ICT-IOT

System Integration Services Market

System Integration Services Market Size, Share, Growth & Industry Analysis, By Service Type (Consulting Services, Enterprise Application Integration Services, Infrastructure Integration Services), By Vertical (BFSI (Banking, Financial Services, and Insurance), Government & Defense, IT & Telecom, Healthcare, Others) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : April 2024

Report ID: KR670

System Integration Services Market Size

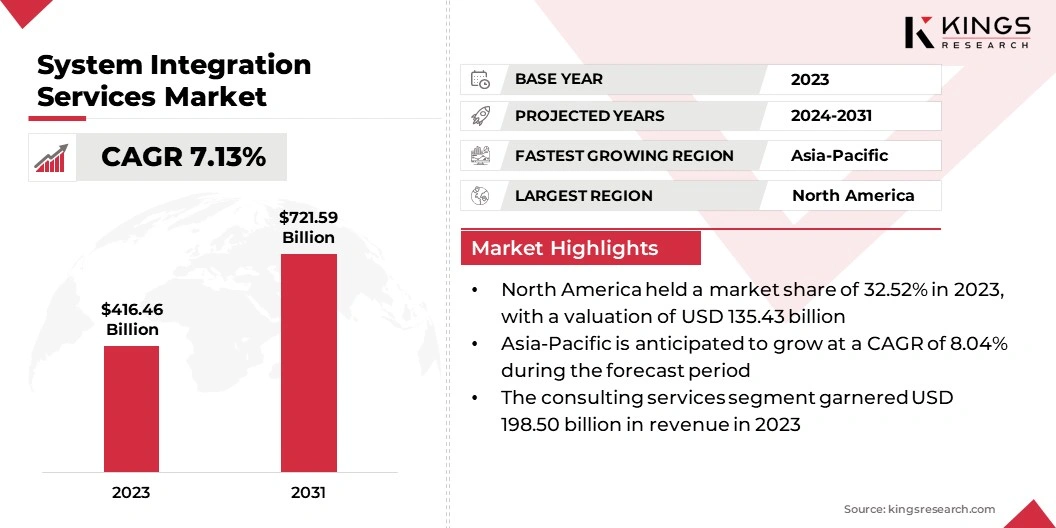

The global System Integration Services Market size was valued at USD 416.46 billion in 2023 and is projected to reach USD 721.59 billion by 2031, growing at a CAGR of 7.13% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Deloitte Touche Tohmatsu Limited, Cognizant, Wipro, Capgemini, Aspire Systems, Infosys Limited, Itransition, CGI Inc., Tata Consultancy Services Limited, Fiserv and others.

The expansion of the system integration services market is driven by the rising complexity of IT infrastructures and an imperative need for digital transformation across various sectors. Companies are increasingly seeking to synchronize different systems, applications, and data sources to enhance operational efficiency and gain a competitive advantage.

System integration services encompass a comprehensive set of activities aimed at connecting disparate computing systems and software applications to function cohesively as a unified entity. These services are pivotal in modern IT landscapes, facilitating the seamless collaboration of various technological components, including hardware, software, and networking infrastructure. Through meticulous planning, custom software development, data integration, and enterprise application integration (EAI), among other techniques, organizations are optimizing operational efficiency, reducing costs, and enhancing information flow.

System integration services play a crucial role in enabling different businesses to adapt and utilize evolving technological requirements to achieve their strategic objectives, including companies that have not integrated on-premises systems with cloud-based services or lack the interoperability between diverse systems.

Analyst’s Review

The system integration services market is experiencing growth due to the rapid impact of digital transformation, the expansion of the Internet of Things (IoT), and the integration of AI services across various domains globally. While certain challenges such as legacy system compatibility and cybersecurity risks have the potential to disrupt this growth, opportunities exist in vertical-specific solutions and service management. Service providers can enhance their presence in the industry by offering customized service solutions and mitigating cybersecurity risks through the development of a robust support infrastructure.

System Integration Services Market Growth Factors

As companies adopt diverse software applications, cloud-based services, and legacy systems, the need to seamlessly integrate these components is increasing. System integration services offer the expertise and solutions required to bridge these different technologies, enabling effective communication and data flow. This rising complexity is driving the demand for integration services, as businesses strive to optimize their IT environments and extract maximum value from their investments while maintaining operational agility and scalability.

System integration services play a pivotal role in facilitating digital transformation across varied industries by seamlessly integrating new technologies with legacy systems. This ensures smooth operations, data consistency, and enables organizations to utilize the potential of digital innovation. Furthermore, the growing emphasis on digital transformation is emerging as a key factor supporting the expansion of the system integration services market.

System Integration Services Market Trends

Increasing adoption of hybrid cloud environments by organizations in order to leverage benefits associated with on-premises and cloud based infrastructures is a prominent trend in the market. This entails the development of robust strategies and solutions to integrate data, applications, and workflows across on-premises data centers and multiple cloud platforms. System integrators are innovating to address the challenges posed by hybrid cloud integration, including data security, interoperability, and governance, to enable organizations to realize the full potential of their hybrid cloud deployments while ensuring operational efficiency and agility.

Another significant trend shaping the system integration services market landscape is the integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and blockchain into existing IT infrastructures. Organizations are increasingly exploring the transformative potential of these technologies to drive innovation, improve decision-making, and enhance customer experiences.

System integrators are at the forefront of this trend, offering expertise in integrating these cutting-edge technologies with legacy systems and business processes. This trend requires that system integrators remain updated on the latest developments in emerging technologies and adapt their integration approaches to leverage their full capabilities effectively.

Segmentation Analysis

The global system integration services market is segmented based on service type, vertical, and geography.

By Service Type

Based on service type, the market is segmented into consulting services, enterprise application integration services, and infrastructure integration services. The consulting services dominated the market in 2023 with a valuation of USD 198.50 billion and is expected to grow in the forecast duration. Consulting services are dominating the systems integration services market due to their expertise, strategic planning capabilities, and vendor-neutral advice. Consultants offer tailored solutions, assessing clients' needs and crafting comprehensive integration strategies to optimize outcomes.

By providing guidance on technology selection and customization, they ensure seamless integration and cost-effectiveness. Moreover, consultants offer change management support, addressing organizational concerns and facilitating smooth transitions throughout the integration process. Their deep industry knowledge and collaborative approach enhance project success, making consulting services indispensable for organizations navigating the complexities of system integration.

By Vertical

Based on vertical, the market BFSI (banking, financial services, and insurance), government & defense, IT & telecom, healthcare, and others. The BFSI segment holds the highest market share of 32.1% in 2023. The dominance of the BFSI (banking, financial services, and insurance) sector is mainly attributable to its complex IT infrastructure, stringent regulatory requirements, and ongoing digital transformation initiatives. System integration services are crucial for BFSI organizations to streamline operations, ensure compliance, and enhance customer experiences.

With the integration of various applications, platforms, and data sources, BFSI firms are improving operational efficiency, strengthening cybersecurity defenses, and adapting quickly to changing market dynamics. As the sector continues to invest in technology-driven innovation and regulatory compliance, system integration services play a pivotal role in driving digital transformation and helping companies maintain competitive advantage in the BFSI landscape.

System Integration Services Market Regional Analysis

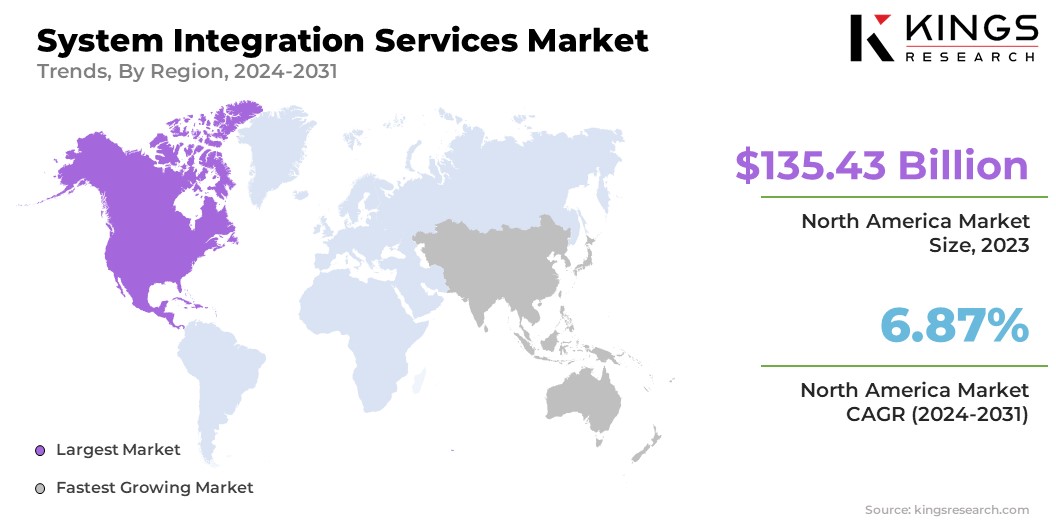

Based on region, the global system integration services market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America System Integration Services Market share stood around 32.52% in 2023 in the global market, with a valuation of USD 135.43 billion and is estimated to maintain its dominance over the forecast period (2024-2031). North America's dominance in the system integration services industry is primarily fueled by its technological expertise, significant presence of large enterprises, stringent regulatory environment, and widespread adoption of cloud computing.

Due to the strong economy in the region and significant investments in IT infrastructure, businesses prioritize technology investments to streamline operations, ensure compliance, and further drive innovation. These factors collectively contribute to North America's leading position in deploying and optimizing complex IT solutions through system integration services.

Asia-Pacific is estimated to experience significant growth at a robust CAGR of 8.04% over the review period. This considerable growth is majorly driven by the rapid economic development, rising digitalization efforts across various industries, and increasing IT spending in the region. The region boasts a diverse ecosystem of IT service providers, supported by favorable government initiatives, which empower businesses to invest in system integration to modernize operations, enhance efficiency, and meet regulatory requirements. This expanding market presents significant opportunities for system integrators and technology firms to capitalize on the region's increasing demand for integrated IT solutions and services.

Competitive Landscape

The report on the global system integration services market aims to offer significant insights into the industry's dynamics. Leading companies are prioritizing various strategic initiatives, including partnerships, mergers, acquisitions, product advancements, and joint ventures, to broaden their range of offerings and bolster their market presence across various geographic areas. Strategic actions such as investing in research and development (R&D) activities, establishing new manufacturing facilities, and optimizing supply chain operations are anticipated to create potential opportunities for market growth.

List of Key Companies in System Integration Services Market

- Deloitte Touche Tohmatsu Limited

- Cognizant

- Wipro

- Capgemini

- Aspire Systems

- Infosys Limited

- Itransition

- CGI Inc.

- Tata Consultancy Services Limited

- Fiserv, Inc.

Key Industry Developments

- October 2023 (Partnership): DMC inked a partnership agreement with Arduino Systems Integrators Partner Programs, an open-source electronics program specializing in microcontroller-based development boards and related software tools. Arduino's services encompass a diverse range of end-uses from custom electronics to complex IoT solutions.

- July 2023 (Acquisition): Bosch announced the finalization of its agreement to acquire Paladin Technologies, Inc., a technology company providing solutions in audio-visual, security, structured cabling, and wireless and networking technologies. The company offers system integration services and has a significant market presence, particularly across the North American region.

The Global System Integration Services Market is Segmented as:

By Service Type

- Consulting Services

- Enterprise Application Integration Services

- Infrastructure Integration Services

By Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- IT & Telecom

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership