IoT, Artificial Intelligence and Machine Learning), By Component (Hardware, Software, Services), By Application (Port Operations Management, Fleet Management, Security and Safety, Energy Management), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2025

Report ID: KR1346

Market Definition

The smart port market refers to the integration of advanced technologies like Internet of Things (IoT), Artificial Intelligence (AI), blockchain, and automation into port operations to enhance efficiency, security, and sustainability.

This market focuses on optimizing logistics, reducing costs, and improving decision-making processes in ports, transforming them into interconnected, data-driven hubs for seamless and eco-friendly global trade.

Smart Port Market Overview

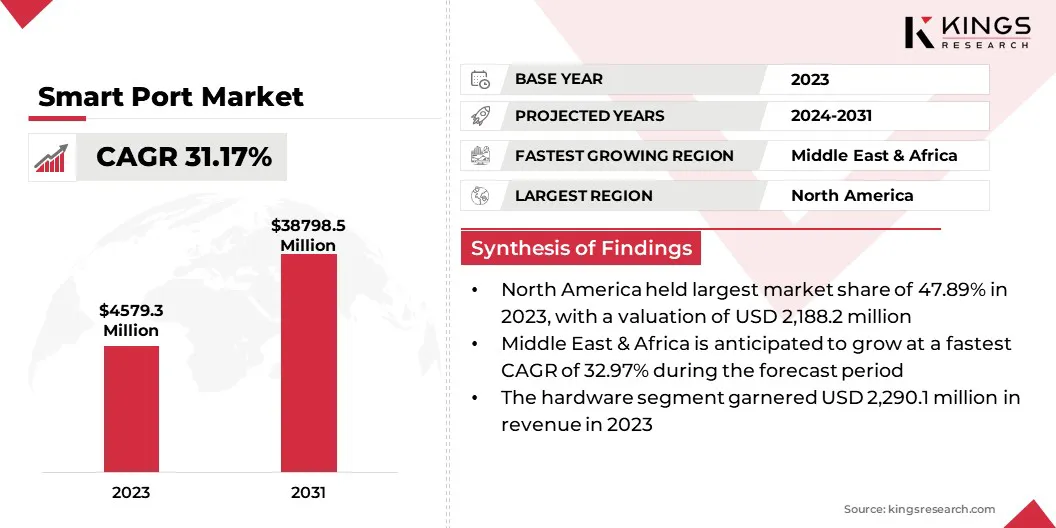

The global smart port market size was valued at USD 4,569.3 million in 2023, which is estimated to be valued at USD 5,807.2 million in 2024 and reach USD 38,798.5 million by 2031, growing at a CAGR of 31.17% from 2024 to 2031.

Technological advancements, such as IoT, AI, and automation, are key growth drivers for the market. These innovations enable enhanced operational efficiency, real-time data insights, sustainability, and improved security, responding to increasing global trade demands and evolving consumer expectations.

Major companies operating in the global market are Intel Corporation, Kaleris, Cisco Systems, Inc., KONGSBERG Gruppen ASA , Wipro, ABB, Trelleborg Marine and Infrastructure, Huawei Technologies Co., Ltd., IBM , Accenture, General Electric Company , Ramboll Group A/S, IKUSI , Envision Enterprise Solutions Pvt. Ltd., and Scientific Enterprises Ltd.

The smart port Industry is evolving rapidly as ports seek to modernize and enhance their operations through the integration of advanced technologies. Ports are becoming more efficient, secure, and sustainable by leveraging automation, digital tools, and real-time data.

This transformation not only boosts logistical capabilities but also creates more interconnected, responsive port ecosystems. As trade volumes grow and environmental considerations take precedence, smart ports are poised to redefine global trade dynamics, offering a more streamlined and resilient infrastructure for the future.

- In October 2024, the Saudi Ports Authority (MAWANI), Hamburg Port Authority (HPA), and HPC Hamburg Port Consulting (HPC) signed a strategic MOU at the IAPH World Port Conference. This collaboration aims to drive digitalization, optimize port infrastructure, and enhance workforce capacity, shaping smarter, greener, and more resilient ports while fostering innovation in global port management and trade connectivity. The partnership focuses on utilizing cutting-edge technologies to redefine port operations, sustainability, and efficiency along major trade routes.

Key Highlights:

- The global smart port market size was valued at USD 4,569.3 million in 2023.

- The market is projected to grow at a CAGR of 31.17% from 2024 to 2031.

- North America held a market share of 47.89% in 2023, with a valuation of USD 2,188.2 million.

- The automation and robotics segment garnered USD 1,531.3 million in revenue in 2023.

- The hardware segment is expected to reach USD 17,698.9 million by 2031.

- The security and safety segment is anticipated to register the fastest CAGR of 33.48% during the forecast period.

- The market in the Middle East & Africa is anticipated to grow at a CAGR of 32.97% during the forecast period.

Market Driver

"Increased Global Trade"

The surge in global trade is a significant growth driver for the smart port market, as rising trade volumes create a need for more efficient, scalable port operations.

- As highlighted by the World Economic Forum in February 2024, with 90% of global trade transported by sea, maintaining the flow of these vital waterways is essential. The English Channel, the world’s busiest shipping lane, sees over 500 vessels daily, connecting the North Sea to the Atlantic and linking the UK to continental Europe.

Amid the increasing traffic and complex logistics, ports are adopting advanced technologies like automation, IoT, and AI to streamline operations, reduce congestion, and improve turnaround times. These innovations enable ports to remain competitive, meet demand, and ensure smoother, faster global trade flows, driving further investment in smart port infrastructure.

- In October 2024, Tanco Holdings Bhd (THB) signed a memorandum of agreement with CCCC Dredging Southeast Asia (CDSA) to design Malaysia’s first smart AI container port in Port Dickson. CDSA will provide comprehensive design services for the project, which aims to enhance Malaysia’s maritime logistics, support global trade, and foster economic growth, leveraging AI and advanced technologies to position the port as a key Southeast Asia transshipment hub.

Market Challenge

"Cybersecurity Risks"

Cybersecurity risks are a significant challenge for the smart port market as increased reliance on digital systems makes ports more vulnerable to cyber-attacks and data breaches. These threats can disrupt operations, compromise sensitive information, and harm a port's reputation. Thus, ports need to invest in robust cybersecurity frameworks, regular security audits, and employee training on best practices.

Additionally, employing advanced encryption, AI-driven security solutions, and establishing collaboration with cybersecurity experts can enhance protection and ensure smooth, secure port operations.

- In October 2024, Marlink acquired 100% of Port-IT, a leading cybersecurity provider for the maritime industry. This acquisition strengthens Marlink’s cybersecurity capabilities, combining Port-IT’s expertise with Diverto’s, creating a dedicated unit of 130 experts to enhance global maritime, energy, and critical infrastructure security.

Market Trend

"AI and Automation Integration"

AI and automation integration is a significant trend in the smart port market, as ports increasingly adopt robotics, AI, and automated systems to enhance operational efficiency. These technologies streamline cargo handling, reduce human error, and speed up turnaround times.

Automated cranes, vehicles, and predictive analytics are helping ports optimize logistics, improve decision-making, and manage traffic more effectively. This shift toward intelligent, automated solutions not only boosts productivity but also enhances safety and reduces operational costs, making ports more competitive and sustainable.

- In September 2024, Seadronix launched its NAVISS 2.0 True-AI Ship Navigation and Monitoring System at SMM 2024 in Hamburg. The system offers advanced 360-degree situational awareness for ship crews, reducing human error and enhancing safety through AI-powered real-time monitoring and collision detection.

Smart Port Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Automation and Robotics, Blockchain, IoT, Artificial Intelligence and Machine Learning. |

|

By Component |

Hardware, Software, Services. |

|

By Application |

Port Operations Management, Fleet Management, Security and Safety, Energy Management. |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Automation and Robotics, Blockchain, IoT, Artificial Intelligence and Machine Learning): The automation and robotics segment earned USD 1,531.3 million in 2023, due to increased demand for efficient, cost-effective cargo handling and reduced operational delays in port logistics.

- By Component (Hardware, Software, Services): The hardware segment held 50.12% share of the market in 2023, due to the growing need for advanced infrastructure such as automated cranes, sensors, and communication systems that support port automation technologies.

- By Application (Port Operations Management, Fleet Management, Security and Safety, Energy Management): The port operations management segment is projected to reach USD 17,269.6 million by 2031, owing to the adoption of AI-driven systems that optimize port activities, improve efficiency, and reduce operational costs.

Smart Port Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 47.89% share of the global smart port market in 2023, with a valuation of USD 2,188.2 million. North America is expected to dominate the market, due to its strong infrastructure, technological advancements, and high adoption rates of automation and AI in port operations.

Major ports in the region are investing heavily in digital transformation to enhance efficiency, security, and sustainability. Government initiatives, coupled with a robust demand for smarter logistics solutions, position North America as a key player in shaping the future of global port operations.

The smart port Industry in the Middle East & Africa is poised for significant growth at a robust CAGR of 32.97% over the forecast period. The Middle East & Africa is emerging as the fastest-growing region for the market, driven by rapid infrastructure development and strategic investments in port modernization.

Countries in this region are increasingly adopting AI, IoT, and automation to enhance operational efficiency, reduce costs, and meet growing trade demands. As this region focuses on strengthening its position as a global logistics hub, the adoption of smart technologies in port operations is expected to accelerate, fueling growth in the region’s maritime industry.

- In December 2024, CMA CGM and Abu Dhabi Ports launched the CMA Terminals Khalifa Port in the UAE, a joint venture that boosts container capacity by 23%. Featuring advanced automation and sustainable infrastructure, the facility strengthens its position as a key global trade hub.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The Maritime Transportation Security Act (MTSA) is a significant piece of legislation which reinforces the national and global importance of security for the marine transportation system and provides a crucial framework for ensuring the security of maritime commerce and U.S. domestic ports.

- In the European Union (EU), the Parliament and the Council of Ministers established a framework for the provision of port services and common rules on the financial transparency of ports. The aim is to level the playing field in the sector, protect port operators against uncertainties, and create a conducive climate for efficient public and private investments.

- International Maritime Organization (IMO) is a United Nations specialized agency that is responsible for the safety and security of shipping and the prevention of marine and atmospheric pollution by ships. IMO measures cover all aspects of international shipping – including ship design, construction, equipment, manning, operation, and disposal – to ensure that this vital sector for remains safe, environmentally sound, energy efficient, and secure.

Competitive Landscape:

The global smart port market is characterized by a large number of participants, including both established corporations and rising organizations. Companies in the market are increasingly forming strategic partnerships to leverage complementary expertise in technology, logistics, and sustainability. These collaborations often focus on developing innovative solutions such as automation, AI, cybersecurity, and data integration, aiming to enhance operational efficiency, port security, and sustainability across global maritime operations.

- In September 2024, Trelleborg Marine and Infrastructure partnered with Arkas Holding to enhance fleet performance and reduce carbon emissions. Integrating Trelleborg’s TSX5 shaft power meters with Arkas’ fleet performance software allows real-time monitoring, optimizing efficiency, supporting EEXI and CII compliance, and contributing to a sustainable, smart port future.

List of Key Companies in Smart Port Market:

- Intel Corporation

- Kaleris

- Cisco Systems, Inc.

- KONGSBERG Gruppen ASA

- Wipro

- ABB

- Trelleborg Marine and Infrastructure

- Huawei Technologies Co., Ltd.

- IBM

- Accenture

- General Electric Company

- Ramboll Group A/S

- IKUSI

- Envision Enterprise Solutions Pvt. Ltd.

- Scientific Enterprises Ltd

Recent Developments(Launch/Collaboration/Consolidation/Acquisition)

- In February 2024, MacGregor launched the MacGregor GravityVibe self-unloading system, featuring a vibrating unloader to ease the discharge of coarse materials like wood chips, expanding cargo variety and increasing capacity, ultimately improving efficiency, environmental performance, and lowering maintenance costs.

- In February 2024, Intel, in collaboration with Amazon Web Services, Cisco, NTT DATA, Ericsson, and Nokia, deployed Intel-powered private 5G solutions globally to enhance AI and edge computing. These solutions enable scalable, secure, high-performance private networks, transforming industries like manufacturing, healthcare, and port, accelerating digital transformation.

- In January 2025, Cuxport, a deep-water terminal in Northern Germany, implemented Kaleris’ Navis Mixed Cargo Terminal Operating System to replace its legacy system. This solution optimizes terminal operations, centralizes workflows for breakbulk and container handling, and enhances operational efficiency, providing greater visibility and reduced manual processing for improved productivity.

- In July 2024, Naportec S.A. went live with Navis Octopi by Kaleris, replacing its legacy system. The new TOS implementation improved operational visibility, real-time KPI distribution, and integrated seven applications, including Gate Transactions, Customs, and Invoicing, significantly reducing paper use and enhancing efficiency.

- In January 2025, KONGSBERG consolidated its digital maritime initiatives within Kongsberg Maritime to support the industry’s transition toward renewable fuels, decarbonization, and digitalization. This strategic shift optimizes operations, enhancing energy utilization and positioning KONGSBERG as a leader in the maritime sector’s green transformation.

- In December 2024, Trelleborg Marine and Infrastructure acquired Mampaey Offshore Industries, enhancing its vessel berthing capabilities and expanding its marine solutions. This acquisition strengthens Trelleborg’s position in smart port technologies, offering advanced mooring and docking systems for efficient, sustainable port operations and improved customer service.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership