Food and Beverages

Sunflower Oil Market

Sunflower Oil Market Size, Share, Growth & Industry Analysis, By Type (Crude Oil, Refined Oil), By Nature (Organic, Conventional), By Extraction Type (Cold Pressed, Solvent Extraction, Hydraulic Pressed, Others), By End User Industry, By Distribution Channel, and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1033

Sunflower Oil Market Size

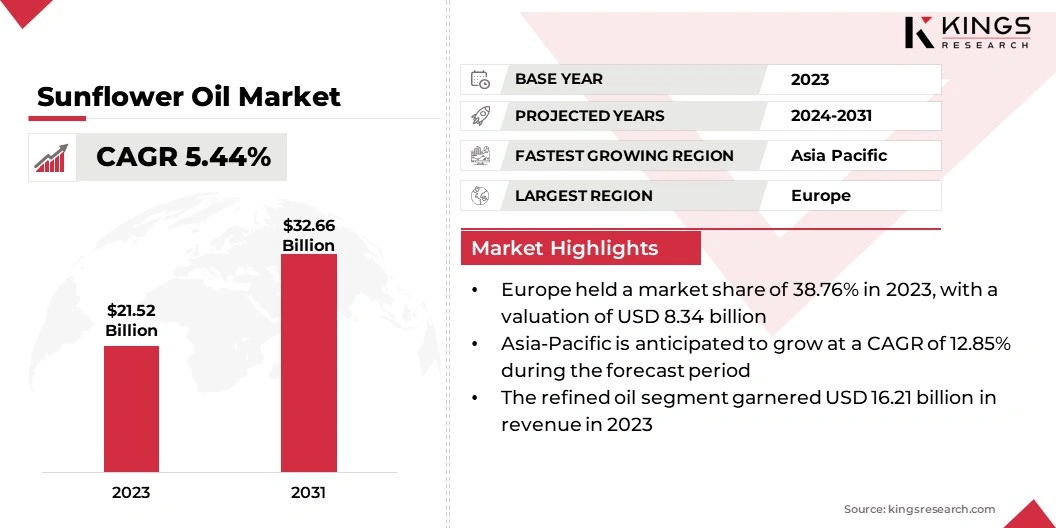

The global Sunflower Oil Market size was valued at USD 21.52 billion in 2023 and is projected to grow from USD 22.55 billion in 2024 to USD 32.66 billion by 2031, exhibiting a CAGR of 5.44% during the forecast period. The growth of the market is significantly influenced by the rising health consciousness among consumers.

As people become more aware of the impact of their dietary choices on their overall well-being, the preference for healthier cooking oils is expected to increase significantly. Sunflower oil, which is rich in unsaturated fats, particularly linoleic and oleic acids, has gained popularity for its benefits in promoting heart health.

It is known to lower cholesterol levels and support immune function, making it an attractive choice for health-conscious individuals. The natural antioxidant properties of sunflower oil further enhance its appeal, as they contribute to reducing oxidative stress in the body. This growing awareness of the health benefits associated with sunflower oil has led to a surge in its demand.

In the scope of work, the report includes products offered by companies such as Cargill, Incorporated, Bunge, KAISSA, AVRIL SCA, ADM, Optimus Agro, Delta Wilmar, Agro Tech Foods Ltd. Inc, Parakh Group, Colorado Mills, and others.

Moreover, the increasing consumer preference for convenience has led to a significant rise in the consumption of packaged and ready-to-eat foods. Sunflower oil, with its long shelf life and ability to maintain food freshness, is widely used in these products. The growing demand for such convenience foods, particularly in urban areas, is driving the adoption of sunflower oil as a preferred choice for frying, baking, and preserving packaged foods.

Sunflower oil is a non-volatile, light yellow-colored oil extracted from the seeds of the sunflower. It is widely used in cooking and food preparation due to its mild flavor, high smoke point, and nutritional benefits. Sunflower oil is rich in unsaturated fatty acids, particularly linoleic and oleic acid, making it a heart-healthy option. It is also commonly used in the production of margarine, salad dressings, and as a base for various industrial products, including biodiesel, cosmetics, and pharmaceuticals.

Click to learn, How data-driven insights can impact your market position

Click to learn, How data-driven insights can impact your market position

Analyst’s Review

Companies in the sunflower oil market are significantly witnessing growth due to their ongoing research and development efforts. As global consumers increasingly prioritize healthier dietary options, sunflower oil is gaining traction due to its high unsaturated fat and antioxidant levels.

This growing trend, especially in developed markets, has prompted producers to invest in R&D to enhance product quality and diversify their offerings. Such innovations are meeting the rising consumer demand and contributing to market expansion.

- In May 2024, PepsiCo India began trials to substitute palm oil and palmolein with a blend of sunflower oil and palmolein in Lay's chips.

In addition to the evolving consumer preferences, advancements in R&D are further boosting market growth. Companies are exploring innovative formulations for the pharmaceutical sector that incorporate sunflower oil’s beneficial properties. These R&D efforts are broadening the applications of sunflower oil, from topical treatments to dietary supplements, further increasing its appeal in the health and wellness industry.

- In October 2023, researchers from Skoltech, the Pustovoit All-Russian Research Institute of Oil Crops, OilGene, a Skoltech startup, and other organizations discovered new markers that will expedite the breeding of high oleic sunflowers, enhancing the production of oil rich in oleic acid. This oil is more resistant to thermal oxidation and contains low levels of saturated fatty acids.

R&D advancements in biofuels are also opening new opportunities for the market. Companies are focusing on developing more efficient and sustainable biofuel technologies, enhancing the viability of sunflower oil as a renewable energy source. Research aimed at improving production processes and increasing yield is making sunflower oil a more attractive alternative to traditional fossil fuels. This supports environmental sustainability and drives market growth.

By embracing these R&D-driven approaches, companies are capitalizing on consumer trends and expanding their market presence. These efforts are shaping the market, fostering innovation, and creating new opportunities for growth.

Sunflower Oil Market Growth Factors

The growing food manufacturing sector, particularly in Asia-Pacific and Latin America, is contributing to the consumption of sunflower oil, as manufacturers seek reliable and cost-effective ingredients for their products. With the rapid urbanization and changing lifestyles, there has been a significant increase in the demand for processed and packaged foods.

Sunflower oil is a preferred ingredient in the food processing industry due to its favorable properties, such as a high smoke point, stability in cooking, and neutral flavor. It is commonly used in frying, baking, and as a preservative in various food products.

- According to a report published by Worldmetrics.org in July 2024, the global food manufacturing industry is valued at USD 8.7 trillion. Additionally, the organic food manufacturing sector is witnessing rapid expansion,at a projected CAGR of 16.4% from 2021 to 2028.

Moreover, advancements in extraction and processing techniques are also playing a crucial role in driving the market. Innovations such as cold-pressing and refining processes have improved the quality and shelf life of sunflower oil, making it more appealing to consumers and manufacturers.

These techniques help preserve the nutritional value and flavor of the sunflower oil while ensuring a longer shelf life, which is particularly important for food manufacturers. As technology continues to evolve, the efficiency and quality of sunflower oil production are also expected to improve, contributing to market expansion.

However, volatility in raw material prices is restraining the expansion of the sunflower oil market. The cost of sunflower seeds, which are the primary raw material for sunflower oil production, can fluctuate significantly due to factors like weather conditions, agricultural yields, and global demand. Such price volatility can lead to unpredictable production costs for manufacturers, making it challenging to maintain consistent product pricing.

To mitigate the challenges, producers are adopting various approaches such as diversification of seed sourcing, where companies procure sunflower seeds from multiple regions or suppliers to reduce the risk of supply disruptions and price spikes. Another strategy involves investing in agricultural technology and practices that improve crop yields and resilience, such as drought-resistant seed varieties and precision farming techniques. By enhancing the reliability and efficiency of sunflower production, these innovations help stabilize raw material costs.

Furthermore, the expanding use of sunflower oil in pharmaceutical applications is another factor boosting its market growth. Sunflower oil is utilized in the formulation of various medicinal products due to its anti-inflammatory and antioxidant properties. It is often used as a carrier oil in topical ointments, creams, and capsules.

The growing demand for natural and plant-based ingredients in the pharmaceutical industry is encouraging the increased use of sunflower oil, particularly as consumers seek alternatives to synthetic chemicals in their medications.

Sunflower Oil Market Trends

The shift toward plant-based diets, driven by ethical, environmental, and health considerations, is expected to continue fueling the demand for sunflower oil in the coming years. As more consumers adopt these diets, there is a rising demand for plant-based ingredients, including oils.

Sunflower oil is particularly favored in this context due to its neutral flavor and versatility in various culinary applications. It is widely used in cooking, baking, and as a dressing, making it a staple in vegan and plant-based cuisine. Additionally, sunflower oil is a common ingredient in many plant-based food products, which can further boost the sunflower oil market growth.

Sunflower oil is increasingly being adopted in the cosmetic and personal care industry as well. Its moisturizing and skin-nourishing properties make it an ideal ingredient in skincare products, such as lotions, creams, and cleansers. Sunflower oil is rich in vitamins A, D, and E, which are beneficial for skin health, it is preferred for natural and organic cosmetic formulations.

As consumer demand for natural and eco-friendly beauty products rises, the use of sunflower oil in these applications is expected to grow, further driving its market share.

- In April 2024, Hallstar Beauty introduced a natural active beauty ingredient, BLISS Oléoactif, designed to counteract the effects of psychological stress. This innovative product was developed using a patented, eco-friendly oléo-éco-extraction process that utilizes 100% recycled waste. It combines the nourishing properties of linden sapwood and sunflower oil, both sourced responsibly, organically, and locally.

Segmentation Analysis

The global market has been segmented based on type, nature, extraction type, end user industry, and geography.

By Type

Based on type, the market has been segmented into crude oil and refined oil. The refined oil segment led the sunflower oil market in 2023, reaching USD 16.21 billion due to its wide-ranging applications and consumer preference for high-quality, versatile cooking oils.

Refined sunflower oil undergoes a thorough purification process, which removes impurities, resulting in a neutral flavor and extended shelf life. This makes it ideal for use in various cooking methods, including frying, baking, and sautéing, in both household and industrial food preparation.

The high smoke point and stability of sunflower oil at high temperatures further enhance its appeal, especially in the food processing industry. Additionally, refined sunflower oil is more widely available and accessible, making it the preferred option for consumers and businesses alike, thereby driving its dominance in the market.

By Nature

Based on nature, the market has been classified into organic and conventional. The organic segment is expected to witness significant growth at a robust CAGR of 6.09% over the forecast period.

The organic segment in the sunflower oil market is experiencing the highest growth due to the increasing consumer demand for healthier and environmentally sustainable products. Organic sunflower oil is produced without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), for health-conscious consumers who prioritize clean-label products.

Additionally, the growing global trend supporting the consumption of organic and natural food products has led retailers and manufacturers to expand their organic offerings, including sunflower oil. This shift is particularly strong in developed markets, where consumers are willing to pay a premium for organic products, thereby fueling the rapid expansion of the organic segment in the market.

By Extraction Type

Based on extraction type, the sunflower oil market has been divided into cold pressed, solvent extraction, hydraulic pressed, and others. The solvent extraction segment secured the largest revenue share of 43.78% in 2023 due to its efficiency and cost-effectiveness in oil extraction.

This method involves using a solvent, typically hexane, to extract oil from sunflower seeds, resulting in a higher yield compared to other methods. The process is favored for its ability to extract nearly all the available oil, making it ideal for large-scale production and meeting high market demand.

Additionally, solvent extraction is well-suited for industrial applications, where consistency and scale are crucial. Its relatively lower production costs and ability to handle large volumes contribute to its dominance, as it meets the needs of both producers and consumers in a cost-effective manner.

By End User

Based on end user, the market has been divided into food processing industry, cosmetics and personal care, pharmaceuticals, agriculture, retail/household, and others. The pharmaceuticals segment is expected to witness significant growth at a CAGR of 6.15% over the forecast period, due to the beneficial properties and increasing use of sunflower oil in medicinal formulations.

Sunflower oil is valued in the pharmaceutical industry for its high content of essential fatty acids, particularly linoleic acid, which has anti-inflammatory and antioxidant properties. These attributes make it an effective carrier oil for various topical treatments, ointments, and supplements. The growing consumer preference for natural and plant-based ingredients in pharmaceuticals is also driving the demand for sunflower oil.

By Distribution Channel

Based on distribution channel, the market has been divided into business to business and business to consumer. The business to consumer segment has been further classified into hypermarket/supermarket, specialty store, convenience store, online retail, and others.

The business to consumers segment is expected to secure the largest revenue share of 59.97% in 2031 due to its direct reach to consumers and the growing demand for convenient purchasing options. Supermarkets, hypermarkets, and online retail platforms play a significant role in this segment, offering consumers easy access to a variety of sunflower oil brands and packaging sizes.

The rise in consumer awareness regarding healthy cooking oils and the increasing trend of home cooking have further boosted the demand for sunflower oil through B2C channels. Moreover, aggressive marketing strategies, promotions, and discounts offered by retailers encourage frequent consumer purchases, driving the dominance of the B2C segment in the sunflower oil market. The convenience and accessibility provided by these channels make them the preferred choice for consumers, which further aids to the segment growth.

Sunflower Oil Market Regional Analysis

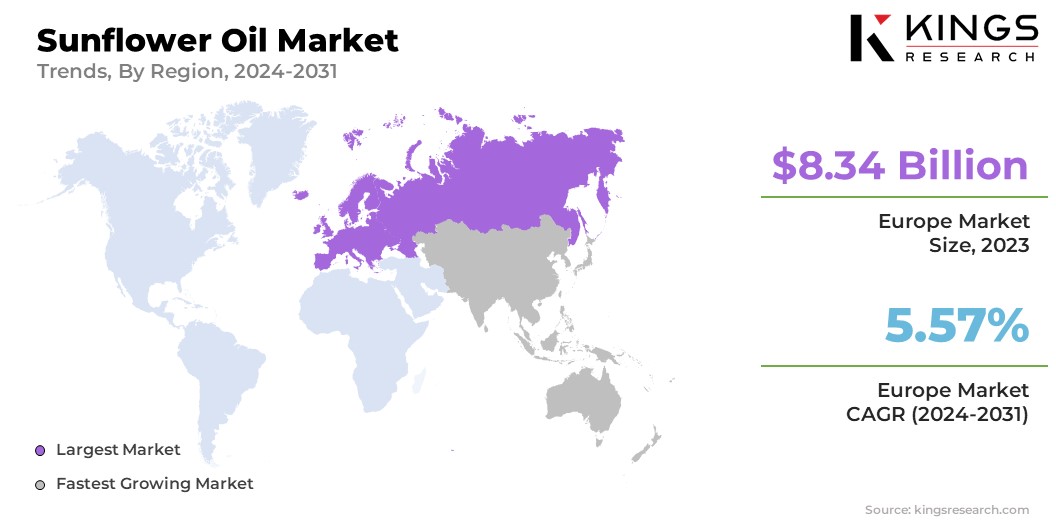

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe sunflower oil market share stood around 38.76% in 2023 in the global market, with a valuation of USD 8.34 billion. Europe's position as the largest producer of sunflower oil globally is a key factor driving the market growth in the region.

Countries like Ukraine, Russia, France, Spain, and Hungary are the major producers, collectively accounting for a substantial share of the global output. These countries benefit from favorable agricultural conditions and well-established farming practices, enabling them to maintain profitable sunflower cultivation and oil extraction.

Despite the ongoing disruptions caused by the Russia-Ukraine war, Ukraine has managed to increase its sunflower oil production, contributing to the market's resilience. Although sunflower oil prices saw a hike, they remained comparatively cheaper than soy and palm oil, making it a preferred choice for consumers.

According to the 2024 report by the U.S. Department of Agriculture, war-related disruptions in 2022 posed significant threats to the viability of Ukraine's crushing industry. However, despite the ongoing challenges, Ukraine has managed to increase its production of sunflower seed meal and oil. Nonetheless, expectations for further growth in this sector remain subdued.

- In June 2024, India imported approximately 500,000 metric tons of sunflower oil, driven by intense competition between leading suppliers Russia and Ukraine, which made it more affordable than soyoil and palm oil. Throughout 2023, India consistently purchased an average of 250,000 tons of sunflower oil each month, primarily sourced from the Black Sea region.

Furthermore, government initiatives to sustain trade and ensure the safe transport of grains and other commodities facilitated the steady export of sunflower oil from regional ports. These factors have collectively supported the growth of the market in Europe, solidifying its dominance in the global market.

- The Black Sea Grain Initiative was launched in Istanbul on 22 July 2022 by the Russian Federation, Türkiye, Ukraine, and the United Nations. This initiative established a mechanism to ensure the safe export of grain, oil seeds, edible oils, and related foods, including fertilizer and ammonia, from designated Ukrainian ports to global markets.

The European market is experiencing a notable shift toward organic and natural products, driven by consumer demand for clean-label and environmentally friendly options. Organic sunflower oil, produced without synthetic pesticides or GMOs, aligns with this trend and is seeing significant growth. The emphasis on sustainable and eco-friendly practices is encouraging both consumers and retailers to opt for organic sunflower oil, leading to an expansion of this segment in the European market.

Asia Pacific is poised for significant growth at a robust CAGR of 12.85% over the forecast period. The rapid expansion of the food processing industry in the Asia-Pacific region is a significant driver favoring the sunflower oil market's growth. As the region continues to urbanize and consumer lifestyles shift toward convenience, there is a growing demand for processed and packaged foods.

Sunflower oil, with its neutral flavor, high smoke point, and stability, is increasingly used in the production of a wide range of food products, including snacks, baked goods, and ready-to-eat meals. The expanding food processing sector, particularly in major economies like China, India, and Southeast Asian countries, is driving the demand for sunflower oil.

- According to the FAO, vegetable oil consumption in the Asia-Pacific region is expected to surpass the global average by 2030, reaching 21 kg per capita annually. Coupled with robust population growth in countries like India, this trend indicates that the region will account for 71% of the global increase in vegetable oil consumption over the next decade.

Competitive Landscape

The global sunflower oil market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Sunflower Oil Market

- Cargill Incorporated

- Bunge Ltd

- Kaissa Oil

- Avril Group

- ADM

- Optimus Agro Trade LLC

- Delta Wilmar

- Agro Tech Foods Ltd.

- Parakh Group

- Colorado Mills.

Key Industry Developments

- April 2024 (Business Expansion): Avril Group has unveiled plans to enhance its sunflower seed crushing capacity in France and reduce its dependence on imports, in response to the disruptions caused by the war in Ukraine. Investments in French sunflower crushing facilities have improved output reliability, and the expansion of the Lezoux site in central France will increase its annual capacity from170,000 tons to 240,000 tons by 2025.

- February 2023 (Product Launch): Cargill announced the introduction of Gemini Pureit in Karnataka, India, to expand its edible oils portfolio into South India. This expansion is supported by the newly acquired facility in Nellore, Andhra Pradesh, which began operations in December 2022.

The global sunflower oil market is segmented as:

By Type

- Crude Oil

- Refined Oil

- Linoleic

- Mid Oleic

- High Oleic

By Nature

- Organic

- Conventional

By Extraction Type

- Cold Pressed

- Solvent Extraction

- Hydraulic Pressed

- Others

By End User

- Food Processing Industry

- Cosmetics and Personal Care

- Pharmaceuticals

- Agriculture

- Retail/Household

- Others

By Distribution Channel

- Business to Business

- Business to Consumer

- Hypermarket/Supermarket

- Specialty Store

- Convenience Store

- Online Retail

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

CUSTOMIZATION OFFERED

Additional Company Profiles

Additional Countries

Cross Segment Analysis

Regional Market Dynamics

Country-Level Trend Analysis

Competitive Landscape Customization

Extended Forecast Years

Historical Data Up to 5 Years