Consumer Goods

Snus Market

Snus Market Size, Share, Growth & Industry Analysis, By Product Type (Loose Snus, Portion Snus), By Flavor (Original, Flavored), By Distribution Channel (Tobacco Stores, Convenience Stores, Online Retailers, Supermarkets), and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : January 2025

Report ID: KR1250

Market Definition

Snus is a smokeless tobacco product of Swedish origin, composed of finely ground tobacco leaves that are moistened and flavored for oral use. Snus is considered an alternative to cigarettes, as it delivers nicotine without the combustion and smoke associated with smoking.

This eliminates exposure to many of the harmful chemicals found in cigarette smoke, such as tar and carbon monoxide. Snus is typically packaged in small, pre-portioned pouches designed for placement under the upper lip, allowing for extended and discreet consumption.

Snus Market Overview

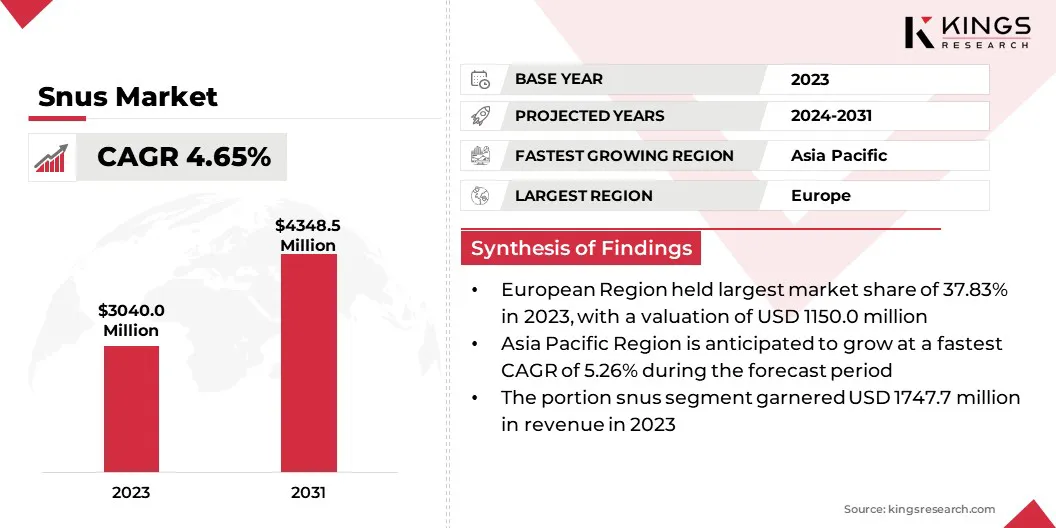

Global snus market size was valued at USD 3040.0 million in 2023 and is projected to grow from USD 3162.9 million in 2024 to USD 4348.5 million by 2031, exhibiting a CAGR of 4.65% during the forecast period.

The global increase in demand for snus is fueled by the rising demand for smokeless tobacco products, ease of use & convenience, increasing urbanization, and growing health consciousness among consumers.

In the scope of work, the report includes products offered by companies such as Swedish Match, Altria Group, Inc., BAT, Imperial Brands plc, Fiedler and Lundgren AB, GN Tobacco, Japan Tobacco Inc., Philip Morris Products S.A., Skruf, Habit Factory, Ministry of Snus, NGP Tobacco, Kurbits Snus, Mac Baren, Scandinavian Tobacco Group., and others.

The rising demand for snus is leading to product innovation. Companies are focusing on catering to health-conscious consumers and those looking to reduce nicotine dependence. They are further exploring new taste profiles and delivery mechanisms such as pouches with faster nicotine release and dissolvable snus.

- The National Youth Tobacco Survey published in December 2024 revealed that flavored nicotine pouches are highly prevalent among U.S. consumers, with 86.5% reporting use of flavored varieties. Mint emerged as the most popular flavor choice, followed by fruit. This data underscores the significant role that flavorings play in attracting and retaining consumers, particularly those experimenting with nicotine pouches for the first time.

Key Highlights:

- The global snus market size was recorded at USD 3040.0 million in 2023.

- The global market is projected to grow at a CAGR of 4.65% from 2024 to 2031.

- Europe held a market share of 37.83% in 2023, with a valuation of USD 1150.0 million.

- The flavored snus segment garnered USD 1583.5 million in revenue in 2023.

- The portion snus segment is expected to reach USD 2427.5 million by 2031.

- Tobacco stores are anticipated to generate USD 1222.2 million in revenue in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.26% during the forecast period.

Market Driver

"Flavored Snus Caters to Diverse Consumer Preferences"

The availability of a wide variety of flavors enables effective market segmentation and caters to diverse consumer preferences, driving overall snus market demand for snus.

Flavored snus options, including mint, fruit, and coffee, offer a more accessible alternative, appealing to a broader consumer base, including younger demographics. These flavors improve the overall sensory experience by masking the inherent tobacco taste, especially for new users.

- In January 2024, Koeber AG launched a range of exclusive snus flavors, including mint and citrus, in response to evolving consumer demand and preferences. The company pioneers in the flavor development of oral tobacco, offering tailored support in developing exceptional flavor profiles to tobacco manufacturers.

Market Challenge

"Regulations Hamper Snus Market Growth"

The market is registering substantial growth; however, it faces significant challenges, including restrictions on marketing and advertising and negative public perception. Regulatory constraints and public health concerns limit marketing and advertising activities for snus products, hindering the ability of manufacturers to promote their offerings and reach new consumer segments.

Manufacturers are supporting educational campaigns aimed at raising awareness about the relative risk profiles of various tobacco and nicotine products and addressing misinformation surrounding snus.

- In September 2024, BAT launched a global initiative called Omni with the goal of creating a smoke-free world. The campaign emphasizes the harm reduction potential of smokeless products, advocating for a transition from traditional cigarettes to less risky alternatives such as e-cigarettes and nicotine pouches.

Market Trend

"Snus: A Less Harmful Alternative to Cigarettes"

The perception of snus as a less harmful alternative to traditional cigarettes is a significant driver of its adoption, particularly among health-conscious consumers. Scientific studies have demonstrated a substantially lower risk of lung cancer and other respiratory cancers associated with snus use compared to smoking.

Switching to snus can be considered a harm reduction strategy for smokers seeking to reduce the health risks associated with nicotine consumption. Individuals can significantly mitigate their risk of developing serious smoking-related health conditions by transitioning to this less harmful form of nicotine intake.

- A study conducted by the Public Health Agency of Sweden in 2022 reveals that the adoption of snus and oral nicotine products has contributed to a significant reduction in smoking prevalence in the country. Smoking prevalence in Sweden declined from 16.5% in 2004 to 5.8% in 2022, the lowest rate among OECD countries. This decline is attributed, in part, to the widespread use of snus as a less harmful alternative to smoking.

Snus Market Report Snapshot

| Segmentation | Details |

| By Product Type | Loose Snus, Portion Snus |

| By Flavor | Original/Unflavored, Flavored |

| By Distribution Channel | Tobacco Stores, Convenience Stores, Online Retailers, Hypermarkets/Supermarkets |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Product Type (Loose Snus, Portion Snus): The portion snus segment earned USD 1747.7 million in 2023, due to convenience and discreetness of the pouches.

- By Flavor (Original/Unflavored, Flavored): The flavored snus segment held 52.09% share of the market in 2023, due to evolving consumer preferences and increasing product innovation.

- By Distribution Channel (Tobacco Stores, Convenience Stores, Online Retailers, Hypermarkets/Supermarkets): Tobacco stores are projected to reach USD 1573.3 million by 2031, owing to easy accessibility and wide range of products.

Snus Market Regional Analysis

Europe accounted for 37.83% share of the snus market and was valued at USD 1150.0 million in 2023. In Sweden and other Scandinavian countries like Norway, snus has a deeply rooted cultural history and enjoys widespread acceptance, establishing a robust market presence in Europe.

The increasing recognition of snus as a reduced-harm alternative to combustible cigarettes has prompted numerous European smokers, especially in Sweden, to transition to snus as a means of mitigating health risks. This perception of reduced harm is driving the adoption of snus within the European market.

The snus market in Asia Pacific is anticipated to grow at a fastest CAGR of 5.26% during the forecast period of 2024-2031. The region is home to a substantial portion of the global population, characterized by rapidly expanding urban centers. This large and increasingly urbanized population represents a significant potential consumer base for snus products.

Urbanization trends are introducing new consumer segments to snus, positioning it as a potentially more modern and convenient alternative to traditional tobacco products, thereby driving the market demand.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In 1992, the European Union (EU) implemented a ban on the sale of oral tobacco products in all member states except Sweden due to adverse health impacts. Smokeless tobacco products, including oral and chewing tobacco, contain nicotine, a toxic and highly addictive substance with well-documented negative health consequences and the potential to prolong nicotine addiction.

- In the U.S., the Food and Drug Administration (FDA) regulates the manufacturing, import, packaging, labeling, advertising, promotion, sale, and distribution of snus under the Family Smoking Prevention and Tobacco Control Act of 2009. This Act mandates that smokeless tobacco packaging include warning statements covering at least 30% of each side of the packaging.

- In India, the use of tobacco is regulated by the Cigarettes and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) Act, 2003 (COTPA). This Act prohibits public smoking and the advertisement, promotion, and sponsorship of tobacco products to control their availability and accessibility, with the aim of improving public health.

- The World Health Organization Framework Convention on Tobacco Control (WHO FCTC), adopted in May 2003, supports countries in implementing effective tobacco control and prevention strategies. This international treaty has been ratified by 180 countries globally, including 43 member states in the African region.

- In January 2023, Mexico amended its tobacco control law, implementing a comprehensive ban on smoking in public spaces, prohibitions on the promotion, advertising, and sponsorship of tobacco products, among other restrictions. Furthermore, it mandates that tobacco manufacturers and importers disclose information about the contents of their products to both the public and government authorities.

Competitive Landscape

The snus market is characterized by a large number of participants, including both established corporations and rising organizations.

Key market participants include Swedish Match, Altria Group, Inc., BAT, Imperial Brands plc, Fiedler and Lundgren AB, GN Tobacco, Japan Tobacco Inc., Philip Morris Products S.A., Skruf, Habit Factory, Ministry of Snus, NGP Tobacco, Kurbits Snus, Mac Baren, Scandinavian Tobacco Group, and others.

Snus manufacturers are creating new and appealing flavors to attract new consumers and cater to diverse preferences. They are also continuously innovating with pouch materials, sizes, and formats to enhance the user experience, including the development of more discreet and comfortable options.

Furthermore, manufacturers are investing in research and development (R&D) related to smokeless nicotine products to meet the growing demand for alternative cigarettes.

- In March 2024, Philip Morris International (PMI) expanded its presence in the Japanese market with the launch of IQOS ILUMA, a new line of scientifically substantiated smoke-free products. Utilizing innovative induction-heating technology, IQOS ILUMA heats tobacco from within, providing adult users with a consistent taste experience, eliminating tobacco residue, and offering a potentially less harmful alternative to traditional cigarettes.

List of Key Companies in Snus Market:

- Swedish Match

- Altria Group, Inc.

- BAT

- Imperial Brands plc

- Fiedler and Lundgren AB

- Swedish Smokeless Solutions

- Japan Tobacco Inc.

- Philip Morris Products S.A.

- Skruf

- Habit Factory

- Ministry of Snus

- NGP Tobacco

- Kurbits Snus

- Mac Baren

- Scandinavian Tobacco Group

- Others

Recent Developments

- In October 2024, Japan Tobacco Inc. (JT) acquired Vector Group Ltd., a manufacturer of cigarette products, to strengthen its presence and distribution network in the U.S. market. This acquisition is expected to broaden the retail availability of JT's snus products, such as Camel Snus, across the country.

- In July 2024, Philip Morris International (PMI) has signed a memorandum of understanding (MOU) with KT&G, South Korea’s leading manufacturer of tobacco and nicotine products, to collaborate on regulatory submissions required for commercialization of KT&G products in the U.S. Through this partnership, both companies aim to expand their market share within the U.S. heat-not-burn (HNB) product segment.

- In July 2024, R. J. Reynolds Vapor Company, BAT's indirect U.S. tobacco subsidiary, received marketing authorization from the FDA for its Vuse Alto device and the Golden Tobacco and Rich Tobacco flavor pods. This approval positions BAT with the largest portfolio of authorized vapor products in the U.S. under the Premarket Tobacco Product Application (PMTA) pathway.

- In June 2023, Altria Group, Inc. acquired NJOY Holdings, Inc., a manufacturer and distributor of electronic cigarettes and vaping products, to establish a presence in the smokeless tobacco market. The company's strategy focuses on enhancing NJOY's product awareness and appeal among adult smokers, as well as addressing distribution gaps and implementing merchandising improvements.

- In June 2023, Imperial Brands plc acquired a portfolio of nicotine pouches from TJP Labs, a Canadian tobacco manufacturer, to facilitate its entry into the U.S. market. Following further consumer testing, this product range was relaunched in 2024 under a new brand, leveraging the company’s existing U.S. sales force for distribution and marketing efforts.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)