Truck Axle Market

Truck Axle Market Size, Share, Growth & Industry Analysis, By Type (Rigid Axles, Drive Steer Axles, Non-Drive Steer Axles), By Application (Front, Rear, Drive, Dead), and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : August 2024

Report ID: KR946

Truck Axle Market Size

The global Truck Axle Market size was valued at USD 1,431.5 million in 2023 and is projected to grow from USD 1,489.4 million in 2024 to USD 2,117.4 million by 2031, exhibiting a CAGR of 5.15% during the forecast period. The expansion of the market is driven by the increasing demand for commercial vehicles, ongoing advancements in axle technology, regulatory pressures for improved fuel efficiency, and the rise of electric and hybrid trucks.

In the scope of work, the report includes products offered by companies such as American Axle & Manufacturing, Inc., Dana Limited, Meritor HVS (India) Limited, Qingte Group Co., Ltd., Sisu Axles, Talbros Engineering Limited, Zhucheng Yihe Axle Co., Ltd., RÁBA Járműipari Holding Nyrt., SAF-HOLLAND Group, WEICHAI POWER CO.,LTD, and others.

The growth of the truck axle market is primarily fueled by the increasing demand for commercial vehicles, particularly in emerging economies. The expansion of the e-commerce sector has increased the need for efficient transportation, thereby boosting the demand for heavy-duty trucks.

Technological advancements in axle design, focusing on durability and weight reduction, are propelling market expansion. Additionally, stringent government regulations on vehicle emissions and fuel efficiency standards compel manufacturers to innovate, thereby fostering market progress.

Infrastructure development and rising construction activities further contribute to the surging demand for trucks, thus directly impacting the axle market. Moreover, the growing trend toward electric and hybrid trucks presents new opportunities, as these vehicles require specialized axles to accommodate different powertrain configurations.

- According to the European Automobile Manufacturers’ Association, despite a slight decline in 2024, diesel trucks continued to dominate the EU market, holding 95.5% of new registrations in the first quarter. Meanwhile, electrically chargeable trucks experienced significant growth, increasing by 29.5% and capturing nearly 2% of the market share. Germany led this surge, contributing more than half of the EU’s electric truck sales.

The truck axle market encompasses the production and distribution of axles for various truck types, including light-duty, medium-duty, and heavy-duty trucks. It is characterized by a competitive landscape with numerous key players striving for major market share through innovation and strategic partnerships.

The market further witnesses substantial investments in research and development to enhance axle performance and efficiency. Despite challenges such as fluctuating raw material prices and economic uncertainties, the market is expected to grow steadily in the forthcoming years.

Axles are crucial components that support the vehicle's weight and facilitate power transfer from the engine to the wheels. They come in various types, including drive axles, dead axles, and lift axles, each serving different functions within the truck's drivetrain. This market includes both original equipment manufacturers (OEMs) and aftermarket suppliers, catering to the diverse needs of truck manufacturers and operators. As trucks evolve with advancements in technology and changes in regulatory landscapes, the axle market is adapting to meet these demands.

Analyst’s Review

The market is witnessing significant advancements, mainly due to key efforts from manufacturers to enhance product performance and meet evolving market demands. Companies are investing heavily in innovative technologies and lightweight materials to improve fuel efficiency and durability. New product launches, including advanced drive steer axles and electric truck axles, are shaping market dynamics.

- For instance, in March 2024, Ketchel Axle Systems introduced its new electrified axle system, the eRHINO, designed to enhance efficiency, power, and modularity for class 3-8 vehicles. The system integrates an electric motor, inverter, and thermal management into a traditional axle location, optimizing performance while requiring minimal changes from OEMs. It allows for easy adaptation to both existing and future chassis, thereby streamlining the deployment of electrified work trucks.

Analysts recommend that manufacturers should focus on developing eco-friendly solutions to align with global emission standards and consider forming partnerships to expand their market reach. Additionally, investing in R&D for electric and autonomous truck axles is likely to be crucial as the industry shifts toward greener and more technologically advanced vehicles.

Truck Axle Market Growth Factors

The increasing adoption of electric trucks due to rising environmental concerns and regulatory mandates is leading manufacturers to focus on developing advanced axles specifically designed for electric trucks. These axles need to support different powertrain configurations and provide enhanced efficiency. The demand for electric trucks is rising, especially in urban areas where emission regulations are stringent.

Moreover, there is a growing need for specialized axles designed to meet the unique requirements of electric trucks. This shift toward electrification in the trucking industry is significantly boosting the expansion of the market, as manufacturers proactively invest in research and development to create innovative, high-performance axle solutions.

A major challenge hindering the development of the truck axle market is the fluctuating prices of raw materials. These variations lead to increased production costs, thereby affecting the profit margins of manufacturers. To overcome this challenge, companies are focusing on enhancing their supply chain management strategies.

This includes establishing long-term contracts with suppliers to secure stable pricing and investing in the development of alternative materials to reduce dependence on traditional resources. Additionally, the implementation of advanced manufacturing techniques, such as automation, contributes to reducing waste and improving efficiency.

Implementation of these measures allow manufacturers to mitigate the impact of raw material price fluctuations, thereby ensuring consistent production and maintaining market competitiveness.

Truck Axle Market Trends

The integration of smart technology in truck axles is a significant trend impacting the market. Manufacturers are incorporating sensors and telematics into axles to monitor performance in real-time. This technology provides valuable data on axle load, temperature, and wear, enabling predictive maintenance and reducing downtime. Fleet managers are increasingly adopting these smart axles to enhance operational efficiency and extend the lifespan of their vehicles.

This trend is further fueled by the growing emphasis on data-driven decision-making in the logistics industry. As the demand for connected and autonomous trucks rises, the integration of smart technology in axles is becoming essential, thereby fostering innovation and stimulating market growth.

The rising shift toward lightweight axles is another notable trend in the truck axle market. Manufacturers are using advanced materials such as high-strength steel and aluminum alloys to reduce the weight of axles without compromising durability. This trend is further supported by the need to improve fuel efficiency and reduce emissions in response to stringent environmental regulations.

Lightweight axles contribute to enhanced performance of trucks by increasing payload capacity and reducing fuel consumption. Additionally, the adoption of electric trucks boosting this trend, as lighter axles contribute to better battery efficiency and extended range. The focus on weight reduction is significantly shaping the development and innovation in the market.

Segmentation Analysis

The global market is segmented based on type, application, and geography.

By Type

Based on type, the truck axle market is classified into rigid axles, drive steer axles, and non-drive steer axles. The drive steer axles segment is poised to witness significant growth at a CAGR of 5.91% through the forecast period (2024-2031), largely due to the increasing demand for vehicles that offer better maneuverability and load-carrying capacity.

These axles provide improved traction and stability, which are essential for heavy-duty trucks operating in challenging terrains. The rise in infrastructure projects and construction activities is fueling the need for trucks equipped with drive steer axles. Additionally, advancements in axle technology, such as enhanced durability and weight reduction, are leading to their increased popularity. Manufacturers are actively focusing on producing more efficient and robust drive steer axles to meet the growing demand, thus stimulating segmental expansion.

By Application

Based on application, the market is categorized into front, rear, drive, and dead. The front segment led the truck axle market in 2023, reaching a valuation of USD 573.9 million. The demand for front axles is increasing due to their critical function in enhancing vehicle stability and handling. The growth of the automotive industry, particularly in the commercial vehicle sector, is boosting the need for robust and reliable front axles.

Additionally, technological advancements in axle design, which emphasize weight reduction and enhanced durability, are further supporting the expansion of the segment. The emphasis on improving fuel efficiency and vehicle performance is resulting in increased adoption of advanced front axles in the market.

Truck Axle Market Regional Analysis

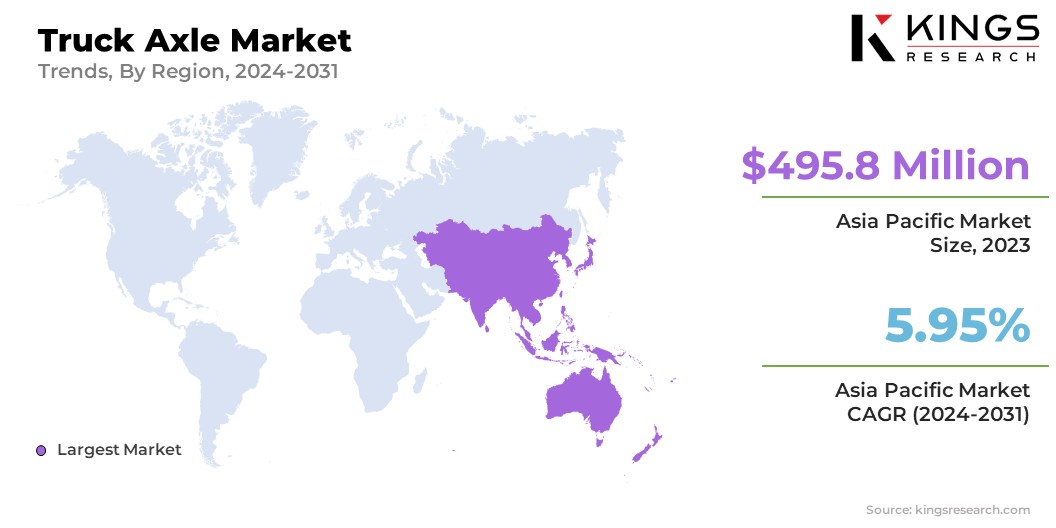

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific truck axle market share stood around 34.64% in 2023 in the global market, with a valuation of USD 495.8 million. This dominance is reinforced by the rapid industrialization and urbanization in countries such as China and India, which are major contributors to the commercial vehicle market. The growing demand for heavy-duty trucks in different sectors further fuels regional market expansion.

Additionally, the presence of key manufacturers and the availability of cost-effective labor and raw materials enhance production capabilities in the region. Government initiatives that support infrastructure development and the expansion of the e-commerce sector are boosting the demand for advanced truck axles, solidifying Asia-Pacific's leading market position.

North America is set to experience significant growth at a CAGR of 5.22% through the projected timeframe. This growth is primarily attributed to the increasing adoption of advanced automotive technologies and the strong demand for commercial vehicles in the logistics and transportation sectors. The region's robust economy and extensive infrastructure development projects are further propelling domestic market development.

Additionally, stringent emission regulations are prompting manufacturers to innovate and produce more efficient and durable axles. Investments in research and development, along with the presence of leading truck manufacturers, are bolstering regional market growth. The growing trend of electric and autonomous trucks in North America is further contributing to the rising demand for specialized truck axles.

Competitive Landscape

The global truck axle market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Truck Axle Market

- American Axle & Manufacturing, Inc.

- Dana Limited

- Meritor HVS (India) Limited

- Qingte Group Co., Ltd.

- Sisu Axles

- Talbros Engineering Limited

- Zhucheng Yihe Axle Co., Ltd.

- RÁBA Járműipari Holding Nyrt.

- SAF-HOLLAND Group

- WEICHAI POWER CO.,LTD

Key Industry Developments

- December 2023 (Launch): Jing-Jin Electric (JJE) emphasized its commitment to innovation with the introduction of its new 15,000Nm 2-speed electric beam axle. This axle showcased high torque and efficiency, effectively reducing thermal loading and enhancing system durability. The integrated hairpin motor and Silicon Carbide inverter ensured resilience against shock and vibration.

- July 2023 (Launch): Hendrickson, a global manufacturer of medium and heavy-duty suspensions and axles, launched air and mechanical suspensions for trailers in India. The TA 14 heavy-duty air suspension, designed for local road conditions, offered Top and Low Mount variants. The single axle, compatible with various suspension systems, used high-strength alloy steel and friction-welded spindles for durability. The MS 16 mechanical suspension, rated at 16T, featured a robust leaf spring assembly, thus ensuring high performance and low maintenance.

The global truck axle market is segmented as:

By Type

- Rigid Axles

- Drive Steer Axles

- Non-Drive Steer Axles

By Application

- Front

- Rear

- Drive

- Dead

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership