Advanced Materials and Chemicals

Trifluoroacetic Acid Market

Trifluoroacetic Acid Market Size, Share, Growth & Industry Analysis, By Purity (99.5% Trifluoroacetic Acid, 99.9% Trifluoroacetic Acid), By End User (Pharmaceutical and Biotechnology, Agriculture and Crop Protection, Chemical Manufacturing, Others), and Regional Analysis, 2024-2031

Pages : 160

Base Year : 2023

Release : February 2025

Report ID: KR1384

Market Definition

The trifluoroacetic acid market involves the production, distribution, and utilization of trifluoroacetic acid, a potent carboxylic acid extensively employed in pharmaceuticals, agrochemicals, biotechnology, and chemical research.

Trifluoroacetic acid (TFA) serves as a reagent, solvent, and intermediate in organic synthesis, peptide synthesis, and the manufacturing of herbicides and insecticides.

Trifluoroacetic Acid Market Overview

The global trifluoroacetic acid market size was valued at USD 200.1 million in 2023 and is projected to grow from USD 213.1 million in 2024 to USD 352.5 million by 2031, exhibiting a CAGR of 7.46% during the forecast period.

The market is driven by the increasing demand for TFA in peptide sequencing and protein analysis from the pharmaceutical and biotech industries. Its use in fluorinated compounds and environmental applications further contributes to the market growth. Key factors influencing the market include raw material availability, production costs, regulatory policies, and environmental concerns related to fluorinated chemicals.

Major companies operating in the global trifluoroacetic acid Industry are Honeywell International Inc, Nantong Baokai Pharmaceutical Co.,Ltd., Sterlitech Corporation, Apollo Scientific, Tokyo Chemical Industry (India) Pvt. Ltd, Merck KGaA, Midas Pharma GmbH, BIOZOL Diagnostica Vertrieb GmbH, Anhui Jin'ao Chemical Co., Ltd., SINOCHEM GROUP CO., LTD, Halocarbon, LLC, SRF LIMITED, Solvay, Shandong Xingshun New Material Co., Ltd., Kinbester Co.,Limited, and IRIS BIOTECH GMBH.

Key Highlights:

- The global trifluoroacetic acid market size was valued at USD 200.1 million in 2023.

- The market is projected to grow at a CAGR of 7.46% from 2024 to 2031.

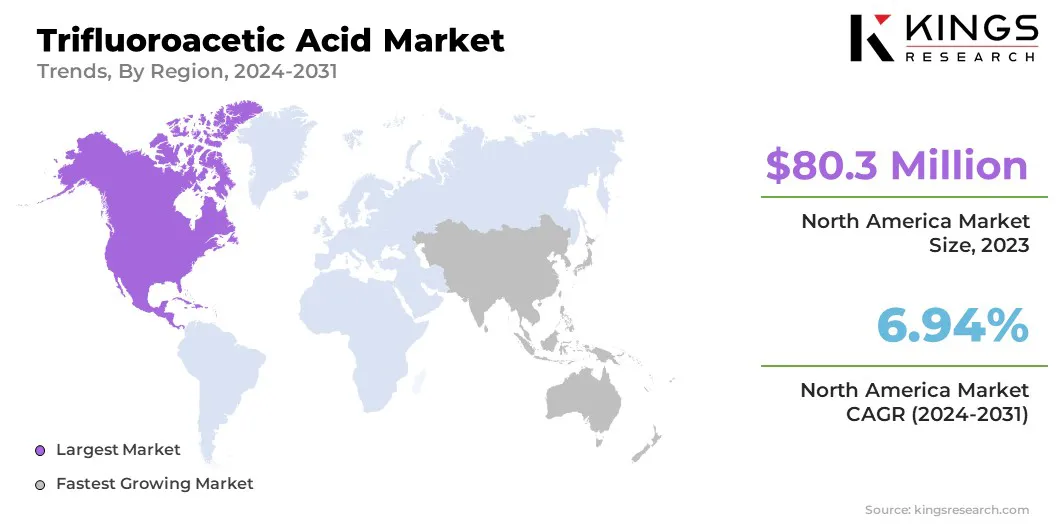

- North America held a market share of 40.12% in 2023, with a valuation of USD 80.3 million.

- The 99.5% trifluoroacetic acid segment garnered USD 109.4 million in revenue in 2023.

- The pharmaceutical and biotechnology segment is expected to reach USD 137.6 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.33% during the forecast period.

Market Driver

"Rising Demand from the Pharmaceutical & Biotech Industries propels the market"

A key driver of the global trifluoroacetic acid market is its growing demand in the pharmaceutical and biotechnology industries. TFA plays a vital role in peptide synthesis, protein analysis, and drug development, making it indispensable in pharmaceutical research and manufacturing.

It is extensively utilized in solid-phase peptide synthesis (SPPS), a fundamental process in the production of peptide-based therapeutics, including insulin, antibiotics, and oncology treatments. Furthermore, TFA serves as an ion-pairing reagent in high-performance liquid chromatography (HPLC), facilitating the purification and identification of biomolecules.

Market Challenge

"Stringent Environmental Regulations"

A significant challenge facing the trifluoroacetic acid market is the increasing stringency of environmental regulations. Amid growing emphasis on sustainability, the production and disposal of fluorinated compounds like TFA are under greater scrutiny due to their potential ecological impact.

Regulatory bodies, such as the European Union's REACH, have imposed stricter rules, raising compliance costs for manufacturers. These regulations require investments in sustainable production methods and waste management.

Companies in the market should invest in sustainable production technologies, such as energy-efficient processes and renewable energy sources, to reduce their environmental impact and ensure regulatory compliance.

Focusing on the development of greener alternatives, such as bio-based solvents, can help them align with the market demand for sustainable solutions. Collaboration with regulatory bodies and industry associations is also key to staying ahead of emerging regulations and best practices, enabling companies to navigate the evolving landscape while maintaining a competitive edge.

Market Trend

"Increasing adoption of sustainable chemistry practices"

A notable trend in the trifluoroacetic acid market is the growing adoption of green chemistry in its production. Driven by regulatory pressures and global sustainability goals, companies are exploring environmentally friendly production methods.

These include the development of bio-based alternatives and the use of renewable energy in manufacturing. This trend is increasingly influenced by consumer demand for sustainable products. Companies are aligning with these preferences to reduce their environmental footprint while meeting regulatory and market expectations for greener processes.

Trifluoroacetic Acid Market Report Snapshot

|

Segmentation |

Details |

|

By Purity |

99.5% Trifluoroacetic Acid, 99.9% Trifluoroacetic Acid |

|

By End User |

Pharmaceutical and Biotechnology, Agriculture and Crop Protection, Chemical Manufacturing, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Purity (99.5% Trifluoroacetic Acid, 99.9% Trifluoroacetic Acid): The 99.5% trifluoroacetic acid segment earned USD 109.4 million in 2023, driven by its widespread use in various applications requiring high purity and precision.

- By End User (Pharmaceutical and Biotechnology, Agriculture and Crop Protection, Chemical Manufacturing, Others): The pharmaceutical and biotechnology segment held 42.45% share of the market in 2023, driven by the growing demand for TFA in drug development, peptide synthesis, and the production of active pharmaceutical ingredients (APIs).

Trifluoroacetic Acid Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a trifluoroacetic acid market share of around 40.12% in 2023, with a valuation of USD 80.3 million. This dominance is attributed to the strong demand for TFA in pharmaceuticals, biotechnology, and specialty chemicals.

Furthermore, continuous Research and Development (R&D), alongside stringent environmental regulations, are contributing to the market growth, particularly with the increasing focus on sustainable production methods and green chemistry initiatives. Environmental concerns about its non-biodegradability may lead to stricter regulations and a potential shift toward alternative compounds.

The trifluoroacetic acid Industry in Asia Pacific is poised for significant growth at a robust CAGR of 8.33% over the forecast period, driven by rising demand in key sectors like pharmaceuticals, biotechnology, and chemicals.

Countries such as China and India are major contributors to this growth, owing to their expanding industrial base and focus on improving production standards. The market is also fueled by the adoption of sustainable manufacturing practices and increasing investments in R&D.

Regulatory Frameworks

- The Environmental Effects Assessment Panel (EEAP), under the Montreal Protocol, evaluates the regulatory considerations for TFA. The panel highlights concerns regarding TFA’s environmental persistence but emphasizes that it does not exhibit significant bioaccumulation or toxicity at current exposure levels.

- The U.S. Environmental Protection Agency (EPA) has excluded TFA from its working definition of per- and polyfluoroalkyl substances (PFAS) under the Toxic Substances Control Act (TSCA). The EPA considers TFA a well-studied non-PFAS chemical, primarily formed as a breakdown product of certain hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs).

- The United Nations Environment Programme (UNEP) Environmental Effects Assessment Panel reviewed TFA in relation to substances regulated under the Montreal and Kyoto Protocols. The report highlights that while TFA is persistent in the environment, its current projected levels from hydrofluorocarbon (HFC) degradation pose minimal risk to human health and ecosystems.

Competitive Landscape

The global trifluoroacetic acid market is characterized by a number of participants, including both established corporations and rising organizations. Companies employ various strategic initiatives, including mergers and acquisitions, product innovation, capacity expansion, and strategic partnerships, to gain a competitive edge in the market.

Established market leaders leverage their extensive distribution networks, technological expertise, and strong brand reputation to maintain their market position, while newer entrants focus on cost-efficient production methods and niche applications to establish a foothold.

List of Key Companies in Trifluoroacetic Acid Market

- Honeywell International Inc

- Nantong Baokai Pharmaceutical Co.,Ltd.

- Sterlitech Corporation

- Apollo Scientific

- Tokyo Chemical Industry (India) Pvt. Ltd

- Merck KGaA

- Midas Pharma GmbH

- BIOZOL Diagnostica Vertrieb GmbH

- Anhui Jin'ao Chemical Co., Ltd.

- SINOCHEM GROUP CO., LTD

- Halocarbon, LLC

- SRF LIMITED

- Solvay

- Shandong Xingshun New Material Co., Ltd.

- Kinbester Co.,Limited

- IRIS BIOTECH GMBH

Recent Developments (Agreements)

- In September 2024, Solvay announced a consultation to cease the production of TFA and its derivatives at the Salindres site in France, due to poor financial performance. This closure is expected to affect 68 positions between early 2025 and October 2025. The company cited unfavorable market conditions as the primary cause. A provision of 52.4 million will be recorded in Q3 2024, with most expenses occurring from 2025 onwards.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership

.webp)