Healthcare Medical Devices Biotechnology

Vascular Closure Devices Market

Vascular Closure Devices Market Size, Share, Growth & Industry Analysis, By Device Type (Passive Approximators, Active Approximators, External Hemostatic Devices), By Access, By Application (Interventional Cardiology, Interventional Radiology/Vascular Surgery), By End User and Regional Analysis, 2024-2031

Pages : 120

Base Year : 2023

Release : September 2024

Report ID: KR1065

Vascular Closure Devices Market Size

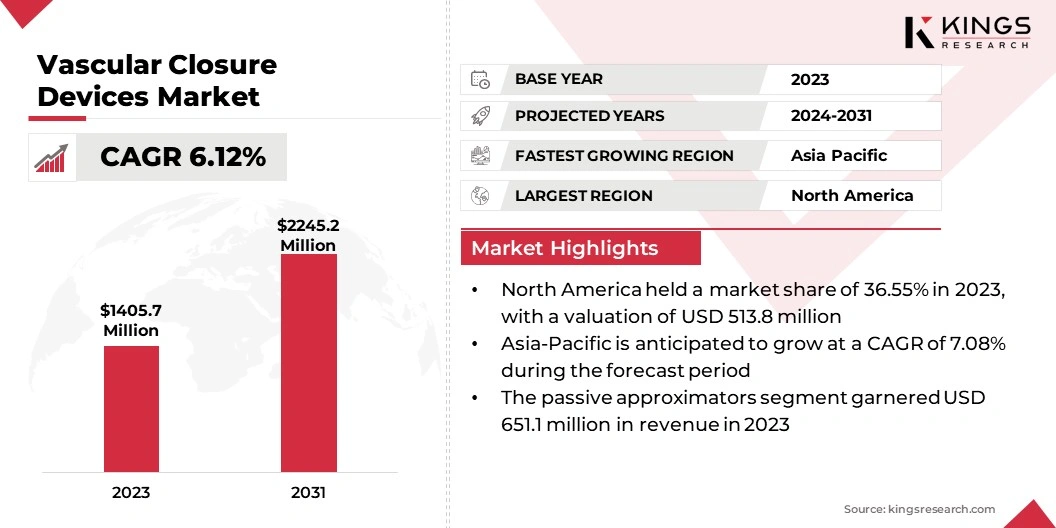

The global Vascular Closure Devices Market size was valued at USD 1,405.7 million in 2023 and is projected to grow from USD 1,481.0 million in 2024 to USD 2,245.2 million by 2031, exhibiting a CAGR of 6.12% during the forecast period. The global market is growing due to several factors such as the rising prevalence of cardiovascular diseases, the increasing number of minimally invasive procedures, and technological advancements in device design.

Enhanced safety features and reduced complication rates are further contributing to the growing adoption. Additionally, the rising focus on improving patient recovery times and the integration of innovative solutions are supporting market expansion. In the scope of work, the report includes products offered by companies such as Abbott, B. Braun SE, Biotronik SE & Co. KG, BD, Cardinal Health, Vivasure Medical Ltd, Medtronic, TERUMO CORPORATION, Teleflex Incorporated, Transluminal Technologies, and others.

The growing prevalence of cardiovascular diseases is significantly boosting the demand for vascular closure devices. This surge is largely attributed to the increased number of minimally invasive procedures, such as angioplasty and catheterization.

- In May 2023, the World Heart Federation (WHF) reported a significant increase in global fatalities from cardiovascular disease (CVD), which increased from 12.1 million in 1990 to 20.5 million in 2021. CVD became the leading cause of mortality worldwide in 2021, with 80% of these fatalities occurring in low- and middle-income countries.

As these procedures become more common worldwide, the need for effective vascular closure solutions is rising. Vascular closure devices play a crucial role in improving patient outcomes by facilitating efficient closure of access sites and minimizing complications. This surge in procedure volume is leading to higher adoption rates of these devices, thereby expanding the market.

Vascular closure devices (VCDs) are medical tools used to seal the access site after vascular procedures, such as angioplasty or catheterization, to prevent bleeding and ensure proper hemostasis. These devices facilitate the closure of puncture sites in blood vessels, significantly reducing the risk of complications such as hematoma or pseudoaneurysm.

VCDs come in various types, including mechanical, bioabsorbable, and collagen-based, each designed to address specific procedural needs and enhance patient outcomes. By improving the closure process and accelerating recovery, VCDs are essential in minimizing post-procedure complications and supporting successful patient recovery.

Analyst’s Review

The vascular closure devices market is experiencing significant growth due to increasing collaborations and investments from key players who are focused on developing advanced solutions. These strategic initiatives are enabling the development of more efficient and safer devices, which are crucial for reducing complications associated with cardiovascular procedures, such as bleeding and prolonged recovery times.

- In March 2023, Haemonetics Corporation invested USD 32.2 million in Vivasure Medical, an Ireland-based company that specializes in developing a portfolio of fully absorbable, patch-based, large-bore percutaneous vessel closure devices.

As these devices evolve, integrating innovative materials and improved mechanisms, they are becoming more effective at sealing puncture sites following catheterization or other vascular interventions. This has led to growing adoption among healthcare providers, which is expected to further contribute to market expansion.

Vascular Closure Devices Market Growth Factors

The demand for vascular closure devices (VCDs) is increasing due to their ability to facilitate efficient closure of access sites, reduce hemostasis time, and enable early ambulation for patients. These advantages significantly enhance patient outcomes, leading to wider global adoption of VCDs.

Moreover, manual compression techniques, which may result in complications such as hematoma, pseudo aneurysm, and arterial occlusion, are labor-intensive and extend recovery time. This increases hospital costs and contributes to the growing preference for VCDs over manual methods.

- According to a 2023 article by the National Institutes of Health (NIH), cardiac catheterization is among the most frequently performed cardiac procedures, with over 1,000,000 conducted annually in the U.S. These invasive procedures can lead to various patient-related and procedure-related complications. To mitigate these risks, vascular closure devices (VCDs) are employed, which help reduce complications and increase the demand for these products.

Additionally, the increasing prevalence of cardiovascular diseases and the surge in interventional cardiology procedures are bolstering the growth of the market.

A major challenge impeding the development of the vascular closure devices market is the high cost associated with advanced devices, which can limit their accessibility in developing regions. Additionally, regulatory hurdles and varying standards across countries make it challenging to enter the market and get products approved.

Key players are addressing these challenges by investing in cost-effective manufacturing technologies and developing a range of products at different price points to cater to diverse markets. They are further engaging in strategic collaborations and partnerships to navigate regulatory landscapes more efficiently and accelerate product approvals.

Vascular Closure Devices Market Trends

The increasing use of vascular closure devices following minimally invasive surgical procedures is significantly boosting market growth. As cardiovascular diseases become more prevalent, the frequency of interventional procedures, such as angioplasty and catheterization, is rising.

- The 2022 Heart Disease & Stroke Statistical Update Fact Sheet on the Global Burden of Disease estimated that 244.1 million people worldwide were living with ischemic heart disease (IHD), with a higher prevalence observed in males compared to females.

This surge in procedures has led to increased demand for vascular closure devices. These devices are essential for effective site closure, minimizing complications, and enhancing patient recovery. The growing focus on reducing post-procedure issues and improving outcomes boosts the adoption of these devices, thereby propelling market expansion.

Innovations in vascular closure devices are fostering the vascular closure devices market growth through advancements such as biocompatible materials and automated closure systems. These developments are improving device efficiency and safety, reducing recovery times, and enhancing overall procedural outcomes.

Biocompatible materials reduce the risk of adverse reactions, while automated systems enhance precision by streamlining the closure process. As clinical settings increasingly adopt these advanced devices to address evolving procedural needs, the market for vascular closure devices is expanding. This growth reflects the ongoing technological advancements and their positive impact on healthcare.

Segmentation Analysis

The global market has been segmented based on device type, access, application, end user, and geography.

By Device Type

Based on device type, the vascular closure devices market has been categorized into passive approximators, active approximators, and external hemostatic devices. The passive approximators segment garnered the highest revenue of USD 651.1 million in 2023. These devices play a critical role in enhancing alignment and precision across various applications, including optical systems and mechanical assemblies.

The growth of the segment is propelled by increased research and development activities by key players, who are focusing on launching advanced passive devices.

- For instance, in June 2022, CyndRx initiated patient enrollment in the U.S. for the SEAL TO HEAL clinical trial,. This trial aims to assess the safety and efficacy of the new AbsorbaSeal 5.6.7F vascular closure device.

Such advancements and clinical trials conducted by industry leaders are significantly contributing to the expansion of the passive approximators segment.

Furthermore, advances in material technology and manufacturing processes are enhancing both the performance and longevity of passive approximators. As industries seek more reliable and low-maintenance solutions for precision tasks, the demand for passive approximators is rising, boosting the expansion of the segment.

By Application

Based on application, the market has been categorized into interventional cardiology and interventional radiology/vascular surgery. The interventional cardiology segment is expected to garner the highest revenue of USD 1,342.7 million by 2031.

This notable expansion is largely attributed to the increasing prevalence of cardiovascular diseases and the increasing use of minimally invasive procedures. Advances in medical technology are enhancing the precision and effectiveness of interventional techniques, leading to the surging demand for specialized devices such as vascular closure devices.

The segment benefits from growing patient populations requiring angioplasty, stenting, and catheterization, coupled with improvements in procedural safety and outcomes. This growth is further supported by ongoing research and development efforts aimed at refining interventional tools and techniques.

By End User

Based on end user, the market has been categorized into hospitals, ambulatory surgical centers, and clinics. The hospitals segment captured the largest vascular closure devices market share of 43.65% in 2023, mainly due to government initiatives in developed countries aimed at improving hospital stays and enhancing treatment efficiency.

These facilities have led to an increase in hospital admissions and a higher demand for cardiology procedures. The rise in patient visits and the higher frequency of cardiology procedures are fueling the adoption of passive approximators, thereby supporting the expansion of the segment.

- According to data from the U.S. Department of Health & Human Services, in April 2024, approximately 13 million patients visiting physician offices were diagnosed with coronary atherosclerosis and other chronic ischemic heart diseases.

This high patient volume underscores the growing need for advanced devices in hospital settings, thereby propelling the expansion of the segment.

Vascular Closure Devices Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America vascular closure devices market accounted for the largest share of 36.55% in 2023, with a valuation of USD 513.8 million. This considerable growth is fostered by the region's advanced healthcare infrastructure, high cardiovascular disease prevalence, and increased adoption of minimally invasive procedures.

The U.S. and Canada are experiencing rising demand, supported by significant investments in medical technology and ongoing R&D. Government initiatives aimed at improving patient outcomes and a rise in interventional cardiology procedures further boost demand.

- For instance, in December 2022, the Ambulatory Surgery Center Association reported that there were 6,200 Medicare-certified ASCs in the U.S. This surge is expected to enhance the accessibility of advanced vascular closure devices.

The region's rising focus on innovation and technology, along with a growing elderly population, boosts the demand for vascular closure devices.

Asia-Pacific is anticipated to witness the fastest growth, with a CAGR of 7.08% over the forecast period. This notable growth is fueled by rapid urbanization, improvements in healthcare infrastructure, and increasing healthcare expenditure. Emerging economies such as China and India are contributing to this growth through expanding healthcare networks and rising awareness of cardiovascular diseases.

Moreover, the region is experiencing a surge in medical tourism, leading to a higher demand for advanced medical devices. Additionally, government initiatives to enhance healthcare access and foster medical technology innovation are propelling regional market expansion.

Competitive Landscape

The global vascular closure devices market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Vascular Closure Devices Market

- Abbott

- Braun SE

- Biotronik SE & Co. KG

- BD

- Cardinal Health

- Vivasure Medical Ltd

- Medtronic

- TERUMO CORPORATION

- Teleflex Incorporated

- Transluminal Technologies

Key Industry Developments

- October 2023 (Product Approval): Terumo announced that its vascular closure devices, Angio-Seal VIP and Femoseal, have received CE certification under the new Medical Device Regulation (EU MDR). This certification marks a significant milestone, ensuring that both devices meet the rigorous standards required for market approval in the European Union.

- February 2024 (Expansion): Terumo Medical Corporation (TMC) began construction on a new manufacturing facility at its Caguas, Puerto Rico site. This expansion is in response to the increasing global demand for the company's Angio-Seal Vascular Closure Device (VCD), a leading solution for vascular closure worldwide. Angio-Seal offers facilitates rapid and reliable hemostasis after angiographic or interventional procedures, allowing for quicker patient mobility and same-day discharge, which enhances recovery efficiency.

The global vascular closure devices market is segmented as:

By Device Type

- Passive Approximators

- Active Approximators

- External Hemostatic Devices

By Access

- Femoral Access

- Radial Access

By Application

- Interventional Cardiology

- Interventional Radiology/Vascular Surgery

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CHOOSE LICENCE TYPE

Frequently Asked Questions (FAQ's)

Get the latest!

Get actionable strategies to empower your business and market domination

- Deliver Revenue Impact

- Demand Supply Patterns

- Market Estimation

- Real-Time Insights

- Market Intelligence

- Lucrative Growth Opportunities

- Micro & Macro Economic Factors

- Futuristic Market Solutions

- Revenue-Driven Results

- Innovative Thought Leadership