ICT-IOT

Telecom Service Assurance Market

Telecom Service Assurance Market Size, Share, Growth & Industry Analysis, By Type (Proactive Services and Reactive Series), By Operator Type (Mobile Operator and Fixed Operator), By Deployment Type (On-Premises and Cloud), By End-Use (SMEs and Large Enterprises) and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : July 2024

Report ID: KR863

Telecom Service Assurance Market Size

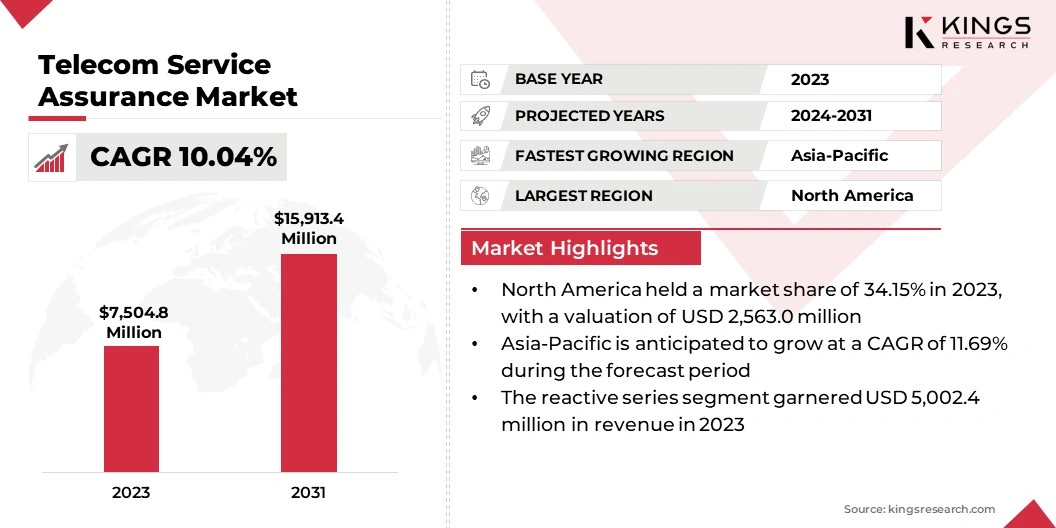

The global Telecom Service Assurance Market size was valued at USD 7,504.8 million in 2023 and is projected to grow from USD 8,145.7 million in 2024 to USD 15,913.4 million by 2031, exhibiting a CAGR of 10.04% during the forecast period. The increasing demand for seamless communication services and the proliferation of 5G technology are driving the growth of the market.

In the scope of work, the report includes solutions offered by companies such as Accenture, Amdocs, Anritsu, Cisco, NEC Corporation, Nokia, Telefonaktiebolaget LM Ericsson, EXFO Inc, IBM, NETSCOUT, and others.

The expansion of the telecom service assurance market is primarily augmented by the increasing demand for seamless and reliable communication services. The rise of smartphones and other connected devices has led to increased need for robust telecom infrastructure.

Additionally, the advent of 5G technology is influencing the market, highlighting the necessity for enhanced service quality and network performance monitoring.

- For instance, in September 2023, CloudFabrix introduced its AI-driven ‘Telco Service Assurance and Automation Solution’ and launched a GSI Partner Progra. The solution consolidated data from various sources, enhanced automation through AutoML, data automation, and service automation. Additionally, it addressed the complexities of large telco environments, meeting stringent service level agreements.

Regulatory mandates for improved service quality and enhanced customer experience further propel market growth. Moreover, the growing adoption of Internet of Things (IoT) devices and services is fueling the demand for telecom service assurance solutions to ensure uninterrupted connectivity and optimal performance.

The market is experiencing significant growth due to the rising complexity of telecom networks and the pressing need for efficient monitoring and management solutions. This market encompasses various tools and services designed to ensure the reliability and performance of telecom networks.

The market is characterized by the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) to enhance predictive maintenance and real-time analytics, thereby improving overall service delivery and customer satisfaction.

Telecom service assurance refers to a comprehensive set of processes and tools aimed at ensuring optimal performance and quality of telecom services. It involves the proactive management and monitoring of network performance, fault detection, and resolution to maintain high service standards.

This domain covers various aspects such as network performance management, service quality management, and customer experience management.

Telecom service assurance solutions are crucial for telecom operators to deliver consistent and reliable services, minimize downtime, and address issues promptly. These solutions are increasingly integrated with AI and ML technologies to enable predictive analytics and automated problem resolution, thus enhancing operational efficiency.

Analyst’s Review

Manufacturers in the telecom service assurance market are actively focusing on integrating advanced technologies such as AI and ML into their solutions to enhance network performance and predictive maintenance. New products are being launched to offer real-time analytics and automated fault detection, addressing the growing demands of 5G and IoT applications.

- For instance, in February 2024, Ericsson launched a new service orchestration and assurance product viz. Ericsson Service Orchestration and Assurance that helped communication service providers manage and scale services across various network domains. Additionally, the Ericsson Dynamic Network Slicing solution, integrated with this product, aimed to enhance 5G network slicing and reduce implementation risks, supporting end-to-end service orchestration and monetization.

To maintain competitiveness, it is imperative for manufacturers to invest in R&D to continuously innovate their offerings. Additionally, forming strategic partnerships with telecom operators is anticipated to enable rapid deployment of advanced service assurance solutions.

Keeping up with regulatory changes and ensuring compliance are likely to play a crucial role in maintaining leading position and ensuring the delivery of high-quality telecom services.

Telecom Service Assurance Market Growth Factors

The increasing adoption of 5G technology is stimulating the expansion of the telecom service assurance market. Telecom operators are increasingly upgrading their infrastructure to support 5G networks, which offer faster data speeds and lower latency. This technological shift is significantly boosting the demand for advanced service assurance solutions.

These solutions are crucial for managing the complexities of 5G networks, ensuring optimal performance, and maintaining high service quality. Additionally, 5G networks are supporting a wide range of applications, including autonomous vehicles, smart cities, and IoT devices, emphasizing the need for robust telecom service assurance to handle the increased data traffic and connectivity requirements.

A significant challenge impeding the development of the market is the rising integration of new technologies with existing legacy systems. This integration process is often complex and resource-intensive, leading to operational disruptions and increased costs. To overcome this challenge, telecom operators are adopting hybrid approaches that gradually incorporate new technologies while maintaining essential legacy operations.

Utilizing advanced integration platforms and middleware solutions is helping streamline the transition, ensuring compatibility and interoperability between old and new systems. Furthermore, investing in staff training and development is essential for managing this technological shift smoothly, reducing potential downtime, and enhancing overall operational efficiency.

Telecom Service Assurance Industry Trends

The growing adoption of artificial intelligence (AI) and machine learning (ML) is transforming the telecom service assurance market landscape. These technologies are increasingly being integrated into service assurance solutions to enhance predictive maintenance, automate fault detection, and optimize network performance. AI and ML algorithms analyze vast amounts of data sourced from telecom networks, identifying patterns and anomalies in real-time.

This proactive approach is helping telecom operators anticipate and address potential issues before they impact service quality. Additionally, AI-powered chatbots and virtual assistants are improving customer support by providing faster and more accurate responses. AI and ML are playing pivotal roles in enhancing operational efficiency and improving customer experience in the telecom sector.

The rise of cloud-based service assurance solutions is significantly impacting the telecom market dynamics. Telecom operators are increasingly adopting cloud technologies to improve scalability, flexibility, and cost-efficiency. Cloud-based service assurance platforms are enabling real-time monitoring and management of network performance from remote locations, thereby reducing the need for extensive on-premises infrastructure.

These solutions support seamless updates and integration with other cloud services, thus enhancing overall operational agility. Moreover, the cloud's ability to handle large data volumes is crucial for managing the growing complexity of modern telecom networks. This trend is helping operators deliver high-quality services while adapting to rapidly changing market demands and continual technological advancements.

Segmentation Analysis

The global market is segmented based on type, operator type, deployment type, end-use, and geography.

By Type

Based on type, the market is categorized into proactive services and reactive series. The reactive series segment led the telecom service assurance market in 2023, reaching a valuation of USD 5,002.4 million. This expansion is primarily boosted by the ongoing need for immediate issue resolution in telecom networks. Reactive services are essential for addressing unexpected network faults and service disruptions promptly.

The surging demand for these services is fueled by the increasing complexity of telecom infrastructure, where unforeseen problems notably impact service quality. Additionally, advancements in diagnostic tools and technologies are enhancing the effectiveness of reactive services, making them a critical component for maintaining network reliability and enhancing customer satisfaction.

By Operator Type

Based on operator type, the market is classified into mobile operator and fixed operator. The mobile operator segment is poised to witness significant growth at a robust CAGR of 10.48% through the forecast period (2024-2031). This expansion is attributed to the rapid proliferation of mobile devices and the increasing reliance on mobile networks for communication and data services.

The ongoing deployment of 5G technology is further boosting the progress of the segment, as mobile operators upgrade their infrastructure to support faster data speeds and lower latency. Additionally, the growing adoption of IoT devices is contributing to the increasing demand for robust mobile networks, underscoring the need for telecom service assurance solutions that ensure seamless connectivity and optimal performance.

By Deployment Type

Based on deployment type, the market is segmented into on-premises and cloud. The cloud segment secured the largest telecom service assurance market share of 59.99% in 2023.

The expansion of this segment is fostered by the numerous advantages offered by cloud-based solutions, such as scalability, flexibility, and cost-efficiency. Telecom operators are increasingly adopting cloud technologies to manage the rising complexity and data volume of modern networks.

Cloud-based service assurance platforms provide real-time monitoring and management capabilities, enabling operators to maintain high service quality remotely. Moreover, the ease of integration with other cloud services and the ability to quickly adapt to technological advancements are propelling the growth of the cloud deployment segment.

Telecom Service Assurance Market Regional Analysis

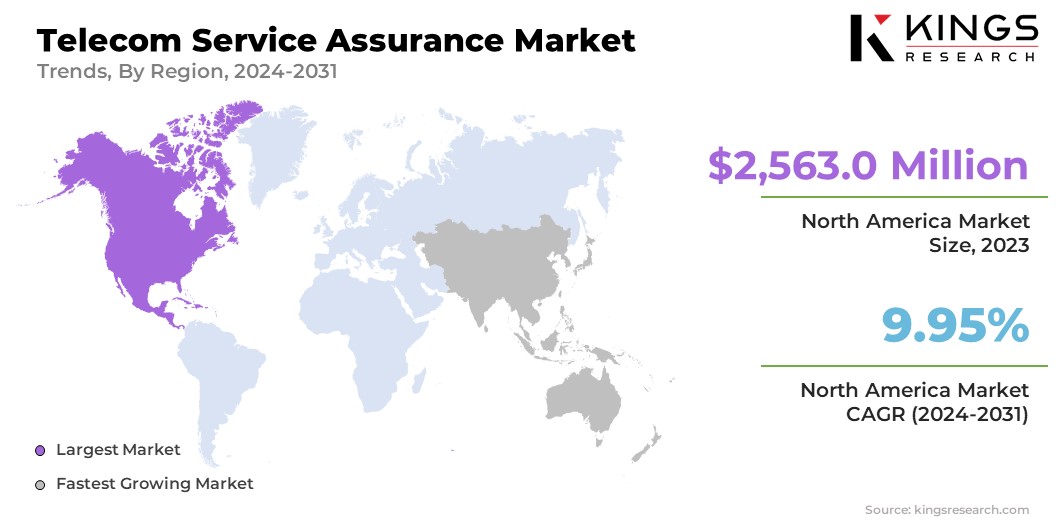

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America telecom service assurance market share stood around 34.15% in 2023 in the global market, with a valuation of USD 2,563.0 million. This dominance is reinforced by the region's advanced telecom infrastructure and early adoption of cutting-edge technologies such as 5G, AI, and IoT. North American telecom operators are heavily investing in service assurance solutions to ensure high service quality and maximize customer satisfaction.

Additionally, the presence of major market players and innovative startups in the region is fostering continuous advancements in telecom service assurance technologies, solidifying North America's leading position in the global market.

Asia-Pacific is anticipated to grow at a robust CAGR of 11.69% through the projection period. This rapid expansion is fueled by the increasing penetration of mobile devices and internet connectivity across the region. The ongoing deployment of 5G networks in countries such as China, India, and Japan is significantly boosting the demand for advanced service assurance solutions.

Furthermore, the region's large and diverse population is highlighting the need for reliable and high-quality telecom services. Favorable government initiatives and increased investments in telecom infrastructure are playing crucial roles in augmenting Asia-Pacific market growth.

Competitive Landscape

The global telecom service assurance market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategic initiatives adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Telecom Service Assurance Market

- Accenture

- Amdocs

- Anritsu

- Cisco

- NEC Corporation

- Nokia

- Telefonaktiebolaget LM Ericsson

- EXFO Inc

- IBM

- NETSCOUT

Key Industry Developments

- February 2024 (Expansion): VMware announced the deployment of its telco cloud service assurance by DISH Wireless across its boost wireless network in a pilot production environment. Thisinitiative aimed to deliver real-time network monitoring, automation, and assurance, thereby enhancing the performance of the 5G network and improving subscriber experience. DISH Wireless tested the solution for pipeline reporting, multi-site monitoring, cell site infrastructure topology, and automated alarm management to improve network management and operational efficiency.

- February 2024 (Launch): Ericsson introduced new service orchestration and assurance capabilities, enabling global communication service providers (CSPs) to leverage 5G and 5G Standalone (SA) use cases. The Ericsson assurance product and service orchestration provided tools for CSPs to manage services across multiple technologies and network domains. Additionally, Ericsson unveiled the Dynamic network slicing solution, designed to reduce implementation risk, operationalize 5G network slicing, and accelerate value generation. Associated services provide comprehensive support for end-to-end service orchestration and assurance.

The global telecom service assurance market is segmented as:

By Type

- Proactive Services

- Reactive Series

By Operator Type

- Mobile Operator

- Fixed Operator

By Deployment Type

- On-Premises

- Cloud

By End-Use

- SMEs

- Large Enterprises

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership