Energy and Power

Sustainable Aviation Fuel Market

Sustainable Aviation Fuel Market Size, Share, Growth & Industry Analysis, By Fuel Type (Biofuel, Hydrogen Fuel, Power-to-Liquid, Gas-to-Liquid), By Technology (FT-SPK, HEFA-SPK, HFS-SIP, ATJ-SPK, CHJ, Others), By Blending Capacity (Below 30%, 30% - 50%, Above 50%) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : March 2024

Report ID: KR565

Sustainable Aviation Fuel Market Size

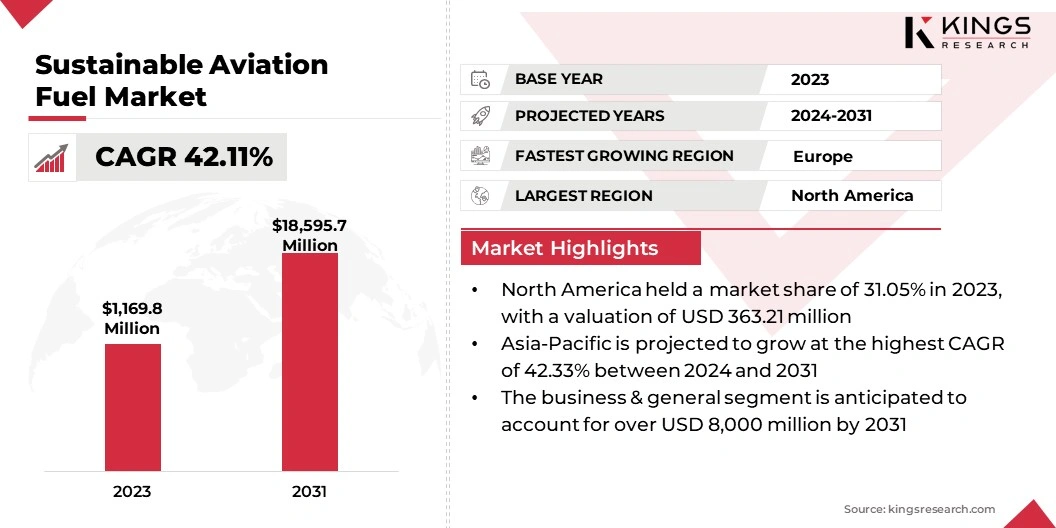

The global Sustainable Aviation Fuel Market was valued at USD 1,169.8 million in 2023 and is projected to reach USD 18,595.7 million by 2031, growing at a CAGR of 42.11% from 2024 to 2031. The global sustainable aviation fuel market is anticipated to witness substantial growth and transformation over 2024-2031, driven by several factors such as environmental imperatives, regulatory mandates, technological advancements, and shifting consumer preferences within the aviation industry.

In the scope of work, the report includes products offered by companies such as Neste, TotalEnergies, World Energy, LLC, LanzaTech, Aemetis, SkyNRG, Air France-KLM, Boeing, Airbus, GE Aviation and others.

Global focus on mitigating carbon emissions and addressing climate change concerns is among the prominent factors fostering market growth. With aviation being a notable contributor to greenhouse gas emissions, regulatory interventions, such as carbon pricing mechanisms and blending mandates, have created a conducive environment for SAF adoption, thereby driving investments in production infrastructure and technology. This has led to a growing recognition of SAF as a viable solution to decarbonize aviation operations while maintaining crucial air connectivity.

Regulatory interventions have emerged as a key factor propelling the adoption of SAF. Governments and international organizations are increasingly implementing policies, incentives, and targets to incentivize the production and uptake of sustainable aviation fuel. These regulatory measures, ranging from carbon pricing mechanisms to blending mandates, are creating a favorable market environment and driving investments in SAF production infrastructure and technology development.

Technological innovation is another critical factor shaping the future trajectory of the SAF market. Advancements in biomass conversion, synthetic fuel production, and hydrogen generation are expanding the range of feedstock and production pathways for sustainable aviation fuel.

Additionally, ongoing research and development efforts prioritize improving the efficiency, scalability, and cost-effectiveness of SAF production processes. This approach addresses key challenges such as feedstock availability, production costs, and lifecycle emissions.

Collaboration and partnerships are playing a pivotal role in accelerating the commercialization and deployment of SAF. Airlines, fuel producers, technology developers, and governments are forging strategic alliances to establish robust supply chains, invest in infrastructure development, and create the demand for sustainable aviation fuel. These collaborative efforts are essential for overcoming barriers to scale and ensuring the long-term viability and competitiveness of SAF in the aviation fuel market.

Despite the promising growth prospects, the sustainable aviation fuel market faces several challenges. Cost competitiveness compared to conventional jet fuel, feedstock availability constraints, regulatory uncertainties, and the need for significant investment in infrastructure and technology are some of the factors impeding the growth of the global sustainable aviation fuel market.

However, addressing these challenges presents opportunities for innovation and collaboration across the aviation value chain.

Analyst’s Review

The global sustainable aviation fuel market is projected to experience sustained growth as stakeholders across the aviation value chain increasingly recognize the imperative of transitioning toward more sustainable fuel alternatives.

While challenges remain, including cost competitiveness, feedstock availability, and regulatory uncertainties, concerted efforts to overcome these barriers are expected to unlock new opportunities and drive the widespread adoption of SAF, thereby contributing to a greener and more resilient aviation sector over 2024-2031.

Market Definition

The sustainable aviation fuel market encompasses the production, distribution, and consumption of alternative aviation fuels derived from renewable sources with lower carbon footprints compared to traditional fossil fuels. This market serves the aviation industry's growing demand for cleaner energy solutions amid increasing concerns regarding climate change and environmental sustainability.

Key stakeholders include airlines, fuel producers, technology developers, governments, and regulatory bodies. The market is characterized by a dynamic ecosystem of technological innovation, regulatory frameworks, and industry collaborations aimed at overcoming challenges such as cost competitiveness, feedstock availability, and infrastructure development.

With rising global efforts to reduce carbon emissions and transition toward a low-carbon economy, the sustainable aviation fuel market presents significant growth opportunities for stakeholders committed to advancing sustainable aviation practices and mitigating the environmental impact of air travel

Market Dynamics

Regulatory interventions play a pivotal role in driving the adoption of sustainable aviation fuel by imposing mandates and offering incentives. Governments worldwide are enacting policies to curb carbon emissions from the aviation sector by incentivizing the use of SAF through tax credits, subsidies, and renewable energy targets.

- For instance, the European Union's Renewable Energy Directive mandates a minimum share of renewable fuels in aviation, aiming for a 14% share by 2030. Moreover, the U.S. Federal Aviation Administration's (FAA) Alternative Jet Fuel Program provides funding for SAF research and development projects. These regulatory frameworks create a conducive environment for investment and innovation in SAF production, thereby fostering market growth.

- According to a report by the International Air Transport Association (IATA), global SAF production is projected to reach 2.6 billion gallons by 2025, supported by regulatory measures promoting its adoption.

Moreover, collaboration and partnerships among key stakeholders across the aviation value chain are playing a major role in driving the growth of the sustainable aviation fuel market.

Airlines, fuel producers, technology developers, governments, and regulatory bodies are increasingly joining forces to establish robust supply chains, invest in infrastructure, and create demand for SAF. For instance, airlines are forming strategic partnerships with SAF producers to secure long-term supply agreements and accelerate SAF adoption in their operations.

- For instance, United Airlines has made a significant investment in Fulcrum BioEnergy's biofuel production facility, showcasing its collaboration in sustainable aviation fuel initiatives.

Furthermore, public-private partnerships and government initiatives play a crucial role in supporting sustainable aviation fuel market development through funding, policy support, and research grants.

For instance, the U.S. Department of Energy's Bioenergy Technologies Office provides funding for research and development projects aimed at advancing SAF production technologies. By fostering collaboration and partnership across the aviation industry, stakeholders can collectively drive the adoption of SAF and contribute to a more sustainable future for air travel.

- For instance, as reported by ATAG, in 2023 purchase agreements of more than USD 45 billion for SAF were signed by airlines.

Despite the growth factors, the sustainable aviation fuel market faces several challenges such as limited production capacities and feedstock. Feedstock availability constraints arise from competition with other sectors, such as the food and chemical industries, for biomass resources such as waste oils, agricultural residues, and algae.

Additionally, uncertainties surrounding the scalability and sustainability of feedstock supply chains pose significant challenges for SAF producers. Addressing feedstock availability constraints requires innovative solutions, such as the development of advanced feedstock cultivation techniques, expansion of feedstock sourcing regions, and diversification of feedstock options. Overcoming these challenges is crucial for scaling up SAF production and meeting the growing demand for sustainable aviation fuel in the aviation industry.

Segmentation Analysis

The global sustainable aviation fuel market is segmented based on fuel type, technology, blending capacity, aircraft type, and geography.

By Fuel Type

Based on fuel type, the sustainable aviation fuel market is categorized into biofuel, hydrogen fuel, power-to-liquid, and gas-to-liquid. Biofuel held a prominent market share of 58.75% in 2023 and is estimated to continue its dominance over 2024-2031. This dominance is driven by several factors, including the maturity of biofuel production processes, its compatibility with existing aircraft and infrastructure, and increasing regulatory support for renewable fuels.

With growing concerns regarding climate change and the aviation sector's carbon footprint, there is a strong push to reduce emissions by adopting biofuels. Technological advancements in biomass conversion and feedstock availability have further contributed to the growth of biofuel production capacity, thereby bolstering its market position.

By Technology

Based on technology, the sustainable aviation fuel market is classified into FT-SPK, HEFA-SPK, HFS-SIP, ATJ-SPK, CHJ, and others. The HEFA-SPK segment generated the highest revenue of USD 317.59 million in 2023. This growth can be attributed to its proven performance, compatibility with existing aircraft engines, and established production infrastructure.

HEFA-SPK offers a drop-in solution for aviation fuel, making it an attractive option for airlines striving to reduce their carbon footprint without significant modifications to their fleets. Furthermore, HEFA-SPK benefits from regulatory incentives and mandates promoting the use of renewable fuels in aviation, thereby contributing to the rising adoption.

While other technologies such as FT-SPK, HFS-SIP, ATJ-SPK, and CHJ hold promise, HEFA-SPK's market leadership reflects its maturity and widespread adoption within the industry. Continued investment in HEFA-SPK production capacity and research into alternative feedstock is likely to sustain its growth trajectory in the forthcoming years.

By Aircraft Type

Based on aircraft type, the sustainable aviation fuel market is divided into commercial, military, business & general, and unmanned aerial vehicle. The business & general segment is anticipated to account for over USD 8,000 million by 2031. This growth is mainly driven by increasing demand from corporate and private aviation operators aiming to reduce their carbon emissions and align with sustainability goals.

Business jets and general aviation aircraft are well-suited for the adoption of sustainable aviation fuels due to their smaller fleets and flexibility to choose alternative fuels. Additionally, regulatory pressures, customer preferences for eco-friendly travel options, and corporate sustainability initiatives are driving adoption in this segment.

While commercial aviation remains the largest consumer of SAF, the business and general aviation segment presents lucrative opportunities for SAF producers and suppliers. Continued investment in infrastructure, supply chain development, and regulatory support is likely to support SAF adoption in business and general aviation.

Sustainable Aviation Fuel Market Regional Analysis

Based on region, the global sustainable aviation fuel market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Sustainable Aviation Fuel Market share stood around 31.05% in 2023 in the global market, with a valuation of USD 363.21 million. The region boasts a dynamic and influential role in the sustainable aviation fuel market, with diverse factors shaping its growth trajectory. The region benefits from a robust regulatory framework and a supportive policy environment at both the federal and state levels.

In the United States, initiatives such as the Federal Aviation Administration's (FAA) Alternative Jet Fuel Program and California's Low Carbon Fuel Standard (LCFS) provide incentives and regulatory certainty for SAF production and use. These policies stimulate investment and innovation in SAF technologies and infrastructure.

Moreover, North America's vast agricultural and forestry resources offer abundant feedstock options for SAF production, including agricultural residues, forestry residues, and municipal solid waste. This rich resource base enhances the region's potential for sustainable aviation fuel production and reduces dependence on imported feedstock.

Additionally, the region capitalizes on a strong tradition of innovation and entrepreneurship, with numerous startups and research institutions driving technological advancements in SAF production processes. Collaborative efforts between academia, industry, and government fuel the commercialization of novel SAF technologies and facilitate regional market growth.

However, challenges such as securing long-term feedstock contracts, scaling up production capacity, and ensuring regulatory consistency across jurisdictions remain significant hurdles to market growth in North America.

Asia-Pacific is projected to grow at the highest CAGR of 42.33% between 2024 and 2031. The region is a dynamic and rapidly evolving market for sustainable aviation fuel, influenced by a combination of factors augmenting market growth. Increasing air travel demand, due to population growth, rising disposable incomes, and expanding tourism in the region is driving the growth.

As the world's fastest-growing aviation market, Asia-Pacific presents immense opportunities for SAF adoption to mitigate the environmental impact of this growth. Governments and industry stakeholders across the region are increasingly recognizing the importance of sustainable aviation and are actively exploring policies, incentives, and partnerships to promote SAF development and deployment.

Furthermore, Asia-Pacific boasts a diverse array of biomass resources suitable for SAF production, including agricultural residues, waste oils, and algae. Utilizing these abundant feedstock sources presents the region with a strategic advantage in establishing a sustainable aviation fuel supply chain.

Competitive Landscape

The global sustainable aviation fuel market will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Sustainable Aviation Fuel Market

- Neste

- TotalEnergies

- World Energy, LLC

- LanzaTech

- Aemetis

- SkyNRG

- Air France-KLM

- Boeing

- Airbus

- GE Aviation

Key Industry Developments

- February 2024 (Partnership) - ASL Group, a private aircraft operator, and Azzera, an organization dedicated to sustainability solutions, unveiled a collaborative venture aimed at implementing an online system for sustainable aviation fuel credits. They claim that this initiative will play a pivotal role in lowering carbon footprints. Leveraging Azzera's Celeste platform, ASL Group intends to streamline the process of booking SAF credits for its clientele. This advancement is expected to facilitate the offsetting of emissions stemming from flights, marking a significant step forward in promoting environmental sustainability within the aviation industry.

- February 2024 (Investment) - LanzaJet, Inc., a prominent sustainable fuels technology company and producer, disclosed a $30 million investment by Southwest Airlines Co. (Southwest) in LanzaJet. Under this arrangement, LanzaJet and Southwest are set to collaborate on the establishment of a sustainable aviation fuel production facility. Additionally, the two entities intend to join forces to enhance the operations of SAFFiRE Renewables, LLC, a company focused on corn stover to ethanol technology, in which Southwest holds an investment.

The Global Sustainable Aviation Fuel Market is Segmented as:

By Fuel Type

- Biofuel

- Hydrogen Fuel

- Power-to-Liquid

- Gas-to-Liquid

By Technology

- FT-SPK

- HEFA-SPK

- HFS-SIP

- ATJ-SPK

- CHJ

- Others

By Blending Capacity

- Below 30%

- 30% - 50%

- Above 50%

By Aircraft Type

- Commercial

- Military

- Business & General

- Unmanned Aerial Vehicle

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership