Food and Beverages

Spices and Seasonings Market

Spices and Seasonings Market Size, Share, Growth & Industry Analysis, By Type (Cardamom, Cinnamon, Clove, Pepper, Turmeric, Garlic, Mustard, Others), By Nature(Organic, Conventional), By Application and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : May 2024

Report ID: KR704

Spices and Seasonings Market Size

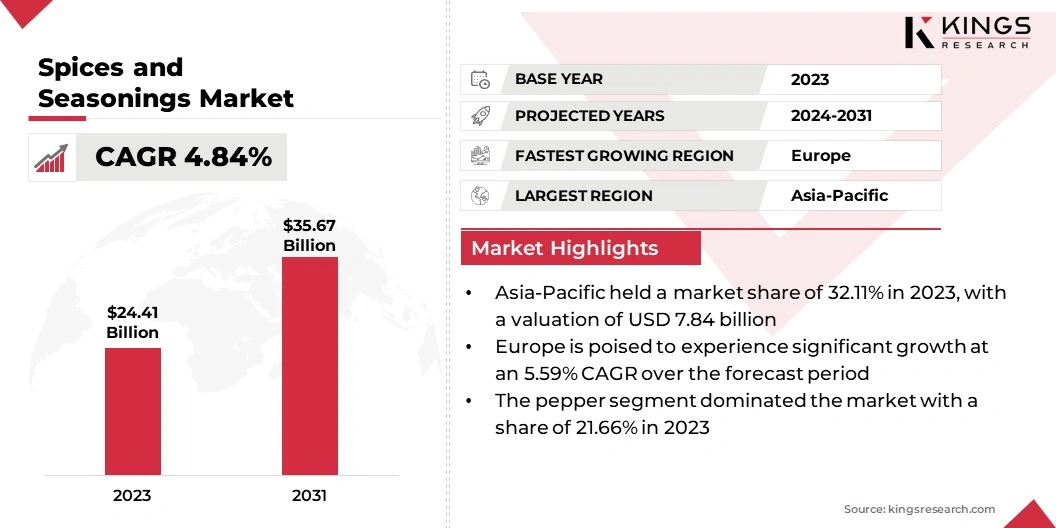

The Global Spices and Seasonings Market size was valued at USD 24.41 billion in 2023 and is projected to reach USD 35.67 billion by 2031, growing at a CAGR of 4.84% from 2024 to 2031. The growth of the spices and seasonings market is primarily driven by increasing consumer awareness regarding the health benefits of natural ingredients and growing demand for ethnic cuisines worldwide.

In the scope of work, the report includes products offered by companies such as Ajinomoto Co., Inc., Döhler GmbH, H. Worlée & Co. (GmbH & Co.) KG, Kerry Group plc., Koninklijke Euroma BV, McCormick & Company, Inc., Olam International Limited, Sensient Technologies, SHS Group, ROYAL SPICES, and others.

Additionally, the rise in disposable incomes, changing food preferences, and the trend of home cooking have contributed to market growth. Moreover, technological advancements in packaging and distribution have facilitated market expansion by enhancing product shelf life and accessibility.

The spices and seasonings market includes a wide range of products used to enhance the flavor and aroma of food. It includes spices such as pepper, turmeric, and cinnamon, along with different herbs. Seasonings often combine various spices and herbs to create unique flavor blends. This market serves both residential and commercial sectors, with households and restaurants being major consumers. The market is characterized by continuous innovation, product diversification, and a focus on natural, organic offerings.

However, the market is subject to regulatory oversight from key bodies including FSSAI and FDA, among others. The FSSAI has developed guidance documents for Food Safety Management Systems specifically tailored for spice processing. Additionally, the authority provides support for manufacturers looking to adopt the HACCP approach in their facilities.

The spices and seasonings products include spices derived from seeds, roots, fruits, and bark, as well as herbs obtained from plant leaves. In addition, seasonings are blends of multiple spices and herbs designed to add specific flavors to dishes. The market includes the industry segment dedicated to the distribution, production, and sale of various flavor-enhancing products utilized in culinary applications.

The market caters to diverse consumer preferences, offering a range of options from traditional spices to gourmet blends. Manufacturers in the market operate globally, with product offerings customized to include regional variations in popular spices and flavor profiles influenced by cultural, culinary, and dietary factors.

Analyst’s Review

The spices and seasonings market is witnessing significant expansion due to factors such as increasing consumer awareness regarding health benefits, growing demand for diverse flavors, and technological advancements in packaging and distribution.

Manufacturers are establishing new facilities and expanding their production capacities to meet the rising demand. Moreover, manufacturers are adding new products to their portfolio to innovate their product lineup and serve a diverse clientele base.

Spices and Seasonings Market Growth Factors

The rise in consumer preference for natural and organic products is a key factor driving the expansion of the spices and seasonings market. Consumers are actively seeking healthier options and becoming increasingly conscious of the ingredients used in their food. This trend is further fueled by a growing awareness concerning the potential health benefits of natural spices and herbs, including their antioxidant properties and their potential to support overall well-being.

In response to this, manufacturers and retailers are focusing on offering a wider range of organic and natural spices and seasonings to meet this demand and capitalize on this market trend.

A significant challenge in the spices and seasonings market is ensuring product quality and safety throughout the supply chain, especially regarding sourcing, processing, and storage. In order to mitigate this issue, companies are implementing robust quality control measures at each stage of production. This includes thorough testing of raw materials, adherence to food safety regulations, and proper storage conditions to maintain freshness and prevent contamination.

Additionally, investments in advanced technologies such as blockchain provide transparency and traceability, thereby reassuring consumers about the authenticity and safety of the products they purchase.

Spices and Seasonings Market Trends

The growing demand for exotic and global flavors is a key emerging trend in the market. Consumers are increasingly exploring international cuisines and flavors, leading to a rise in the popularity of spices and seasonings traditionally used in Asian, Middle Eastern, and Latin American cuisines. This trend is further bolstered by factors such as globalization, travel experiences, and culinary experimentation in domestic settings.

Manufacturers and retailers are expanding their product offerings to include a diverse range of exotic spices, blends, and seasonings to cater to these evolving consumer preferences and capitalize on the growing demand for unique flavors.

There is an ongoing shift toward sustainable and eco-friendly practices in the spices and seasonings market. Consumers are becoming more conscious of environmental issues and are actively seeking products that align with their values of sustainability and ethical sourcing. This trend has led to an increased demand for organic spices, fair trade certifications, and transparent supply chains.

Companies in the market are responding to this rising demand by adopting sustainable farming practices, reducing packaging waste, and supporting initiatives that promote social and environmental responsibility.

Segmentation Analysis

The global spices and seasonings market is segmented based on type, nature, application, and geography.

By Type

Based on type, the market is categorized into cardamom, cinnamon, clove, pepper, turmeric, garlic, mustard, and others. The pepper segment dominated the market with a share of 21.66% in 2023. This dominance is fostered by its widespread used as a spice globally, known for its versatile flavor profile that enhances a variety of dishes across different cuisines.

Its popularity is further fueled by the increasing demand for spicy and flavorful foods, along with the growing preference for natural ingredients. Additionally, advancements in farming techniques, efficient supply chains, and innovative product offerings have contributed to the expansion of the pepper segment, making it a staple in households and foodservice establishments alike.

By Nature

Based on nature, the market is bifurcated into organic and conventional. The organic segment is anticipated to witness the highest growth of 5.88% over the forecast period, mainly driven by shifting consumer preferences toward healthier and environmentally sustainable products. Consumers are increasingly choosing organic spices due to their perceived health benefits, such as the absence of synthetic pesticides and GMOs.

Moreover, growing awareness regarding sustainable farming practices and ethical sourcing is influencing purchasing decisions. Manufacturers and retailers are focusing on expanding their organic spice offerings, investing in organic certification, and promoting transparency in sourcing to capitalize on the rising demand for organic products.

By Application

Based on application, the market is divided into soups, sauces & dressings, snacks & savory, bakery & confectionery, meat & seafood, dairy & frozen products, and others. The bakery and confectionary segment accounted for the highest revenue of USD 8.62 billion in 2023 due to the extensive use of spices and flavorings in product formulations.

Spices play an important role in enhancing the taste and aroma of baked goods, desserts, and confectionery items, thereby influencing consumer preferences toward flavorful and indulgent treats.

Additionally, the growing trend of gourmet baking and artisanal confectionery has increased the demand for premium spices and unique flavor combinations. The bakery and confectionery segment is likely to continue to serve as a lucrative market for spices and seasonings manufacturers.

Spices and Seasonings Market Regional Analysis

Based on region, the global spices and seasonings market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Spices and Seasonings Market share stood around 32.11% in 2023 in the global market, with a valuation of USD 7.84 billion. Due to several factors such as the region's diverse culinary traditions and large population, create a substantial demand for a wide range of spices and seasonings.

Additionally, economic growth, rapid urbanization, and changing dietary preferences are contributing to the increased consumption of packaged spices and convenience foods. Furthermore, Asia Pacific's robust supply chains and competitive pricing support its dominance in the market.

Europe is likely to experience significant growth at a 5.59% CAGR between 2024 and 2031. This growth is driven by the rising popularity of global cuisines and culinary diversity within the region. Increased consumer awareness regarding health benefits associated with certain spices and herbs is fueling regional market expansion. Furthermore, advancements in distribution networks and the availability of a wide variety of spice blends contribute to Europe's rapid growth in the market.

Competitive Landscape

The global spices and seasonings market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Spices and Seasonings Market

- Ajinomoto Co., Inc.

- Döhler GmbH

- H. Worlée & Co. (GmbH & Co.) KG

- Kerry Group plc.

- Koninklijke Euroma BV

- McCormick & Company, Inc.

- Olam International Limited

- Sensient Technologies

- SHS Group

- ROYAL SPICES

Key Industry Developments

- January 2024 (Launch): McCormick introduced the Flavor Maker Seasonings, a new product line that inspired and flavored meals from prep to plate. The collection was available online and at Amazon.com, with plans for expanding their offering at Walmart.com. It featured 15 blends, each enhancing the flavor of dishes such as ramen and rice with minimal effort.

- August 2023 (Launch): ofi, a leading global provider of natural food and beverage ingredients, launched its herb processing facility in Beni-Suef, Egypt, to enhance its herb-related product offerings and services. The facility is operated by Dehydro Foods, an ofi subsidiary, and the sourced raw materials from over 1,000 farmers.

The Global Spices and Seasonings Market is Segmented as:

By Type

- Cardamom

- Cinnamon

- Clove

- Pepper

- Turmeric

- Garlic

- Mustard

- Others

By Nature

- Organic

- Conventional

By Application

- Soups, Sauces & Dressings

- Snacks & Savory

- Bakery & Confectionery

- Meat & Seafood

- Dairy & Frozen Products

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership