Advanced Materials and Chemicals

Synthetic Rubber Market

Synthetic Rubber Market Size, Share, Growth & Industry Analysis, By Type [Styrene Butadiene Rubber (SBR), Polybutadiene Rubber (BR), Butyl Rubber (IIR), Others], By Application [Tires, Automotive (Non-Tire), Footwear, Industrial Goods, Others], and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : December 2024

Report ID: KR1157

Synthetic Rubber Market Size

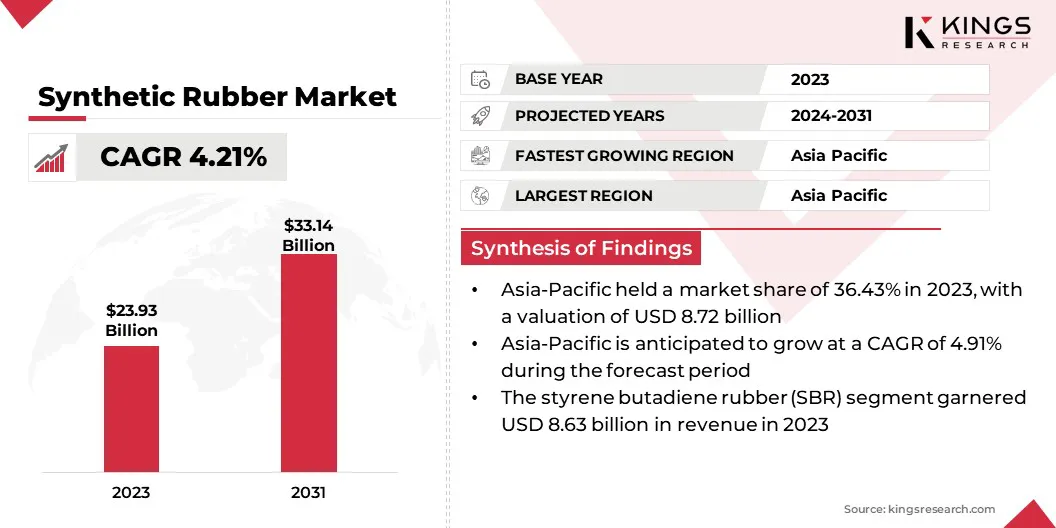

The global Synthetic Rubber Market size was valued at USD 23.93 billion in 2023 and is projected to grow from USD 24.83 billion in 2024 to USD 33.14 billion by 2031, exhibiting a CAGR of 4.21% during the forecast period. The rising demand for synthetic rubber, especially in tire manufacturing, is fueling market expansion due to its durability and performance benefits.

In the scope of work, the report includes products offered by companies such as Synthos, Exxon Mobil Corporation, TSRC, Dow, Zeon Europe GmbH, CNPC, Apcotex, ENEOS Holdings, Inc, MITSUBISHI GAS CHEMICAL COMPANY, INC, Reliance Industries Limited, and others.

The synthetic rubber market is dynamic and competitive, with applications across various sectors such as automotive, industrial, and consumer goods. It serves as a crucial material in the production of tires, footwear, seals and gaskets, offering durability, flexibility, and resistance to heat and chemicals.

Manufacturers in the market focus on innovation, developing specialized types of synthetic rubber to meet the diverse industry needs. The market is influenced by evolving consumer preferences and advancements in technology, leading to continuous improvements in product quality and performance.

- SIBUR's March 2024 shift to an industry-based model reflects the company's focus on innovation. By enhancing R&D and developing eco-friendly solutions, the company aims to meet diverse industry needs, support technological advancements, and improve product quality, particularly in synthetic rubber and polymers, thereby fostering local production growth.

Synthetic rubbers are man-made materials produced from petroleum, designed to replicate natural rubber's properties such as flexibility, durability, and resistance to heat, oils, and chemicals. Common types include styrene-butadiene rubber (SBR), butadiene rubber (BR), and ethylene propylene diene monomer (EPDM).

The production of synthetic rubbers is governed by various regulations, including the Environmental Protection Agency (EPA) to control emissions and waste, health and safety standards from the Occupational Safety and Health Administration (OSHA), and chemical safety regulations by the European Commission to ensure safety, quality, and minimal environmental impact.

Analyst’s Review

The synthetic rubber market is highly competitive, with manufacturers employing various strategies such as continuous product innovation, advanced production technologies, and expanding portfolios to meet diverse industry needs. Additionally, companies are diversifying their offerings and optimizing supply chains to ensure steady production.

Companies are forming strategic partnerships, investing in emerging markets, and focusing on sustainability by developing eco-friendly solutions. Regulatory bodies and consumers are demanding higher quality and environmental standards.

Companies should focus on increasing R&D investment in sustainable products, improving supply chain resilience, and actively engaging with regulators to ensure compliance with evolving environmental standards, ensuring long-term growth and market competitiveness.

- For instance, All India Rubber Industries Association (AIRIA) aims to promote, protect, and foster cooperation among rubber industry members while supporting engagement with regulators to ensure compliance with evolving environmental standards. By offering a platform for dialogues, resources, and government representation, AIRIA helps members navigate regulatory challenges and industry growth, promoting investment in sustainable practices for long-term competitiveness.

Synthetic Rubber Market Growth Factors

The increasing demand for eco-friendly products is propelling the growth of the synthetic rubber market, as industries transition to sustainable materials such as eco-friendly tires. This trend is boosting the use of synthetic rubber in environmentally conscious sectors.

Additionally, the rising demand for consumer goods, including footwear, household items, and medical supplies, further supports market growth. As synthetic rubber is essential in these applications due to its versatility and durability, its usage continues to expand across various industries, thus fueling market development.

- For instance, in November 2024, Synthos, a global leader in synthetic rubber, signed a Memorandum of Understanding (MOU) with Sumitomo Rubber Industries (SRI), a prominent Japanese tire manufacturer. The collaboration focuses on the development of high-performance rubber powders from recycled rubber, combined with advanced synthetic rubber, to create a more sustainable tire solution. This partnership aims to significantly reduce the environmental footprint of tires while maintaining safety, durability, and rolling resistance, addressing the growing demand for eco-friendly rubber in the automotive industry.

Synthetic rubber production poses considerable environmental challenges, including air, water, and noise pollution. The manufacturing process releases harmful emissions and chemicals into the air and water, negatively impacting ecosystems and human health. Additionally, the noise generated during production can contribute to environmental disruption.

To address these issues, manufacturers are increasingly adopting cleaner, more sustainable production methods, focusing on technologies to minimize emissions and waste. These efforts aim to reduce pollution and promote sustainability in the synthetic rubber industry.

Synthetic Rubber Industry Trends

The growing demand for sustainable and eco-friendly materials is a significant trend in the synthetic rubber market. This shift is promoting the development of biodegradable and recyclable rubber materials, particularly in the tire industry, as companies focus on reducing environmental impact.

Manufacturers are increasingly prioritizing eco-friendly production methods to minimize waste and improve the recyclability of synthetic rubbers, supporting the circular economy and aligning with global sustainability goals.

- In May 2024, CSRC Group formed a strategic partnership with Eco Infinic Co., Ltd., a subsidiary of the SHEICO Group, to invest in the recovered carbon black (rCB) business at the Continental Carbon Company’s Phenix plant. This collaboration aims to develop a sustainable solution for tire production by incorporating recycled carbon black, a critical material in synthetic rubber. The joint venture aligns with the growing demand for eco-friendly materials in the tire industry, focusing on sustainability and recyclability and aligns with global circular economy and sustainability goals.

As industries, especially the automotive sector, demand more durable and efficient materials, the need for high-performance synthetic rubbers is increasing. These rubbers are engineered to offer superior resistance to heat, chemicals, and wear, making them essential for applications such as tires, seals, and gaskets.

Their ability to withstand harsh conditions significantly improves the safety, longevity, and performance. With automotive manufacturers focusing on vehicle safety, fuel efficiency, and durability, the demand for synthetic rubbers that meet these rigorous standards is expected to grow, fostering innovation and market expansion.

Segmentation Analysis

The global market has been segmented based on type, application and geography.

By Type

Based on type, the market has been segmented into styrene butadiene rubber (SBR), polybutadiene rubber (BR), ethylene propylene diene monomer (EPDM), butyl rubber (IIR), and others. The styrene butadiene rubber (SBR) segment led the synthetic rubber market in 2023, reaching a valuation of USD 8.63 billion.

This growth is largely attributed to its cost-effectiveness, as it is relatively inexpensive to produce than other synthetic rubbers, making it an attractive to manufacturers. Additionally, SBR’s versatility in various applications such as tires, footwear, and industrial products expands its market reach.

Its excellent performance characteristics, including strength, abrasion resistance, and elasticity, further enhance its appeal. As industries prioritize high-performance, cost-effective materials, the widespread use of SBR in tire manufacturing and beyond continues to drive segmental expansion.

By Application

Based on application, the market has been classified into tires, automotive (non-tire), footwear, industrial goods, and others. The tires segment secured the largest revenue share of 33.52% in 2023. This growth is mainly supported by the booming automotive industry, particularly due to the rising demand for tires.

Increased vehicle ownership increases, fueled by higher disposable incomes and urbanization, is boosting the demand for tires and, consequently, synthetic rubber consumption. Tires require specific properties such as durability, traction, and fuel efficiency, which synthetic rubber delivers effectively.

Additionally, technological advancements in tire innovation, such as high-performance tires, are increasing the demand for advanced synthetic rubber compounds, thereby aiding segmental expansion.

Synthetic Rubber Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific synthetic rubber market accounted for a notable share of around 36.43% in 2023, with a valuation of USD 8.72 billion. Rapid industrialization in countries such as China and India is leading to the increased demand for synthetic rubber across various industries.

The booming automotive sector, fueled by a growing middle-class population and rising disposable incomes, is contributing significantly to the surging demand for synthetic rubber in tire production and automotive components. Additionally, substantial investments in infrastructure development are further highlighting the need for construction materials, including synthetic rubber-based products.

These factors are creating a strong demand for synthetic rubber in key sectors across emerging markets, thereby propelling regional market growth.

Europe synthetic rubber market is poised to witness significant growth over the forecast period, registering a CAGR of 4.50%. Europe is a key market for high-performance synthetic rubber products, mainly due to the growing demand for advanced materials across various industries.

The region’s focus on high-performance products is further supported by stringent environmental regulations, which promote the development of sustainable and eco-friendly synthetic rubber solutions. These regulations are prompting manufacturers to innovate and produce more environmentally responsible products, aligning with Europe’s commitment to sustainability. The rising demand for high-performance products and environmental responsibility is shaping the Europe market.

Competitive Landscape

The synthetic rubber market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic actions such as investing in research and development, building new production facilities, and enhancing supply chain efficiency are likely to presentp new growth opportunities for market expansion.

List of Key Companies in Synthetic Rubber Market

- Synthos

- Exxon Mobil Corporation

- TSRC

- Dow

- Zeon Europe GmbH

- CNPC

- Apcotex

- ENEOS Holdings, Inc

- MITSUBISHI GAS CHEMICAL COMPANY, INC

- Reliance Industries Limited

Key Industry Developments

- October 2024 (Funding): Bridgestone Americas received a grant from the U.S. Department of Energy to develop a pilot plant for butadiene production from ethanol. This initiative aims to reduce the carbon footprint of synthetic rubber production by replacing fossil fuels with bio-based or recycled materials. This aligns with Bridgestone's commitment to sustainability and its goal of using 100% sustainable raw materials by 2050.

The global synthetic rubber market has been segmented as:

By Type

- Styrene Butadiene Rubber (SBR)

- Polybutadiene Rubber (BR)

- Ethylene Propylene Diene Monomer (EPDM)

- Butyl Rubber (IIR)

- Others

By Application

- Tires

- Automotive (Non-Tire)

- Footwear

- Industrial Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership