ICT-IOT

Transportation Management Systems Market

Transportation Management Systems Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Deployment (Cloud-based, On-Premises), By Transportation (Roadway, Railway, Airway, Maritime), By Vertical (Retail & E-commerce, Healthcare, Logistics, Manufacturing, Government, Others), and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR1329

Market Definition

The Transportation Management Systems (TMS) market involves software solutions that assist businesses in planning, executing, and optimizing the movement of goods across transportation networks. Transportation Management Systems (TMS) aims to streamline operations, reduce costs, improve efficiency, and ensure on-time deliveries.

It includes functionalities like route planning, freight management, and shipment tracking to enhance overall supply chain performance and logistics management.

Transportation Management Systems Market Overview

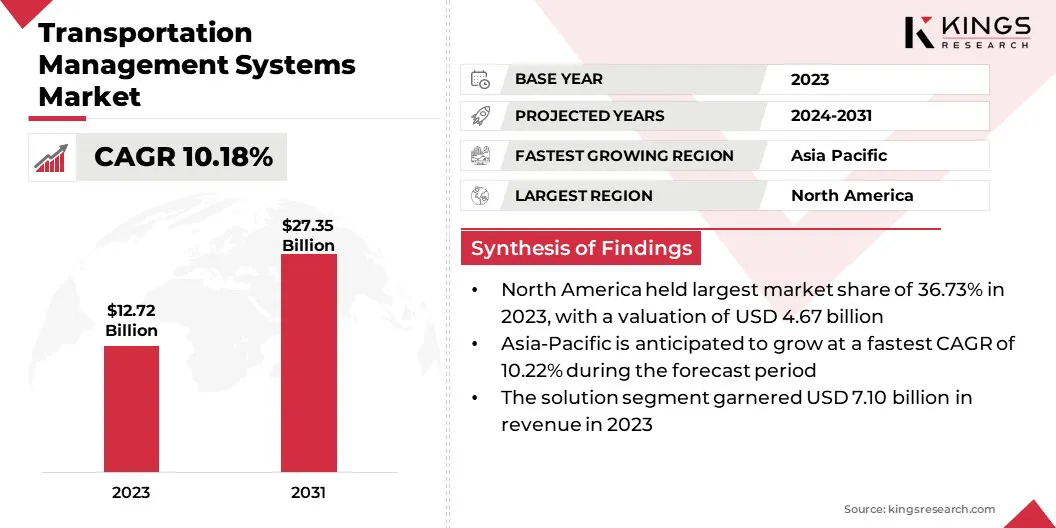

The global transportation management systems market size was valued at USD 12.72 billion in 2023, which is estimated to be valued at USD 13.88 billion in 2024 and reach USD 27.35 billion by 2031, growing at a CAGR of 10.18% from 2024 to 2031.

The rapid growth of e-commerce has significantly increased the demand for faster, more efficient logistics and delivery solutions, driving the adoption of TMS to optimize routing, improve tracking, and streamline operations for timely deliveries in a highly competitive market.

Major companies operating in the transportation management systems industry are e2open, LLC, Cargobase, GoComet Solutions Pte Limited, 3Gtms, LLC, Infor, Blue Yonder Group, Inc, Manhattan Associates, Körber AG (MercuryGate), Oracle, SAP SE, The Descartes Systems Group Inc, Trimble, CTSI-Global, C.H. Robinson Worldwide, Inc., and Alpega Group.

The market is increasingly becoming a cornerstone of modern supply chain management, as businesses focus on enhancing their logistics and operational efficiency. TMS platforms evolve to offer more integrated, user-friendly capabilities as the demand for faster, cost-effective solutions grows.

These systems are essential in optimizing transportation networks, providing end-to-end visibility, and helping companies stay competitive by enabling smarter decision-making and better control over their transportation processes.

- In July 2024, Cart.com launched Constellation WMS and Constellation TMS as standalone offerings, enhancing their suite of unified commerce solutions. These systems, alongside Constellation OMS, provide powerful, scalable tools for warehouse and transportation management, driving efficiency, cost savings, and seamless integration across operations.

Key Highlights:

- The transportation management systems industry size was valued at USD 12.72 billion in 2023.

- The market is projected to grow at a CAGR of 10.18% from 2024 to 2031.

- North America held a market share of 36.73% in 2023, with a valuation of USD 4.67 billion.

- The solution segment garnered USD 7.10 billion in revenue in 2023.

- The on-premises segment is expected to reach USD 13.95 billion by 2031.

- The roadway segment had a market share of 36.81% in 2023.

- The logistics segment is anticipated to have a CAGR of 10.26% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.22% during the forecast period.

Market Driver

"E-commerce Expansion"

The expansion of e-commerce has significantly increased the demand for efficient logistics and fast, reliable deliveries, driving the need for robust TMS.

- The International Trade Administration (ITA) forecasts a consistent compound annual growth rate (CAGR) of 14.4% for the global B2C e-commerce market through 2027. Similarly, the global B2B e-commerce market is expected to grow at a CAGR of 14.5% through 2026.

Businesses must streamline their supply chains to meet customer expectations for timely deliveries, real-time tracking, and accurate order fulfillment as online shopping continues to grow. TMS solutions play a crucial role in optimizing routes, managing freight, and providing visibility across the entire transportation network, ensuring cost-effective and on-time deliveries.

With the rise in direct-to-consumer (D2C) orders and cross-border shipping, TMS systems have become essential for handling the complexities of modern e-commerce logistics.

- In March 2024, GEODIS launched its multi-carrier parcel shipping solution to optimize e-commerce fulfillment, offering direct carrier connections and cloud-based integration with warehouse management systems. This solution enhances rate shopping, improves delivery performance, and streamlines global parcel shipments for customers.

Market Challenge

"Integration Complexity"

Integration complexity is a significant challenge for the transportation management systems market, as businesses often struggle to connect TMS with existing legacy systems and other software platforms.

This can lead to operational inefficiencies and data silos. A potential solution is adopting API-driven, modular TMS solutions that offer seamless integration capabilities, allowing businesses to gradually replace or integrate old systems without significant disruption.

Investing in user-friendly, customizable platforms and working with experienced vendors can also ease the integration process and improve overall system compatibility.

- In September 2024, Trimble launched Transporeon Visibility in North America, offering real-time shipment tracking and AI-powered ETA predictions across road, ocean, and air transportation sectors. This solution enhances visibility, reduces delays, and integrates seamlessly with Trimble TMS, optimizing freight management and improving operational efficiency for carriers and shippers.

Market Trend

"AI and ML Integration"

A key trend in the transportation management systems market is the integration of Artifical Intelligence (AI) and Machine Learning (ML). These technologies are increasingly being adopted to enhance predictive analytics, optimize routes, and improve decision-making.

TMS can analyze vast amounts of data in real time, enabling businesses to forecast potential disruptions, reduce inefficiencies, and improve overall transportation planning by leveraging AI and ML. This trend helps companies streamline operations, lower costs, and enhance customer service by providing more accurate, data-driven insights.

- In April 2024, Umovity and Derq launched an AI-powered traffic management solution that integrates real-time analytics to enhance safety and traffic operations. This trend reflects the broader adoption of AI in transportation systems, similar to AI's role in optimizing route planning and decision-making within the market.

Transportation Management Systems Market Report Snapshot

| Segmentation | Details |

| By Component | Solution (Operational Planning, Order Management, Audits & Payment, Monitoring & Tracking, Analytics & Reporting, Others), Services (Managed, Professional) |

| By Deployment | Cloud-based, On-premises |

| By Transportation | Roadway, Railway, Airway, Maritime |

| By Vertical | Retail & E-commerce, Healthcare, Logistics, Manufacturing, Government, Others |

| By Region | North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Solution, Services): The solution segment earned USD 7.10 billion in 2023, due to increasing adoption of advanced TMS solutions, helping businesses optimize transportation routes, reduce costs, and improve delivery efficiency.

- By Deployment (Cloud-based, On-premises): The on-premises segment held 51.09% share of the market in 2023, due to the preference of businesses for greater control over their infrastructure and data security within their own premises, especially in large-scale operations.

- By Transportation (Roadway, Railway, Airway, Maritime): The roadway segment is projected to reach USD 10.06 billion by 2031, owing to the growing demand for road-based logistics, real-time tracking, and route optimization, driven by e-commerce expansion.

- By Vertical (Retail & E-commerce, Healthcare, Logistics, Manufacturing, Government, Others): The logistics segment is anticipated to have a CAGR of 10.26% during the forecast period, due to the rising demand for efficient freight management, route optimization, and real-time shipment visibility in global supply chains.

Transportation Management Systems Market Regional Analysis

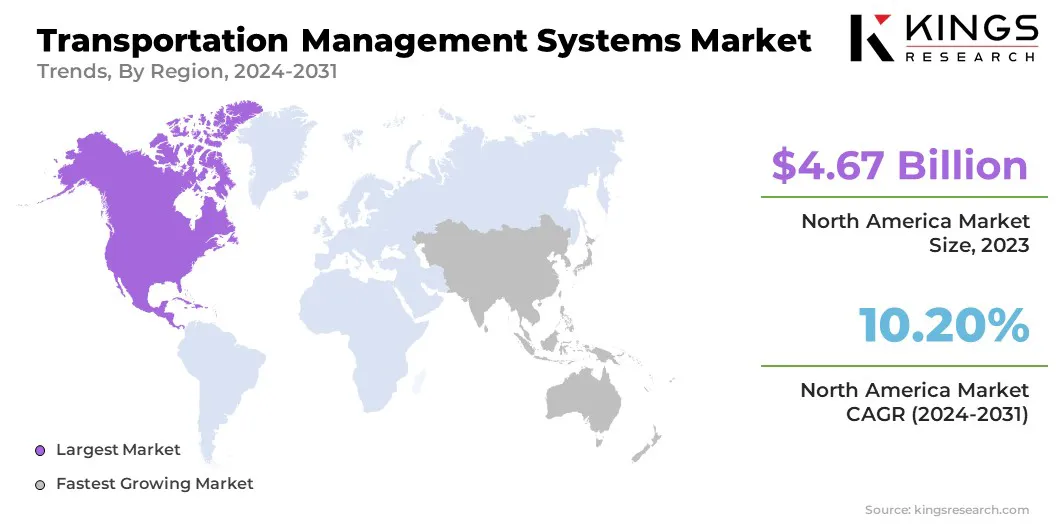

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a market share of around 36.73% in 2023, with a valuation of USD 4.67 billion. North America remains the most dominant region in the transportation management systems market, due to its advanced infrastructure, high adoption of technology, and the presence of major logistics players.

The region benefits from a well-developed supply chain ecosystem, widespread e-commerce growth, and a strong focus on operational efficiency. Additionally, the region is known for investing in cloud-based TMS solutions and AI-driven technologies to streamline transportation management, reduce costs, and improve customer satisfaction, reinforcing the region’s leadership in the market.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 10.22% over the forecast period. Asia Pacific is emerging as the fastest-growing region in the transportation management systems industry, fueled by expanding economies, rapid digital transformation, and increasing logistics complexity.

The region's shift toward advanced technologies, such as AI and cloud solutions, is driving the demand for more efficient transportation management. Additionally, the rise in cross-border trade, expanding infrastructure, and greater investment in smart logistics are contributing to the accelerated adoption of TMS, positioning Asia Pacific as a key growth hub for the market.

- In February 2024, J&T Express highlighted its strong growth during the Lunar New Year, leveraging its extensive Southeast Asian network. By upgrading fleets and enhancing operational capabilities, the company showcased improved delivery efficiency, aligning with the growing demand in the market.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Federal Motor Carrier Safety Administration (FMCSA) under the Department of Transportation ensures safety in motor carrier operations through strong enforcement of safety regulations, targeting high-risk carriers and commercial motor vehicle drivers, improving safety information systems and commercial motor vehicle technologies, strengthening commercial motor vehicle equipment and operating standards, and increasing safety awareness.

- The General Data Protection Regulation (GDPR) sets out detailed requirements for companies and organisations on collecting, storing and managing personal data. It applies both to European organisations that process personal data of individuals in the EU, and to organisations outside the EU that target people living in the EU.

- In the UAE, the Federal Customs Authority deals with customs affairs and shall be responsible for customs policymaking along with preparing unified legislations for organizing customs work and anti-customs smuggling and fraud.

Competitive Landscape:

The transportation management systems industry is characterized by a large number of participants, including both established corporations and rising organizations. Acquisitions in the market are becoming increasingly common as companies aim to expand their technological capabilities, enhance service offerings, and strengthen their market position.

These strategic acquisitions allow businesses to integrate advanced solutions, improve operational efficiency, and meet the growing demand for more sophisticated transportation management systems.

- In September 2024, AMCS's acquisition of Qv21 Technologies enhances its fleet management and logistics capabilities, enabling further integration of TMS solutions. This strategic move allows AMCS to provide more efficient, sustainable, and data-driven solutions for bulk commodity transportation and logistics management.

List of Key Companies in Transportation Management Systems Market:

- e2open, LLC

- Cargobase

- GoComet Solutions Pte Limited

- 3Gtms, LLC

- Infor

- Blue Yonder Group, Inc

- Manhattan Associates

- Körber AG (MercuryGate)

- Oracle

- SAP SE

- The Descartes Systems Group Inc

- Trimble

- CTSI-Global

- H. Robinson Worldwide, Inc.

- Alpega Group

Recent Developments

- In March 2024, Ocean State Job Lot selected Manhattan Active Transportation Management to enhance logistics planning and execution. This shift to a cloud-native TMS will optimize transportation networks, improve visibility, reduce costs, and help unify OSJL’s supply chain operations for greater efficiency.

- In August 2024, Blue Yonder finalized its acquisition of One Network Enterprises for USD 839 million, enabling customers to collaborate and share real-time data across supply chains. This integration enhances visibility, agility, and decision-making through AI-driven insights, optimizing resources and addressing market disruptions effectively.

- In May 2023, Manhattan Associates unveiled its re-imagined Manhattan Active Yard Management solution, unifying warehouse and transportation management on a cloud-native platform. This integration offers real-time insights, optimizing yard operations, reducing risks, and enhancing warehouse and transportation efficiency.

- In February 2024, Oracle introduced new logistics capabilities within its Fusion Cloud SCM, enhancing Oracle Transportation Management. These updates aim to optimize logistics operations, improve visibility, reduce costs, automate compliance, and support decision-making to address ongoing global supply chain challenges.

- In April 2023, Descartes Systems Group acquired the assets of Localz, a platform offering real-time tracking and communication for customer deliveries. This acquisition enhances Descartes' final-mile delivery capabilities, improving customer experience through real-time updates and efficient scheduling solutions.

- In October 2024, C.H. Robinson advanced logistics efficiency by automating over 10,000 routine email-based transactions daily. This generative AI technology accelerates freight processes, improving response time, reducing manual tasks, and offering faster, cost-effective solutions to customers.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership