Energy and Power

Solar Power Station Market

Solar Power Station Market Size, Share, Growth & Industry Analysis, By Technology (Solar PV, Concentrated Solar Power), By Capacity (Utility Scale, Distributed Scale), By End User (Industrial, Commercial, Residential), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR441

Solar Power Station Market Size

The global Solar Power Station Market size was valued at USD 147.42 billion in 2023 and is projected to grow from USD 156.00 billion in 2024 to USD 244.87 billion by 2031, exhibiting a CAGR of 6.65% during the forecast period. Government incentives and subsidies for solar power projects and declining costs of solar panels are augmenting the growth of the market.

In the scope of work, the report includes services offered by companies such as First Solar, Inc., SunPower Corporation, Enel Green Power S.p.A., NextEra Energy, Inc., Vivint, Inc, TotalEnergies, Ørsted A/S, Neoen, BayWa r.e. AG, Nextracker Inc., and others.

The integration of solar power stations with other renewable energy sources, particularly wind, presents a unique opportunity for diversified and stable energy production. Solar and wind energy are complementary; solar power stations generate electricity during the day, while wind energy is typically harvested at night or in cloudy conditions. This synergy mitigates the intermittent issues of each source, ensuring a more consistent and reliable energy supply.

- For instance, in December 2023, the International Renewable Energy Agency (IRENA) and the International Energy Agency (IEA) emphasized the need to triple the share of renewable energy in electricity generation to meet Paris Agreement targets. By 2030, 90% of global electricity must be sourced from renewables, providing significant growth opportunities in clean energy markets.

Combining these two renewable sources into hybrid systems allows energy producers to mitigate fluctuations in power generation, thereby reducing the need for costly energy storage systems.

Additionally, hybrid solar-wind power stations optimize land use by allowing both technologies to occupy the same space, thus maximizing energy output per square meter. As regions seek to reduce their reliance on fossil fuels and transition to greener energy sources, the integration of solar and wind energy in power stations is anticipated to be crucial for meeting growing energy demands sustainably and efficiently.

A solar power station is a large-scale facility that utilizes energy from the sun to generate electricity using photovoltaic (PV) panels or concentrated solar power (CSP) technology. These stations convert sunlight into direct current (DC) electricity, which is then transformed into alternating current (AC) for distribution through power grids.

Depending on the technology employed, solar power stations can vary in capacity, ranging from small plants that produce a few megawatts to large utility-scale facilities generating hundreds of megawatts. Solar power stations typically serve utility companies, industrial sectors, and corporate buyers committed to renewable energy sourcing.

Advancements in solar power stations technology, including improvements in PV panel efficiency, enhanced CSP system design, and better energy storage integration, have led to increased energy yields. These advancements, coupled with declining costs of solar components, have positioned solar power stations as crucial in reducing global carbon emissions and providing a stable, affordable energy source.

Analyst’s Review

Key players in the solar power station market are increasingly focused on expanding their portfolios through strategic investments in new and emerging renewable energy technologies. These companies are adopting a dual-pronged approach of enhancing operational efficiency and expanding their geographic footprint to tap into high-growth regions.

- For instance, in December 2023, CPV Renewable Power commenced operations at CPV Maple Hill Solar, a 100-MWAC solar power facility in Portage Township, Pennsylvania. Developed on a former coal mine site, the project includes 235,000 panels and was built by Gemma Power Systems, expanding CPV’s growing portfolio of utility-scale renewable energy projects.

Furthermore, numerous players are heavily investing in research and development (R&D) to improve solar panel efficiency and integrate energy storage solutions that mitigate the intermittency of solar power. Furthermore, partnerships and collaborations with governments and private entities are vital for securing long-term contracts, ensuring stable revenue streams, and addressing regulatory risks.

Current growth trends indicate that market leaders are capitalizing on declining solar technology costs to scale operations rapidly while sustaining profitability.

Key imperatives for these companies include bolstering their supply chain resilience, diversifying energy portfolios by integrating complementary renewable sources such as wind and enhancing grid management systems to ensure seamless energy distribution. By focusing on these strategies, companies are positioning themselves for long-term success in an increasingly competitive renewable energy market.

Solar Power Station Market Growth Factors

Government incentives and subsidies for solar power projects are accelerating the global transition to renewable energy, thereby propelling solar power station market growth. Governments around the world are implementing policies that reduce the financial burden of solar power development, making it more attractive for investors and utility companies.

These incentives often come in the form of tax credits, feed-in tariffs, and capital subsidies that lower upfront costs, while some regions also provide grants and low-interest loans for large-scale solar projects.

- For instance, in 2024, the Indian government launched the PM Surya Ghar: Muft Bijli Yojana, offering up to 40% subsidy on rooftop solar panel installation. The scheme targets 10 million households and aims to save the government Rs. 75,000 crore (USD 9.04 billion) annually. This initiative underscores India’s commitment to promoting solar energy adoption through financial incentives.

Government-driven programs significantly stimulate private investment and increase the competitiveness of solar energy against fossil fuel alternatives. For instance, in countries such as the United States, the Investment Tax Credit (ITC) facilitates the rapid growth of solar installations by allowing developers to recover a portion of their capital expenditures.

In the European Union, renewable energy policies are compelling member states to meet stringent carbon reduction targets, leading to increased adoption of solar power. As governments prioritize climate goals, their financial support is likely to be crucial for expanding solar power infrastructure globally.

High initial capital investment poses a significant challenge to the development of the solar power station market, particularly for large-scale utility projects. Solar power installations require substantial upfront financial outlay, including costs for purchasing photovoltaic (PV) panels, land acquisition, infrastructure setup, and labor.

Despite technological advancements reducing initial investments, they continue to pose a barrier for several developers, especially in regions with limited financing options. Furthermore, the costs associated with integrating solar power into existing grid systems and maintaining the infrastructure add to the overall financial burden.

Although solar energy has lower long-term operational costs of solar energy compared to traditional energy sources, its significant upfront investment may hinder adoption, especially for smaller entities or emerging markets.

To mitigate this challenge, innovative financing models such as power purchase agreements (PPAs), green bonds, and third-party ownership schemes are being introduced to the market. These models shift the financial burden to investors or service providers, enabling developers to overcome capital barriers and expedite the deployment of solar power stations.

Solar Power Station Industry Trends

The integration of energy storage systems with solar power is emerging as a notable trend influencing the solar power station market. Energy storage solutions, such as lithium-ion batteries, are integrated with solar installations to store excess electricity generated during peak sunlight hours. This stored energy is then released during the absence of sunlight, such as at night or in cloudy conditions, ensuring a continuous and reliable power supply.

- For instance, in February 2024, the Solar Energy Corporation of India (SECI) commissioned India’s largest battery energy storage system (BESS) in Rajnandgaon, Chhattisgarh. This 40 MW/120 MWh BESS, integrated with a 152.325 MWh solar PV plant, offers a dispatchable capacity of 100 MW AC (155.02 MW peak DC), thereby advancing India’s renewable energy infrastructure.

The increasing adoption of storage technologies is addressing one of the key limitations of solar energy. This trend is particularly significant as it enhances the flexibility of solar power stations, enabling them to provide more stable contributions to the energy grid.

Additionally, energy storage improves the economics of solar power by allowing operators to manage supply and demand more effectively, thereby reducing dependence on backup fossil fuel generators.

As battery technology advances and costs decline, energy storage is expected to be essential in supporting the broader deployment of solar power, positioning it as a more viable alternative to conventional energy sources.

Segmentation Analysis

The global market has been segmented on the basis of technology, capacity, end user, and geography.

By Technology

Based on technology, the market has been bifurcated into solar PV, and concentrated solar power. The solar photovoltaic (PV) segment captured the largest market share of 57.15% in 2023, largely attributed to the increasing demand for renewable energy solutions across residential, commercial, and industrial sectors.

Solar PV technology is favored for its scalability, cost-effectiveness, and ease of installation, making it the most popular choice for both small and large-scale solar projects. The declining costs of PV panels, supported by advancements in technology and mass production, are making solar energy more affordable, thus promoting broader adoption.

- In 2023, According to IRENA, accelerated deployment of solar PV and electrification could contribute 21% of COâ‚‚ emission reductions by 2050. Global solar capacity must reach over 8,000 gigawatts, 18 times current levels, to meet climate goals, highlighting solar PV’s critical role in the energy transition.

Additionally, government incentives, such as tax credits and subsidies, are accelerating the growth of PV installations, thereby bolstering the expansion of the market. PV systems are highly adaptable, allowing for decentralized energy generation, which is critical for regions with limited grid infrastructure.

The global shift toward decarbonization and reducing reliance on fossil fuels is propelling investments in PV projects. The dominance of the solar PV segment is reinforced by its key role in driving the renewable energy transition.

By Capacity

Based on capacity, the market has been classified into utility scale and distributed scale. The utility-scale segment led the solar power station market in 2023, reaching a valuation of USD 79.12 billion. This growth is primarily fueled by the rising demand for large-scale renewable energy solutions to meet global energy needs.

Utility-scale solar projects are rapidly advancing as countries aim to achieve climate goals and reduce carbon emissions. These large solar farms generate significant electricity, directly feeding the power grid to supply thousands of households and businesses. The ability of utility-scale solar stations to produce electricity at a lower cost per megawatt compared to smaller installations is contributing significantly to this growth.

Furthermore, favorable government policies, such as renewable portfolio standards and power purchase agreements (PPAs), are promoting investments in large-scale solar projects. Advances in solar panel efficiency and energy storage technology are further supporting the expansion of the segment.

As global energy consumption rises and the need for cleaner energy sources intensifies, the utility-scale segment is estimated to experience robust growth in the forthcoming years.

By End User

Based on end user, the market has been divided into industrial, commercial, and residential. The industrial segment is poised to record a staggering CAGR of 6.98% through the forecast period. This expansion is primarily propelled by the growing adoption of solar energy solutions to power manufacturing plants, processing units, and large-scale industrial operations.

The increasing focus on reducing operational costs and enhancing energy efficiency is prompting industries to shift toward renewable energy sources such as solar. With rising energy consumption and the volatility of fossil fuel prices, industries are seeking long-term energy solutions that offer cost stability and environmental benefits.

Large industrial facilities are increasingly integrating solar power systems, either through on-site installations or via partnerships with utility providers, to offset their energy needs and reduce carbon footprints.

Furthermore, regulatory pressures and sustainability mandates are compelling industries to adopt cleaner energy practices, thereby fueling the demand for solar installations. Government incentives, subsidies, and favorable financing models are facilitating the adoption of solar power in the industrial sector, bolstering the growth of the segment.

Solar Power Station Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

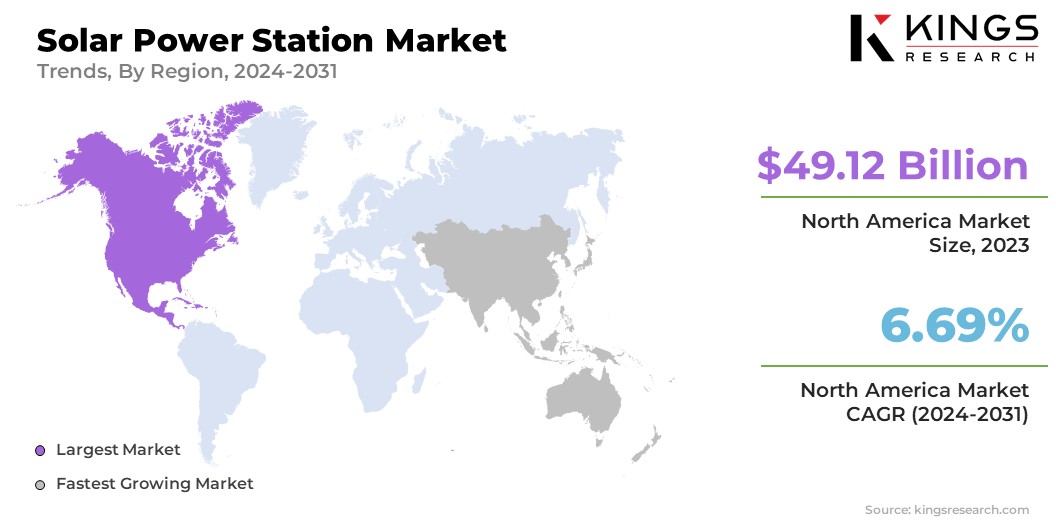

North America solar power station market accounted for a substantial share of 33.32% and was valued at USD 49.12 billion in 2023. This dominance is attributed to the significant investments in renewable energy infrastructure, particularly in the United States and Canada.

The region’s strong focus on reducing carbon emissions and transitioning to clean energy sources is driving large-scale utility and distributed solar installations. Favorable government policies, such as the extension of the Investment Tax Credit (ITC) in the U.S. and various state-level incentives, are promoting further investments in solar power.

- For instance, as of September 2024, Solar Energy Industries Association reports that the U.S. has over 200 GW of installed solar capacity, powering 36.1 million homes. The U.S. solar market has grown at an annual rate of 25% over the last decade, with more than 4.8 million solar installations ranging from residential to utility-scale projects.

In addition, North America’s abundant solar resources, particularly in the southwestern U.S., make it a highly attractive region for solar power generation. The increasing corporate demand for renewable energy through long-term power purchase agreements (PPAs) is further bolstering regional market growth.

Asia-Pacific solar power station market is expected to grow at the highest CAGR of 6.91% in the forthcoming years. This rapid growth is mainly facilitated by rapid urbanization, increasing energy demand, and a strong focus on renewable energy adoption across key economies.

Countries such as China, India, Japan, and South Korea are making substantial investments in solar power infrastructure as part of their broader efforts to reduce reliance on fossil fuels and combat climate change.

China is at the forefront of solar panel manufacturing and deployment, with aggressive targets for renewable energy capacity additions. India’s ambitious solar initiatives, such as the National Solar Mission, are contributing to the region’s robust growth in solar power installations.

Additionally, in India, supportive government policies, including feed-in tariffs, subsidies, and tax incentives, are leading to increased investments in large-scale solar projects across the region.

- For instance, in February 2024, SJVN Limited, a Government of India public sector enterprise, began commercial operations of its 50 MW Gujrai Solar Power Station in Uttar Pradesh. With this addition, SJVN’s total installed capacity reached 2,277 MW, enhancing its position in India’s growing renewable energy sector and advancing the country’s clean energy goals.

The region’s vast potential for solar energy generation, combined with declining costs of photovoltaic (PV) technology, is positioning Asia-Pacific as a key market for solar power station.

Competitive Landscape

The global solar power station market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Solar Power Station Market

- First Solar, Inc.

- SunPower Corporation

- Enel Green Power S.p.A.

- NextEra Energy, Inc.

- Vivint, Inc

- TotalEnergies

- Ørsted A/S

- Neoen

- BayWa r.e. AG

- Nextracker Inc.

Key Industry Developments

- September 2024 (Expansion): Total has secured agreements to develop the Al Kharsaah Solar PV IPP Project, an 800 MWp solar plant, located 80 kilometers west of Doha, Qatar. The project was awarded to a consortium of Total (49%) and Marubeni (51%) following Qatar’s first solar tender, marking a pivotal step in the country’s renewable energy expansion.

The global solar power station market has been segmented:

By Technology

- Solar PV

- Concentrated Solar Power

By Capacity

- Utility Scale

- Distributed Scale

By End User

- Industrial

- Commercial

- Residential

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership