ICT-IOT

Unified Communications Market

Unified Communications Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Deployment (On-premises, Cloud-based (UCaaS)), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), By End-User Industry, and Regional Analysis, 2021-2031 2024-2031

Pages : 150

Base Year : 2023

Release : January 2025

Report ID: KR1205

Unified Communications Market Size

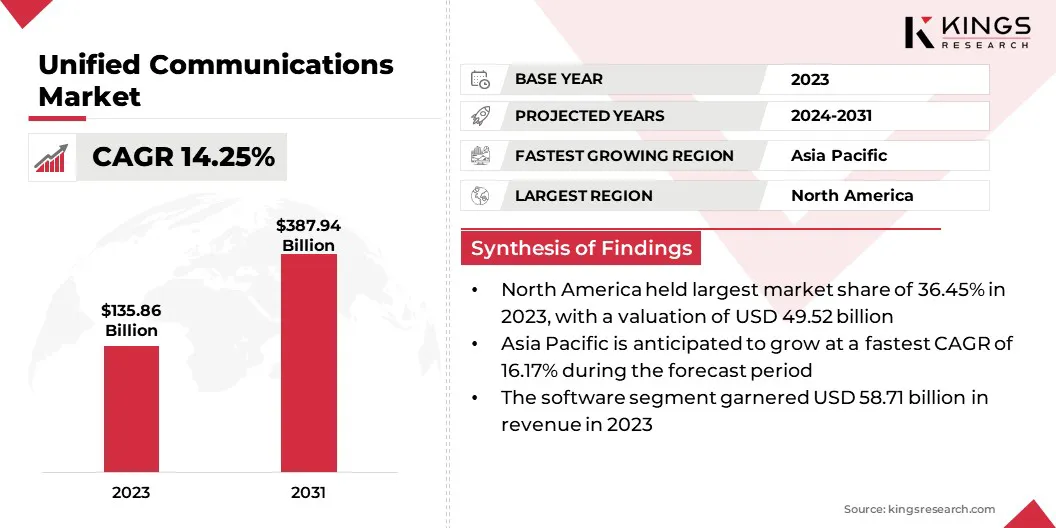

The global unified communications market size was valued at USD 135.86 billion in 2023, and is projected to grow from USD 152.69 billion in 2024 to USD 387.94 billion by 2031, exhibiting a CAGR of 14.25% during the forecast period. Enterprises are increasingly shifting toward unified communication platforms to streamline their operations and improve collaboration.

Integrated solutions that consolidate voice, video, messaging, and data sharing have emerged as preferred options for businesses focusing on simplifying workflows and reducing complexity. This growing preference for comprehensive solutions is fueling the expansion of the market globally.

In the scope of work, the report includes products and services offered by companies such as Microsoft, IBM, Cisco Systems, Inc., Avaya LLC, Google LLC, NEC Corporation Verizon, Mitel Networks Corp., RingCentral, Inc., Zoom Communications, Inc., and others.

The widespread adoption of remote and hybrid work environments has significantly propelled the growth of the unified communications market. These tools ensure continuity in workflows and reduce disruptions caused by physical distance. With businesses continuing to embrace flexible work arrangements, the need for robust communication systems has amplified, driving investments in unified communications technologies across industries.

Unified Communications (UC) involves integrating various communication tools and technologies into a single, cohesive system to facilitate seamless interactions and collaboration across multiple devices and platforms.

UC solutions typically combine voice calls, video conferencing, instant messaging, email, file sharing, and other communication methods, enabling users to interact in real-time or asynchronously through a unified interface. This approach enhances productivity, streamlines workflows, and reduces communication silos, making it particularly beneficial for businesses and organizations aiming to improve connectivity and efficiency among teams.

Analyst’s Review

Companies in the unified communications market are adopting several strategic approaches that are significantly contributing to its growth. One of the key strategies is the incorporation of artificial intelligence (AI) and automation into their communication solutions.

AI-driven features such as virtual assistants, real-time transcription, intelligent call routing, and automated scheduling are being integrated to enhance both user experience and operational efficiency.

Companies are leveraging these AI capabilities to optimize internal communication and enhance customer engagement, providing more personalized and responsive service. By embedding AI into their platforms, organizations are positioning unified communications solutions as essential tools for modern, data-driven operations.

- In October 2024, Cisco introduced a range of new AI-driven innovations, including the Webex AI Agent, AI Agent Studio, and Cisco AI Assistant features for the Webex Contact Center. These AI solutions harness advanced conversational intelligence and automation to elevate customer interactions, expedite issue resolution, and boost overall customer satisfaction. This empowers business leaders to provide faster, more effective, and more empathetic engagements, ultimately strengthening customer trust and brand loyalty.

Furthermore, many companies are expanding their offerings by integrating emerging technologies, such as the Internet of Things (IoT) and blockchain, into their unified communications systems. This integration not only strengthens the functionality of unified communications platforms but also attracts new customers in industries, such as finance and healthcare, with high data security needs.

Unified Communications Market Growth Factors

The rising use of mobile devices, including smartphones and tablets, alongside the growing number of IoT connections, has accelerated the growth of the market.

Mobile-enabled unified communication platforms provide employees with the flexibility to connect and collaborate from virtually anywhere, fostering productivity. Features such as mobile video conferencing, instant messaging, and secure file sharing ensure seamless interconnectedness, enabling organizations to maintain business continuity.

The increasing number of IoT devices further enhances this connectivity, allowing real-time data sharing and collaboration across interconnected systems, which optimizes operational efficiency and decision-making.

- A 2024 report from 5G Americas reveals that global IoT subscriptions total 3.3 billion, alongside 6.7 billion smartphone subscriptions. Projections indicate that IoT subscriptions will grow to 5 billion. In contrast, smartphone subscriptions are expected to rise to 8 billion by 2028, underscoring the dynamic shift in connectivity and the increasing interconnectedness of the digital world.

Small and medium-sized enterprises (SMEs) are contributing to the growth of the unified communications market by embracing these solutions to improve productivity and customer engagement. Unified communications platforms provide SMEs with access to advanced communication tools that were previously limited to larger enterprises.

By offering scalable and cost-effective solutions, unified communications systems help SMEs enhance collaboration, streamline workflows, and improve customer experience.

However, high initial cost of implementation, including infrastructure upgrades, software licenses, and employee training is restraining the growth of the market. These expenses pose a challenge, particularly for small and medium-sized enterprises (SMEs) with limited budgets.

To address this, companies are increasingly adopting cloud-based unified communication solutions, which reduce upfront costs by offering subscription-based pricing models.

Additionally, vendors are introducing scalable solutions tailored to business size and offering flexible payment plans to ease financial constraints. These approaches enable organizations to transition to unified communication platforms without significant financial burden, fostering broader market adoption.

Unified Communications Industry Trends

Improved global internet penetration and the deployment of advanced networks such as 5G are facilitating the growth of the unified communications market. Reliable and high-speed internet connectivity ensures seamless operation of unified communication tools, allowing organizations to maintain uninterrupted communication.

Developing regions are increasingly adopting unified communications platforms due to improved network infrastructure, creating new growth avenues for market players. The ability to connect globally without compromising quality or performance is driving the widespread adoption of unified communications technologies.

The rapid evolution of cloud technology is a pivotal in driving the market. Businesses are shifting from traditional on-premise systems to cloud-based unified communications solutions due to their scalability, flexibility, and cost-effectiveness.

Cloud platforms enable organizations to access communication tools on-demand without the need for extensive infrastructure or maintenance. This transition allows enterprises to adapt quickly to changing needs, reducing downtime and improving operational efficiency.

- In November 2024, Alight, Inc., a prominent provider of cloud-based human capital and technology-enabled services, and Avanade, a leader in Microsoft expertise, announced a partnership to integrate Alight Worklife with Microsoft Teams. This integration enables employers to enhance their employees' benefits experience by offering seamless access to benefits and well-being information directly within the Teams platform.

Segmentation Analysis

The global market has been segmented based on component, deployment, organization size, end user, and geography.

By Component

Based on component, the market has been segmented into hardware, software, and services. The software segment led the unified communications market in 2023, reaching the valuation of USD 58.71 billion.

Organizations increasingly rely on software-based platforms to integrate communication tools such as video conferencing, messaging, and voice services into a single, unified interface. This streamlining of communication processes enhances collaboration and boosts operational efficiency.

The rapid shift toward cloud-based deployment further accelerates the adoption of software solutions, as these platforms provide real-time updates, seamless integration with third-party applications, and remote accessibility.

By Deployment

Based on deployment, the market has been classified into on-premises and cloud-based (UCaaS)). The cloud-based (UCaaS) segment is poised for significant growth at a robust CAGR of 14.78% over the forecast period.

Businesses across industries are increasingly adopting UCaaS solutions to streamline communication and collaboration without the need for substantial capital investment in hardware and infrastructure. These solutions allow organizations to scale operations dynamically, accommodating the growing demand for hybrid and remote work models.

- The 2024 report from the International Data Corporation (IDC) predicts that cloud-based Unified Communications and Collaboration deployments will progressively replace on-premises solutions, driven by continuous improvements in security and data integrity.

Additionally, UCaaS platforms integrate advanced features such as AI-powered analytics, real-time collaboration tools, and seamless integration with third-party applications.

By Organization Size

Based on organization size, the market has been divided into small and medium-sized enterprises (SMEs), and large enterprises. The large enterprises segment secured the largest revenue share of 59.58% in 2023.

Large enterprises operate across multiple locations and often have globally dispersed teams, requiring robust communication platforms to ensure seamless connectivity.

Unified communications solutions provide these businesses with the ability to integrate voice, video, messaging, and collaboration tools into a single platform, enhancing operational efficiency. Additionally, large enterprises prioritize advanced security features, scalability, and customization, which are readily available in unified communication platforms.

Unified Communications Market Regional Analysis

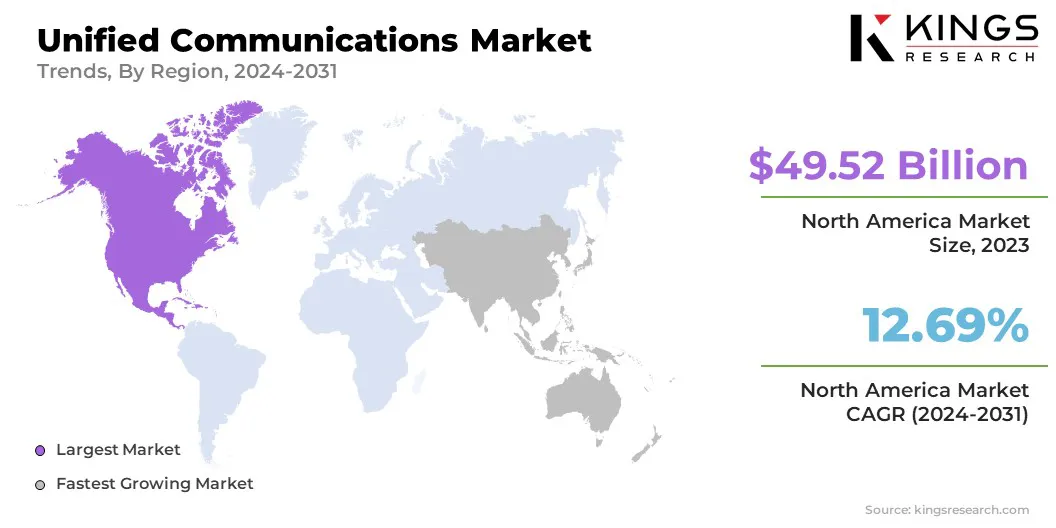

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America unified communications market share stood at 36.45% in 2023 with a valuation of USD 49.52 billion. North America leads in integrating advanced technologies such as AI, IoT, and 5G into unified communication systems.

AI-powered features like virtual assistants and real-time analytics enhance operational efficiency, while IoT enables seamless device-to-device communication. The rollout of 5G networks further supports high-quality, real-time communication, driving the adoption of unified communication solutions.

- According to the 5G Americas 2024 report, global 5G connections reached nearly 2 billion in Q1 2024, with 185 million new additions. This number is projected to rise to 7.7 billion by 2028. In North America, 5G adoption accounts for 32% of all wireless cellular connections, more than double the global average. The region is experiencing 11% growth, adding 22 million new connections.

North America is home to several global leaders in unified communications, including Microsoft, Cisco, and Zoom, who continue to innovate and invest heavily in R&D. Their presence ensures the availability of cutting-edge solutions and contributes to the rapid adoption of unified communication technologies across the region.

Asia Pacific is poised for significant growth at a robust CAGR of 16.17% over the forecast period. The rise of a mobile and tech-savvy workforce in Asia-Pacific is boosting the demand for unified communication solutions that support seamless connectivity on smartphones, tablets, and other mobile devices. Features such as mobile conferencing and real-time messaging cater to the needs of on-the-go employees, fostering growth in the market.

Furthermore, the booming e-commerce sector in Asia-Pacific has heightened the need for unified communication tools that enhance customer engagement and streamline service delivery. Businesses are adopting multi-channel communication platforms to offer personalized interactions and real-time support, boosting customer satisfaction and loyalty.

Competitive Landscape

The global unified communications market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Unified Communications Market

- Microsoft

- IBM

- Cisco Systems, Inc.

- Avaya LLC

- Google LLC

- NEC Corporation

- Verizon

- Mitel Networks Corp.

- RingCentral, Inc.

- Zoom Communications, Inc.

Key Industry Developments

- October 2024 (Expansion): Zoom upgraded its AI capabilities with new features to boost productivity, streamline communication, and improve user experience. Powered by AI Companion 2.0, these upgrades extend across team chats, emails, Zoom Docs, and meetings, enabling users to synthesize information from sources like Microsoft Outlook and Google Mail and Calendar, ensuring seamless collaboration.

- May 2024 (Partnership): Cisco and Lenovo announced a global strategic partnership to provide fully integrated infrastructure and networking solutions. The collaboration focuses on designing, engineering, and delivering advanced generative AI capabilities and digital workplace solutions aimed at enhancing enterprise productivity.

The global unified communications market has been segmented:

By Component

- Hardware

- Software

- Services

By Deployment

- On-premises

- Cloud-based (UCaaS)

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End User

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Government

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership