Consumer Goods

Sports Technology Market

Sports Technology Market Size, Share, Growth & Industry Analysis, By Sports Type (Soccer, Cricket, Baseball, Basketball, Tennis, Others), By Technology (Devices, Smart Stadiums, Esports, Sports Analytics), By End User (Sports Association, Clubs, Sports Leagues, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : February 2024

Report ID: KR490

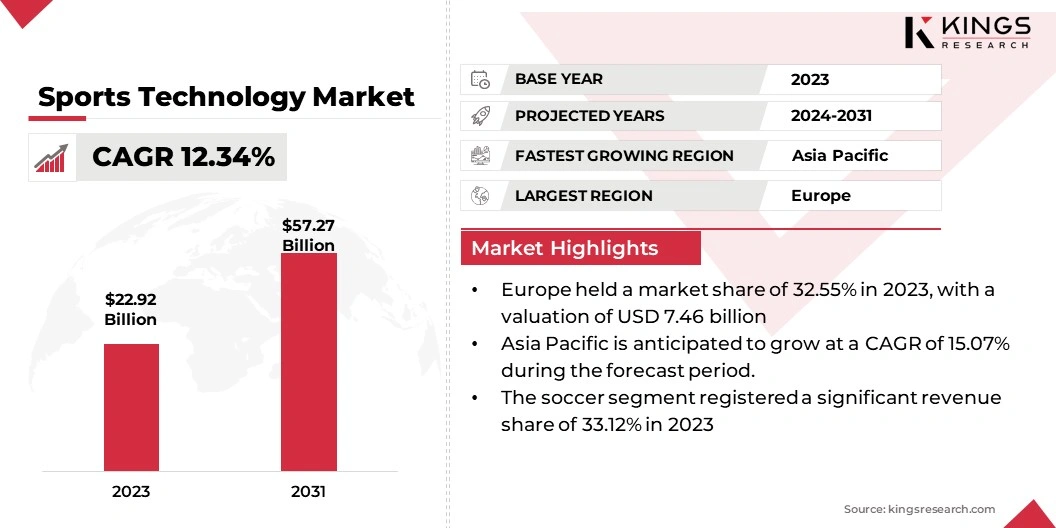

Sports Technology Market Size

The global Sports Technology Market size was valued at USD 22.92 billion in 2023 and is projected to reach USD 57.27 billion by 2031, growing at a CAGR of 12.34% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Catapult Sports, Garmin Ltd, Hawk-Eye Innovations, Under Armour, Fitbit, Apple Inc., FUJITSU, Synergy Sports, Adidas, Zepp Inc., and Others.

The sports technology market has witnessed remarkable growth and innovation in recent years, driven by the increasing demand for tools and solutions that enhance athletic performance, improve fan engagement, and optimize sports management. With advancements in wearable technology, data analytics, virtual reality, and smart stadium infrastructure, the sports technology market has become a dynamic and rapidly evolving industry.

As athletes and teams strive to gain a competitive edge, wearable technology has played a crucial role in monitoring and analyzing performance metrics in real-time. Furthermore, data analytics have revolutionized the way coaches and managers make strategic decisions, providing valuable insights into player performance, injury prevention, and game tactics.

The integration of virtual reality has further enhanced player training and fan experiences, allowing users to immerse themselves in the game from the comfort of their own homes.

With smart stadium infrastructure, fans can enjoy a seamless and interactive experience, from personalized seat recommendations to ordering concessions through mobile apps. Overall, the sports technology market shows no signs of slowing down, as innovations continue to transform the way people play, watch, and manage sports activities.

Analyst’s Review

The sports technology market is experiencing significant growth due to the development of smart stadiums and venue technology. Stadiums are being increasingly equipped with high-speed Wi-Fi, digital signage, mobile ticketing, and interactive fan engagement platforms. These enhancements not only improve the overall game-day experience for spectators but also optimize venue operations and revenue generation for sports organizations.

Additionally, smart stadiums are incorporating advanced analytics and data-driven technologies to provide real-time insights into player performance, team strategies, and fan behavior. This not only enhances the spectator experience but also enables sports organizations to make data-driven decisions for marketing, ticketing, and sponsorship opportunities.

Market Definition

Sports technology refers to the application of technological innovations and advancements to enhance various aspects of sports performance, management, and fan engagement. This interdisciplinary field encompasses a wide range of technologies, including wearable devices, data analytics, virtual reality, augmented reality, smart stadium infrastructure, and sports equipment embedded with sensors or connected to digital platforms.

Additionally, sports technology plays a crucial role in sports management and operations, with applications ranging from data analytics platforms for team management and scouting to smart stadium solutions for venue optimization, fan engagement, and revenue generation.

Additionally, virtual reality and augmented reality technologies are transforming the way fans interact with sports content, providing immersive viewing experiences, interactive simulations, and virtual broadcasts.

Sports Technology Market Dynamics

Athletes, teams, and coaches seek to continually improve performance, thus driving the demand for technologies that provide insights into training effectiveness, biomechanical data, and real-time performance metrics. Wearable devices, analytics platforms, and training simulations are among the technologies meeting this demand.

Wearable devices have revolutionized the way athletes track their performance, offering real-time data on heart rate, steps taken, and even sleep patterns. These devices provide invaluable insights into training effectiveness, allowing athletes to make data-driven decisions to optimize their performance. Furthermore, analytics platforms have emerged as powerful tools, collecting and analyzing vast amounts of data to uncover patterns and trends that were once impossible to detect.

Coaches and teams can now rely on these platforms to identify areas of improvement and tailor training programs accordingly. Additionally, training simulations have become increasingly sophisticated, providing athletes with virtual environments to practice and refine their skills. These simulations offer a safe and controlled space for athletes to experiment with different strategies, ultimately enhancing their performance on the field or court.

Sports technology often involves the collection and analysis of sensitive personal data, such as biometric information and performance metrics. Ensuring the privacy and security of this data presents challenges in terms of complying with regulations, protecting against cyber threats, and maintaining trust among users.

For instance, in professional football, wearable devices are used to collect data on players' heart rate, speed, and distance covered during training sessions and matches. This data is subsequently analyzed to monitor players' performance and prevent injuries. However, ensuring the privacy and security of this sensitive personal information is crucial to prevent potential misuse or unauthorized access by rival teams or hackers.

Segmentation Analysis

The global sports technology market is segmented based on sports type, technology, end user, and geography.

By Sports Type

By sports type, it is bifurcated into soccer, cricket, hockey, baseball, tennis, and others. The soccer segment registered a significant revenue share of 33.12% in 2023. This growth can be attributed to the massive popularity of soccer globally and the increasing adoption of advanced technologies in the sport.

The segment is witnessing a surge in demand for sports technology solutions such as video analysis, player tracking systems, and virtual reality training platforms. These advancements are not only enhancing the performance of players but also providing valuable insights to coaches and trainers, thus making soccer one of the leading segments in the sports technology market.

By Technology

By technology, it is bifurcated into devices, smart stadiums, esports, and sports analytics. The smart stadium segment accounted for a notable revenue share of 38.15% in 2023. This growth is primarily driven by the increasing adoption of IoT and connected devices in stadiums to enhance the overall fan experience.

Smart stadiums offer features such as high-speed Wi-Fi, mobile ticketing, and interactive screens, allowing fans to engage with the game in new and exciting ways. Additionally, the integration of advanced analytics and data tracking in smart stadiums enables teams to analyze player performance and make data-driven decisions for improved gameplay.

By End User

By end user, it is bifurcated into sports associations, clubs, sports leagues, and others. The sports leagues segment generated the highest revenue share of 35.36% in 2023, driven by the increasing adoption of technology-driven solutions by sports leagues to enhance the overall fan experience and improve player performance.

The integration of advanced analytics, virtual reality, and wearable devices in sports leagues has revolutionized the way games are played, analyzed, and consumed by fans. Additionally, the rising popularity of fantasy sports and e-sports has fueled the demand for sports technology solutions among sports leagues, thereby driving the growth of this segment in the sports technology market.

Sports Technology Market Regional Analysis

Based on region, the global sports technology market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The Europe Sports Technology Market share stood around 32.55% in 2023 in the global market, with a valuation of USD 7.46 billion. The dominance of Europe can be attributed to the region's strong sports culture and investment in infrastructure and technology. Additionally, the growing popularity of sports analytics and wearable devices among professional athletes and sports teams has boosted the demand for sports technology in the European market.

Asia-Pacific is projected to experience a rapid growth rate of 15.07% over the forecast period. This growth is mainly propelled by the increasing investments in sports infrastructure and the rising interest in sports among the population in the region. Furthermore, the growing middle-class population and the emergence of new sports leagues and tournaments in countries such as China and India are fueling the demand for sports technology solutions in the Asia-Pacific region.

Competitive Landscape

The global sports technology market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

List of Key Companies in Sports Technology Market

- Catapult Sports

- Garmin Ltd

- Hawk-Eye Innovations

- Under Armour

- Fitbit

- Apple Inc.

- FUJITSU

- Synergy Sports

- Adidas

- Zepp Inc.

Key Industry Developments

- June 2022 (Partnership) - The British Universities & Colleges Sport (BUCS), the authorized governing entity for university sports in the United Kingdom, formed an alliance with Catapult, a renowned global leader in performance technology for professional sports. This collaboration, spanning three years, aims to enhance knowledge and promote the application of sports science within the higher education sports sector. By working together, the partnership strives to foster innovation and facilitate the integration of advanced technology for the enhancement of individual athlete and team performance.

- August 2023 (Product Launch) - Garmin unveiled the Venu® 3 and Venu 3S GPS smartwatches, specifically crafted to aid individuals in achieving their health and fitness objectives. These innovative timepieces are equipped with comprehensive fitness analytics, stunning AMOLED touchscreens, and exceptional battery longevity. The Venu 3 series aims to provide users with a holistic understanding of their well-being.

The Global Sports Technology Market is Segmented as:

By Sports Type

- Soccer

- Cricket

- Baseball

- Basketball

- Tennis

- Others

By Technology

- Devices

- Smart Stadiums

- Esports

- Sports Analytics

By End User

- Sports Association

- Clubs

- Sports Leagues

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership