Energy and Power

UHV Submarine Cable Market

UHV Submarine Cable Market Size, Share, Growth & Industry Analysis, By Type (Mono-polar, Bi-polar), By Application (Power, Communication), By End User (Offshore Wind Generation, Inter-Country and Island Connection, Offshore Oil and Gas), and Regional Analysis, 2024-2031

Pages : 190

Base Year : 2023

Release : February 2025

Report ID: KR1403

Market Definition

UHV submarine cable (Ultra-High Voltage Submarine Cable) refers to a specialized power transmission cable designed to carry ultra-high voltage electricity across underwater distances, such as seas and oceans.

These cables enable efficient long-distance power transmission with minimal energy loss, supporting cross-border electricity trade and offshore renewable energy projects. Engineered to withstand extreme underwater conditions, UHV submarine cables are essential for integrating offshore wind farms, interconnecting power grids, and enhancing global energy security.

UHV Submarine Cable Market Overview

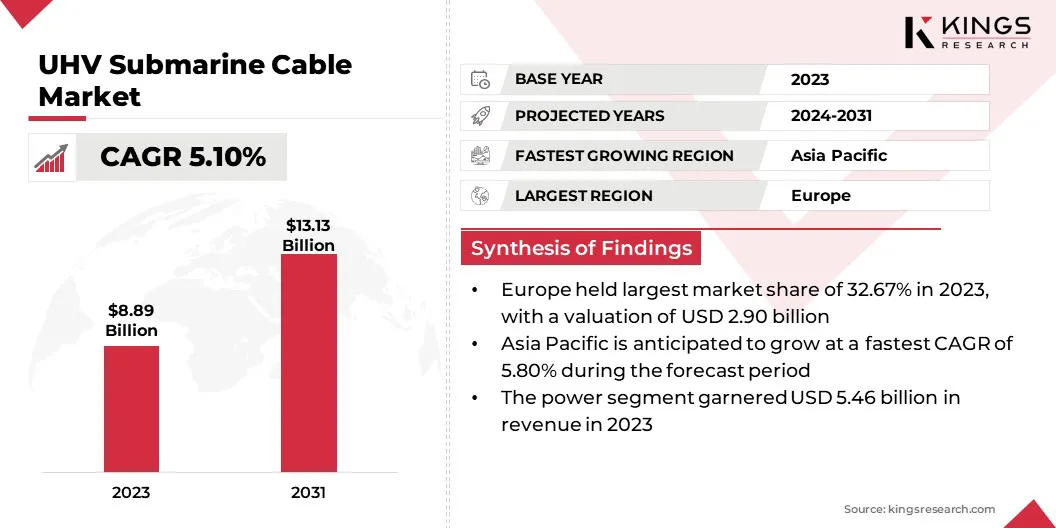

The global UHV submarine cable market size was valued at USD 8.89 billion in 2023 and is projected to grow from USD 9.27 billion in 2024 to USD 13.13 billion by 2031, exhibiting a CAGR of 5.10% during the forecast period.

The growth of the market is driven by the increasing deployment of offshore wind farms and rising investments in subsea interconnections for cross-border electricity transmission.

Governments worldwide are setting ambitious renewable energy targets, fueling the demand for high-capacity transmission infrastructure. Additionally, advancements in HVDC technology are improving transmission efficiency over long distances, further supporting market expansion.

Major companies operating in the global UHV submarine cable Industry are Prysmian S.p.A, Nexans, ZTT, ORIENT CABLE, Sumitomo Electric Industries, Ltd, Furukawa Electric Co., Ltd, Qingdao Hanhe Cable Co., Ltd, KEI Industries Ltd., Far East Cable Co., Ltd., Jiangsu Shangshang Cable Group Co., Ltd., Southwire Company, LLC, Wuxi Jiangnan Cable Co., Ltd., HENGTONG GROUP CO., LTD., LS Cable & System Ltd., NKT A/S, and others.

Governments and energy companies are expanding offshore wind projects to meet sustainability goals, creating a strong demand for high-capacity power transmission solutions.

- The U.S. Department of Energy's Wind Energy Technologies Office (WETO) funds research to advance offshore wind technologies for leveraging coastal wind resources. The federal government aims to deploy 30 gigawatts of new offshore wind energy by 2030 to power 10 million homes and cut carbon emissions by 78 million metric tons. To support this, the Department of Energy has committed over USD 300 million to competitively selected projects for offshore wind research, development, and demonstration.

UHV submarine cables are essential for transferring electricity from offshore wind farms to onshore grids with minimal transmission loss. Increased funding for renewable energy infrastructure, along with advancements in floating wind farms, is accelerating the growth of the market.

Strong policy support, coupled with declining costs of offshore wind technology, is further promoting large-scale installations, highlighting the need for reliable and efficient underwater power transmission systems.

- In February 2025, Ørsted commenced offshore construction for Taiwan’s Greater Changhua 2b and 4 wind farms, with a combined capacity of 920 MW. Spanning 185 square kilometers, these projects are located 35 to 60 km off the coast of Changhua County in water depths of 24—44 meters. Offshore installation is expected to conclude by late 2025, with all 66 Siemens Gamesa 14-236 DD 14-MW turbines integrated into Taiwan’s grid in 2026.

Key Highlights:

- The global UHV submarine cable market size was recorded at USD 8.89 billion in 2023.

- The market is projected to grow at a CAGR of 5.10% from 2024 to 2031.

- Europe held a share of 32.67% in 2023, valued at USD 2.90 billion.

- The bi-polar segment garnered USD 4.54 billion in revenue in 2023.

- The power segment is expected to reach USD 8.19 billion by 2031.

- The inter-country and island connection segment is set to grow at a CAGR of 5.36% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.80% through the estimated timeframe.

Market Driver

"Increasing Cross-Border Power Transmission Projects"

Countries are strengthening energy security by investing in interregional power grids, contributing significantly to the growth of the UHV submarine cable market. These cables support efficient long-distance electricity transfer, supporting international power-sharing agreements.

Large-scale projects, such as European interconnectors and transcontinental HVDC links, are creating opportunities for market expansion. The ability of UHV submarine cables to handle high-voltage electricity transmission while minimizing power losses is essential for global energy trade. Strategic collaborations between governments and private stakeholders are further accelerating the development of cross-border electricity infrastructure.

- In February 2025, the European Commission committed nearly USD 1.3 billion to support 41 cross-border energy infrastructure projects under the Project of Common Interest (PCI) and Project of Mutual Interest (PMI). The largest portion, approximately USD 769 million, was directed toward eight electricity grid projects, including offshore and smart grid developments.

Market Challenge

"High Installation and Maintenance Costs"

The UHV submarine cable market faces a major challenge due to the high costs associated with installation and maintenance. Deploying these cables in deep-sea environments requires advanced technology, specialized vessels, and extensive labor, significantly increasing expenses. Harsh underwater conditions further complicate repairs, adding to overall costs.

To mitigate this challenge, companies are investing in advanced cable-laying vessels and robotic inspection technologies to enhance efficiency. Strategic partnerships with governments and energy providers help secure funding for large-scale projects. Additionally, innovations in self-monitoring cables with real-time diagnostics reduce maintenance expenses and improve operational reliability.

Market Trend

"Expansion of Deepwater and Floating Offshore Projects"

The development of deepwater and floating offshore wind farms is increasing the need for advanced UHV submarine cable solutions. These projects require highly durable cables capable of withstanding extreme marine conditions and deep-sea installations.

The shift toward deeper offshore wind farms with stronger wind resources is creating long-term demand for ultra-high voltage transmission solutions. Market players are investing in innovative cable technologies to support the increasing complexity of offshore energy infrastructure, boosting the growth of the UHV submarine cable market.

- By the end of 2024, the UK exceeded 30 GW of wind generation capacity, with offshore wind contributing over 14 GW and meeting more than 17% of the country's electricity demand. The 2024 Allocation Round 6 (AR6) awarded 5.3 GW for offshore wind projects, including 400 MW for floating wind technology.

UHV Submarine Cable Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Mono-polar, Bi-polar |

|

By Application |

Power, Communication |

|

By End User |

Offshore Wind Generation, Inter-Country and Island Connection, Offshore Oil and Gas |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Mono-polar and Bi-polar): The bi-polar segment earned USD 4.54 billion in 2023, mainly due to its higher efficiency in long-distance power transmission, reduced power losses, and enhanced system stability.

- By Application (Power and Communication): The power segment held a substantial share of 61.36% in 2023, largely attributed to the rising deployment of high-voltage subsea transmission networks for integrating offshore wind farms and cross-border electricity interconnections, ensuring efficient long-distance power transfer with minimal losses.

- By End User (Offshore Wind Generation, Inter-Country and Island Connection, and Offshore Oil and Gas): The offshore wind generation segment is projected to reach USD 5.65 billion by 2031, fueled by the expansion of large-scale offshore wind farms, government renewable energy targets, rising investments in subsea transmission infrastructure, and the demand for high-capacity cables for efficient power transmission to onshore grids.

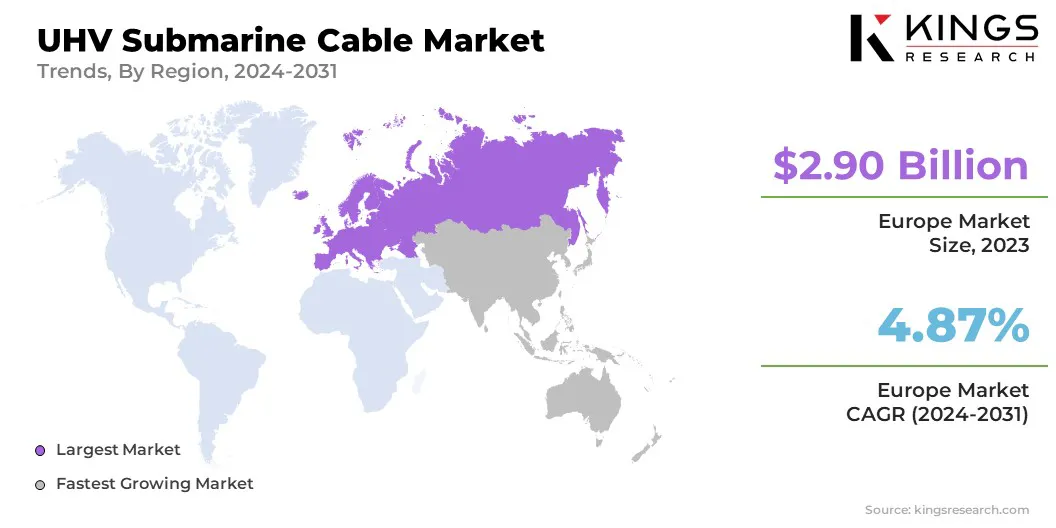

UHV Submarine Cable Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Europe UHV submarine cable market captured a notable share of around 32.67% in 2023, valued at USD 2.90 billion. Europe is strengthening its transnational power grid through interconnectors that enable cross-border electricity trade, contributing significantly to this growth.

Projects such as the Viking Link between Denmark and the UK, North Sea interconnectors, and planned Baltic Sea transmission networks are facilitating seamless energy exchange.

These initiatives support energy security, stabilize electricity prices, and integrate renewable energy sources across borders, making UHV submarine cables essential for modernizing Europe’s power infrastructure.

Additionally, Europe is leading the deployment of floating offshore wind farms, particularly in deep-water locations unsuitable for fixed-bottom turbines. The UK, Norway, and France are investing in this technology, highlighting the need for advanced UHV submarine cable solutions for stable and efficient power transmission.

As floating wind capacity expands, demand for specialized high-voltage cables capable of withstanding deep-sea conditions is increasing.

- In November 2024, the Norwegian government approved a budget of approximately USD 3.2 billion for the 500 MW ‘Utsira Nord’ floating offshore wind auction. This initiative reinforces Norway’s commitment to maintaining its leadership in the global floating offshore wind sector. Upon completion, Utsira Nord is set to become Europe's largest floating offshore wind farm.

Asia Pacific UHV submarine cable Industry is likely to grow at a CAGR of 5.80% over the forecast period. Countries in the region are investing in transnational power grids to enhance energy security and enable electricity trade.

Projects such as the ASEAN Power Grid and interconnections between China, South Korea, and Japan are fostering the demand for UHV submarine cables. These initiatives enhance regional energy integration, ensuring gird stability and suporting sustainable development.

Furthermore, supportive policies, subsidies, and funding programs are accelerating the development of high-voltage submarine transmission infrastructure.

Governments in the region are advancing long-term energy transition plans, such as China's Five-Year Plan for Renewable Energy, South Korea’s Green New Deal, and Japan’s Basic Energy Plan, with a strong focus on offshore wind and interconnection projects. These initiatives are creating lucrative opportunities for regional market expansion.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) oversees the regulation of submarine cables, requiring entities to obtain a cable landing license to connect the U.S. with foreign countries. This requirement is mandated by the Cable Landing License Act, which prohibits the landing or operation of such cables without a written license issued by the President of the United States. In 2022, the FCC initiated a comprehensive review of its submarine cable licensing process to enhance the security and reliability of submarine cable systems.

- The UK regulates submarine cables through a combination of national legislation and adherence to international agreements. The installation and maintenance of submarine cables require compliance with environmental regulations, maritime laws, and coordination with the Crown Estate, which manages the seabed around the UK. Operators must must secure permits and ensure minimal disruption to other marine users and must obtain the necessary permits before commencing any installation work.

- In China, the Ministry of Industry and Information Technology (MIIT) oversees the approval process for the construction and operation of submarine cables. Projects involving foreign investment or partnerships are subject to rigorous scrutiny to protect national security interests.

- In India, the Department of Telecommunications (DoT) under the Ministry of Communications is responsible for regulating submarine cables. Operators must secure licenses and adhere to guidelines that address security concerns, particularly those related to foreign collaborations.

- Internationally, the 1884 International Convention for the Protection of Submarine Telegraph Cables remains in effect, providing foundational principles that continue to influence domestic regulations worldwide.

Competitive Landscape

The global UHV submarine cable market is characterized by a large number of participants, including both established corporations and emerging players. Market participants are implementing strategies that involve agreements with government organizations and various industrial partners to supply subsea transmission cables.

These collaborations facilitate large-scale offshore wind and interconnection projects, ensuring reliable power transmission across regions. Such strategic initiatives strengthen market positioning, enhance technological capabilities, and foster innovation in ultra-high voltage submarine cable solutions.

Expanding partnerships with key stakeholders further accelerates project deployment, addressing the growing demand for efficient and sustainable energy infrastructure, thereby contributing to market growth.

- In December 2023, GE Vernova’s Grid Solutions business and MYTILINEOS Energy & Metals secured a contract worth approximately USD 1.26 billion from National Grid Electricity Transmission and SP Transmission (SP Energy Networks) to develop the UK’s first high-capacity east coast subsea link. As consortium leaders, GE Vernova, along with MYTILINEOS, will engineer and supply technology for two VSC HVDC converter stations, which will convert direct current to alternating current for integration into the onshore grid.

List of Key Companies in UHV Submarine Cable Market:

- Prysmian S.p.A

- Nexans

- ZTT

- ORIENT CABLE

- Sumitomo Electric Industries, Ltd

- Furukawa Electric Co., Ltd

- Qingdao Hanhe Cable Co., Ltd

- KEI Industries Ltd.

- Far East Cable Co., Ltd.

- Jiangsu Shangshang Cable Group Co., Ltd.

- Southwire Company, LLC

- Wuxi Jiangnan Cable Co., Ltd.

- HENGTONG GROUP CO., LTD.

- LS Cable & System Ltd.

- NKT A/S

Recent Developments (M&A/Agreements/Expansion)

- In July 2024, Prysmian successfully completed sea trial tests for the ultra-deep installation of a 500 kV HVDC MI1 cable at a water depth of 2,150 meters, marking the first deployment of an HVDC cable at such depth. The cable is designated for the Tyrrhenian Link, a USD 1.84 billion project awarded by Terna in 2021. Under the contract, Prysmian is responsible for designing, supplying, and installing over 1,500 km of submarine cables to enhance power exchange between Sardinia, Sicily, and Campania.

- In June 2024, Nexans expanded its high-voltage subsea cable facility in Halden, Norway to address growing global electrification and energy transition demands. This expansion strengthens Nexans’ capacity to support major projects, including its 2023 frame agreement with TenneT.

- In June 2024, Sumitomo Electric acquired a majority stake in Südkabel, a leading German high-voltage cable manufacturer. Additionally, the company is expanding its production capacity in Mannheim, Germany to locally produce advanced 525 kV HVDC cables, supporting the German government’s net-zero initiatives.

- In May 2024, Sumitomo Electric Industries, Ltd. secured a contract to supply a 132kV submarine power cable for the Gwynt y Môr Offshore Wind Farm, situated around 15 km off the North Coast of Wales. This achievement marks a significant step for Sumitomo Electric in strengthening the quality and reliability of offshore wind transmission systems in the UK.

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership