Healthcare Medical Devices Biotechnology

Sustainable Pharmaceutical Packaging Market

Sustainable Pharmaceutical Packaging Market Size, Share, Growth & Industry Analysis, By Raw Material (Plastics, Paper & paperboard, Glass, Metal), By Type (Primary, Secondary, Tertiary), By Process (Recyclable, Reusable, Biodegradable), and Regional Analysis, 2024-2031

Pages : 170

Base Year : 2023

Release : March 2025

Report ID: KR1425

Market Definition

Sustainable pharmaceutical packaging involves designing and producing medicine packaging with environmental responsibility while ensuring safety, quality, and compliance. It focuses on reducing waste, optimizing materials, and adopting innovative solutions to lower the ecological footprint of pharmaceutical products.

Sustainable Pharmaceutical Packaging Market Overview

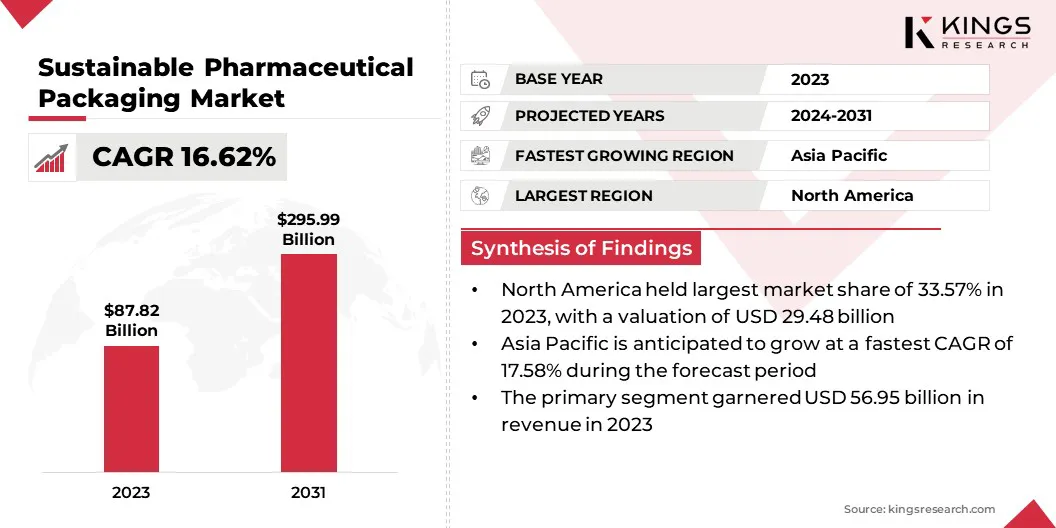

The global sustainable pharmaceutical packaging market size was valued at USD 87.82 billion in 2023 and is projected to grow from USD 100.91 billion in 2024 to USD 295.99 billion by 2031, exhibiting a CAGR of 16.62% during the forecast period.

The market is experiencing significant growth, driven by increasing environmental awareness, stringent regulatory frameworks, and technological advancements. This expansion is largely attributed to pharmaceutical companies adopting eco-friendly materials and innovative designs to reduce their environmental footprint.

Additionally, the rising demand for personalized medicines and biologics is boosting the need for innovative and sustainable packaging solutions that enhance product stability while minimizing waste.

Major companies operating in the global sustainable pharmaceutical packaging industry are Amcor plc, AptarGroup, Inc., Berry Global Inc., Gerresheimer AG, WestRock Company, Sonoco Products Company, Huhtamäki Oyj, Sealed Air Corporation, Drug Plastics & Glass Co., Inc., CCL Industries Inc., Comar, Silgan Holdings Inc., Stevanato Group S.p.A., Vetter Pharma-Fertigung GmbH & Co. KG, and Greiner Packaging.

The shift toward sustainable packaging is further propelled by the surging consumer demand for recyclable and biodegradable options and government initiatives promoting environmental responsibility. Moreover, consumer awareness and preference for eco-conscious brands are prompting pharmaceutical companies to adopt circular economy principles, creating a strong demand for sustainable packaging solutions.

- In October 2024, Klöckner Pentaplast launched kpNext MDR1, a sustainable medical device packaging film, expanding its kpNext brand into the medical device sector. The film imaintains the performance of traditional packaging films, offering a eco-friendly solution without compromising device protection or processing ease.

Key Highlights:

- The global sustainable pharmaceutical packaging market size was valued at USD 87.82 billion in 2023.

- The market is projected to grow at a CAGR of 16.62% from 2024 to 2031.

- North America held a share of 33.57% in 2023, valued at USD 29.48 billion.

- The plastics segment garnered USD 32.28 billion in revenue in 2023.

- The primary segment is expected to reach USD 56.95 billion by 2031.

- The recyclable segment is likley to generate a USD 33.21 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 17.58% over the forecast period.

Market Driver

"Growing Demand and Regulatory Push"

The sustainable pharmaceutical packaging market is experiencing significant growth, driven by increasing regulatory pressures and shifting consumer preferences. Governments and regulatory bodies worldwide are enforcing stringent environmental regulations and sustainability policies, compelling pharmaceutical companies to adopt eco-friendly packaging solutions.

Additionally, growing consumer awareness and demand for sustainable products are pronpting companies to integrate recyclable, biodegradable, and reusable materials into their packaging. Patients and healthcare providers are increasingly prioritizing greener alternatives.

The rising focus on corporate social responsibility (CSR) and the adoption of net-zero carbon goals by leading pharmaceutical manufacturers are further accelerating investments in sustainable packaging.

Moreover, advancements in material science, such as plant-based bioplastics and water-soluble films, are expanding the possibilities for innovative and environmentally friendly packaging solutions.

Consequently, pharmaceutical manufacturers are intensifying efforts to develop innovative, sustainable packaging solutions that meet both regulatory standards and consumer expectations.

- In December 2024, LOG Pharma Primary Packaging revealed its new barrier eco line. The eco-friendly packaging reduces bottle weight by up to 30% while maintaining superior barrier properties. This innovation aims to offer sustainable, cost-effective packaging solutions without compromising protection, quality, and regulatory compliance.

Market Challenge

"High Production Costs and Recycling Infrastructure"

The sustainable pharmaceutical packaging market faces high production costs due to the use of biodegradable polymers, paper-based alternatives, and plant-derived bioplastics, which requires expensive raw materials and specialized manufacturing processes.

Unlike conventional plastic packaging, which benefits from cost-efficient, scalable production, sustainable alternatives involve higher processing costs and limited raw material availability. This poses adoption challenges, oarticularly for smaller firms.

However, advancements in material science, economies of scale, and increased investments in research and development are gradually reducing costs, enhancing the feasibility of sustainable packaging.

The growth of the sustainable pharmaceutical packing market is further impeded by the lack of efficient recycling infrastructure, which limits the proper disposal and reuse of eco-friendly packaging materials. Many regions lack adequate infrastructure for separating, processing, and recycling biodegradable plastics, paper-based alternatives, and plant-derived bioplastics.

To overcome this challenge, governments and industry players are expanding recycling facilities, enforcing stricter waste management policies, and promoting consumer awareness on proper disposal methods. Continuous innovation and regulatory support are boosting the adoption of sustainable pharmaceutical packaging.

Market Trend

"Advancements in Biodegradable Materials and Smart Packaging"

The sustainable pharmaceutical packaging market is witnessing rapid growth, propelled by advancements in biodegradable materials and the integration of smart packaging technologies.

Companies are increasingly adopting biodegradable and plant-based packaging materials, such as biodegradable polymers, paper-based alternatives, and plant-derived bioplastics, to reduce reliance on conventional plastics and minimize their carbon footprint. This shift aligns with global sustainability initiatives and the transition to a circular economy.

Additionally, the integration of smart packaging technologies, including RFID tags and QR codes, is revolutionizing pharmaceutical packaging by enhancing product traceability, authentication, and patient engagement. These smart solutions improve supply chain efficiency and support sustainability efforts by reducing excess packaging materials and enabling better recycling practices.

- In October 2024, Bayer and Liveo Research launched a first-of-its-kind polyethylene terephthalate (PET) blister packaging for Bayer’s Aleve brand. This innovative packaging reduces the carbon footprint by 38% and eliminates the use of polyvinyl chloride (PVC), marking a significant step in environmental sustainability within the healthcare industry.

Sustainable Pharmaceutical Packaging Market Report Snapshot

|

Segmentation |

Details |

|

By Raw Material |

Plastics, Paper & paperboard, Glass, Metal |

|

By Type |

Primary, Secondary, Tertiary |

|

By Process |

Recyclable, Reusable, Biodegradable |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Raw Material (Plastics, Paper & Paperboard, Glass, and Metal): The plastics segment earned USD 32.28 billion in 2023 due to its lightweight, durable, and recyclable properties.

- By Type (Primary, Secondary, and Tertiary): The primary segment held a share of 64.84% in 2023, propelled by its essential role in protecting pharmaceutical products from contamination and ensuring extended shelf life.

- By Process (Recyclable, Reusable, and Biodegradable): The recyclable segment is projected to reach USD 111.94 billion by 2031, as a result of sustainability initiatives, stringent environmental regulations, and increasing adoption of circular economy practices.

Sustainable Pharmaceutical Packaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial sustainable pharmaceutical packaging market share of 33.57% in 2023, valued at USD 29.48 billion. This dominance is reinforced by stringent regulatory policies promoting eco-friendly packaging, high adoption of advanced packaging technologies, and the strong presence of major pharmaceutical companies investing in sustainable solutions.

The U.S. is at the forefront of this growth, supported by favorable government initiatives, increasing consumer awareness, and the widespread adoption of recyclable and biodegradable materials in pharmaceutical packaging.

Additionally, the presence of well-established recycling infrastructure, continuous research and development in sustainable materials, and increasing collaborations between pharmaceutical companies and packaging manufacturers strengthen North America's dominanat market position.

Asia Pacific sustainable pharmaceutical packaging industry is expected to register the fastest growth, recording a CAGR of 17.58% over the forecast period. Rapid industrialization, growing pharmaceutical manufacturing hubs in countries such as China, India, and Japan, and increasing government regulations promoting sustainability are contributing significantly to this growth.

Additionally, rising healthcare expenditures, expanding generic drug production, and consumer preference for environmentally friendly packaging solutions are accelerating regional market growth.

The region’s increasing focus on reducing plastic waste and improving recycling infrastructure further supports the adoption of sustainable pharmaceutical packaging. The rising adoption of digital and smart packaging solutions, coupled with a growing e-commerce pharmaceutical market, is creating a robust demand for sustainable and efficient packaging alternatives.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates pharmaceutical packaging to ensure compliance with safety, labeling, and quality standards. Additionally, the Environmental Protection Agency (EPA) monitors its environmental impact, promoting sustainable practices through reduced plastic waste and recyclable materials.

- In Europe, the European Medicines Agency (EMA) ensures that pharmaceutical packaging to ensure drug safety and efficacy while promoting sustainability. The European Commission, through its Circular Economy Action Plan, advocates for reducing packaging waste and adopting eco-friendly materials in the pharmaceutical industry.

- In China, the National Medical Products Administration (NMPA) ensures that pharmaceutical packaging meets safety and quality standards. The Ministry of Ecology and Environment (MEE) is responsible for enforcing regulations that address the environmental impact of packaging materials, promoting the use of sustainable and recyclable materials.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates pharmaceutical packaging to ensure compliance with health and safety standards, while the Ministry of the Environment (MOE) promotes environmentally friendly packaging to minimize plastic waste.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates pharmaceutical packaging to ensure safety and efficacy in drug storage and transport. The Ministry of Environment, Forest and Climate Change (MoEFCC) enforces packaging waste regulations, promoting sustainable materials and practices.

Competitive Landscape

The global sustainable pharmaceutical packaging market is characterized by a large number of participants, including both established corporations and emerging players. This market is highly competitive, spurred by continuous innovation in eco-friendly materials, regulatory compliance, and sustainability initiatives.

Companies are investing heavily in research and development to introduce biodegradable, recyclable, and reusable packaging solutions in compliance with global environmental policies. Strategic partnerships, mergers, and acquisitions are key strategies to expand market presence and strenghthen technological capabilities.

Additionally, advancements in smart packaging technologies, such as Radio Frequency Identification (RFID) tags and QR codes, are gaining traction, offering enhanced traceability and patient engagement while complementing sustainability goals.

The growing emphasis on circular economy principles is prompting manufacturers to develop closed-loop recycling systems and integrate renewable materials into their packaging designs.

As demand rises, competition is intensifying, with companies focusing on reducing carbon footprints, optimizing supply chain efficiency, and addressing consumer preferences for environmentally responsible pharmaceutical packaging.

- In February 2025, DS Smith launched TailorTemp, a fibre-based temperature-controlled packaging solution.Made from recyclable corrugated cardboard, it supports pharmaceutical cold chain logistics by maintaining temperatures for up to thirty-six hours. Developed in collaboration with an independent laboratory, it uses predictive modelling and parametric algorithms to optimize temperature control and sustainability.

List of Key Companies in Sustainable Pharmaceutical Packaging Market:

- Amcor plc

- AptarGroup, Inc.

- Berry Global Inc.

- Gerresheimer AG

- WestRock Company

- Sonoco Products Company

- Huhtamäki Oyj

- Sealed Air Corporation

- Drug Plastics & Glass Co., Inc.

- CCL Industries Inc.

- Comar

- Silgan Holdings Inc.

- Stevanato Group S.p.A.

- Vetter Pharma-Fertigung GmbH & Co. KG

- Greiner Packaging

Recent Developments (Acquisition/Partnership /New Product Launch)

- In December 2024, ALPLA acquired full owenership of its joint venture with Taba. The compaby manufactures plastic bottles, preforms, and closures for various industries, including pharmaceuticals, while continuing to invest in sustainable packaging and recycling solutions.

- In November 2024, Körber’s Business Area Pharma acquired Wilhelm Bähren GmbH & Co. KG, a supplier of labels and leaflets. This acquisition expands Körber’s packaging portfolio, enabling a comprehensive secondary packaging solution, including boxes, labels, and leaflets.

- In October 2024, Constantia Flexibles introduced sustainable pharmaceutical packaging solutions, including REGULA CIRC, a 100% recyclable coldform foil with superior barrier protection, and PERPETUA, a high-barrier, recyclable polypropylene laminate. The company also introduced PERPETUA ALTA, a recycle-ready laminate with enhanced chemical resistance, aligning with sustainability goals while ensuring product safety and shelf life.

- In May 2024, IMA and ETIMEX partnered to advance sustainable packaging innovation. Their collaboration focuses on ETIMEX’s PURELAY polypropylene films, which offer enhanced barrier properties, superior clarity, and recyclability as an alternative to traditional PVC and PVDC films.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)