Semiconductor and Electronics

Spectrum Analyzer Market

Spectrum Analyzer Market Size, Share, Growth & Industry Analysis, By Type (Handheld Spectrum Analyzer & Benchtop Spectrum Analyzer), By Network Technology (Wired and Wireless), By End-User (Automotive & Transportation, IT & Telecommunication, Medical & Healthcare, Industrial & Energy) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : June 2024

Report ID: KR771

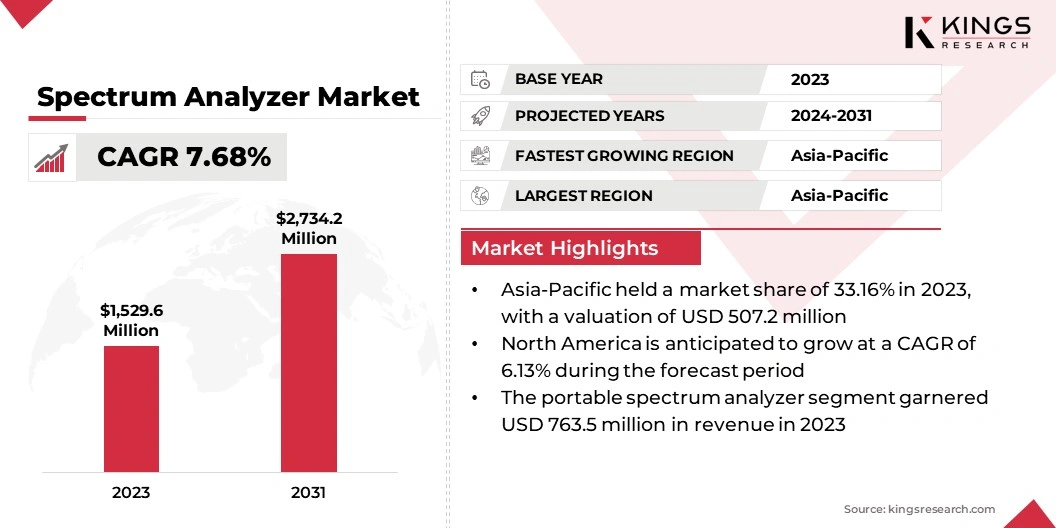

Spectrum Analyzer Market Size

Global Spectrum Analyzer Market size was recorded at USD 1,529.6 million in 2023, which is estimated to be at USD 1,628.7 million in 2024 and projected to reach USD 2,734.2 million by 2031, growing at a CAGR of 7.68% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Advantest Corporation, Anritsu Corporation, Giga-tronics Incorporated., Keysight Technologies, LP Technologies, Rohde & Schwarz, Teledyne LeCroy, VIAVI Solutions Inc., Yokogawa Electric Corporation, NATIONAL INSTRUMENTS CORP., and others.

The market is witnessing substantial growth due to the rapid expansion of telecommunication sector, increasing adoption of wireless technology, and expanding use of electronic devices. The surge in demand for higher bandwidth and faster data transfer rates highlights the crucial role of spectrum analyzers to ensure signal integrity and efficient spectrum usage. The widespread adoption of IoT devices and advancements in 5G technology further contribute significantly to market growth. Additionally, the pressing need for precise measurement and analysis in aerospace, defense, and automotive industries fuels the demand for advanced spectrum analyzers.

The spectrum analyzer market is experiencing robust growth, driven by technological advancements and expanding application areas. Spectrum analyzers are essential tools in various industries, including telecommunications, electronics, aerospace, and defense. They are used to measure the magnitude of an input signal versus frequency within a specific frequency range. The market is witnessing increasing investments in R&D and the introduction of innovative products that offer enhanced performance and usability. Key industry players are focusing on expanding their product portfolios and geographic presence to cater to the growing demand across different sectors.

- Tektronix, Inc., a prominent test and measurement solutions provider, has launched SignalVu Spectrum Analyzer Software, Version 5.4. This software allows engineers to analyze up to eight signals simultaneously for multi-channel modulation, thereby transforming their oscilloscopes into versatile wireless system testers. This innovation eliminates the need for separate testers, such as vector signal analyzers, and provides cost-effective solutions for comprehensive signal analysis.

A spectrum analyzer is an electronic device used to analyze the frequency spectrum of radio frequency (RF) signals. It displays signal amplitude (strength) as it varies by frequency within a specified frequency range, providing critical data for identifying and diagnosing issues in RF systems. Spectrum analyzers are widely utilized in designing, manufacturing, and maintaining electronic devices and communication systems. They come in various forms, including benchtop, portable, and handheld models, each serving distinct applications based on precision, portability, and specific industry requirements.

Analyst’s Review

Manufacturers are focusing on developing innovative spectrum analyzers with enhanced capabilities and user-friendly interfaces. These efforts include integrating AI for advanced signal analysis and introducing portable models for field use. New products that feature higher frequency ranges and improved accuracy are being developed to meet the rising demands of 5G and IoT applications. These advancements are positioning manufacturers to address the evolving needs of various industries and drive market growth.

Spectrum Analyzer Market Growth Factors

The increasing deployment of 5G technology is driving the growth of the spectrum analyzer market. 5G networks require extensive testing and monitoring to ensure optimal performance and compliance with regulatory standards. Spectrum analyzers are essential for validating the frequency bands, signal integrity, and interference levels in 5G infrastructure. They help network operators and equipment manufacturers enhance the quality of service and accelerate the rollout of 5G services. The need for higher data speeds and reliable connectivity in various applications, including autonomous vehicles, smart cities, and industrial automation, is further impacting the demand for advanced spectrum analyzers.

- According to Ericsson and the General Services Administration (GSA), By the end of 2023, global 4G population coverage reached approximately 90% and is anticipated to rise to about 95% by 2029. Moreover, the progression of 5G deployment has witnessed around 280 network launches worldwide. This indicates that 5G population coverage is projected to expand to around 85% by 2029, growing from about 45% in 2023.

The high cost associated with advanced models poses a formidable barrier for small and medium-sized enterprises (SMEs), prompting manufacturers to focus on developing cost-effective solutions without compromising performance. Implementation of modular designs enables users to purchase basic units and add functionalities as needed. Additionally, offering leasing and rental options eases the accessibility of advanced spectrum analyzers to SMEs. Collaboration with educational institutions and government bodies to provide subsidies and grants for purchasing testing equipment further helps alleviate the financial burden on smaller organizations.

Spectrum Analyzer Market Trends

The integration of artificial intelligence (AI) in spectrum analyzers is emerging as a significant market trend. AI algorithms are enhancing the functionality of spectrum analyzers by enabling automated signal detection, classification, and anomaly detection. This integration is improving the efficiency and accuracy of spectrum analysis, thereby reducing the time required for manual interpretation. AI-driven spectrum analyzers are particularly beneficial in complex environments such as crowded RF spectra and dense urban areas. The ability to process large volumes of data and provide real-time insights is making AI-enhanced spectrum analyzers a valuable tool across various industries.

The growing shift toward portable and handheld spectrum analyzers is another notable trend. These compact and lightweight devices offer the flexibility and convenience required for field applications, such as on-site testing and troubleshooting. Portable spectrum analyzers are becoming increasingly popular in diverse industries, including telecommunications, aerospace, and defense, where mobility is crucial. Advances in battery technology and miniaturization are allowing these devices to deliver high performance comparable to their benchtop counterparts. The growing demand for versatile and user-friendly tools is resulting in the widespread adoption of portable spectrum analyzers in diverse operational settings.

Segmentation Analysis

The global spectrum analyzer market is segmented based on type, network technology, end-user, and geography.

By Type

Based on type, the market is categorized into handheld spectrum analyzer, portable spectrum analyzer, and benchtop spectrum analyzer. The portable spectrum analyzer segment led the market in 2023, reaching a valuation of USD 671.5 million. The segment is expanding due to its versatility and convenience for field applications. These devices are lightweight and easy to transport, making them ideal for on-site testing and troubleshooting across various industries such as telecommunications, aerospace, and defense. The advancement in battery technology and miniaturization allows portable spectrum analyzers to offer high performance comparable to that of benchtop models. Their ability to provide accurate and real-time data analysis in remote and challenging environments is driving their adoption, thus contributing to the growth of the segment.

By Network Technology

Based on network technology, the market is segmented into wired and wireless. The wired segment secured the largest market share of 74.62% in 2023, majorly attributed to its reliability and stability in high-performance applications. Wired connections are essential for environments that require consistent and high-speed data transfer, such as data centers, industrial automation, and critical infrastructure. The absence of interference and signal degradation in wired networks ensures secure and efficient communication, which is crucial for mission-critical operations. This reliability and robustness make wired network technology the preferred choice for numerous enterprises, which is supporting the expansion of the segment.

By End-User

Based on end-user, the market is classified into automotive & transportation, IT & telecommunication, medical & healthcare, semiconductors & electronics, industrial & energy, and others. The IT & telecommunication segment is poised witness significant growth at a CAGR of 9.10% through the forecast period (2024-2031). This notable growth is primarily fueled by continuous advancements in communication technologies and the increasing demand for high-speed internet and data services. The expansion of 5G networks, IoT devices, and cloud computing is leading to the pressing need for sophisticated spectrum analyzers to ensure optimal network performance and signal integrity. The expansion of the segment reflects ongoing investments in upgrading and expanding telecommunication infrastructure to meet the growing consumer and industrial demand for reliable and efficient connectivity.

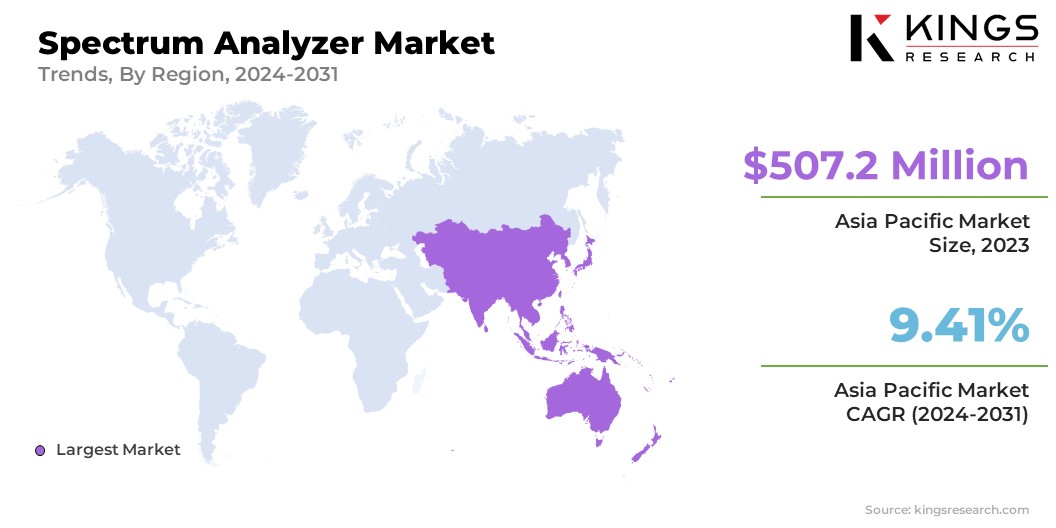

Spectrum Analyzer Market Regional Analysis

Based on region, the global spectrum analyzer market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America..

The Asia Pacific Spectrum Analyzer Market share stood around 33.16% in 2023 in the global market, with a valuation of USD 507.2 million. The region is dominating the spectrum analyzer market due to rapid industrialization and ongoing technological advancements in major countries such as China, Japan, India and South Korea. The region is experiencing significant investments in telecommunications infrastructure, particularly with the rollout of 5G networks. Additionally, the booming electronics manufacturing industry in this region demands high-precision testing and measurement tools. The presence of major electronics and semiconductor companies further supports domestic market growth. Moreover, gGovernment initiatives promoting digitalization and smart city projects contribute to the high demand for spectrum analyzers.

- According to the World Bank, India is experiencing rapid urbanization and by 2036, towns and cities are likely to house 600 million people, constituting approximately 40% of the population, up from 31% in 2011. Urban areas have been contributing nearly 70% to the overall GDP of the country.

North America is poised to witness steady growth, registering a CAGR of 6.13% over the forecast period. This robust growth in the spectrum analyzer market is due to continuous advancements in technology, policy developments, and significant investments in R&D. The region's strong presence in the aerospace, defense, and telecommunications sectors drives the demand for sophisticated spectrum analyzers. Additionally, the increasing adoption of IoT devices and the expansion of 5G infrastructure are contributing to regional market growth. The rising emphasis on maintaining high standards of communication and signal integrity in critical applications supports ongoing demand.

- In March 2023, the Government of Canada introduced a new licensing policy to provide local access to the 5G spectrum, benefiting Internet service providers, industries, and rural communities. This initiative aimed to ensure better connectivity and access to advanced wireless technologies. Minister François-Philippe Champagne announced this move, reflecting the government's commitment to enhancing Internet accessibility. The policy supported various sectors such as agriculture, mining, and healthcare, thereby facilitating the adoption of 5G in localized areas, including rural and Indigenous communities.

Competitive Landscape

The global spectrum analyzer market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Spectrum Analyzer Market

- Advantest Corporation

- Anritsu Corporation

- Giga-tronics Incorporated.

- Keysight Technologies

- LP Technologies

- Rohde & Schwarz

- Teledyne LeCroy

- VIAVI Solutions Inc.

- Yokogawa Electric Corporation

- NATIONAL INSTRUMENTS CORP.

Key Industry Developments

- April 2024 (Launch): HAROGIC launched the Real-Time Spectrum Analyzer PXE-200. It features a frequency range of 9kHz to 20GHz and incorporates a superheterodyne receiver structure with 19-segment preselected filtering. With a spectrum scanning rate of up to 900GHz/s, this device is capable of displaying an average noise level measured at -168dBm/Hz and offers a single sideband phase noise of -100 dBc/Hz @1GHz. It features a 10.1-inch touch screen and provides efficient interaction and portability weighing only 1.5kg. Standard measurement functions include channel power, side channel rejection ratio, and phase noise analysis.

- September 2023 (Launch): NI, a prominent player in automated wireless testing and measurement, unveiled enhanced features and options for its third-gen PXI Vector Signal Transceiver (VST), the PXIe-5842. This upgrade, in conjunction with NI’s software ecosystem, transformed the PXIe-5842 into a multifunctional tool ideal for validating aerospace and defense products. Its capabilities extended to traditional RF functions such as signal analysis, spectrum analysis, and signal generation, in order to meet the rising demands for RF bandwidth, frequency agility, and digital data movement in various applications, including SatCom, radar, Wi-Fi 7, electronic warfare, 6G, Ultra-wideband, and Bluetooth.

The Global Spectrum Analyzer Market is Segmented as:

By Type

- Handheld Spectrum Analyzer

- Portable Spectrum Analyzer

- Benchtop Spectrum Analyzer

By Network Technology

- Wired

- Wireless

By End-User

- Automotive & Transportation

- IT & Telecommunication

- Medical & Healthcare

- Semiconductors & Electronics

- Industrial & Energy

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership